A crucial chance for Budget to fill the gap left by China in the semiconductor sector

A crucial chance for Budget to fill the gap left by China in semiconductor sector. The budget comes at an ideal time for India to demonstrate that it is a serious competitor for global control of wafer production, as the world is engulfed in a chip war.The negative consequences of COVID-19 have not yet been fully reversed in the global supply chain. In actuality, the chip shortage was sparked by the epidemic. The pandemic’s far-reaching impacts, including additional breakouts, labour difficulties, and geopolitical uncertainty, added to the suffering for the component, which is used in practically everything from televisions to autos.

The most recent epidemic in China, which has paralysed the majority of its operations, has now compelled the factory floor to halt significant expenditures meant to create a chip sector that can rival the US. In the middle of this, there are no immediate signs of recovery, and the supply chain is still severely interrupted.

In such a situation, India’s ongoing efforts to encourage domestic chip production can greatly benefit both the country’s domestic requirements and its ability to become a more significant exporter. Currently, imports from nations like the US, Japan, and Taiwan provide practically all of India’s semiconductor needs. With no end-to-end manufacturing basis, India has a sizable human resource pool in this industry, which is now centred on design. In other words, despite its proficiency in chip design, India is forced to rely on imports due to a dearth of fabs.

“India’s complete design ecosystem is its greatest asset.” In India, there are about 24,000 design engineers employed. That is a sizable ecology, then. That implies that the skill is present, as are the application procedures and the knowledge of how to use the talent. Ashwini Vaishnaw, Minister for Railways, Communications, Electronics, and Information Technology, stated that this is what gives us a significant edge.

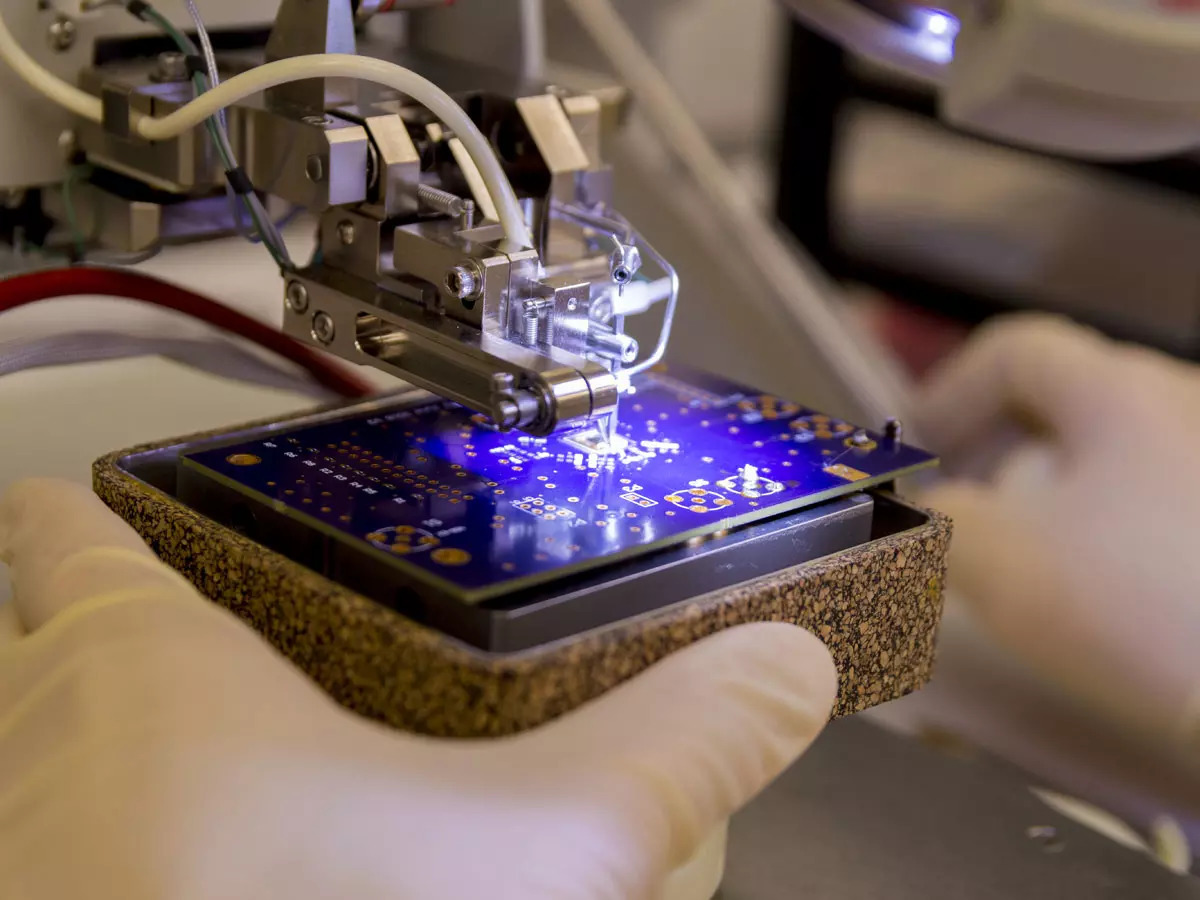

A first-of-its-kind production-linked incentive (PLI) plan, worth Rs 76,000 crore, was authorised by the government in December 2021 to promote the nation’s semiconductor and display industries. The action aims to strategically assist India in taking advantage of the semiconductor scarcity occurring throughout the world, increase manufacturing, and decrease reliance on imports. Even a small manufacturing plant costs billions of dollars to build.The price will increase much more when more recent technical advancements are taken into account. Additionally, fabrication facilities need a consistent power supply and consume a lot of clean water.

According to Rajeev Singh and Abhishek Malik of Deloitte Touché Tohmatsu India LLP, “Even if the PLI scheme gives financial assistance for at least two new greenfield fabrication units’ establishment costs, not much of the presenter expenses, such as display production units, testing facilities, packaging facilities, and chip design centers, would be included in the budget for the program.”![]()

Rumors suggest that the Ministry of Electronics and Information Technology (MeitY) is also creating an incentive scheme to encourage domestic production of expensive components that could be used in items like smartphones, servers, and personal computers. The incentive programme is expected to cost between Rs 10,000 crore and Rs 12,000 crore.

According to people familiar with the plan’s specifics, the goal of the components incentive objective is to provide a fully functional environment for India’s electronics manufacturing. Analysts believe that the policy may help further lure international companies like Apple to increase local production.

“The programme may provide financial assistance for establishing industrial facilities as well as incentives for component manufacture.” The exact details of the programme are still being worked out, but we want to release the policy by the start of the following fiscal year, which begins on April 1, an official said on the condition of anonymity.

The government has previously stated that it would be willing to enter into joint ventures (JVs) with Chinese companies for high-tech components, allowing companies like Apple to increase their production in India. The incentive programme for components will help businesses in places like Taiwan, Korea, and Japan move or open new facilities.

According to a letter from the electronics sector to the government, the promotion of the production of electronic components and semiconductors (Specs) should be extended by five years, and the budget should be increased from the present Rs 3,000 crore to at least Rs 10,000 crore.

The government is providing financial incentives of 25% under Specs on capital investment for producing electronic components, semiconductor or display production facilities, assembly, testing, and capital goods that make up the downstream value chain of electronic products. According to the Indian Cellular and Electronics Association’s recommendations to the government, “the industry would not be able to make use of the benefits beyond this time,” since the scheme’s sunset date will be March 2023 because it was only introduced for three years.![]()

To expand its status as a semiconductor powerhouse, India will soon start building its first chip production facility. Karnataka now has the upper hand in securing investments under the government’s $10 billion incentive programme for semiconductor businesses because of the $3 billion semiconductor chip-making facility built by the international semiconductor consortium ISMC.

Along with ISMC, Foxconn of Taiwan and Vendanta of India have committed to constructing their manufacturing facilities in Gujarat. A $3.2 billion semiconductor park in Tamil Nadu, planned by Singapore’s IGSS Ventures, is also in the works. Singh and Malik of Deloitte argue that to shield the supply chain from geopolitical risks, India must advocate for a multi-nation Supply Chain Resilience Fund. Such protections are already in place in nations like the US.

Quad should support specialised trailing-edge fabs (45 nanometers and higher) in India, Japan, or Australia while the United States resumes manufacture at leading-edge nodes (5 nanometers). The Center has raised import taxes over the last few years. Such regulations may seriously harm India’s semiconductor potential. As an Indian semiconductor fab will still be closely connected to the rest of the globe, buying equipment from some nations and selling chips to others, the reduction of import levies might go a long way in creating a robust semiconductor ecosystem.