Adani lowers development and investment goals in post-Hindenburg recovery efforts

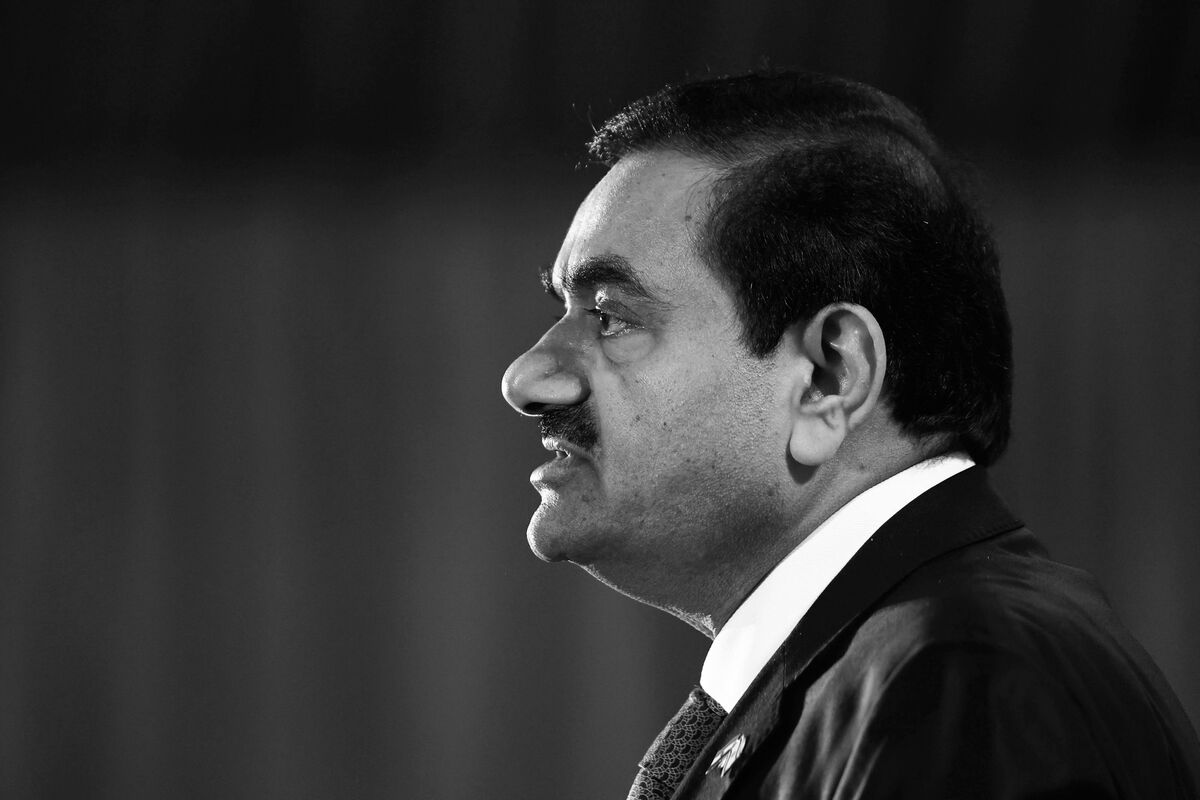

According to people familiar with the situation, Gautam Adani’s company has reduced its revenue growth target and plans to postpone further capital investments as the Indian billionaire works to rebuild investor trust after a brutal short seller onslaught.

The individuals, who requested to remain anonymous because the talks are private, stated that the organization will now strive for revenue growth of 15% to 20% for at least the upcoming fiscal year, down from the 40% increase initially envisaged. They said that capital spending plans will also be cut as the company prioritizes strengthening its financial position over rapid development.

The upgrade demonstrates the ports-to-power company’s efforts to repair the harm caused by an unfavourable review. is centred on maintaining cash on hand, paying off debt, and recovering pledged shares, according to a January 24 analysis by Hindenburg Research. Although the American short seller’s accusations of accounting fraud and stock manipulation were rejected by Adani Group, the incident still led to a stock market fall that significantly decreased the market value of the Adani empire by around $120 billion.

By deferring investments for only three months, the company may save up to $3 billion, money that, according to another source, may be used to lower debt or boost the company’s cash reserves. The organization’s plans are still being looked at, but it is anticipated that they will be finished in the coming weeks. A message asking for opinions on the Adani Group’s decision to lower its revenue target and postpone capital investment did not immediately receive a response from a corporate spokesperson.

‘Inter-Linkages’

According to research released on February 10 by Barclays Plc analysts led by Avanti Save, “the magnitude and economic interlinkages of the Adani businesses make it pertinent to examine what any slowdown in the group’s investments may entail for the economy as a whole.” The group’s investments or a disruptive conclusion to the situation “may have consequences for India’s capex cycle.”

Jugeshinder Singh, the chief financial officer of the Adani group, stated last month that the move occurred as Adani’s main firm was ready to sell further shares in response to Hindenburg’s accusations. The withdrawal demonstrates the serious impact the Hindenburg assault has had on the business. The preceding several years had seen the millionaire on a quick, debt-fueled expansion binge.

The first-generation businessman quickly expanded his empire, which today includes ports, airports, coal mines, power plants, and utilities after starting with an agri-trading company in the 1980s. It entered the green energy, cement, media, data centers, and real estate industries in the last couple of years, leveraging itself significantly in a way that alarmed some credit analysts.

Adani and his businesses have been attempting to allay investor and lender fears in the days following the stock market crash brought on by the Hindenburg disaster. Despite having been fully subscribed the day before, the $2.5 billion follow-on share offer was unexpectedly canceled by the flagship company Adani Enterprises Ltd. NSE -3.60% on February 1 as the billionaire aimed to save his investor’s painful mark-to-market losses amid the relentless stock selloff. A retail bond offering was terminated by the corporation a few days later.

To boost trust and satisfy concerns about its financial health, Adani Group has been focusing. The group said on February 6 that Adani and his family paid off debts totaling $1.11 billion to free pledged shares across three companies, and on February 8, the Ports Authority stated intentions to pay down 50 billion rupees in debt throughout the upcoming fiscal year to raise a critical credit rating.

The corporation seeks to prepay a $500 million debt after numerous banks started refinancing it. bridge loan due next month, Bloomberg News reported on Wednesday, citing individuals familiar with the negotiations. It was a part of the fundraising efforts made last year to pay for the acquisition of Holcim Ltd.’s cement holdings in India.

The auditor from the Big Four

According to a statement made earlier this month on its interests in India by French energy giant TotalEnergies SE, Adani Group intends to appoint a Big Four auditor “to carry out a broad audit.” This will assist in addressing some of the warning signs that Hindenburg mentioned.

According to sources familiar with the situation, News on Saturday claimed that the Indian giant has appointed public relations company Kekst CNC as its worldwide communications consultant. According to Kekst’s website, the company has “worked against some of the most aggressive counterparties” in high-profile legal disputes.

Shares rose early last week as a result of efforts to alleviate market jitters, but there are still significant challenges. After MSCI Inc. reduced the number of shares it deems freely traded for four of the businesses, the stock selloff resumed. This action will result in lower weightings in its indexes. In light of the recent share price decline, Moody’s Investors Service lowered its forecast for Adani Green Energy Ltd. and three other group firms on Friday. SBICaps Trustee stated in a letter to Indian exchanges late Friday that additional shares in three Adani Group firms were pledged “for the benefit of the lenders” of Adani Enterprises.

Significant danger in India’s nets zero strategy.

A possible weakness in India’s ambitious goal to decrease emissions has been exposed by the problem affecting billionaire Gautam Adani: the plan’s reliance on the nation’s wealthiest and most influential private residents. India’s business tycoons have so far committed to spending considerably more than the government on the energy transformation, led by Adani’s $70 billion planned investment in green energy infrastructure. Energy goliaths like Tata Group and Mukesh Ambani of Reliance Industries Ltd. have also hurried to support the transition to a greener future.

However, charges made by Hindenburg Research regarding businesses connected to the Adani Group have cast doubt on the company’s future, particularly its significant investment in green energy. Additionally, it has caused issues for Adani Green, the company’s renewable energy division. Since Hindenburg Research has questioned the nation’s corporate governance, the tempest enveloping Asia’s current second-richest man also poses a danger to the other corporations.

According to Ashiwni Swain, a fellow at the Centre for Policy Research in New Delhi, the rate of investment may decrease because Adani group dominates India’s renewable energy industry. “To achieve our objectives, we cannot rely just on two or three corporations. We require a crowded area, he declared. There are other participants, and there will be a lot more as the voyage continues.

India has a 2070 deadline for achieving net zero emissions, which is ten years after China and twenty years after Europe. India will keep growing its coal power fleet to help with electricity shortages, which prompted the government to defend its use of fossil fuels last month while simultaneously pledging to continue its commitment to decarbonization.

According to the International Energy Agency, India needs to invest $160 billion year until 2030 to reach its objective, which is about treble current levels. Despite expanding, foreign direct investment still only makes up a small portion of present commitments. Adani’s swift demise might erode investor trust in India more generally, endangering capital inflows for green finance.

The difference demonstrates how the government depends on the private sector to achieve its environmental goals. While private cash will be required to combat climate change on a global scale, India’s problems are so large that the country is more dependent on its wealthiest residents and largest corporations.

Executives have thus far been glad to comply since the reward is a high position in one of the future’s most profitable businesses. The billionaires Adani and Ambani of Reliance are competing to be the only greatest investor in India’s green industry. They are continually outdoing one another by announcing new massive manufacturing facilities and some of the biggest projects in the world.

Adani frequently aligns his companies with the development objectives of Prime Minister Narendra Modi, and he sees Hindenburg Research’s accusations of fraud as an assault on his own nation. Meanwhile, Raj Kumar Singh, India’s power minister, told reporters in New Delhi on Thursday that the country has more than a dozen sizable companies that can advance its goals.

Adani, who amassed his fortune from his coal business, has established himself as a major proponent of cutting-edge green technologies. In order to position India as an exporter of the clean fuel, he is establishing massive solar and wind production facilities around the nation as well as a supply network for the world’s cheapest green hydrogen.

However, several environmentalists point out that Adani and his business were never really environmentally friendly. In spite of Modi’s pledge to provide more Indians with stable energy in the face of a worldwide fuel supply crisis, Adani increased its coal production last year. According to SumOfUs, a group of activists that launches campaigns aimed at exerting pressure on significant businesses, the organization’s mining operations are responsible for at least 3% of the world’s coal-related CO2 emissions.

Much more than Adani, India is. Their contribution to India’s energy revolution is debatable, according to Assaad Razzouk, CEO of Singapore-based renewable energy company Gurin Energy. “It is extremely risky to equate India’s energy transformation with the viewpoint or market strength of one group.”

By 2030, India wants to cut the proportion of fossil fuels in its electrical mix from more than 57% to 50%. With demand for the dirtiest fossil fuel predicted to increase slightly through 2025, India continues to rely largely on coal for the generation of electricity. Critics contend that the government should be doing more to slow global warming.

The present Adani crisis will make it more challenging for the billionaire to borrow money to finance its green development, which is the most obvious short-term effect. The debt at Adani Green Energy Ltd., the division responsible for the development of renewable energy projects, is another unresolved issue.

According to calculations by, the company’s debt-to-capital ratio increased to 95.3% in the previous fiscal year, which ended in March. Since then, it has decreased to 88.5%, yet it is still greater than its rivals.

According to analysts at Intelligence, Adani Green has the most funding risk among the group firms because of its fragile balance sheet and $1.25 billion in debts that are due in 2019. The analysts stated that Adani Green Energy’s cash as of September “cannot cover short-term loan obligations.”

“Will Adani suffer from this? Categorically. Tim Buckley, the director of the Sydney-based Climate Energy Finance think group and a longtime follower of the billionaire, asserted that it should have happened earlier. “You’ll discover that the Adani group is now being avoided by a lot of Western finance. It will jeopardise Adani’s access to western financing on a global scale, particularly green and ESG money.

edited and proofread by nikita sharma