India’s Biggest Banking Fraud Case of “ABG Shipyard”, Almost Double the Amount of PNB Scam. Both happened under the Regime of BJP Government Since 2014

India’s Biggest Banking Fraud Case of “ABG Shipyard”, Almost Double the Amount of PNB Scam. Both happened under the Regime of BJP Government

The Central Bureau of Investigation (CBI) has charged ABG Shipyard Limited, its former chairman and managing director Rishi Kamlesh Agarwal, and others in the country’s biggest bank fraud case.

The accused are charged with defrauding the State Bank of India (SBI) and 27 more banks and lenders out of a total of Rs 22,842 crore. Several others have been arrested by the CBI in connection with the ABG Shipyard fraud case.

The Congress questioned the Modi government as the big ABG Shipyard scandal became public after the CBI charged the company and its former chairman with defrauding a consortium of banks headed by the State Bank of India.

The party raised questions regarding why it took the government five years since the liquidation of ABG Shipyard to file an FIR in respect of the alleged scam of 28 banks. In 2018, the Congress Party held a public press conference to alert the government that ABG Shipyard is a fraud, according to Randeep Surjewala, the Congress General Secretary and chief spokesperson.

During Mr Narendra Modi’s time as Gujarat chief minister, the Gujarat government allotted ABG Shipyard 1,21,000 square metres of land in 2007, which explains why it took the government five years to act against the company. ABG Shipyard was granted 50 hectares of land in Dahej by the then-Gujarat government, he says.

According to Surjewala, the Modi government is running a vast “loot-and-escape” scheme for bank fraudsters such as Vijay Mallya, Nirav Modi, Mehul Choksi, Lalit Modi, Jatin Mehta, Chetan and Nitin Sandesara, and others who have fled the country owing to bank fraud. Agarwal and others, he described as “fresh gems,” are the most recent additions to the list, according to him.

As per reports, there has been 5 lakh 35,000 crores worth of bank frauds in the last 7.5 years of the Modi regime. This would be the country’s largest bank-loan fraud, dwarfing the cases involving Nirav Modi and Vijay Mallya.

What is the ABG shipyard company about and who owns it?

The owner of ABG Shipyard Ltd. is the ABG Group, an organization that specializes in shipbuilding and ship repair. The company is headquartered in Mumbai. The company’s shipyards are in Gujarat, Surat and Dahej.

Rishi Agarwal, a key participant in the Indian shipbuilding sector, is the group’s promoter. ABG Shipyard Limited (ABGSL) has the capacity to build vessels with a dead weight tonnage (DWT) of up to 18,000 at Surat Shipyard and 1,20,000 at Dahej Shipyard.

ABGSL has built over 165 vessels for leading companies in India and abroad in the last 16 years. These include newsprint carriers, self-dispensing and loading bulk cement carriers, floating cranes, dynamic positioning diving support vessels, interceptor boats, and flotillas, all approved by international certification societies like Lloyd’s, American Bureau of Shipping, IRS, Bureau Veritas, and NV.

In 2011, ABGSL was reportedly offered contracts to build ships for the Indian Navy, however, the deal was later discontinued due to the company’s financial difficulties.

ABG Shipyard Fraud Case Timeline

– In July 2016, ABG Shipyard’s loan account was first designated as a non-performing asset (NPA).

– On November 8, 2019, SBI filed its first complaint.

– The loan account was declared fraudulent in 2019.

– On March 12, 2020, CBI requested clarifications on SBI’s complaint.

– SBI submitted a fresh complaint in August 2020.

– The CBI acted on SBI’s complaint on February 7, 2022, after reviewing the FIR for nearly a year and a half.

The company received credit facilities worth Rs 2468.51 crore from 28 banks. Between 2012 and 2017, the company’s promoters allegedly engaged in illicit actions including money laundering, misappropriation, and criminal breach of trust. In July 2016, the loan account was labelled a non-performing asset, and fraud was declared in 2019.

The State Bank of India filed its first complaint in this case on November 8, 2019. The investigative agency wanted further information, and the complaint allegedly left out specifics such as the time of the fraud, the modus operandi, and so on. In August 2020, the bank filed a new case. The CBI filed an FIR on February 7, 2022, after reviewing the complaint.

List of people listed in this case by the CBI

Apart from Rishi Kamlesh Agarwal, the CBI has named Santhanam Muthaswamy (Executive Director at the time) and Ashwini Kumar, Ravi Vimal Nevetia, Sushil Kumar Agarwal (directors at the time) and another entity ABG International Pvt Ltd.

The agency has charged them with criminal conspiracy, criminal breach of trust, cheating and misuse of official position in violation of the IPC and the Prevention of Corruption Act.

Banks owed money by ABG Shipyard

The accused was alleged of defrauding a group of 28 institutions, including the branches of erstwhile State Bank of Patiala, Commercial Finance Branch, New Delhi, the erstwhile State Bank of Travancore, Commercial Branch, New Delhi, and the State Bank of India, Overseas Branch, Mumbai, among others. According to a CBI press release, SBI Bank led the collaboration.

As per the FIR, the accused company owes ICICI Bank Rs 7,089 crore, IDBI Bank Rs 3,639 crore, SBI Rs 2,925 crore, Exim Bank of India Rs 1327 crore, Punjab National Bank Rs 1243 crore, Indian Overseas Bank Rs 1228 crore, Bank of Baroda Rs 1,614 crore and the remainder to various banks and financial organisations.

On August 1, 2017, the company was submitted to the Ahmedabad bench of the NCLT (National Company Law Tribunal), which enabled the official liquidator for ABG Shipyard to conduct a private sale of the assets.

CBI’s Investigation in the Case

The CBI is investigating one of the largest bank fraud cases (larger than the Punjab National Bank scam involving Nirav Modi and Mehul Choksi).

Following a complaint from the State Bank of India again in 2020, the CBI stepped into action. The CBI uncovered records that implicated the corporation and its executives.

According to CBI spokesperson RC Joshi, the suspects reportedly conspired and perpetrated the fraud by diverting funds to be utilised to purchase assets. Huge investments, he claimed, had been made in the foreign subsidiaries.

The forensic audit was filed with the CBI by the State Bank of India, which handled ABG Shipyard’s accounts. According to a report by PTI, the CBI also highlighted that funds were being used for reasons other than those for which they were authorized by banks.

Between 2012 and 2017, the accused collaborated and undertook illicit acts such as money laundering, embezzlement, and criminal breach of trust, according to the forensic audit conducted by Ernst & Young.

The CBI claimed in an official statement that on Saturday, February 12, 2022, it searched 13 addresses which included the premises of the accused including directors of private company’s in Mumbai, Pune, Surat and Bharuch. According to the agency, the raiders resulted in the recovery of incriminating documents.

Reasons for the Failure of ABG Shipyard

“Global crisis has damaged the shipping industry due to reduction in commodity demand and pricing, and consequent fall in cargo demand,” according to the FIR. The cancellation of a few contracts for ships/vessels resulted in inventory stacking up.

This has resulted in a shortage of working capital and a significant lengthening of the operational cycle, exacerbating the liquidity and financial issues. Even in 2015, there was little demand for commercial vessels due to the industry’s decline.

In addition, no new defence orders were issued in 2015. The corporation was having a difficult time meeting the milestones outlined in the CDR. As a result, the corporation was unable to pay the interest and instalments on time.”

The Trend of Increasing Bank Frauds under the BJP rule

According to RBI data, bad loans on Indian banks’ books have increased dramatically since 2014, the year in which the Bharatiya Janata Party was elected to office.

According to Reserve Bank of India data, Indian banks have written off bad loans or non-performing assets (NPAs) of Rs 660 thousand crores since 2014. The entire number of loans written off is half of the total amount of bad loans documented in the banks’ financial accounts.

In 2013-14, bad loans totalled Rs 205 thousand crores, but by 2018-2019, they had risen to Rs 1,173 thousand crores. This unexpected increase in NPAs occurred during the BJP’s 2014 election campaign when the party promised to “take appropriate actions to minimise NPAs in the banking industry.”

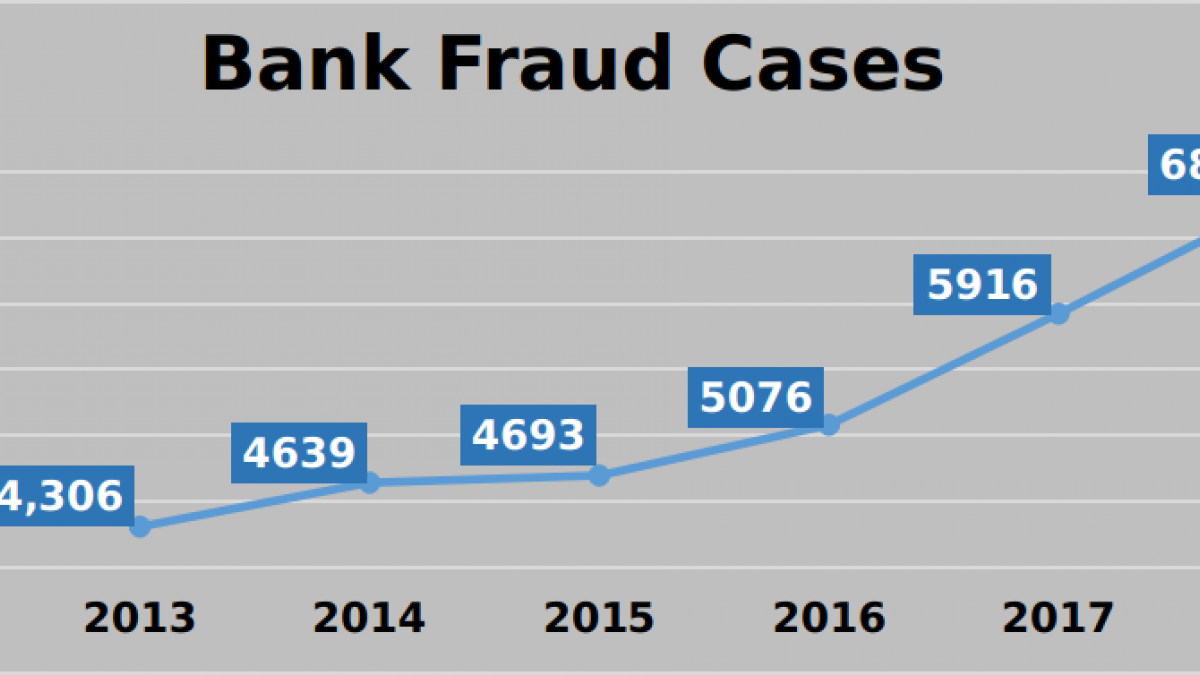

During the same period, the number of bank fraud instances increased dramatically. The number of cases involving more than Rs 1 lakh jumped from 4,306 in 2012-13 to 6,801 in 2018-19.

The Central Bank’s report also shows that in the financial year 2018-19 alone, banks wrote off Rs 237,000 crores from their books. There was a significant increase in the amount of money written off, which banks referred to as technical write-offs. When banks were unable to recover loans, this allowed them to keep their books clean.

“Bank fraud incidences” totalling 5.35 lakh crore have been registered in the last seven and a half years of the Modi administration. Bank write-offs in India totalled Rs. 8.17 lakh crore over this period.

– According to the Reserve Bank of India, Banks reported a total of 5,916 such cases in 2017-18, totalling Rs 41,167.03 crore.

– Another 6,800 incidents of bank fraud totalling an unprecedented Rs 71,500 crore were registered in 2018-19 according to the study.

– As per the reports of RBI, 6,801 cases of fraud were reported by scheduled commercial banks and select financial institutions in the previous fiscal, totalling Rs 71,542.93 crore (an increase of nearly 73 per cent in the fraud amount).

– The data from the central bank, reported a total of 53,334 cases of fraud over the last 11 fiscal years, totalling Rs 2.05 lakh crore.

The Congress holds the BJP Responsible for Escalating Bank Frauds

The Congress accused those at the top of the Modi government of involvement, participation, and collaboration in what is called “India’s greatest bank fraud” by Gujarat-based ABG Shipyard on Sunday.

Congress leader Rahul Gandhi claimed that during the BJP rule, bank frauds worth Rs 5.35 lakh crore occurred, adding that these are “happy days” just for Prime Minister Narendra Modi’s “friends.”

Rahul Gandhi tweeted saying that only Modi supporters will benefit in these days of deceit and looting. He also used the hashtag #KiskeAccheDin, a dig at the government’s ‘achhe din’ motto.

“Between 2014 and 2021, bank NPAs totalled Rs. 21 lakh crore. “India awoke to the rude shock of the biggest ever bank scam in the last 75 years,” the Congress leader stated, adding, “That is the state of severe mismanagement of people’s money, which is lying in the financial system.”

BJP’s Stand on the Case in response to Congress’s Allegations

Mr Syed Zafar Islam, a BJP spokesperson and Rajya Sabha member, stated that Prime Minister Narendra Modi’s government has made it plain that there will be no meddling in the process of banks sanctioning loans.

Unlike in the past, when banks sanctioned loans at the whim of their political masters, banks have been issuing loans based on the strength of enterprises, he said.

The BJP took over the situation, recapitalized the banks, and concentrated on recovery efforts. He claims that banks are now in a stronger situation and are profiting.

He also mentioned that the government passed a law allowing for faster money collection from defaulting enterprises, which he claims has resulted in the recovery of nearly Rs 5 lakh crore.

List of Major Bank Frauds under the BJP Government

- Vijay Mallya Bank Scam (2016)

As a result of defaulting on a loan he had taken for his now-defunct Kingfisher Airlines, liquor baron Vijay Mallya left India in March 2016. Kingfisher Airlines borrowed Rs 9,432 crore from 13 banks under Mallya’s management. The State Bank of India was the largest lender, with 1600 crores, followed by the Punjab National Bank with 800 crores, IDBI with 650 crores, and the Bank of Baroda with 550 crores.

Currently living in the UK, he has been declared fugitive by the Indian government after being charged with money laundering. Scotland Yard arrested him in April 2017 on an extradition warrant, but he is currently free on bail.

- Sandesara Brothers Bank Fraud (2017)

Under Section 4 of the Fugitive Economic Offenders Act, Nitin and Chetan Sandesara, as well as the latter’s wife Dipti, were declared fugitives. The Sandesaras’ brother-in-law, Hiteshkumar Narendrabhai Patel, is also among the accused. In an Rs 8,100-crore bank fraud case, the four directors of Gujarat-based pharma firm Sterling Biotech were designated, fugitive economic offenders.

The company is accused of taking loans worth over Rs 5,000 crore from a consortium led by Andhra Bank that has now turned into non-performing assets. The respondents’ conduct unmistakably shows on record that they fled India to avoid criminal prosecution and that they are avoiding returning to India to face the current trial.

- Rotomac Pen Scam (2018)

Vikram Kothari, the Rotomac Pen’s promoter, was accused of defrauding seven banks of Rs. 3,695 crore. Kothari had misappropriated loans of Rs 2,919 crore from seven banks, resulting in a total due sum of Rs 3,695 crore, including interest.

Bank of India, Indian Overseas Bank, Union Bank of India, Bank of Baroda, Allahabad Bank, Oriental Bank of Commerce, and Bank of Maharashtra are among the banks whose money has been trapped in this scam. Vikram Kothari, the managing director of Rotomac Global Pvt Ltd, passed away on 5th January 2022 in Kanpur U.P.

- R.P. Info Systems Bank Scam (2018)

The CBI has charged RP Info Systems, a computer maker, and its directors Kaustav Ray and Shivaji Panja, with defrauding a consortium of nine banks out of Rs. 515.15 crore. This company obtained the loan by falsifying documents.

The consortium consists of the Punjab National Bank, the State Bank of India, the Union Bank of India, Allahabad Bank, Federal Bank, the Central Bank of India, the Oriental Bank of Commerce, the State Bank of Bikaner and Jaipur, and the State Bank of Patiala. The accused directors of the company were arrested by CBI on 15th March 2018.

- Kanishk Gold Pvt. Ltd. Bank Fraud (2018)

The CBI has filed a case against Chennai-based Kanishk Gold Pvt Ltd for allegedly defrauding an SBI-led consortium of 14 banks out of Rs 824 crore. According to the complaint, Kanishk Gold Pvt Ltd and its directors allegedly diverted funds that were harmful to the bank’s rights and interests.

In its complaint, SBI identified Kanishk Gold, its promoter and director Bhoopesh Kumar Jain and Neeta Jain, Tejraj Achha of Achha Associates, Ajay Kumar Jain of Ajay and Co., Sumit Kedia of Lunawath and Associates, as well as unnamed public servants.

While the fraud is valued at Rs 824.15 crore, the SBI claims that the security available to cover the loss is just around Rs 156.65 crore. Various lending institutions classified the company’s account as a fraud and non-performing asset (NPA) in 2017-18, according to the lawsuit.

- PNB Bank scam (2018)

This Punjab National Bank (PNB) fraud case, has been dubbed India’s largest (Rs 11,400 crore) in the banking sector. Nirav Modi, a millionaire jeweller, and his uncle Mehul Choksi are the key suspects in the scam (owner of Gitanjali). Nirav Modi’s, brother Nishal Modi and his wife Ami Modi are also accused of orchestrating the scam.

In August 2018, the Indian government charged him in the PNB scam case with criminal conspiracy, cheating, corruption, criminal breach of trust, money laundering, fraud, embezzlement, and breach of contract. Modi is currently imprisoned in Wandsworth Prison in southwest London.

- IDBI Bank Fraud (2018)

The CBI had charged Aircel founder Chinnakannan Sivasankaran known as Siva, his son and the companies controlled by them— Axcel Sunshine Limited (British Virgin Islands) and Win Wind Oy (Finland) — as well as 15 IDBI bank personnel with defrauding the bank of Rs 600 crore. According to the sources, Siva had fled the country after being charged for bank fraud.

Unstable Future of Indian Banks

Several industry professionals, analysts, and bank employees’ unions have pointed to rising nonperforming assets (NPAs), written-off bad loans, and bank fraud cases as potential turbulences in the Indian banking system‘s future. Excessive bad loans or new non-performing assets have afflicted Indian banks that claimed to have had substantial growth in recent quarters.

“These facts demonstrate that the financial system has been mismanaged, that bank fraudsters have adopted a loot-and-escape approach, and that banks are being used for criminal purposes,” Mr Surjewala from the Congress Party claimed.

A recent report by the Reserve Bank of India titled Trend and Progress of Banking 2018-19 indicates that Indian lenders have the highest percentage of bad loans as compared to other emerging economies including China, Indonesia, Brazil, Philippines, and Turkey.