10 Major Wealthtech Players in India – 2023

India has seen rapid growth in the wealth tech sector; this can be attributed to the populace’s digital adoption and an evergrowing interest of investors in this segment.

As of this date, the wealth tech sector in India has more than 300 startups working in the field of Robo-advisory, personal finance management, online brokerages, investment platforms, and many others.

India has been concentrating on and has launched a massive drive to digitalize almost all aspects of our economy, and wealth management has been a laggard in that respect.

Wealth Management has remained a conservative industry primarily driven and based on trust and close relationships.

Thus, it is understandable why wealth management could be mindful of digital relationships’ atomized, impersonal nature.

However, we have seen that those fears are mostly unfounded. An expansive range of companies, called Wealthtechs, have shown how digital solutions can increase or even replace elements of the delivery of wealth management services.

The fintech market in India is expanding at an exceptional rate, making India one of the fastest-growing fintech markets, even ahead of the US. This growth also includes a particularly significant expansion of the wealth tech sector in India.

Moreover, internet penetration in India has soared by 8.2% since last year alone due to the pandemic, leading to increased digital adoption.

Further, increasing disposable incomes have also ignited a need for wealth tech solutions. These factors and heightened investor participation in the wealth tech sector from Tier-II cities in India propel the segment forward by leaps and bounds.

According to a recent report by Redseer, the Indian wealth tech market is expected to triple in value from around US$20 billion in 2020 to about US$63 billion by 2025. The report also pointed out the vast market potential for the wealth tech sector in India, whereas per numbers, only 2% of the people invest in stocks as compared to 55% in the US.

However, Wealthtech is a relatively new industry, and one can easily confuse it with Fintech.

What is Wealthtech? Definition of Wealthtech

Wealthtech is a subset of Fintech, which provides a broad range of financial services through digital means. Within that, Wealthtech is concentrated on providing wealth management services digitally.

What has digital allowed in the wealth management space that wasn’t conceivable previously?

The answer to the above fall into two categories:

1. solutions that expand the availability of wealth management services to wider social groups; and

2. solutions that leverage digital to deliver traditional wealth management services more effectively.

Wealthtech Solutions

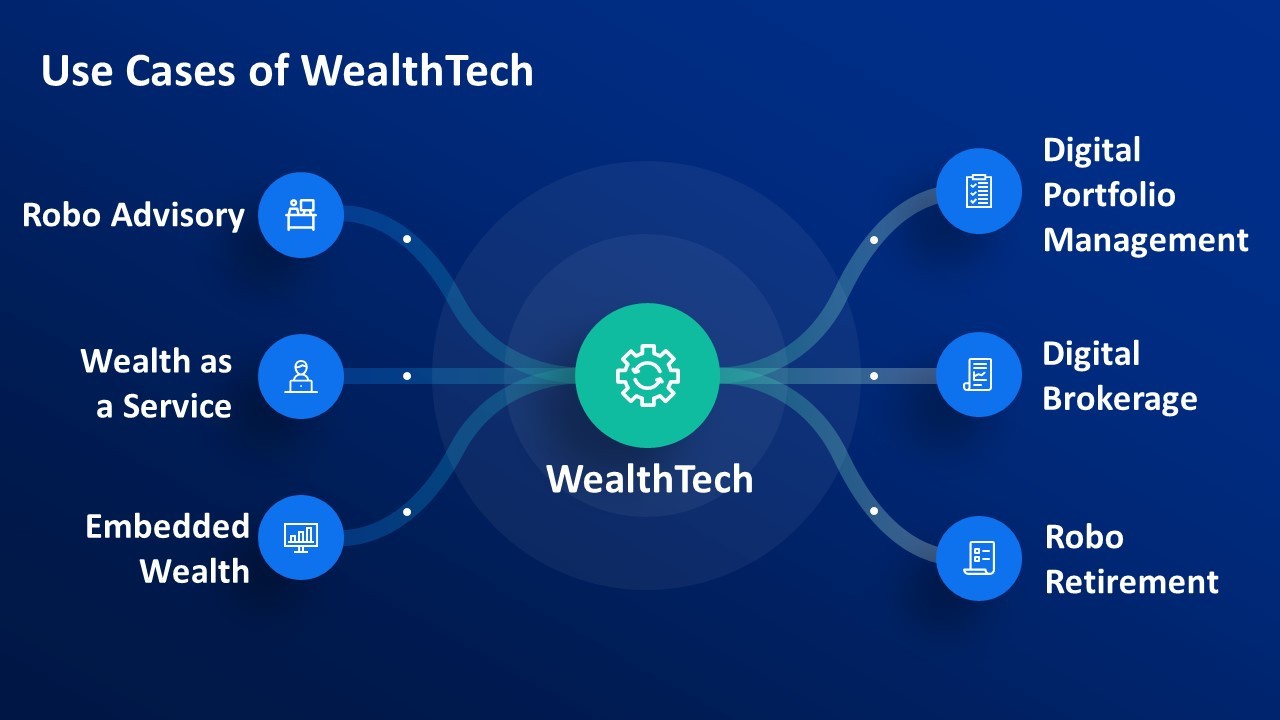

Wealthtech companies include seven distinct verticals.

Robo-Advisors

Robo-advisory platforms provide algorithmically generated investing and financial planning services. Clients complete a questionnaire that evaluates their risk profile and other parameters like ESG views, time horizon, financial goals, and other critical criteria, forming an investment basis. The platform will then typically invest in passive investment funds.

Robo advisors are able to deliver services at scale, allowing them to charge lower fees. Clients can also open accounts with a smaller investment pool and access the service anytime. However, the downside is they have fewer investment options obtainable.

Robo advisors make up the fee deficit by processing larger transactions, thanks to their more extensive client base.

Robo Retirement

Some firms offer algorithmically developed retirement planning. The general approach is similar to the Robo-investment platforms, with a tweaked end goal.

Micro Investing

For people who might struggle to set aside a monthly sum for investing, micro-investing allows customers to round up their daily buys to the nearest primary currency unit and invest the small margin in their portfolio. This will enable customers to gradually build up their investment pot without adjusting their behaviour or spending.

This model is viable with zero investment fees.

Digital Brokers

Digital Brokers automate services offered by traditional brokers in segments such as insurance and mortgages. Robo advisors can also be regarded as digital investment brokerages.

Private Banking Solutions

The ultra-rich have varied or extended needs to manage their wealth than the layman.

Of the automated and traditional (in-person) wealth management, a third alternative is a hybrid advice. Hybrid advice enables clients to handle specific tasks themselves while still providing the option to talk to their personal financial advisor, thereby making and maintaining the critical element of private banking—trust.

Also beneficial for the advisor since such solutions automate strenuous processes so they can focus on their most significant value-add— which is building relationships with clients.

Advicetech

Advicetech companies provide software solutions that help wealth management firms improve the efficiency and cost-effectiveness of their operations. While the term was coined relatively recently, Advicetech is the oldest type of Wealthtech, with financial planning and stock-picking software first appearing in 1998.

History of Wealthtech

Now, let’s take a look at the big picture:

- How Wealthtech began?

- What its adolescent growth phase looked like.

- What’s happening in the industry in the early-mid 2020s as the industry matures?

Stage 1: Origin of Wealthtech

Before Wealthtech started around 2008, proto-Wealthtech companies and services existed. Financial Engines, now known as Edelman Financial Engines, began providing retirement planning and fund-picking software in 1998.

Stage 2: Growth of Wealthtech

The release of Betterment’s platform in 2008 marks the initiation of the Wealthtech movement. Betterment was the first Robo-advice platform and, as of 2022, is the largest globally.

Wealthfront went live in 2008, and Betterment’s release coincided roughly with the 2007 Financial Crisis. Some commentators have drawn a link between the two, arguing that people looked to new ways to control and stabilize their financial situation in a turbulent time.

Stage 3: Consolidation of Wealthtech

While the world’s biggest financial institutions had included Robo-advisory technology in their offerings for a while, the 2020s saw a change in their digital advice strategy. A time of consolidation began, and many of the most successful Robo-advisors were acquired for large sums.

Future of Wealthtech –

Further consolidation: Further purchases of some of the biggest Wealthtech companies will likely follow Nutmeg and Wealthfront. Although still small in comparison, Robo-advisors have built up sizeable AUM (assets under management) and have a proven business model. Companies could also be bought for their analytics models, plugged into established offerings, hence finding synergies.

Growing technological sophistication grows the appeal of Robo-advice.

While there remains suspicion about Robo-advice, the continuing improvement of advice and delivery will see Robo-advice gain more traction on human/expert advice. Compare how shopping on mobile phones feels normal to most people now to ten years ago when people were sceptical about it; taking advice from an algorithm will become more normalized in the coming years.

Algorithms will be improved in terms of analytics as well as personalization. At the same time, AI and natural language processing will let customers talk to live chat robots just as if they were human wealth managers.

Private Wealth Solutions will gain clients.

While many Wealthtech companies focus on the mass market, companies such as Topaz will hone their private wealth offering, delivering an exclusive digital experience that mimics, or even improves, the delivery of traditional wealth management services.

The tech industry has been slowly turning its attention to private wealth management. A great possibility exists to digitize many aspects of the sector, improving client experience and uncovering cost efficiencies for wealth managers.

Increased investment into the sector

Investments in Wealthtech companies have dramatically risen in recent years, and we expect this to continue. According to Fintech Global, Wealthtech investment in 2020 was more than double the 2019 figure of $9.2bn vs $20.9bn—and that last number only covered Q1-3 2020.

The total number of deals grew by 7% in the same timeframe, suggesting that the average value per deal was significantly increased.

While it’s fair to say we can’t expect Wealthtech investment to double yearly, there is undoubtedly momentum behind the growth.

While the wealth tech sector is poised to grow, here’s a look at the major players in the market.

1. INDWealth – Launched in 2019, INDWealth enables customers to track, save and grow their money. The company’s SuperMoneyApp automatically organizes a user’s money and suggests actions to increase savings and earnings across investments, loans, expenses and taxes. On the other hand, its private wealth management offering INDWealth focuses on providing services to private family offices, analysts, tax services, succession planning and trust services.

INDWealth’s platform allows users to maintain a structured record of their finances, covering aspects from loans, taxes and expenses to investments. The machine-learning algorithm enables users to improve cash flows and reach financial goals accordingly.

The startup‘s parent company, Finzoom Investment advisors, is registered as an investment advisor under the Securities and Exchange Board of India (SEBI). The company has bagged over US$58 million to date. Its investor base includes Tiger Global, Steadview Capital and Dragoneer.

2. Zerodha –Zerodha is one of the first discount brokers in India and claims to be one of the largest stock brokers in India. Zerodha has over 5 million clients that contribute to over 15% of all retail order volumes in India daily by trading and investing in various products.

Zerodha users can invest in futures and options, commodity and currency derivatives, stocks and IPOs, direct mutual funds, bonds and government securities.

The firm allows users to trade free of cost in case of interday trades. It charges a nominal 0.03% of the transaction or US$0.27 (INR 20), whichever is lower, for intraday trading of equity, currency, and commodity. It may be interesting to note that the startup, which has gained profitability, has been bootstrapped from its inception. The company’s revenue grew 11% to over US$127 million in FY2020 compared to the previous year. The startup is self-valued at US$1 billion.

3. Upstox – Backed by Ratan Tata and Tiger Global, Upstox operates a desktop and mobile trading app with similar pricing as Zerodha. Founded in 2009, Upstox is registered under SEBI. Upstox allows its users to invest in stocks, commodities, digital gold, futures and options, mutual funds, IPOs and new fund offers (NFOs). Upstox has raised a total of US$29 million to date.

4. Groww –Like Zerodha and Upstox, Groww is an online investment platform in India. However, the chief difference in Groww’s offering is that it allows users to invest in US stocks previously unavailable in the Indian market and other investment options offered by similar platforms.

Groww claims to have over 10 million customers. Founded in 2017, the startup has raised over US$142 million. It counts Y Combinator, Sequoia Capital India, Ribbit Capital and other established names among its investors.

5. Kuvera – Robo-advisory players have rapidly gained prominence in India over the last few years. Assets under management (AUM) in the Robo-advisory segment of the wealth tech sector in India have also been steadily growing, from about US$1.6 billion in 2017 to around US$8.8 billion in 2020. Founded in 2013, Kuvera has established a strong foothold for its fund-based Robo-advisory services. The firm has an AUM of approximately US$1.97 billion, making up a massive market share.

The company also enables users to invest in direct mutual funds easily and has diversified to offer investment in domestic and US stocks, cryptocurrencies, fixed deposits and gold. The firm has over 1.1 million investors on its platform. Kuvera prides itself on not pushing sales but providing investors with valuable investment guidance and advice. Moreover, the startup allows users to import external transactions, enabling them to keep track of all their investments in one place.

6. Scripbox –Scripbox is a dominant Robo-advisor in the wealth tech segment in India. Founded in 2012, Scripbox allows its customers to invest in equity, debt, and tax-saving mutual funds. Additionally, the firm claims to use science and proprietary algorithms for portfolio management. Scripbox has over 4,500 customers who are millionaires and manages over US$450 million in investments. The company has raised over US$23 million from investors, including Omidyar Network, Accel, Axcel Partners, and NuVentures.

7. ETMoney is an online investment platform and a prominent wealth tech player in India. Founded in 2015, ETMoney offers a range of investment options in credit cards and loans, insurance, and financial tools. The company claims to be one of the fastest-growing fintech startups in the country. Over the last two years, ETMoney’s user base has grown five times, while its transaction volume has seen 11x growth.

8. WealthDesk – WealthDesk is an investment management and technology platform that manages the entire asset management and advisory value chain from portfolio creation to transforming those into investment products called WealthBaskets. Founded in 2016, WealthDesk operates in India’s B2B2C segment of wealth tech. It offers a Software-as-a-Service (SaaS) platform for businesses and multiple consumer-focused SaaS platforms (B2C) for brokers and advisors. It recently raised US$3.2 million in a seed funding round.

9. Cube Wealth – Cube Wealth was launched in 2018 by fintech veteran Satyen Kothari. He had previously established Citrus Pay, acquired by PayU in 2016. Cube Wealth is a digital wealth management platform that provides busy professionals with investment options on its app and expert investment advice. The app also helps investors create an investment portfolio with assistance from dedicated wealth advisors. Users can invest in domestic and US equities, mutual funds, gold and even charitable ventures on the Cube Wealth app for a well-diversified portfolio. Investors can also avail themselves of P2P lending and co-investment options.

10. Sqrrl – Established in 2017, Sqrrl is a digital investment management platform focused solely on mutual funds. Sqrrl has cemented its position in the market by targeting the young generations – GenZ and millennials. Sqrrl enables users to save money automatically from as little as roughly US$ 1.38 (INR100) or every time they spend. The firm also helps users save for specific goals.

Moreover, Sqrrl helps users identify tax-saving investment options and one-time investment schemes or set up monthly systematic investment plans (SIPs). The platform also offers personal loan options to users. The company is registered under SEBI and the Association of Mutual Funds in India.

While the list contains some of India‘s most prominent wealth tech players, it could be more comprehensive. As the wealth tech space in India grows more and more crowded, more startups will likely gain market share. Some other wealth tech startups not featured on the list but also enjoy considerable popularity include screener, Trendyline, 5paisa, and MarketsMojo, to name a few.

Conclusion

Wealthtech is an industry to keep an eye on. It is in its nascent stage as of now, but this sector has enormous potential ready to be tapped.

Many Companies are already making a mark in this segment, and the customers, too, have adapted and taken in the idea of wealth tech.

With technology moving at tremendous speed and innovations brought in every day, AI and the concept have gained ground and growing in leap and bound.