Adani Group-Hindenburg Saga: SC Prolongs SEBI Investigation Period By 3 Months Instead of Unfair 6

Adani Group saga continues as SEBI approached SC for extension on case investigation and secured 3 months for final conclusion till Mid-August.

Adani Group vs. Hindenburg case issue continues as the securities market regulatory body of India, SEBI seeks further extension for probe from Supreme Court. Now, the deadline for the SEBI investigation of Hindenburg claims against the Adani Group by SC has been set to 14 August 2023.

SEBI had asked for an extension previously and consequently received a grant on 2 March 2023 for two months from SC which ended on 2 May 2023.

The recent plea for additional 6 months was considered and the tribunal added 3 more months to the investigation, making to a total of 5 months to deliver the carriage of justice.

The SC bench was led by the Chief Justice of India (CJI), D.Y. Chandrachud, and included Justice J.B. Pardiwala and Justice P.S. Narasimha. Whereas, SEBI was represented by Tushar Mehta, the Solicitor General.

SC had appointed ex-Judge A.M. Sapre as the head of an expert committee to probe into the allegations against Adani Group along with SEBI. The 6-member panel includes ex-Chairman of SBI O.P. Bhat, veteran banker K.V. Kamath, retired Justice J.P. Devadhar, Advocate Somasekharan Sundaresan and Founding Chairman of UIDAI Nandan Nilkeni.

During the recent court hearing, the bench appealed to the committee to continue its support in the examination of the case, and to also handover the copies of the report to the both the parties involved in the case as well as their counsels.

The status report of the ongoing investigation has been asked by the CJI-led bench to be submitted by both SEBI and the expert committee. The special panel had submitted its report, while SEBI is scrutinizing the claims levelled in the Hindenburg report.

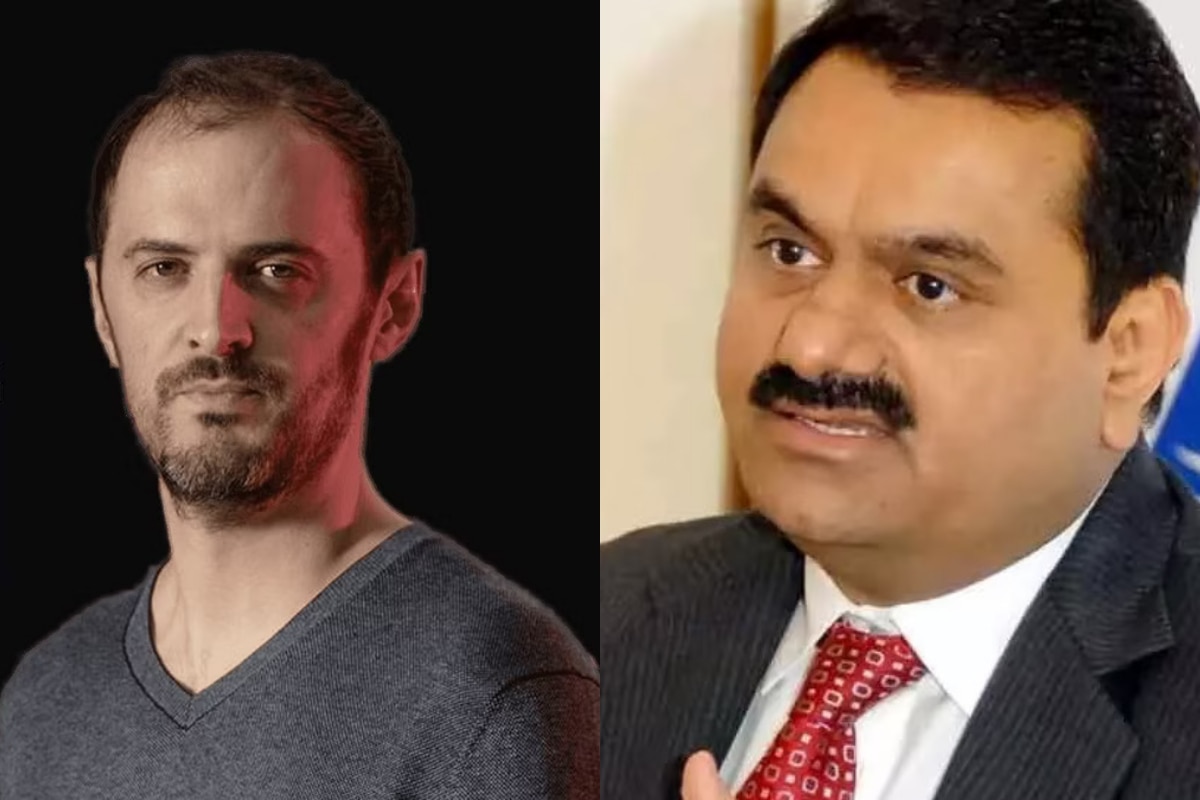

Adani Group was defamed with accusation of breach of laws involving malpractices and stock manipulations in a critical report filed by Hindenburg Research on 24 January 2023.

The repercussion of such fallacies wiped out more than 140 billion dollar shares that Adani Group held in the market.

Nonetheless, in response to the charges, the Gautam Adani founded conglomerate had published a 413 page rebuttal.

SEBI declined the allegations that it had been investigating the Adani Group way before the SC orders in 2021 as ‘factually baseless’, and declared that the regulatory body had not probed into the company since 2016.

This matter was again taken up by opposition advocate Prashant Bhushan during the SC hearing on 15 May, as he stood for one of the petitioners seeking inquiry into the report submitted by Hindenburg.

Bhushan also highlighted that SEBI being a representative of the International Organization of Securities Commission (IOSCO) should not face any difficulty in validating the information concerning international transactions of the Adani Group from the foreign nations.

However, Solicitor General Mehta cleared the misbelief by proclaiming that the 2016 probe by SEBI was concerning the 51 Listed Companies of India for Global Depository Receipts, yet it was found that none of the companies belonged to the Adani Group.

Moreover, SEBI uncovered before the apex court that under the Multilateral Memorandum of Understanding (MMoU), it had approached 11 overseas regulators on account of its investigation into Minimum Public Shareholding (MPS) rules.

Tushar Mehta requested the SC to extend the time period for investigation keeping into account the complexities involved in the case.

The SG pointed out that SEBI had originally wanted to have at least a time frame for 15 months, yet 6 months was the least they sought for the truth to out before the general public.

SEBI also categorized the examinations of the case which direly needs more time broadly into three i.e., those where violations have been found and 6 months are required to come up with conclusive findings; those where violations have not been noted and 6 months are required to revalidate the analysis before heading to a final conclusion; where further scrutiny is needed and data is fairly accessible again 6 months time is required for absolute closure.

In spite of that, CJI was disinclined to offer such an indefinitely long stretch and remarked 6 months to be an unfair time.

D.Y. Chandrachaud exclaimed that SEBI should report to the tribunal with complete and lucid investigation report in the next three months.

Proofread & Published By Naveenika Chauhan