Role of e-Invoicing and GST in changing the business landscape in India 2022

Role of e-Invoicing and GST in changing the business landscape in India 2022

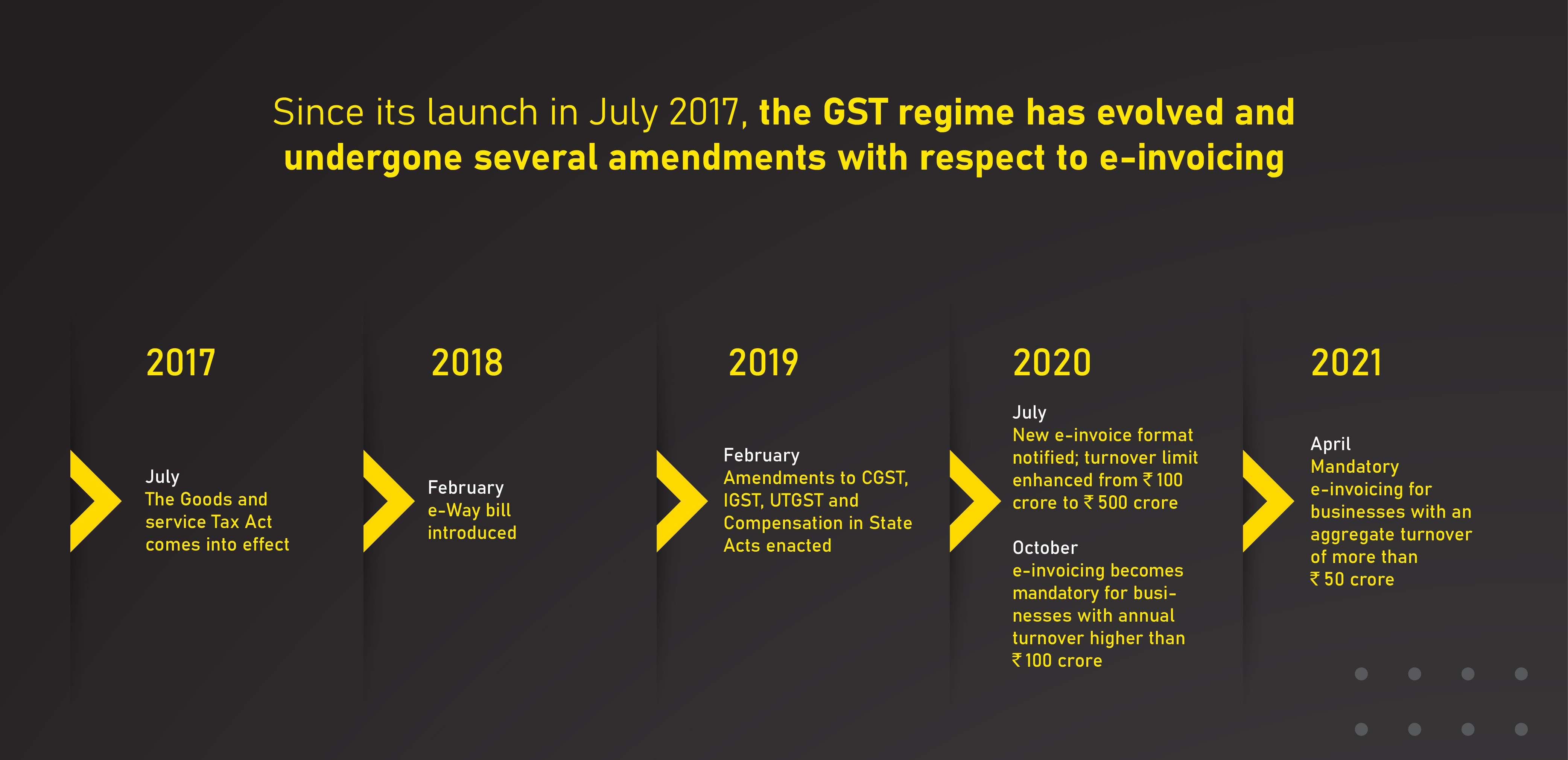

GST has been in place in India for five years, while the e-invoicing system has been in business for about two years. Since then, a lot has changed. While GST consolidated all indirect taxes and set the path for a slew of digital reforms, e-invoicing has revolutionized the way enterprises do business. Both changes have been tremendously beneficial and have sparked a shift in India’s corporate practices. Let’s have a look at how we can do it.

GST implementation acted as a stimulus for digital changes across the country

Businesses profited from GST in a variety of ways. For starters, it consolidated all indirect taxes into a single system that applied across the board. Online registration, returns, and refund procedures avoided the cascading impact of taxes and made doing business and complying with the law more accessible.

The GST has a positive impact on individuals as well as enterprises. The government employed the ‘one nation, one tax’ philosophy to simplify the whole compliance environment, including ITC claims. Changing the GST legislation only to enable ITC claims if a company’s suppliers provide invoices closes some of the most significant loopholes in the previous tax laws.

This affects how businesses operate since they are now responsible for ensuring that the vendors with whom they do business are always compliant. GST also facilitated the digitization of the supply chain, which was less evident at the time but is now. It all started when e-way bills were introduced to trace the flow of products across the country. Then there was e-invoicing, which digitized the invoicing function, which is the first step in preserving records. Both of these actions aided the government in tracking every single B2B transaction and using it to detect and prevent fraud.

To a considerable extent, e-invoicing has simplified reporting and tax compliance.

The government has simplified the invoice management process by mandating e-invoicing for all enterprises with a turnover of more than Rs.20 crore. The goal was to standardize invoices to make them machine-readable and interoperable across business and compliance environments. As a result, invoice reporting, accounts receivables management, e-way bill generating, data reconciliations, and GST return filing have all become more efficient.

Another significant benefit of e-invoicing is the decrease in person-hours required for data input and reconciliations, which were previously required in traditional paper and pen accounting. With the press of a button, taxpayers may now reconcile data or file GST returns. There is no need for them to manually enter data in their books of accounts, GST reports, or for issuing e-way invoices. Data is auto-populated across numerous ecosystems using a single source of data entry.

Making the decision to digitize should be considered.

The adoption of GST and e-invoicing have one thing in common: the digitalization of procedures. GST established the standard by putting typical processes that were previously done offline, such as registration, return filing, and so on, online, including assessments and whole refund procedures.

E-Invoicing was implemented to digitize invoicing, which is the initial stage in record-keeping. Invoicing, reconciliations, tax return filing, and input tax credit claims have all been revolutionized as a result of their collaboration. It will only be a matter of time until e-invoicing is expanded to include other businesses and invoice types in India.

In India, taxpayers should now make digitalization a conscious decision. The government has taken the lead in implementing electronic invoicing and return filing, as well as beginning to use data analytics and artificial intelligence (AI) to detect tax leakages. It’s past time for taxpayers to do the same, but this time to prevent it.

A large number of Indian businesses have hopped on the digital bandwagon and are now using cutting-edge digital technologies provided by SaaS platforms to detect cash flow leakages and optimize taxes, for example. Input tax credits are one of the most common types of cash flow leakage in businesses. In average-sized industries, ITC losses run to lakhs per year due to a combination of non-compliant vendors, poor reconciliations, and ineffective vendor management. This might be in the millions of dollars in larger companies.

The issues listed above may be readily solved by using an automated GST return filing, reconciliation, and ITC claim system. Aside from tax savings, businesses save on labour, which leads to more money. Similarly, SaaS solutions include a plethora of automated features, including invoice capture, integrated e-invoicing, an e-way bill generating, accounts receivables and payables administration. A single button press completes the task while ensuring precision.

Streamlined processes, among other things, make it easier to get credit.

Financial operations may be streamlined by automating them. This results in another significant benefit for both large and small businesses: more accessible and faster access to funding. There are many more choices for supply chain finance now than there were in the past. For example, digital invoice discounting gives organizations a cash inflow nearly quickly.

The implementation of GST and e-invoicing has resulted in unprecedented openness and accountability. Large companies are more inclined to put their cash in the treasury, lending institutions find the verification procedure more accessible, and small businesses have faster access to capital.

As a result, regardless of the company’s size, every company should consider automating procedures. The government will digitize the supply chain sooner or later. To guarantee that all corporate transactions are trackable and traceable, it has already begun with e-invoicing, e-way bills, and the connection of direct and indirect taxes. Taxpayers should strive not simply to keep up but to stay ahead. The advantages of digitalization in the workplace are numerous.