Addressing Critical Parts Conundrum, Apple Seeks Companies In India, South Korea, Japan And Taiwan

Apple is looking to diversify its supply chain in response to delays in approvals for Chinese suppliers and the evolving geopolitical scene. The tech giant is actively seeking alternative suppliers in India, Japan, South Korea, and Taiwan for critical components required for manufacturing its flagship iPhones and iPads. The strategic move comes amid increasing tensions and cautious government approvals, prompting Apple to explore partnerships with companies in different regions. Apple is strategically positioning itself to bolster its manufacturing capabilities outside of China in a bid to overcome obstacles, such as national security concerns and intricate technical requirements.

According to sources familiar with the matter, Apple is actively seeking new suppliers in India, Japan, South Korea, and Taiwan to source essential components for its contract manufacturers in India.

This initiative arises from delays in government approvals for imports from existing suppliers, primarily of Chinese origin, for critical components such as batteries, camera lenses, chargers, and other equipment necessary for manufacturing flagship iPhones and iPads in India.

In January, approximately 17 Chinese companies supplying components for Apple’s devices applied for government clearances to establish manufacturing facilities in India – while 14 received initial approval, four companies faced indefinite delays, and six expressed a lack of interest in manufacturing in India.

National security concerns related to the Chinese origin of these companies were cited as a factor in the cautious granting of approvals.

“The approvals (in January) were only initial approvals. Because most of these companies have Chinese origin, national security is also an issue. Those approvals have to be carefully given. Issues of environmental clearances, which are a state subject, are given by expert committees,” a senior government official said.

The list of approved companies includes Sunny Optical Technology Group and Han’s Laser Technology Industry Group, among others. Due to approval delays, luxshare-ICT, an airpods maker, relocated its manufacturing unit to Vietnam while another significant player, ON Semiconductor Shenzhen China, is also among the approved companies.

However, another government official said, “It is wrong to say we have turned down the application of any of these companies. All government approvals have to be given after careful consideration of all factors.”

Apple is now exploring partnerships with companies in India, Taiwan, Japan, and South Korea to establish “just-in-time” supply chains and accelerate local production.

The strategic move is in response to delays caused by various approvals pending at both central and state levels, prompting Apple to diversify its supply chain beyond China.

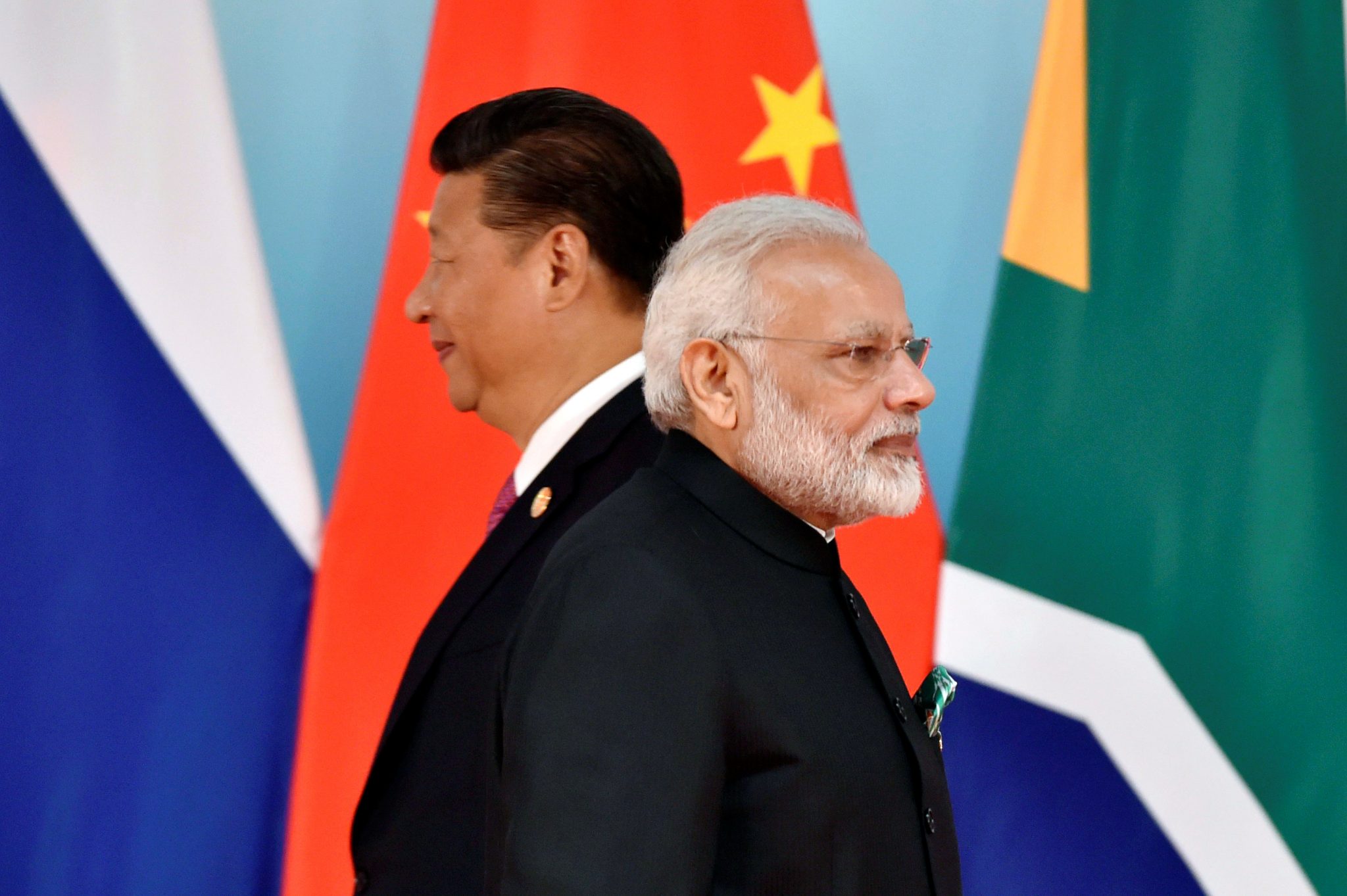

India-China Relations The Main Factor

Geopolitical tensions, particularly the India-China border dispute, may contribute to delays in approvals for Chinese-origin suppliers reckon senior industry executives.

“Some of these companies, which supply crucial components but are smaller on the global stage, are unlikely to take the risk of investing in a hostile country even after they get approvals. They must have re-evaluated the risks,” a senior industry executive said.

Diversifying Supply Chain

Apple’s quest for diversified supply chains outside China aligns with its strategy of setting up assembling units initially and subsequently bringing in specialized component suppliers.

Some of Apple’s major electronics manufacturing services (EMS) players, such as Foxconn, Pegatron, and Wistron (now owned by Tata Electronics), operate in India.

“They work backwards, in the sense that they begin with finding companies that are into distribution and management of large retail networks. Then they move upstream from retail and distribution to assembly, and that’s where players like Foxconn and Wistron come in,” Martin Yang, senior analyst at US-based brokerage Oppenheimer & Co. “Those companies will have their inhouse manufacturers and then, as a final step, they bring in their suppliers.”

In response to challenges, Apple is engaging in preliminary discussions with companies in India, Taiwan, Japan, and South Korea for crucial components like batteries, chargers, casing units, and cables.

While Apple aims to replace Chinese suppliers, challenges may arise in finding alternatives for highly technical components like camera lenses.

However, despite hurdles, Apple remains committed to its aggressive push for manufacturing in India.

Japan-based TDK is set to contribute to Apple’s supply chain by manufacturing lithium-ion battery cells at a new plant in Haryana, as announced by IT minister Ashwini Vaishnaw.

Additionally, Tata Electronics, the sole Indian vendor to Apple, plans to nearly double its capacity at the iPhone casing facility.

As part of its broader supply ecosystem strategy, Apple is taking a phased approach, beginning with assembling units and progressively integrating specialized component suppliers.

Analysts emphasize that Apple’s meticulous planning involves identifying companies involved in distribution and retail management, moving upstream to assembly, and finally incorporating specialized manufacturers through players like Foxconn and Wistron.

While Apple faces challenges in replacing Chinese suppliers for certain highly technical components like camera lenses, the company is strategically evaluating each component’s migration feasibility.

In this sense, Apple remains resolute in its commitment to manufacturing in India and mitigating potential risks associated with geopolitical factors and supply chain disruptions.

The Last Bit, While Apple navigates the intricacies of global supply chain dynamics and geopolitical factors, the company remains resolute in its commitment to manufacturing in India.

The quest for alternative suppliers signifies a strategic move to mitigate risks associated with geopolitical tensions and streamline the production process.

While challenges persist, Apple’s meticulous planning and phased approach to integrating specialized component suppliers demonstrate its determination to establish a resilient and diversified supply chain outside of China.

The tech giant’s steps reflect not only a response to immediate challenges but also a forward-looking strategy to position itself for sustained success in global technology manufacturing.