Bitcoin Plunges Below $26,000 as SpaceX Share Sell-off Reverberates: Market Turmoil Unfolds

Bitcoin Plunges Below $26,000 as SpaceX Share Sell-off Reverberates: Market Turmoil Unfolds

In a shocking turn of events, the cryptocurrency market was sent into a tailspin as Bitcoin, the kingpin of digital currencies, plummeted below the critical $26,000 mark. The turmoil was spurred by reports of a significant sell-off of SpaceX shares, amplifying concerns about the stability of both the crypto and stock markets.

The digital financial landscape experienced seismic ripples as Bitcoin, once regarded as a haven for investors seeking refuge from traditional markets, tumbled to levels not witnessed in recent memory. This drastic decline, triggered by the purported offloading of SpaceX shares, underscores the intricate interplay between cryptocurrency and traditional stock investments, exposing vulnerabilities in both domains.

Market experts and analysts, previously sanguine about the prospects of digital currencies, now find themselves grappling with a confluence of uncertainties. The SpaceX selloff has reignited the debate on the correlation between cryptocurrencies and established equities, shedding light on how closely intertwined these seemingly disparate assets have become.

The cryptic world of digital assets has long been seen as a refuge from the tumultuous fluctuations of the stock market. Bitcoin, often touted as “digital gold,” was embraced by many as a hedge against economic volatility. However, the recent cascade of events has cast doubts on this perception. The sudden and dramatic nosedive of Bitcoin highlights its susceptibility to external factors, rendering it vulnerable to the ebb and flow of traditional markets.

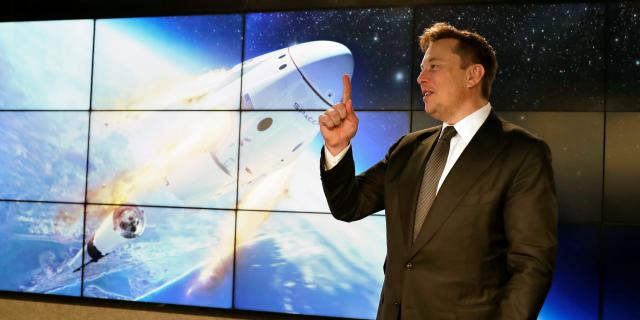

Market dynamics were further exacerbated by the news of SpaceX’s share sell-off, a move that sent shockwaves rippling through the investment community. SpaceX, the brainchild of billionaire entrepreneur Elon Musk, had enjoyed a steadfast reputation as an innovative force in the aerospace industry. However, reports of significant shares being divested added a layer of uncertainty to the company’s trajectory, prompting investors to reassess their positions not only in SpaceX but across their entire portfolios.

As the cryptocurrency market grapples with this unprecedented turbulence, parallels can be drawn with the broader financial landscape. Traditional markets have long been characterized by their susceptibility to market sentiment, where the slightest rumor or unexpected event can lead to cascading effects. The SpaceX share sell-off serves as a stark reminder that digital currencies, despite their decentralized nature, are not impervious to the psychological ebbs and flows that influence investor behavior.

The ramifications of the current market turmoil extend beyond the realms of finance, touching upon broader themes of innovation, technological disruption, and investor psychology. The rapid rise of cryptocurrencies, spearheaded by Bitcoin, was underpinned by the allure of a decentralized financial future. However, the recent developments pose questions about the stability of such a vision and the potential impact on broader adoption.

In the aftermath of the SpaceX sell-off reports, market participants find themselves at a crossroads, grappling with decisions that may shape the trajectory of their investments. The term “cryptocurrency” once evoked notions of groundbreaking financial transformation, but now, it is entwined with questions of market volatility and the intricacies of modern investment strategies.

Amidst this market turmoil, the reactions of key players in both the cryptocurrency and stock market spheres have been palpable. Market analysts, who previously held an optimistic outlook on the resilience of Bitcoin, are now recalibrating their predictions in the face of newfound uncertainties. This swift turn of events has led to fervent discussions about the intrinsic value of cryptocurrencies and their ability to weather external shocks.

While some investors may perceive this confluence of events as a harbinger of instability, others view it as an opportunity for recalibration and reevaluation. Market corrections, though tumultuous, can also serve as a mechanism to clear excesses and bring assets back to more sustainable levels. The current scenario prompts a broader examination of portfolio diversification strategies, emphasizing the importance of not placing all financial eggs in one basket.

Elon Musk, the enigmatic figure at the epicenter of these developments, remains a focal point of discussion. His tweets and public statements have consistently exerted a considerable influence on both the cryptocurrency and stock markets. The SpaceX share sell-off reports, in particular, have reignited debates about the role of influential individuals in shaping market dynamics and investor sentiment. This serves as a reminder of the power vested in those who hold sway over modern communication channels and their ability to impact global financial ecosystems.

In a world where financial landscapes are increasingly interconnected, the events of the past few days underscore the need for heightened vigilance and a deeper understanding of the intricacies that bind various asset classes. The volatility triggered by the SpaceX selloff resonates far beyond mere numerical value; it reverberates as a reminder of the delicate balance that underpins the contemporary investment landscape.

As markets continue to navigate uncharted waters, investors and observers alike are left to grapple with the evolving narrative of the entwined fate of cryptocurrencies and traditional equities.

In conclusion, the recent descent of Bitcoin below the pivotal $26,000 mark, driven by reports of a SpaceX share sell-off, has sent shockwaves throughout both the cryptocurrency and traditional stock markets. This unforeseen correlation between seemingly disparate assets serves as a stark reminder of the complexities that underlie modern investment strategies.

The interplay between these domains has unveiled a tapestry of vulnerabilities, raising questions about the role of digital currencies in a world shaped by shifting market dynamics. As investors grapple with uncertainty, they are faced with decisions that will undoubtedly leave an indelible mark on the financial landscape for years to come.