Apollo Hospitals Follow The Tide: Stakes Worth $200Mn To Be Diluted

India's largest hospital chain, Apollo Hospitals has decided to sell its stake of about 6 per cent in its digital wing, Apollo HealthCo, after incurring losses during the past fiscal year. Here is what it would bring in.

The stakes of Apollo HealthCo, the digital arm of Chennai based Apollo Hospitals Ltd. are proposed to be diluted by 6 per cent at an estimate of about 200 million dollars.

The Chief Financial Officer of Apollo Hospitals Group, Krishnan Akhileswaran proclaimed that the growth story of Apollo HealthCo is backed by a pack of investors evincing high level of interests in the digital arm of the group.

Apollo HealthCo is home to a pharmacy distribution business, the digital business of Apollo Hospitals viz. Apollo 24×7, and a 25.5 per cent interest in Apollo Pharmacies.

Apollo Hospitals would be raising around 200 million dollars in equity from the selling of their stakes in the group’s digital wing.

The Pratap Reddy founded hospital chain uncovered a 52-week high drastic share price of Rs. 5008 per share after the firm announced its stake disposal.

Story Of Profit & Loss

The digital health business of Apollo Hospitals had been burning cash, quoting an average of Rs. 180 Crore in each quarter of FY23, making a total loss of about Rs. 304 Crore in the fiscal year for the healthcare group.

Apollo Hospitals had reported a revenue of Rs. 6705 Crore, thanks to the contribution of its offline pharmacy distribution of Rs. 534 Crore in EBITDA (Earnings before interest, tax, depreciation and amortization) in FY23, which scaled up its overall growth to 31 per cent year-on-year.

The Gross Market Value (GMV) of Apollo 24×7 scored a striking Rs. 1,630 Crore during the last quarter, in contrast to the expected valuation of Rs. 1,500 Crore.

The revenue from the healthcare services of Apollo Hospitals jumped up notably by 18.5 per cent in its fourth quarter by May, which holds about 51 per cent share in the comprehensive revenue of the company.

The losses incorporated in the digital health unit is intended to be narrowed down even as it tries to surmount, while the management team is sketching out the modus operandi.

Owing to the tepid performance struck by the online pharmacy and the hospital segment, the last fiscal year performance for the March quarter were muted for Apollo Hospitals.

Hospital occupancy in the March quarter of FY23 trimmed down to 64 per cent sequentially, whereas a quarter-on- quarter dip of 30 basis points is further revealed in the margin to 24.4 per cent in spite of the lower patient

admission institutionally.

Therefore, to stand in the profitable grounds, around 5-6 per cent of the stakes in Apollo HealthCo is expected to be sold out at an enterprise valuation of approximately 2.5-3 billion dollars.

Channeling The FY24 Growth

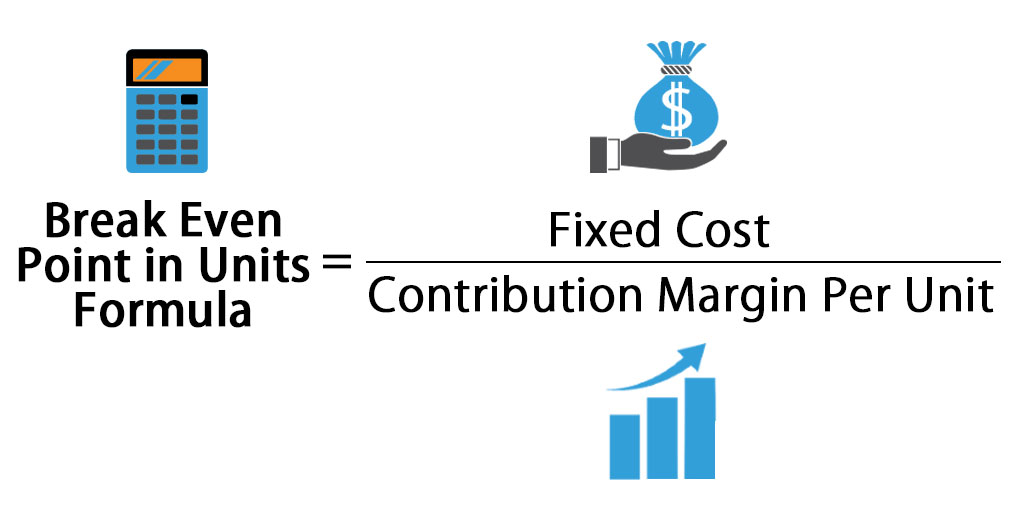

The largest hospital chain of India is laying the groundwork for FY24 to be more operationally successful, that would witness Apollo 24×7 setting foot on the breakeven point of EBITDA, along side some complementary cost effective measures that would wholly contribute to a powerful blended margin for the healthcare group.

Sunita Reddy, the Managing Director of the Omni channel business of the company Apollo 24×7, exclaimed that the last 18 months including the fiscal year 2023 had been quite a loss for the firm, however good to better scenes are still on its way, with the fourth quarter of FY24 most likely showcasing the entry of Apollo 24×7 into the EBITDA breakeven.

Akhileshwaran pointed out that the embarrass de richesses would be significantly lowered in FY24, whereas Apollo 24×7 is pledged to focus more on its balance books by Q4FY24.

Nevertheless, everything comes with a price. In order to reduce the cash burn, some strict measures are deemed to flow in, that would include but not limited to rationalization of manpower, online discount reduction to 18 per cent from 15 per cent, improvising revenue conversion from GMP to 50 per cent rather than 42 per cent, and duplexing the gross merchandise value (GMV) to Rs. 3000 Crore.

The 40-year old Apollo Hospitals group hopes that by the second half of the current financial year, quarterly costs can be curtailed by Rs. 25-30 Crores if the potential initiatives are strategically followed.

With better occupancies, slimming down of cash burn in Apollo 24×7, and refinement in payer mix, the margins would certainly increase in the near term for Apollo Hosptials.

Proofread & Published By Naveenika Chauhan