Adani’s Rise to Riches Outmatches Mukesh Ambani To Become The Richest Indian On The Bloomberg Billionaires Index; Fair And Square On SEBI’s Investigation? What Will Congress Do Now?

Gautam Adani, the chairman of Adani Group, surpassed Mukesh Ambani on the Bloomberg Billionaires Index, claiming the title of the richest Indian. Adani's meteoric rise has been marked by remarkable financial gains, propelling him to the 12th position globally, with a net worth of $97.6 billion. This notable achievement, however, comes amid a tumultuous year for the Adani conglomerate, marred by controversies, accusations, and legal battles. Despite the Supreme Court's vote of confidence in SEBI's investigation, questions about the regulator's efficacy have been raised - a fair verdict? The decision by the Supreme Court has implications, especially for the Congress party, as Congress leader Rahul Gandhi prepares for the Bharat Nyay Yatra, a nationwide tour focusing on economic justice and crony capitalism, where allegations against the Adani Group and the perceived proximity between Prime Minister Narendra Modi and Gautam Adani were set to be key talking points.

Gautam Adani, the head of the Adani Group, has surpassed Mukesh Ambani, the chairman and managing director of Reliance Industries, on the Bloomberg Billionaires Index, emerging as the wealthiest individual in India.

Adani now holds the 12th position, outpacing Ambani, who occupies the 13th spot. Adani’s overall net worth currently stands at $97.6 billion, while Ambani’s net worth is at $97.0 billion; notably, both billionaires have ascended in their rankings on the list.

In December of the preceding year, Adani secured the 16th position globally on the Bloomberg list, experiencing a three-place rise propelled by an impressive 30% gain in just two sessions, resulting in a substantial increase of over $4.41 billion in his fortunes.

The Ashes

The year 2023 brought significant challenges for Gautam Adani and his conglomerate. Allegations of corporate misconduct were levelled against Adani’s company, accompanied by accusations from the Opposition that the government favoured him over others.

Legal complications arose as the Supreme Court became involved, and investors faced financial setbacks.

The Rise From The Ashes

However, the Supreme Court recently dismissed calls for investigations into the Adani Group by a special investigation team (SIT) or the Central Bureau of Investigation (CBI), providing substantial relief to the business entity.

The Supreme Court also acknowledged the ongoing “comprehensive investigation” conducted by the Securities and Exchange Board of India (SEBI), expressing confidence in its proceedings.

The court directed SEBI to conclude the investigation within three months, and SEBI has already completed its Supreme Court-ordered probe into 22 of the 24 items.

In addition, the apex court urged the Central government and SEBI to carefully consider the recommendations put forth by a six-member expert committee, led by former Supreme Court judge AM Sapre.

The committee’s suggestions aim to enhance the regulatory framework, protect investors, and ensure the orderly functioning of the securities market.

Gautam Adani, expressing his gratitude for the court’s decision, posted on social media platform X, stating, “Truth has prevailed… Satyameva Jayate.”

He conveyed his appreciation to those who supported the Adani Group, emphasizing their commitment to contributing humbly to India’s growth story.

The Question Of SEBI’s Credibility?

Despite the Supreme Court’s vote of confidence in SEBI’s investigation, questions about the regulator’s efficacy have been raised.

Congress MP Manish Tewari criticized SEBI’s alleged lackadaisical attitude, questioning the delays in the probe. The court’s assertion that SEBI’s efforts inspire confidence may not align with the regulator’s extended deadlines and reported challenges.

Instances of ownership by benami shell companies and over-invoicing of coal imports by the Adani Group suggest potential discrepancies; the court, however, emphasized that news reports cannot substitute a proper SEBI investigation.

SEBI’s Track Record

The court’s reluctance to transfer the probe to another investigating body was based on SEBI’s perceived competence.

However, historical instances, such as the IL&FS crisis, are examples of SEBI’s failures in timely actions against companies violating regulations.

The extended delay in the Adani case, attributed to overseas challenges, also raises concerns about the regulator’s efficiency.

Congress Game Play

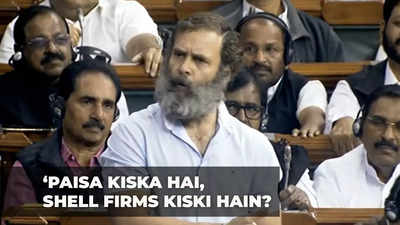

The Supreme Court’s decision on Wednesday to reject the transfer of the probe into allegations of stock price manipulation by Hindenburg Research against the Adani Group to a special investigation team is a setback for the Congress.

The court’s directive, instructing the market regulator SEBI to continue its investigation into the accusations and complete it within three months, coincides with senior Congress leader Rahul Gandhi’s upcoming Bharat Nyay Yatra, the second leg of his nationwide tour.

On the same day, the Congress-led government in Telangana held a meeting with the Adani Group, seeking potential investments in the state.

Rahul Gandhi, who has consistently accused the Narendra Modi government of favoring Gautam Adani, making it a central theme in his election campaigns, had planned to address the allegations against the Adani Group and the Prime Minister’s alleged “relationship” with the businessman during his upcoming yatra from January 14 to March 20.

This focus on economic justice and crony capitalism was expected to be a key talking point.

In February of the previous year, Rahul’s queries on the matter in Parliament were expunged by Lok Sabha Speaker Om Birla, including 18 bits from his 53-minute speech.

Despite this, the Congress had announced its intention to pose three questions daily on the Adani matter, with Congress communications head Jairam Ramesh initiating the questioning from February 5, 2023, onwards.

Opposition Parties

The stance of the Opposition parties in response to the Supreme Court’s order has been marked by a history of Parliamentary standoffs and subsequent shifts in alignment.

In February of the preceding year, the Opposition vehemently pressed for a Joint Parliamentary Committee (JPC) to investigate allegations against the Adani Group, intensifying their demands following the release of the Hindenburg report.

Despite the persistent calls from the Opposition, the Modi government remained resolute in rejecting the demand for a JPC.

However, internal divisions surfaced within the Opposition ranks as time progressed.

Notably, the Trinamool Congress and the Left aligned themselves with a Supreme Court-monitored probe, signaling a departure from the unified front. Further fracturing emerged when Nationalist Congress Party (NCP) chief Sharad Pawar distanced the party from the initial demand for a JPC.

Reacting to the Supreme Court’s recent order, Jairam Ramesh, the Congress communications head, characterized it as “extraordinarily generous to SEBI.”

He stressed the extension of SEBI’s original investigation deadline from August 14, 2023, to April 3, 2024.

Ramesh expressed concern over SEBI’s prolonged investigation into the Adani Group’s alleged violations of securities laws and stock manipulation, emphasizing that the regulator had failed to conclude its inquiry despite a ten-month timeframe provided by the Supreme Court’s expert committee.

Ramesh also referenced “a series of exposés from credible news sources,” including reports from the Organised Crime and Corruption Reporting Project and The Financial Times.

These reports alleged over-invoicing on coal imported by the Adani Group to Mundra Port in Gujarat. According to Ramesh, these exposés established a direct link between funds flowing from Indian coal utilities and electricity consumers to Adani Group companies, violating SEBI rules on minimum ownership and stock manipulation.

While acknowledging the court’s observation that news reports do not substitute for a proper SEBI investigation, Ramesh expressed concern about SEBI seeking repeated extensions while media exposés continued.

He cautioned against viewing the judgment as a “clean chit,” drawing parallels to the Expert Committee’s report, which had critiqued SEBI’s actions regarding reporting requirements related to the ownership of foreign funds.

The committee had noted SEBI’s challenge in balancing suspicions of wrongdoing with compliance, ultimately leading to a global regulatory impasse for the securities market regulator.

What Is The Road Ahead For Congress

In the wake of the Supreme Court’s judgment, the Congress party has affirmed its commitment to persistently address the issue and advocate for a Joint Parliamentary Committee (JPC) probe.

Emphasizing that the mandate of the Securities and Exchange Board of India (SEBI) is confined to investigating violations of securities regulations, the Congress accentuated the need for a broader inquiry.

The party contended that SEBI’s jurisdiction does not extend to scrutinizing actions such as the alleged manipulation of bidding conditions by the Modi government.

According to the Congress, SEBI would not delve into issues raised by objections from entities like the NITI Aayog and the Finance Ministry, leading to the establishment of what they term as a complete airports monopoly for Adani.

The party also accused the government of misusing enforcement agencies like the Enforcement Directorate (ED) and the Central Bureau of Investigation (CBI) to channel critical national assets into the hands of individuals aligned with the Prime Minister.

Jairam Ramesh, the Congress communications head, asserted that, to uncover the depths of what the party refers to as the “Modani MegaScam,” nothing less than a JPC probe would suffice.

He pointed out that none of the hundred pointed questions posed by the Congress in its series last year had been answered following the recent judgment.

Ramesh vowed that the party’s advocacy for justice against crony capitalism and its impact on prices, employment, and inequalities, under the banner of NYAY (Nyuntam Aay Yojana), would continue with increased vigour in the aftermath of the court’s decision.

The Last Bit, Gautam Adani’s ascent to the pinnacle of India’s wealth pyramid symbolizes strategic acumen.

The Supreme Court’s endorsement of SEBI’s ongoing investigation provides a momentary reprieve, yet questions linger about the regulator’s effectiveness and the need for expeditious resolution in sensitive cases that impact the nation’s economy, investor confidence and trust in the present government.