Top 10 Best Life Insurance Policies in India 2025 | Secure Your Future

The Importance of Life Insurance Policies

Life insurance is more than just a financial product; it’s a promise of financial security for your loved ones in case of unforeseen circumstances. In 2025, the best life insurance policies in India are designed to provide comprehensive coverage, long-term savings, and tailored solutions to meet individual needs. This article explores the top 10 best life insurance policies in India, offering insights into their unique features, benefits, and suitability.

1. LIC Jeevan Anand

LIC Jeevan Anand is a popular endowment plan that combines life cover with a savings component, ensuring a secure future for your family.

Key Features:

- Dual benefit of savings and protection

- Bonus additions for higher returns

- Policy term ranging from 15 to 35 years

Who Should Opt For It: Ideal for individuals seeking long-term financial planning with the added benefit of life cover.

2. HDFC Life Click 2 Protect Life

HDFC Life Click 2 Protect Life is a term insurance plan designed for affordability and flexibility, offering multiple coverage options.

Key Features:

- Choice of three plan options: Life, Life Plus, and Life Goal

- Premium waiver for critical illnesses

- Customizable policy term and sum assured

Who Should Opt For It: Perfect for young professionals and first-time insurance buyers.

3. ICICI Prudential iProtect Smart

ICICI Prudential iProtect Smart is a term plan that offers comprehensive coverage, including health-related benefits.

Key Features:

- Coverage against 34 critical illnesses

- Option to receive death benefits in monthly installments

- Tax benefits under Section 80C and 10(10D)

Who Should Opt For It: Best suited for individuals looking for a term plan with added critical illness coverage.

4. Max Life Smart Secure Plus Plan

Max Life Smart Secure Plus Plan offers a blend of affordability and extensive coverage, making it one of the top choices.

Key Features:

- Return of premium option available

- Enhanced protection with accident cover

- Terminal illness benefits

Who Should Opt For It: Ideal for those who want flexibility in premium payments and coverage options.

5. SBI Life eShield Next

SBI Life eShield Next is an advanced term insurance plan offering progressive coverage that grows with your life milestones.

Key Features:

- Increasing cover options to match inflation

- Low premium rates for non-smokers

- Comprehensive coverage with add-on riders

Who Should Opt For It: Suitable for individuals seeking inflation-adjusted life cover.

6. Bajaj Allianz Smart Protect Goal

Bajaj Allianz Smart Protect Goal is a feature-rich term plan that offers financial protection along with optional add-ons for enhanced coverage.

Key Features:

- Critical illness and disability riders

- Affordable premium rates

- Option to choose between lump-sum and regular payout

Who Should Opt For It: Best for those looking for budget-friendly premiums with high coverage.

7. Kotak Life e-Term Plan

Kotak Life e-Term Plan is a digital-first term insurance solution offering customizable benefits to policyholders.

Key Features:

- Coverage up to 75 years of age

- Multiple payout options for death benefits

- Additional accidental death benefits

Who Should Opt For It: Great for tech-savvy individuals seeking seamless policy management.

8. Tata AIA Life Sampoorna Raksha Supreme

Tata AIA Life Sampoorna Raksha Supreme is a term plan that focuses on affordability without compromising on essential benefits.

Key Features:

- Enhanced protection with critical illness riders

- Lower premiums for women policyholders

- Flexible premium payment terms

Who Should Opt For It: Ideal for women and young professionals looking for budget-friendly options.

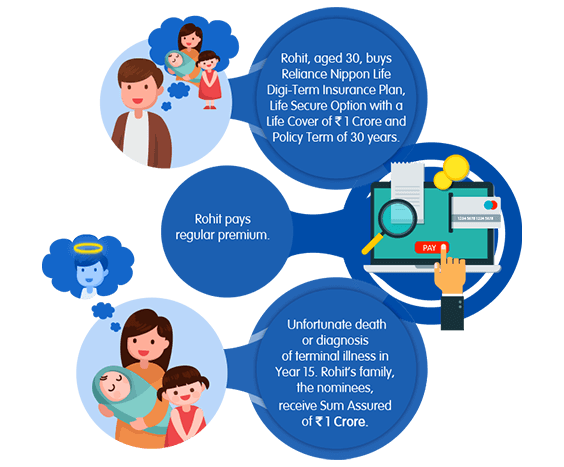

9. Reliance Nippon Life Term Plan

Reliance Nippon Life Term Plan ensures comprehensive life cover with flexible premium payment and benefit options.

Key Features:

- Choice of single, limited, or regular premium payments

- Spouse coverage in the same plan

- Additional benefits for non-smokers

Who Should Opt For It: Designed for families seeking dual coverage in a single plan.

10. Aditya Birla Sun Life Insurance DigiShield Plan

Aditya Birla Sun Life Insurance DigiShield Plan provides customizable benefits to meet diverse policyholder needs.

Key Features:

- Coverage up to 100 years of age

- Multiple death benefit payout options

- Special benefits for women and non-smokers

Who Should Opt For It: Ideal for individuals seeking long-term life coverage with flexible benefits.

Why Choose These Life Insurance Policies?

The top 10 best life insurance policies listed above offer unique features tailored to different financial goals and life stages. Here’s why they stand out:

- Comprehensive Coverage: From basic term plans to advanced options with critical illness coverage, these policies ensure holistic protection.

- Affordability: Competitive premium rates make them accessible to a wide audience.

- Flexibility: Customizable benefits, payout options, and policy terms cater to diverse needs.

- Tax Benefits: Save on taxes under Sections 80C and 10(10D) of the Income Tax Act.

Things to Consider Before Buying Life Insurance

- Assess Your Needs: Understand your financial responsibilities and future goals.

- Compare Policies: Look at coverage, premiums, and additional benefits.

- Riders and Add-ons: Evaluate optional benefits like critical illness cover, accidental death benefits, and waiver of premium.

- Claim Settlement Ratio: Choose insurers with a high claim settlement ratio for hassle-free claims.

The Future of Life Insurance Policies in India

As we move towards a tech-driven future, life insurance policies in India are becoming more innovative and customer-centric.

Digital platforms simplify policy selection and management, while advancements in AI and big data enhance claim processing and risk assessment. By 2025, we expect further innovation, ensuring that life insurance policies continue to provide financial security to millions.

Conclusion

The top 10 best life insurance policies in India for 2025 offer diverse options to secure your financial future and protect your loved ones. Whether you prioritize affordability, comprehensive coverage, or additional benefits, there’s a policy designed for your needs. Make an informed decision and invest in a life insurance policies that safeguards your family’s future.