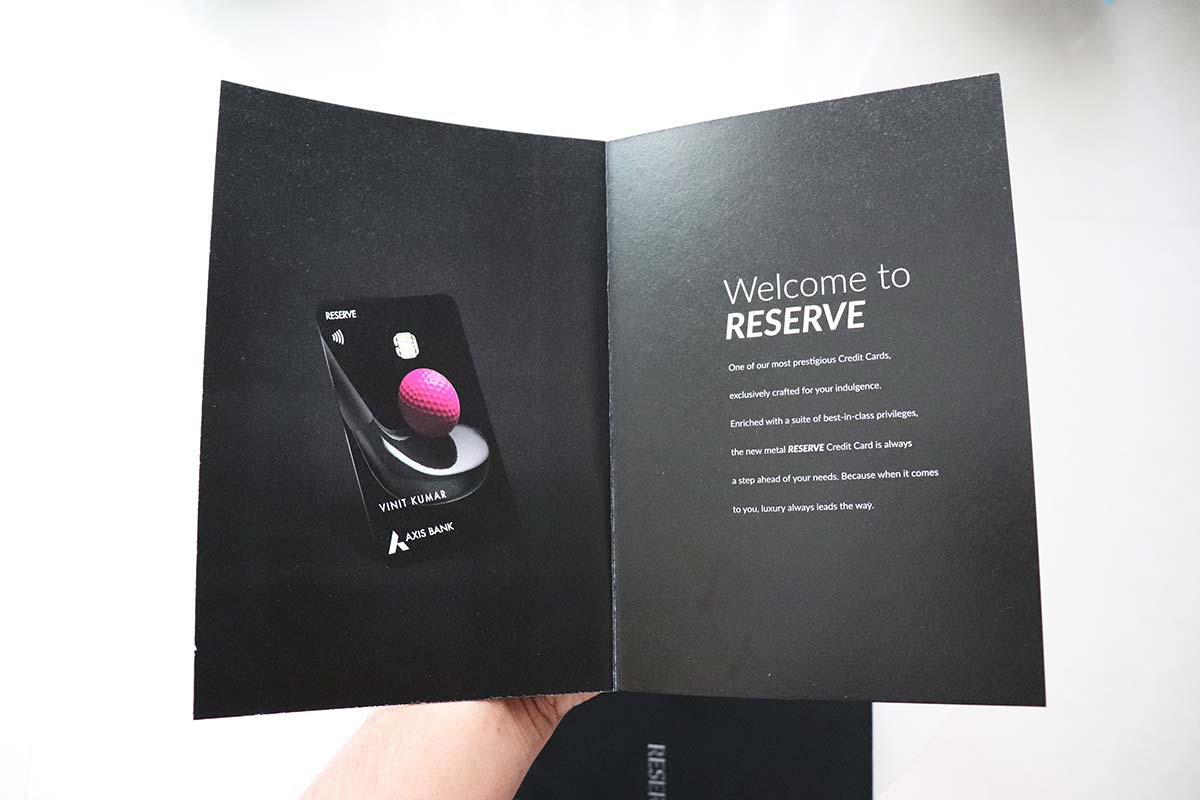

Axis Bank Reserve Credit Card: New Rules for Customers from August 13; Details Here

Axis Bank Reserve Credit Card: New Rules for Customers from August 13; Details Here

The terms and conditions that apply to Axis Bank Reserve Credit Card users have been updated.

Axis Bank, one of India’s largest private-sector banks, has been setting benchmarks in customer service through continuous innovations and improvement in its product offerings. Continuing this tradition, the bank has announced changes in the rules for its highly coveted Reserve Credit Card, which will come into effect from August 13, 2023. These amendments aim to enhance the customer experience and provide added value to cardholders.

The terms and conditions that apply to Axis Bank Reserve Credit Card users have been updated. According to material on the Axis Bank website, the updated restrictions will take effect on August 13, 2023. The information about the modifications that Axis Bank disclosed is provided below.

The bank stated that transactions made with government entities and utilities would not count towards the expenditure criteria for a yearly fee waiver.

Additionally, purchases made at government agencies and for utilities will not qualify for EDGE Rewards.

Customers can transfer EDGE Reward points following the amended transfer ratio 5:1 (5 EDGE Reward Points = 1 Partner Point/Mile) to local and foreign partners across airlines and hotels.

The transfer ratio for Reserve for Accor will be 10:1 (10 EDGE Reward Points = 1 Partner Point/Mile).

A yearly maximum of 5,000,00,000 EDGE Reward Points per customer ID can be converted to Partner Points.

Customers can convert 5,00,000 EDGE Reward Points for 2023 between August 13 and December 31, 2023.

Customers may only link one partner programme loyalty ID for each airline/hotel transfer partner at any one time.

According to the bank, the primary/existing connected ID will be automatically delinked if a customer chooses to link a different ID.

After upgrading the partner loyalty ID with Axis Bank Travel EDGE for each specific partner programme, the client must wait 60 days before updating the secondary or new partner loyalty ID.

Customers may transfer their EDGE Reward Points to 19 local and foreign airlines and hotels to continue redeeming their accrued points.

Axis Bank has also updated the list of Priority Pass-eligible lounges. The list presently consists of:

Agartala – Primus Lounge

Allahabad/Prayagraj – Zesto Executive lounge

Amritsar – Costa Coffee

Bhopal – Primus Lounge

Cochin – Earth Lounge

Dibrugarh – Primus Lounge

Guwahati – The Lounge

Kannur – Pearl Lounge Domestic

Madurai – Primus Lounge

Varanasi – Take Off Bar

One of the significant changes is in the reward points structure. Starting August 13, customers will receive three reward points for every Rs. 100 spent domestically instead of the existing 2 points. Similarly, the reward points have been increased for international spending from 3 points to 4 points for every Rs. 100 spent. This new structure gives frequent shoppers and international travellers an added advantage, as they can now accrue points faster.

The Reserve Credit Card has always been famous for its premium travel benefits. In its new amendments, Axis Bank has further upped the ante. The bank now provides unlimited complimentary access to international lounges under the Priority Pass Program, compared to the earlier limit of 6 visits per year. Domestic lounge visits are also endless, a marked improvement from the previous 2 per quarter.

Axis Bank has revised its insurance policy to enhance the protection benefits for Reserve Credit Card holders. The air accident cover has been increased from Rs. 2.5 crores to Rs. 3.5 crores. The purchase protection cover is now Rs. 1 lakh instead of Rs. 50,000. These enhanced insurance benefits are free, giving cardholders greater peace of mind.

In a significant move, Axis Bank has also reduced the foreign transaction markup fee from 3.5% to 2.5%. This reduction is particularly beneficial for customers who frequently travel abroad or make purchases in foreign currency. The reduced forex markup can translate into substantial savings over time.

With these enhanced benefits, the Reserve Credit Card’s annual fee has been slightly increased. Starting from the second year, the annual fee will be Rs. 12,000, up from Rs. 10,000. However, this fee can be waived if the yearly spending of the customer exceeds Rs. 15 lakhs.

Customers of the Reserve Credit Card will be entitled to unlimited free access to domestic lounges during the year as part of the domestic lounge programme. This applies to owners of both primary and add-on cards. In addition, accompanying visitors receive 12 free visits each year.

Reserve Credit Card holders will be entitled to 12 guest visits annually and unrestricted free access to international lounges for Primary Cardholders as part of the Priority Pass Programme.

The changes announced by Axis Bank reflect its commitment to continuously improve and provide enhanced value to its Reserve Credit Card customers. The increased rewards, enhanced travel and insurance benefits, and reduced forex markup provide considerable value that more than compensates for the slight increase in annual fees.

It’s also a strategic move, likely to attract high-net-worth individuals and frequent travellers to opt for the Reserve Credit Card. Customers should note these changes, effective August 13, and understand how they can leverage the enhanced benefits in their favour.

Disclaimer: The content above is just for informative reasons and is based on data published in a document on Axis Bank’s website. Any questions should be directed to the bank.