Tech Mahindra, Infosys, and others have tested the waters of the metaverse. Can they make money from the craze?

India’s 230 billion dollars IT services businesses have spent most of their time trying to catch up with companies like Accenture, Capgemini, and IBM, Infosys.

People who keep an eye on India’s IT sector often say, “There’s a three- to the five-year gap between global tech services providers and India.” Indian IT mostly took the safer path because it was easy to get the easy things.

But now, with maybe more weight and size, at least some of the players are trying out new things as they roll out. The way that Indian IT companies are responding to the metaverse craze stands out.

Infosys opened a Metaverse Foundry at the beginning of this year, and Tech Mahindra began MVerse around the same time. Both Indian IT companies started working in the metaverse around the same time Accenture began Continuum. All of this happened in the last four to five months. Statista says the global metaverse market was worth 38.85 billion dollars in 2021. Business in the metaverse, seen as the next version of the Internet, is expected to grow to USD47.48 billion in 2022 and USD678 billion by 2030. A business chance like this is too good for any IT company to pass up.

Heavyweights like TCS, Wipro, and HCL don’t have anything to say about metaverse. But Infosys and Tech Mahindra have started dedicated centers for the retail, telecom, and banking sectors, where they build teams and use templates for solutions.

In the metaverse, they see not only a new business opportunity but also one that promises to have higher gross margins than traditional businesses, by about 12–15%.

But if they want to get business in the metaverse, they must show what they can do.

And this is where these special centers can help.

Infosys’s first step

Infosys has already worked on metaverse projects with the Australian Open and the French Open. Infosys’s contract with Roland Garros, the company that runs the French Open tennis tournament, was extended by five years in March of this year. The new agreement focuses on digital innovation and building augmented reality and experiences like a metaverse.

Ravi Kumar S, president of Infosys and head of the company’s metaverse practice, says, “Right now, the retail, shopping, and gaming industries are tapping into and exploring metaverse. At the moment, most of the spending is a matter of choice. However, as the market matures and changes, this could change in the future.” Kumar began his career as a nuclear scientist at the Bhabha Atomic Research Centre. In the last 20 years, he has worked at Infosys in several roles, including driving digital transformation and consulting services.

Gaurav Vasu, the founder and CEO of the research firm Unearthinsight says, “AR, VR, and MR projects are all part of the metaverse. In the next few years, the different building blocks of the metaverse could bring in 8–10% of the business.

Vasu thinks that AR/VR services for gaming, healthcare, social media, e-commerce, real estate, and advertising clients can be kept up by co-developing virtual worlds. Some service companies offer 3D avatars, 3D worlds, cities, spaces, digital assets, and digital economies as examples of how the metaverse can be used.

Amit Singh, executive director and head of IT at Avendus Capital, says, “There is demand for metaverse solutions, but not enough ability. So, it makes sense to have these centers.” He thinks that once Fortune 500 customers see use cases and the ability to make money, they will increase, and centers like the Infosys Foundry and Tech Mverse will be able to jump on the opportunity quickly.

Some companies on the Fortune 500 list have already taken the first steps.

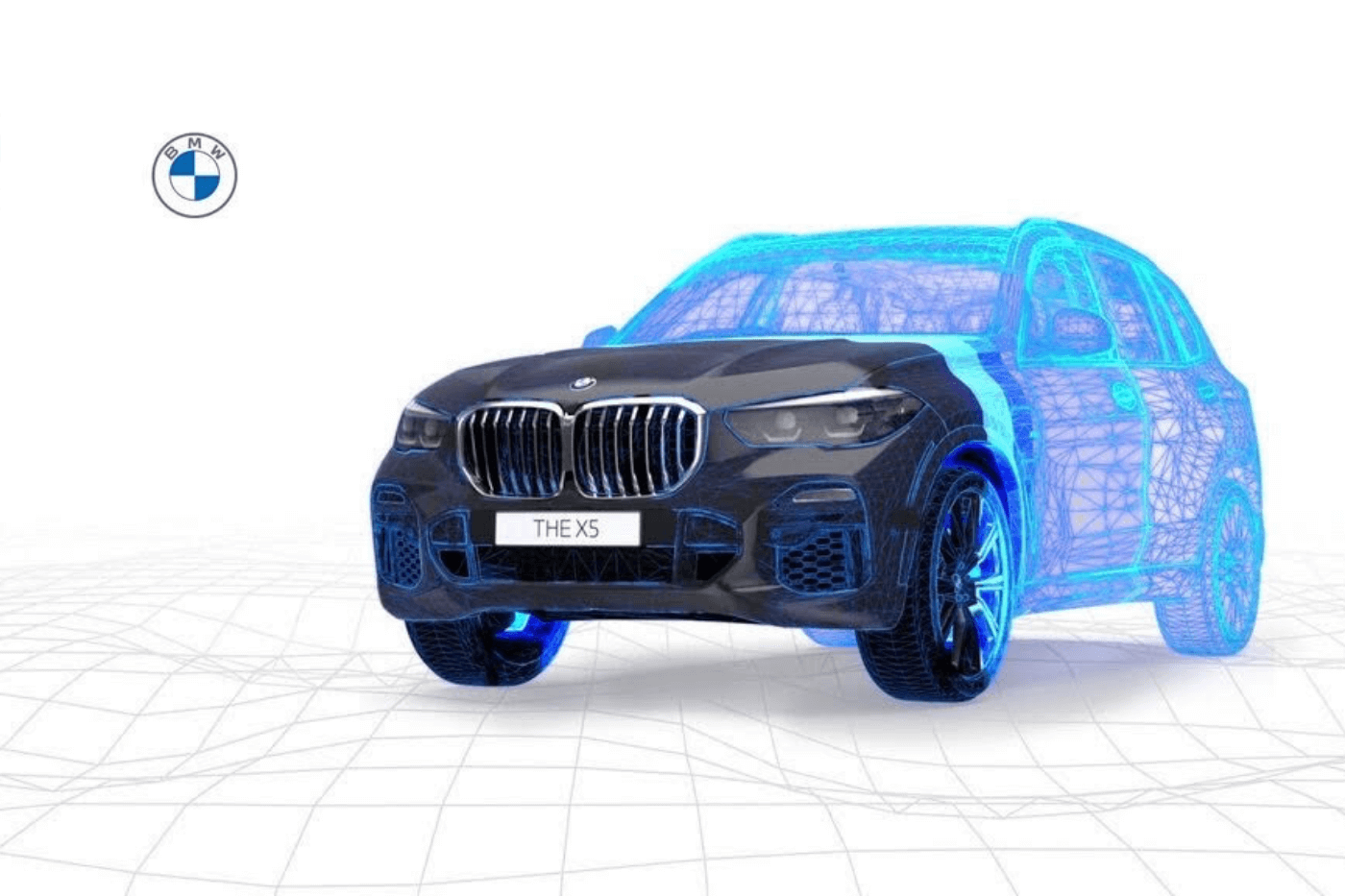

BMW is designing concept cars with AR and VR. Several Fortune 500 companies, like Deutsche Telekom, Audi, Nestle, and Procter & Gamble, are using the metaverse to find new ways to connect with potential customers and add value for them and their retail partners.

“Metaverse margins will be higher than traditional services, much like how Blockchain has gross margins that are 12–15 percent higher,” says Singh.

This is what people who get there first hope to get.

Inside the Foundry, Infosys thinks hybrid life will be the norm in the world after Covid. This is why it is putting money into building its ability to provide metaverse solutions.

Infosys Metaverse Foundry is a collection of 100 templates that clients can use immediately. Infosys, for example, gives businesses a template for setting up immersive retail experiences where customers can explore a branded metaverse environment, buy NFTs, or connect to an online checkout counter to get things delivered in the real world. Infosys is selling this as a service-on-tap.

Kumar says, “As Infosys hybrid living and working becomes the new norm, experiences, like holding meetings in the metaverse and continuing them in the real world or shopping in the metaverse and having products delivered to a real-world address, will be a great value.”

For example, metaverse for education and the workplace (to help train new employees) is becoming more popular. “Clients are looking for useful business applications instead of unique IPs. Here, our more than 100 use cases come in handy,” says Kumar.

Infosys has a small team of about 500 experts who work on things like Unity, CAD tools, and open-source frameworks that are related to games. It thinks there is a chance to make templates for the metaverse even though Kumar doesn’t want to tell anyone about the business that could come from this. “It’s not time yet. Even though our clients have been giving us good feedback since we opened the Foundry.”

It has made an expanded digital-physical store for the Australian Open (tennis) among its business activities. In the metaverse, people can go shopping for goods. Infosys made mixed reality experiences for the French Open so that fans’ avatars could talk to each other and buy things.

Komatsu, a company that makes tools for construction and mining, also worked with Infosys Metaverse Foundry to make metaverse solutions for them.

Banking on MVerse

For Tech Mahindra, an IT company worth US$5.2 billion, the metaverse combines software and hardware to let clients see things in 3D.

The company in Pune offers services like avatar-as-a-service, meta environment development, NFT marketplaces, content management, and more.

The company is looking for business opportunities in India and elsewhere. Kunal Purohit, chief digital services officer at Tech Mahindra, says, “Several things cause the growth of the metaverse in India. This includes the technology ecosystem, the rise of entrepreneurship, the use of smartphones, cheap mobile data, and many millennials. Purohit has been with TechM for a long time and runs the company’s digital and analytics capability solutions units worldwide.

Tech Mahindra focuses on making metaverse environments for specific industries and use cases, such as factories of the future and drug discovery, among other things. It already has a team of 100 people working on metaverse projects, and in a year, that team will grow to 1,000 people.

The company is working on use cases like opening car dealerships in the metaverse, a platform to host NFTs from artists worldwide, a virtual bank in the metaverse, and a gaming center.

In partnership with Tech Mahindra, Union Bank of India opened a metaverse lounge and an open banking sandbox environment on July 8, 2022. This was done to test out new products.

The bank’s metaverse lounge, Uni-verse, will have information and videos about products. Customers’ avatars can move around the lounge and learn about the bank’s deposits, loans, government welfare programs, and digital projects as if they were real.

The largest bank in the country, SBI, is also getting closer to launching its presence in the metaverse.

The market and how it’s used

Tech Mahindra is getting requests for metaverse solutions from banking, retail, and training clients worldwide. For example, the oil and gas business spends a lot of money on training in the field. With metaverse, it could save up to 30% on training costs.

Metaverse projects are becoming more popular, and Infosys, Tech Mahindra, and others are seeing this. However, these projects are still small, costing between $1 million and $5 million. But the margins for metaverse contracts are much higher, as they have always been for new technologies.

Service providers think deployments in back-end infrastructure, such as the deployment and adoption of 5G networks and more use of NFTs, AR, and VR, will lead to more people wanting metaverse services.

“Most of the things that are being done now are like proofs of concept. But unlike the last wave of new technology, service providers want to be ready when the market opens up,” says Singh from Avendus.

They can grow slowly and be ready for big contracts with the help of dedicated centers and labs. Singh also talks about how Indian IT constantly plays catch-up with its peers worldwide. Can they now make the gap smaller?

Accenture began bringing on 150,000 new employees in the metaverse. It plans to have deep applications for specific industries on the client side. For example, it is working on ways for surgical teams to learn new procedures without having to simultaneously be in the same operating room.

Other service providers, like TCS, have made their first investments in the metaverse through their Extended Reality (XR) Lab, where a research and development (R&D) team is piloting and running several proofs of concept and use cases.

In the same way, HCL thinks that XR will grow in the next few years as companies obsessed with redefining the customer experience make services that work with XR a big part of their business.

Everest Group partner Yugal Joshi says that Indian companies are trying to create “pull-through demand.” Clients worldwide seek tech partners to help implement solutions like making digital twins or bringing people on board virtually. They might do it for free at first, set up a lab to do it, or show it to clients if they already have a close relationship with the client.

“Indian IT usually waits until they make money before investing, and India doesn’t do much research and development (unlike Accenture & other global providers). “In these uncertain times, we are fast followers who focus on the near future,” says Joshi.

At least a few providers are now paying more attention to moonshots than they usually do because of the metaverse craze.

edited and proofread by nikita sharma