Bajaj Auto agrees to buy back shares for Rs 2500 billion

Bajaj Auto agrees to buy back shares for Rs. 2500 billion.

As previously the board of the automaker Bajaj Auto NSE 1.25 percent has announced that it would meet on June 27 to make a decision about the share buyback proposal.

The Pune-based company had earlier stated that its board will consider a repurchase on June 14 prior to the decision’s postponement.

This would be Bajaj Auto’s first repurchase since 2000 if allowed.

After 22 years, the corporation is returning with a buyback. In 2000, Bajaj Auto undertook a buyback of up to 1.82 crores of equity shares at a price of Rs 400 per share.

Bajaj Auto shares closed slightly down on Wednesday at Rs 3,635.65. The shares have increased by roughly 12% so far this year, far outpacing the market.

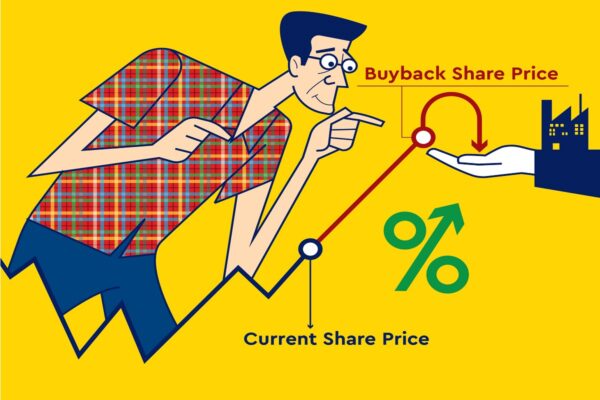

Purchase of shares by Bajaj Auto: The two-wheeler manufacturer said on Monday that the Board has approved the purchase of shares for up to Rs 2,500 crores. At a price of Rs 4,600 per share, the business plans to repurchase 54.35 lakh shares or 1.88 percent of the paid-up share capital.

The proposal to repurchase fully paid-up equity shares of the firm up to Rs 2500 crore at a price that does not exceed Rs 4600 per share was authorized by the Board of Bajaj Auto at its meeting on June 27, 2022. The indicated maximum number of equity shares planned for buyback at the maximum price would be 54,34,782 equity shares, or around 1.88 percent of the company’s paid-up share capital as of 27 June 2022.

A buyback price of no more than Rs4,600 had been authorized, according to a disclosure made by Bajaj Auto to the BSE.

“We are pleased to inform you that the board of directors of the Company (“Board”) has approved the proposal for the buyback of the fully paid-up equity shares of the Company (“Equity Shares”) with a face value of Rs. 10/- each from the existing shareholders of the Company (excluding the Promoter, Promoter Group, and Persons in Control of the Company) from the open market through the stock purchase plan,” the company stated in a BSE filing on Monday.

The buyback price is 20.64 percent higher than Friday’s closing price of Rs3,812.80.

The share repurchase, which will be executed in the open market through a stock exchange mechanism, will only be available to current shareholders, and excludes promoters, promoter groups, and anyone in charge of the company, according to the corporation.

According to the release, it would account for 8.71 percent of the free reserves, which includes the account for securities premiums.

According to the company, under the circumstances that the market price of the equity shares is equal to or less than the maximum buyback price, the indicative maximum number of equity shares proposed to be bought back would be 54,34,782 equity shares, or roughly 1.88 percent of the paid-up share capital of the Company as from 27 June 2022.

The manufacturer said, ” “If equity shares are bought at a price below the maximum buyback price, the actual number of equity shares to be bought may be larger than the proposed repurchase shares, but will always be limited by the maximum buyback size.

The company said that it would buy a minimum of 27,17,392 equity shares based on the minimum repurchase size and maximum buyback price. The amount identified as the maximum buyback size, or Rs. 1,250 crore, will be at least partially used for the buyback, according to the corporation.

The company told BSE that the buyback committee has been established and given permission to carry out any acts, deeds, matters, or things that the board of the company may, in its sole discretion, find necessary, expedient, or proper in connection with the buyback.

Share repurchases, according to analysts, are a common way for companies to grow their earnings per share, distribute extra cash to shareholders, and raise stock prices even in down markets.

What are buyback shares?

A corporation reduces the number of shares that are available on the open market when it purchases its own existing shares, a practice called repurchasing shares.

A company may take this action to give shareholders money they don’t need to pay for operations and other investments back.

In a stock buyback, a company buys shares of stock on the secondary market from any shareholder who wants to sell. All stockholders are eligible to participate in stock buybacks, and no specific class of stockholders is intended to be targeted. Shareholders are not obligated to return their stock to the company.

Companies buy back shares for a number of reasons, such as to increase the value of the shares that are still in circulation by reducing the supply or to stop other shareholders from acquiring a controlling stake.

How do Buybacks shares operate?

There are two ways to conduct buybacks:

A tender offer may be made to shareholders, giving them the chance to submit all or a portion of their shares within a certain time period at a price higher than the current market price. Investors who offer their shares rather than holding onto them are compensated with this premium.

Companies may have a defined share repurchase program that purchases shares at specific times or on a regular basis in addition to repurchasing shares on the open market over an extended period of time. Using cash on hand, loans, or cash flow from operations, a firm can finance its buyback.

A company’s existing share repurchase program is increased with an enlarged share buyback. A company’s share repurchase program is expedited by an enlarged share buyback, which also causes its share float to fall more quickly. An extended share buyback’s effect on the market will depend on how big it is. The share price will probably increase in response to a sizable, expanded buyback.

The buyback ratio evaluates the total amount spent on buybacks during the previous year in relation to the company’s market capitalization at the start of the repurchase period. The buyback ratio makes it possible to compare the prospective effects of repurchases among various companies. Because companies that consistently engage in buybacks often beat the market as a whole, repurchase activity is a good sign of a company’s capacity to return value to its shareholders.

Why Do Businesses Repurchase Their Own Stock?

Companies can invest in themselves through buybacks. A corporation may do a buyback to give investors a return if it believes that its shares are undervalued. By reducing the number of outstanding shares, the share repurchase increases the value of each share as a proportion of the firm.

Compensation criteria are still another justification for a buyback. Companies frequently give stock awards and stock options to management and staff, and a repurchase helps prevent the dilution of current owners. The last option is to use a repurchase to stop other shareholders from acquiring a controlling interest.

The price of a company’s stock increases if there is a demand for its shares, as explained below. A corporation that purchases its own stock adds value for all of its shareholders by driving up the price of its stock through increased demand.

Criticism to buybacks shares

A share repurchase may give the appearance that a company has no alternative viable growth prospects, which is problematic for growth investors seeking higher sales and profit margins. Due to shifts in the economy or market, a firm is not mandatory to buy back shares.

Repurchasing shares puts the company in a vulnerable position if the economy experiences a downturn or the organization also faces financial challenges that it cannot overcome. Some people assert that buybacks are periodically used to artificially inflate market share prices, which can also lead to higher CEO compensation.

edited and proofread by nikita sharma