All You Should Know About Space Investment – How to Invest, Profitable Sectors, and Risks

All You Should Know About Space Investment – How to Invest, Profitable Sectors, and Risks

From commercial space exploration to satellite communications, tech firms and investors everywhere are looking to the skies. With the space sector growing at an impressive rate, this could be the perfect time to invest in space tech. We run through some options for investing in space exploration and the top space companies.

Reasons Why You Should Invest in Space Companies

Growing industries create investment opportunities, and the space sector is certainly on the up. Current predictions from Morgan Stanley suggest the industry could be worth more than $1 trillion by 2040. This projected growth has led to a wave of investment in space firms and start-ups, leading to plenty of exciting ventures that investors can support.

Investment Methods: Which One to Choose?

If you’re wondering how to invest in space firms, there are several methods that you can select. For instance, many people opt for space investments funds, like ETFs or SPACs, while others choose to invest in space companies individually. If you’re keen to find out how to invest in space stocks, this list should give you some ideas:

- Pure-Play Investment

A Pure-Play investment involves putting money into your own space company. Obviously, this one is reserved for billionaires or people with a lot of money to spend. Elon Musk famously built SpaceX this way, just as Jeff Bezos set up Blue Origin. For those on ordinary incomes, this is likely not an option. However, there are still plenty of ways to invest in space travel.

- SPACs or IPOs

Space SPACs have recently become extremely popular. SPACs or IPOs allow private investors to make a direct contribution and then go public, allowing other people to buy stocks. Virgin Galactic and Aerojet Rocketdyne Holdings are among the notable space companies that have gone public through this way.

- ETFs

Exchange Traded Funds are great if you’re wondering how to invest in space industry firms without committing hard to a single enterprise. Similar to a mutual fund, ETFs pool investments across a specific sector, so your money is not tied to a single company. Instead, your contribution is tied to space investment stocks more broadly, making this an accessible long-term approach. This option is also lower risk than direct investments, although you can expect a slightly lower rate of return because of this. If you’re interested in investing in space stocks, ETFs like Ark Space Exploration and Innovation or Procure Space are potential options.

- Venture Capital Funds

Venture Capital Funds are some of the best space investments for high-net-worth investors. High earners with interest in space invest in venture funds to support individual enterprises or companies. These tend to be high-risk, high return, and go all-in on single projects or parts of the sector. If you’re looking for space stocks to invest in or a space investment trust, options include funds like Skyrora Ventures, Space Capital, or Seraphim Space.

- Fringe Investments

Another way to invest in space companies indirectly is to put money into fringe-related companies. These are usually companies that supply or are affiliated with the space sector. Examples of this include investments in aerospace companies like Lockheed Martin, Boeing, Honeywell, Raytheon Technology, or Northrop Grumman. There are also many other fringe firms you could choose to invest in.

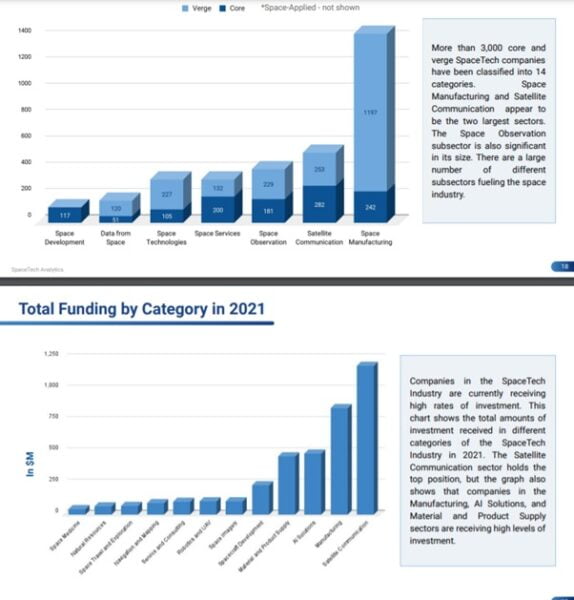

Space Manufacturing and Satellite Communications are Booming

Before you make a targeted investment in any field, you should find out how each area of the sector is performing. Current space sector trends indicate that areas like aerospace and defense, satellite communications, telecom, and high-speed cargo delivery are all likely to experience an upswing. The most recent Space Tech Analytics Report also signals manufacturing sectors and satellites networks as two growing areas.

Downsides of Space Investments

Of course, like all investments, there is an element of risk when you invest in space. Although the space industry is growing, many start-ups have yet to test their products on an open market and may suffer from overinflated demand projections. On top of this, popular sectors, like space tourism, may not become realistically profitable ventures for many years. However, areas like satellite internet networks that have already been tested are more likely to perform in line with projections.

Summary

If you’re interested in returning a profit fast, the space sector is not the best place for you. Overall, those who invest in space are betting on a long-term outcome and increased profitability over time. Still, it is worth doing your research into the best space companies to invest in or finding out which areas are performing well. After all, an investment in the space sector today may help build the technology of tomorrow.