Adani does not Own any Telecom Company. What is Adani going to do with the 5G Spectrum?

Adani Do not own any telecom company, what is Adani going to do with the 5G spectrum?

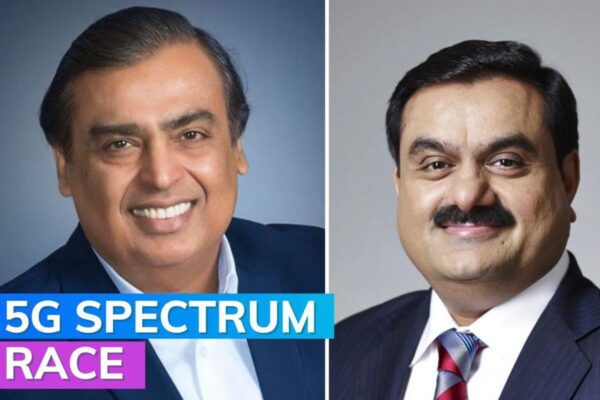

Adani Group intends to compete in the telecom spectrum competition against Mittal’s Airtel and Jio from Ambani.

For the July 26th first-ever auction of 5G airwaves in India, four enterprises have submitted applications. Bharti Airtel, Reliance Jio, Vodafone Idea (Vi), and Adani Group company are among these companies.

The Adani Group remained unanswered about their participation. However, those familiar with the situation confirmed its participation. According to reports cited by news organisation PTI, an Adani firm submitted a bid.

According to Indian telecom laws, the Adani business would need to get unified access service (UAS) permission from the Department of Telecommunications (DoT) to participate in the sale of 5G airwaves.

Adani Enterprises, the group’s main company, saw its shares end the day slightly higher at Rs 2,293,05.

Adani’s potential entry, according to top industry executives and analysts, could increase competition in the upcoming 5G airwaves sale, which was previously anticipated to see muted bidding due to the abundance of spectrum up for grabs and the presence of just two major bidders, Jio and Bharti Airtel, with cash-strapped Vi likely to be a fringe participant.

The deadline for submitting applications was Friday, July 8, by the Notice Inviting Applications (NIA), which defines the auction regulations. The pre-qualification of bidders and mock auctions are scheduled for July 18 and 22, respectively, among other important days.

There will be three extremely wealthy and powerful bidders, and if Adani participates, there may be competitive bidding for the 5G spectrum in the C-band (3.3-3.67 GHz).

“All three are probably going after these airwaves, especially in metro areas, tier-1 cities, and category A circles where 5G adoption rates would be higher, an analyst at a top international investment bank told ET.

The government is selling 72 GHz of 5G frequencies, which at base prices may bring in up to Rs 4.5 lakh crore. Airwaves in 10 bands, from 600 MHz to 26 GHz, will be sold off for 20 years at prices suggested by the telecom regulator.

The telcos have demanded a 90 per cent decrease from the 2018 level, even though current costs are about 40 per cent less than what the regulator had requested back in 2018.

The Center intends to sell spectrum in several lows (600, 700, 800, 900, 1800, 2100, 2300, and 2500 Mhz), mid (3.3-3.67 GHz), and high (26 GHz) frequency bands.

The government anticipates that operators will deploy 5G services using both mid-band and high-band spectrum. To reduce bidders’ financial outflows, it anticipates the decision to eliminate the requirement for upfront payments and permit payments in equal annual instalments over 20 years instead.

Adani Group applied to take part in the 5G auction, where it will compete for spectrum with companies like Reliance Group and Bharti Airtel, but only for private captive networks.

The Adani Group said that it will take part in the government’s next auction for the 5G telecom spectrum and that it has ambitions to use private network solutions throughout its activities.

The organisation made it clear that the business has no plans to compete in the consumer mobility market.

“The statement reads, “We are participating in the 5G spectrum auction to provide private network solutions and enhanced cyber security in the airport, ports and logistics, electricity generation, transmission, and distribution, as well as different manufacturing processes.

The Adani Group applied to take part in the spectrum auction in which current telecom service providers would take part. The selling of airwaves in several bands, including the vital 3.5 GHz airwaves for 5G, is part of the auction.

Reliance Jio, a subsidiary of Mukesh Ambani’s Reliance Group, Bharti Airtel, which is under Sunil Mittal’s leadership, and Vodafone Idea Ltd. are the three telecom service providers competing.

The company claims that having access to the spectrum will aid Adani Group in developing digital platforms and enhancing its data centre capabilities.

The organisation stated that it would need ultra-high quality data streaming capabilities with a high frequency and low latency 5G network access across all of its businesses as it built its digital platform that included super applications, edge data centres, and industry command and control centres.

The group established a 50:50 joint venture in February 2021 in collaboration with EdgeConneX Inc., a well-known data centre operator. In November 2021, the partners invested Rs. 375 crores in the JV business to build hyper-scale data centres in Chennai, Navi Mumbai, Noida, Vizag, and Hyderabad.

The prospective spectrum allocation through open bidding would be consistent with the Adani Foundation’s recent announcement to enhance funding for education, science, healthcare, and skill development in rural areas.

The government made the decision to allocate spectrum for captive private networks in June and published specific rules. Adani, though, has chosen to buy spectrum through an auction.

“The consumer industry and the infrastructure sector are both heavily invested in by the Adani Group. Deven Choksey, managing director of KR Choksey Holdings Private Limited, asserts that they might adapt their service offers via a captive 5G network.

“In addition to integrating group consumers, suppliers, and other service providers on the captive network, data centre enterprises with cloud computing, artificial intelligence, and virtual reality products might operate as a driver for supplying services to group businesses, the expert continued.

In the 5G enterprise market, Adani has several potential benefits. The business house already has a sizable captive base to develop its private network due to straddle sectors including ports, power plants, utilities, airports, aeroplane services, data centres, industrial parks, and manufacturing facilities.

Additionally, according to analysts, Adani will grow the company by providing private network solutions to other businesses. The end consequence would be more intense competition for the nation’s telcos, with the leasing of airwaves suffering as a result of Adani’s plan to provide private captive networks as a service and possible earnings from the enterprise segment, which is predicted to be the mainstay of the 5G business.

Particularly, the possibility of the Adani Group igniting a potential bidding war might derail plans for the cash-strapped Vodafone Idea.

For a minimal Rs 2,800 crore over 20 years, the group will be required to purchase a millimetre band spectrum that will be used to power its 5G private networks. To reduce its overall annual payouts, it can potentially pay this amount in 20 equal instalments.

Additionally, the organisation might apply for roughly 10 MHz of spectrum in the more expensive 3.5 GHz band. Even in this case, with equally lengthy payment terms, the debt would be affordable at Rs 3,170 crore for 20 years.

Telcos think that Adani would have taken a different path at a lower cost if the group’s main goal was to build private networks. The government has approved the creation of captive private networks for businesses and would provide them direct access to spectrum at a lower cost because it would be distributed at an administrative price rather than through auctions.

Consider Tata Communications as an illustration, which has chosen not to proceed with an auction. It will hold off until the government hands out the spectrum to businesses directly. The company will be able to market enterprise products like private networks as a service after purchasing spectrum from the auctions. Additionally, the company might lease out 5G airwaves similarly to telcos.

Additionally, the entire sunrise industry is at risk. By 2026, the potential market for private 5G services in India is expected to be worth 570 million dollars. The market is anticipated to expand at an average rate of nearly 35% over the following three years.

Adani will test 5G services first in its operations, according to Mohit Mittal, Partner, Praxis Global Alliance, before making them available to others. He claims that Adani has an advantage in providing enterprise 5G due to its captive testing and capital and that Adani can target businesses by size or industry depending on strategy.

Telcos are concerned that the Adani group’s long-term plan may involve acquiring a telecom or getting a strategic stake in one of them to enter the consumer mobility market.

Adani’s unexpected entry into the telecom market is nothing new.

Over time, the abrupt entry of large firms into this market has changed the dynamics. For instance, Reliance Industries Ltd. (RIL) announced its entry into the telecom industry by buying the majority of Mahendra Nahata’s Himachal Futuristic arm, Infotel Broadband, at the time when it was the only business to have won Broadband Wireless Access (BWA) spectrum across all 22 zones in India.

Later, Infotel Broadband changed its name to Reliance Jio Infocomm, which is now the dominant telecom provider in India. It would be intriguing to observe how Adani’s participation would change the dynamics of the 5G spectrum auction.

Could this be the corporate telecom industry’s equivalent of the Jio phenomenon, where a fresh player with substantial resources, competitive advantages, and cutting-edge technology ends up snatching up a sizable chunk of the market?

The debate over the direct spectrum award sparked by Adani 5G bid

According to industry observers, Adani Group’s decision to take part in 5G frequency auctions to launch its captive networks will not interfere with other businesses’ efforts to acquire airwaves through non-auction means.

The president of the Broadband India Forum, which advocates for private networks for businesses and supports tech companies, T.V. Ramachandran, argued that even if the group were to pay an auction-determined price for airwaves for captive use, it shouldn’t apply to other businesses because they are unable to make money from their private networks while consumer networks using 5G technology can expect higher revenues.

“Adani’s decision to participate in auctions only supports the argument for captive networks by highlighting the necessity of private 5G networks and the broad interest in them “In a conversation, Ramachandran stated. He claimed that it is irrelevant to ask if Adani’s purchase of spectrum may determine the starting price for captive networks owned by other businesses.

In no way. Everyone is aware, I’m sure, that captive networks have no external connections and no revenue, therefore high auction-style pricing is not an option. It only applies to public networks.”

The regulations for captive non-public networks, or CNPNs, have not yet been released by the department of telecommunications. According to the agency, businesses would be able to acquire spectrum directly and build out their private networks.

However, to provide spectrum to businesses directly, the government is likely to conduct demand surveys and request advice from the sector regulator.

The Cellular Operators Association of India (COAI), on the other hand, claimed that Adani’s entry into private networks levelled the playing field because all businesses wishing to deploy 5G should compete for airwaves. COAI has supported the argument for private networks to be provided by carriers on lease.

Since there is no financial case for the deployment of 5G networks in India, the spectrum shouldn’t be given out on an administrative basis. There would no longer be a viable business case for TSPs (telecom service providers) to roll out 5G networks, according to S.P. Kochhar, director general, if independent entities established private captive networks with direct 5G spectrum allotment from DoT.

Carriers want to increase enterprise revenues by providing 5G network services to small, medium, and large businesses. However, analysts said that Adani’s entry into captive networks by obtaining a unified licence will negatively affect the potential revenues from this segment because participation may be restricted to the 3.5GHz and 26GHz bands for the provision of private business 5G network services.

According to Goldman Sachs analysts, a new entrant building 5G networks, even if exclusively for companies, will result in higher rivalry for current operators because enterprises are likely to be a bigger source of 5G revenue for telcos in the short future.

Here’s why Adani has a great opportunity with the 5G spectrum proposal.

The Adani Group’s decision to participate in the auction for the 5G spectrum startled a lot of people. It provides access to the cellular mobility market, which is currently dominated by three big rivals.

It provides access to the cellular mobility market, which is currently dominated by three big rivals. India is one of the cheapest telecom markets in the world, having evolved from a market where voice and data were originally taxed separately.

The more cheap option available today, which also includes unlimited voice calling and data consumption, is a major deal. Almost all Indians now own a mobile smartphone as a result of this initiative.

According to the organisation, its goal is to deploy the technology for captive private networks rather than to give customers mobility. However, given the wide range of industries, the firm participates in—from FMCG, where it has a substantial portfolio of edible oils, to infrastructure with ports, road development, and power, to name a few—advantageously, it has control over the 5G spectrum.

It was an interesting event that the group acquired a letter of intent (LoI) from the Department of Telecommunications (DoT) in the latter half of the month for the issue of a unified licence for the Gujarat circle.

The managing director of K R Choksey Securities, Deven Choksey, thinks that this has a rather obvious implication.

Building a private virtual network is one way to achieve this, and it is an enticing concept. Their businesses currently use shared networks, and he claims that spectrum control could quickly save prices while enhancing reliability.

Although even the most cautious projections indicate that the government can collect at least Rs 4.3 lakh crore from the auctioning of the spectrum, this would come at a cost. He argues that the group’s “main commercial base” and “natural for them to have a strong focus” are Gujarat when it comes to securing the LoI for Gujarat.

A venture into mobility is also feasible, but it is a difficult ask in the current market given how difficult costs are to recoup and how difficult it is to do so.

Since telecom is such a mess and they might not be interested, it seems tough in the short term, according to Choksey. Enterprise connection is the other possibility, according to Vinit Bolinjkar, Head (Research), Ventura Securities. “It opens up opportunities like edge computing or driverless automobiles. The scenario might change considerably if the 5G spectrum is made available.

He views the group’s ambition to be a major player in data as the backdrop. Early last year, Adani Enterprises partnered with EdgeConneX, a top data centre operator, to build 1 GW of data centre capacity over the following ten years. “A firm can be established on the capacity to serve a sizable base of corporate customers. They will, however, pay special attention to customer mobility, he continues.

The group with good financial standing can manage the significant expenditure on the spectrum purchase. Choksey believes that healing can readily happen over a three-year timeframe. Furthermore, he adds, “the payment for spectrum will be stretched over, say, ten years, giving the Adani Group plenty of time.”

What is currently known regarding the conglomerate’s foray into the telecom sector is listed below.

Because its businesses required ultra-high-quality data streaming capabilities over the 5G network, Adani Group was forced to take part in the spectrum auction.

The organisation also stated, “We will need ultra-high-quality data streaming capabilities over a high frequency and low latency 5G network across all our businesses as we construct our digital platform comprising super applications, edge data centres, and industry command and control centres.

Rich in cash With Adani Group now competing for the 5G spectrum, a bidding battle for the mid (3300 MHz) and high (26 GHz) frequency bands may break out. This would present a problem for the starved-for-cash Vodafone Idea, which might either overbid or fail to get any spectrum for itself.

Adani’s entry into business communications, particularly for ports and airports, could endanger enterprise revenue streams for India’s telecom giants, who had been looking at 5G usage in the business use category as a key source of revenue. Industry estimates place the enterprise portion of 5G revenue at 40% of the overall 5G revenue.

A total of 72,097.85 MHz of spectrum worth at least Rs 4.3 lakh crore at the base price would be sold by the government. On July 26, a 5G spectrum auction will take place. The successful bidders won’t have to pay anything upfront, and the new spectrum is predicted to have 10 times the speed of the 4G spectrum.