Ant Group’s Explosive IPO Listing Delayed: Expert Report on Impact to $1 Billion Revenue Loss

Ant Group’s Explosive IPO Listing Delayed: Expert Report on Impact to $1 Billion Revenue Loss

A recent expert report has revealed that the much-awaited initial public offering (IPO) of Ant Group won’t happen soon. This news has caught the attention of many in the financial world, given the company’s popularity and potential.

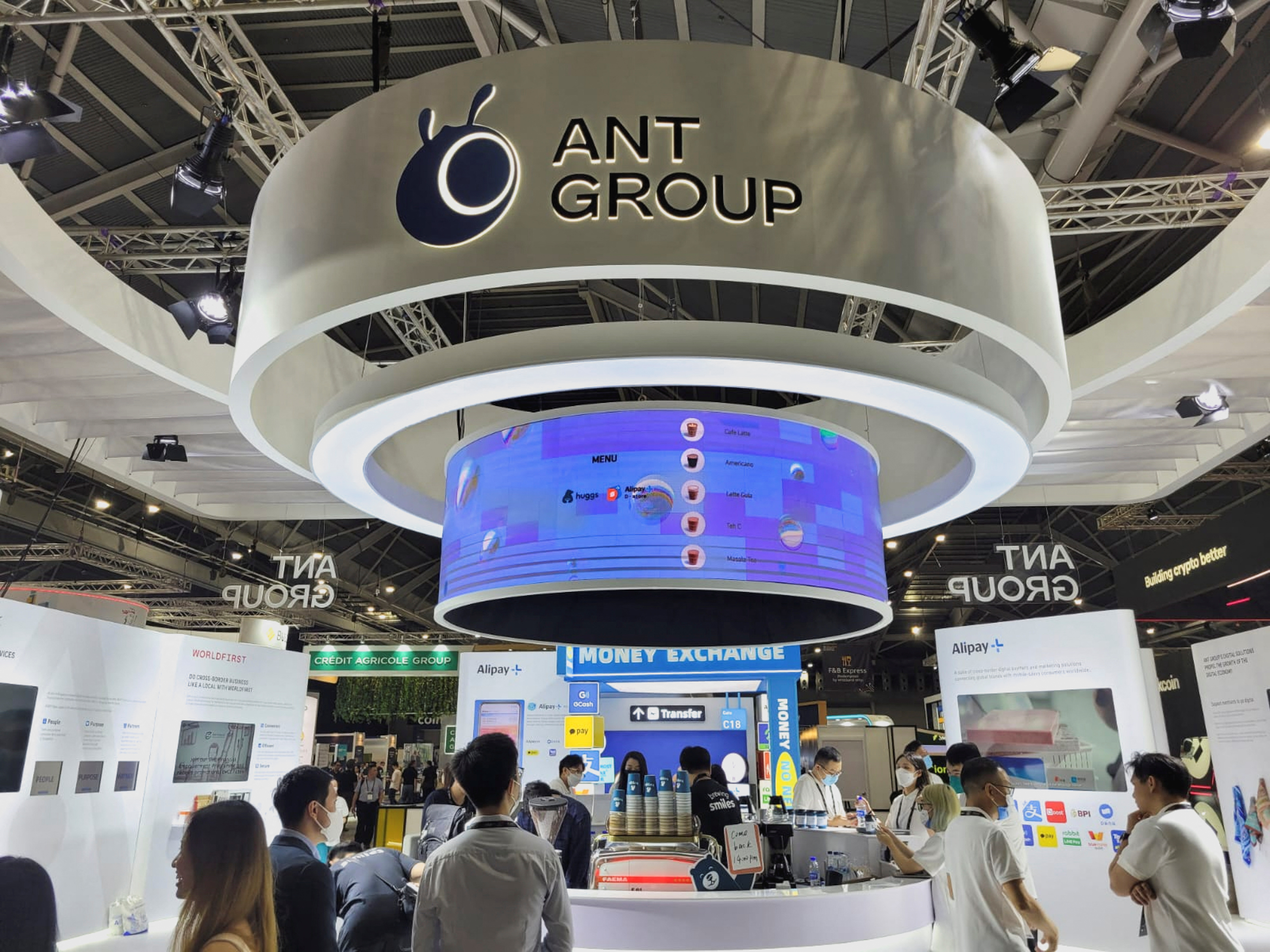

Ant Group, a big player in the world of financial technology and linked to Alibaba, had planned a significant IPO in late 2020. However, just before it was set to happen, Chinese regulators stepped in because they were worried about the company’s complex financial structure and the risks it might pose to the country’s financial stability.

This surprise decision had a major impact on investors and global financial markets. Ant Group’s IPO was expected to be the largest ever, with a value higher than that of many countries. The suspension of the IPO was a huge setback for the company and left investors uncertain about its future.

Since then, Ant Group has been working hard to address the regulators’ concerns and improve its compliance with rules and regulations. But the expert report suggests that the company’s efforts might not be enough to meet the strict regulatory requirements set by Chinese authorities. As a result, the IPO is unlikely to happen anytime soon.

The report points out that the fintech industry in China has been facing increased scrutiny from regulators. They are worried about the risks posed by unregulated financial activities and want to protect the country’s financial stability. Ant Group’s wide range of financial services made it a significant player in China’s financial landscape, leading to closer attention from regulators.

Another challenge for Ant Group is organizing its many operations and separating its various businesses. The company is a technology platform offering various financial services, including digital payments, wealth management, and micro-lending. Making these operations comply with regulatory requirements has proven to be a tough task for Ant Group.

The IPO suspension has also affected Ant Group’s value and financial health. Its valuation, which was very high before, has been lowered due to uncertainty about its future listing. This has led some investors to sell their shares in the company, reducing its market value.

Despite these difficulties, the report acknowledges Ant Group’s efforts to change and adapt its business model to meet regulatory demands. The company has been talking with regulators and promising to be more transparent, improve risk management, and treat customers fairly.

Although the IPO is on hold, Ant Group’s core business remains strong. Its digital payment platform, Alipay, is a dominant force in China’s cashless economy, with millions of users using it for everyday transactions. The company has also been exploring opportunities in global markets through partnerships and investments in different regions.

As Ant Group faces this challenging situation, it has to find a balance between innovation and following the rules. The company’s success was built on its innovative approach to offering financial services to many consumers and small businesses. However, this innovation also attracted regulatory attention, and now Ant Group must find a way to comply with the rules while still innovating.

Alipay, the heart of Ant Group’s business, is essential for its success. It has revolutionized the way people in China make transactions and has become a crucial part of daily life for many. Keeping the trust of its users is crucial, as any mistakes could damage its reputation.

Ant Group has also been trying to expand globally by partnering with overseas companies. This comes with its own set of challenges, like dealing with different regulations and cultures. Ant Group’s success in international markets will depend on its ability to adjust its business model to suit local needs while following international rules.

The delay in the IPO has affected investor confidence and could impact the company’s ability to raise money. However, if Ant Group can resolve its regulatory issues and relist the IPO successfully, it may present a new opportunity for investors, especially if the company’s underlying business remains strong.

It’s important to remember that Ant Group is not the only company facing regulatory challenges in the fintech industry. Around the world, policymakers and regulators are trying to balance encouraging innovation with keeping financial systems stable and protecting consumers.

In response to the regulatory concerns, It has promised to operate more like a financial holding company, with stricter capital requirements and risk management standards. The company also plans to sell some non-core businesses to simplify its operations and reduce risks. These steps show that Ant Group is committed to following the rules, but the process will take time.

In conclusion, the immediate listing of IPO is uncertain, but the company’s journey is not over. The expert report highlights the complexities of dealing with finance and technology. Ant Group’s resilience and willingness to address regulatory concerns are positive signs for its future. As the company continues to change and grow, people all over the world will be watching to see how this fintech giant shapes the future of finance.