Adani Enterprises surpasses the Rs 4 trillion market worth mark, becoming the fourth company in the big Group.

Adani Enterprises, the fourth corporation limited of the Gautam Adani Group to exceed Rs. 4 trillion (US$ 50.51 billion) in market valuation, achieved a new high for the stock on the BSE during the intra-day practice on September 13, 2022.

THE RISE OF THE ADANI GROUP

The Adani group has surfaced amongst the top value builders in market cap accretion over the past year. The Adani Group’s fourth company to exceed the Rs 4 trillion market cap benchmark was Adani Enterprises. Adani Transmission, Adani Total Gas, and Adani Green Energy were the other three Adani group enterprises that had already achieved the Rs4 trillion market cap threshold. Only Adani Transmission maintained above Rs. 4 trillion, while Adani Green Energy and Adani Total Gas have fallen from higher levels.

Comparatively to the Nifty 50 index’s 2% monthly increase, the stock price of Adani Enterprises soared by 24% over the prior period. As contrary to the benchmark index’s 15% growth over the same term, Adani Enterprises has grown 70%.

Adani Enterprises replaced Shree Cements on September 1, 2022, according to the National Stock Exchange (NSE), which confirmed this.

ADANI ENTERPRISES

The holding company of the Gautam Adani Group, Adani Enterprises, is one of the fastest developing corporations that provide an exclusive diversity of goods and services. In addition, the business provides the function of an incubator, generating new businesses in the energy, utility, transportation, and logistics sectors.

Through its subsidiary, Adani New Industry Limited (ANIL), Adani Enterprises is assisting the decarbonization of industries and transportation. Other strategic business investments made by Adani Enterprises for the upcoming generations are focused on supervising airports, roadways, data centers, and water infrastructure, all of which have a lot of potential for value unlocking.

The financials do not adequately present the potential of each company vertical at Adani Enterprises because most of its latest ventures are still in the planning or early stages of profitability. Adani Total Gas’s market capitalization soared to Rs 4.20 trillion on August 30, 2022, while Adani Green Energy attained a record high of Rs 4.83 trillion on April 19, 2022.

ADANI GROUP: INTRODUCTION

The Adani Group, one of India’s prominent corporate enterprises, is led by its flagship company, Adani Enterprises Limited (AEL). Adani Enterprises has prioritized generating world-class infrastructure virtue that undergo nation-building over the years. Adani Enterprises Limited is a subsidiary of the Adani Group and is a multinational holding company with a public listing in India. Its primary goals include mining and trading coal and iron ore, and its headquarters are in Ahmedabad. It also has commercial stakes in culinary oils, data centers, solar manufacturing, and the operation of airports, in addition to constructing roads, rails, and water infrastructure.

VARIOUS SUBSIDIARIES

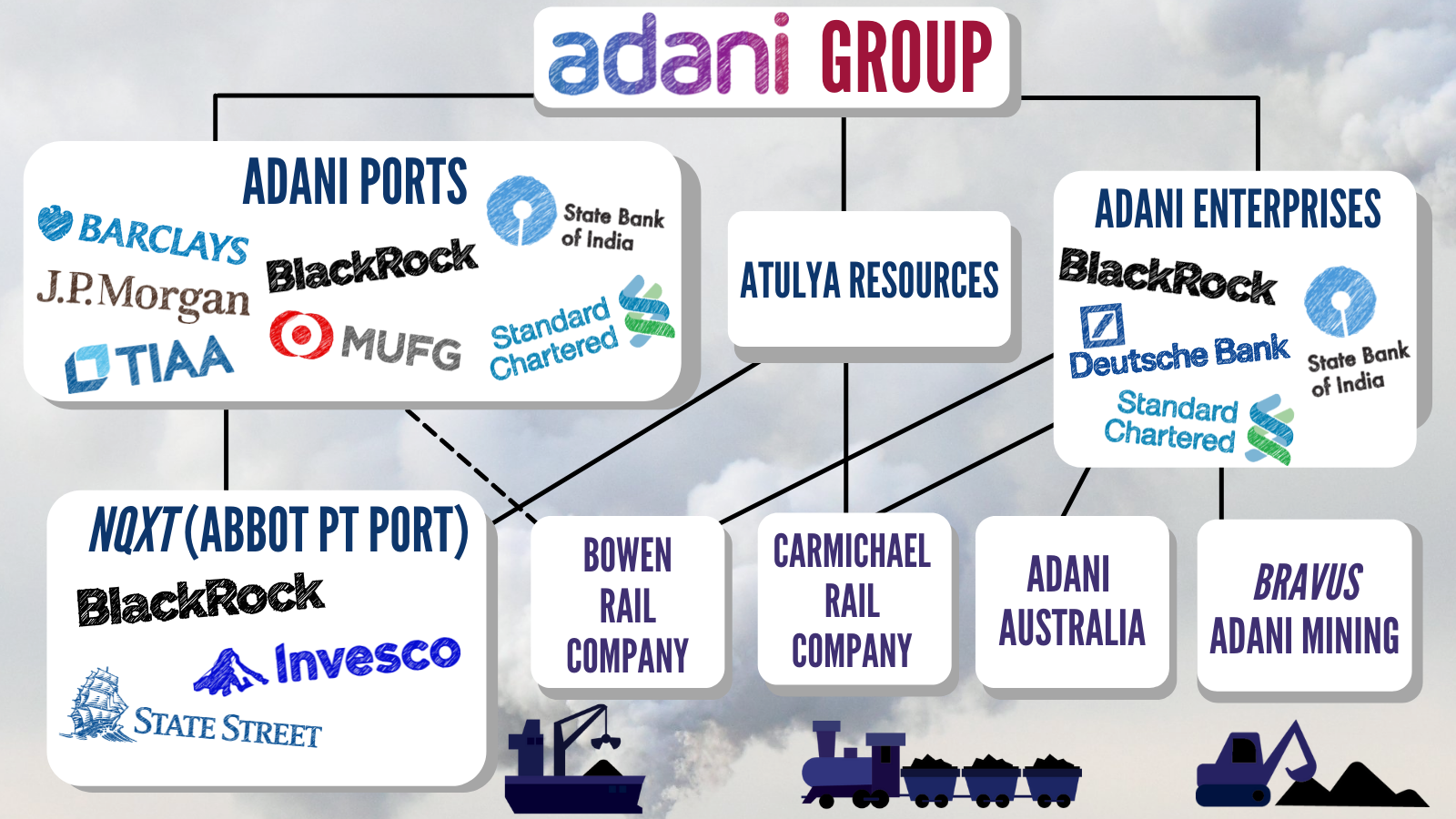

Among Adani Group notable joint-controlling entities and subsidiaries:

Adani Agri Fresh, Adani Cement, Adani Airport Holdings, Adani ConneX, Adani Defense & Aerospace, Adani Mining, Adani New Industries, Adani Road Transport, Adani Solar, Adani Water, Adani Welspun Exploration, Adani Wilmar, and AMG Media Networks.

Former Adani Enterprises subsidiaries Adani Ports & SEZ, Adani Power, and Adani Transmission underwent a de-merger in 2015, while Adani Green Energy and Adani Gas completed a de-merger in 2018.

In April 2022, AMG Media Networks was formed as Adani Enterprises’ newest wholly-owned media and publishing subsidiary. In addition, AMG Media Networks revealed in May 2022 that it had paid an unspecified amount for a 49% stake in Quintillion Business Media, which operates BQ Prime. In March 2022, they acquired unspecified minority ownership in the business.

The business has immensely contributed to the nation’s sovereignty by building unicorns, including Adani Transmission, Adani Power, Adani Ports & SEZ, Adani Green Energy, and Adani Total Gas.

VISION

Adani Enterprises’ mission is to be a global leader in enterprises that improve people’s lives and aid in constituting nations’ infrastructure.

Currently, the stock is ranked 18th amidst all Indian companies with listed stocks. In the Adani Group firm, it comes in fourth. With a market capitalization of Rs3.77 trillion, Adani Transmission is the most valuable company in the group, followed by Adani Green Energy and Adani Total Gas.