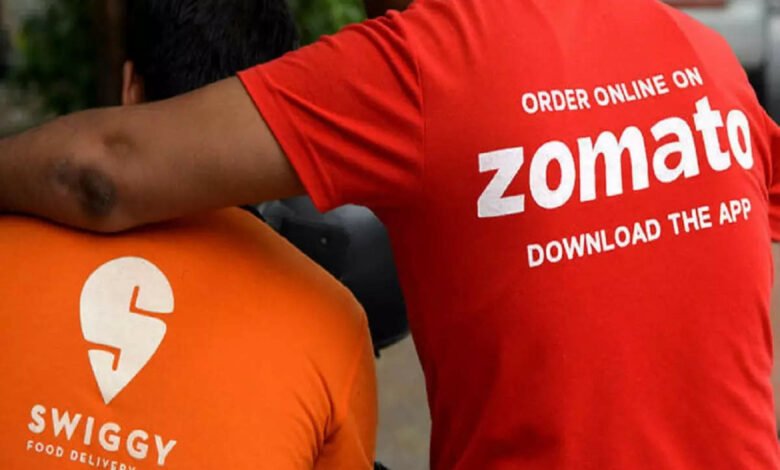

Zomato’s stock declines 5% intraday as CCI investigates Zomato and Swiggy for allegedly violating platform neutrality.

On Monday, the Competition Commission requested a thorough investigation into food delivery websites Zomato and Swiggy for alleged unfair business practices in their dealings with restaurant partners.

The order came after the National Restaurant Association of India filed a complaint (NRAI). The case will be investigated by the watchdog’s probe arm, the Director-General (DG).

“Prima facie, there exists a conflict of interest issue, necessitating a careful examination of its impact on overall competition between the RPs and the private brands/entities that the platforms may be incentivised to favour,” the regulator said.

Both Zomato and Swiggy, according to the Competition Commission of India (CCI), operate as important intermediary platforms in the food delivery arena, demonstrating their market dominance and ability to alter the level playing field significantly.

It further stated that preferential treatment given to Restaurant Partners (RPs) in which these platforms own equity or revenue could make it difficult for current RPs to compete on equal footing.

“Such preferential treatment can occur in a variety of ways, given the platform’s control over various aspects that influence competition on them, such as control over deliveries, search ranking, and other factors that can only be properly investigated in an investigation,” it said.

Furthermore, the antitrust regulator stated that the price parity clauses in Zomato and Swiggy agreements appear to indicate broad restrictions in which the RPs are not allowed to maintain lower prices or higher discounts on any of their supply channels or any other aggregator for the platform to maintain the minimum price or maximum values.

“Such a price parity condition may deter platforms from competing on the basis of commissions because RPs must maintain similar prices on all platforms and give same prices to clients, regardless of the commission rates paid to the platform,” CCI wrote in a 32-page order.

“Given that Zomato and Swiggy are the two largest platforms in the food delivery segment, their separate agreements with RPs of this sort are likely to have an AAEC on the market by building entry barriers for new platforms without accruing any benefits to consumers,” the report continued.

The CCI has ordered an investigation into Swiggy and Zomato’s practices and has requested a report within 60 days.

Food delivery apps Zomato and Swiggy have been ordered to be investigated by India’s anti-monopoly watchdog for possible discriminatory pricing practices and other issues flagged in a complaint by a restaurant group last year.

In July 2021, the National Eateries Association of India (NRAI), representing over 500,000 restaurants in India, filed a complaint with the Competition Commission of India (CCI), accusing meal delivery businesses of anti-competitive behaviour.

The CCI has now requested a report from its director-general within 60 days.

“The Commission believes that there is a prima facie case with respect to some of Zomato and Swiggy conduct, which necessitates an investigation by the director-general (DG), to determine whether… (they have) resulted in contravention of the provisions of Section 3(1) of the Act read with Section 3(4) thereof,” the order stated.

Swiggy and Zomato were accused of engaging in deep discounting, data masking, excessive commissions, and forcing price parity terms on restaurant partners, according to the NRAI.

According to NRAI, restaurant aggregators have resorted to a dual function on their platform. They solely offer cloud kitchen brands comparable to private labels, creating an inherent conflict of interest.

The CCI stated that a conflict of interest scenario has emerged due to the aggregators’ launch of private labels, which could lead to their acting as intermediaries and market participants.

This is also thought to be due to economic interests in the downstream market, hindering them from operating as impartial platforms.

While Zomato’s cloud kitchen service, Access Kitchen, was shut down last year, the fact that it has a revenue interest in these third-party-owned cloud kitchens, through commissions on orders and rent, warrants additional inspection and investigation, according to the CCI.

NRAI, on the other hand, claims that operating parties frequently persuade restaurant partners to commit exclusively to their platform.

The CCI responded by stating that it would look into “platform neutrality” about food-tech companies.

During the inquiry, the CCI observed that it would be possible to assess if exclusivity combined with a minimum guarantee duty further emphasises the structure, preventing the platform from operating neutrally.

The CCI will also investigate NRAI’s complaints of ‘pricing parity’ arrangements, which Zomato and Swiggy have confirmed. According to the competition authorities, restaurant partners were not allowed to keep lower rates on the aggregators, which could have influenced the competitive market by imposing obstacles.

The Commission ruled that ‘bundling’ of meal delivery services with food ordering services does not create any competition concerns.

The restaurant partners aim to file additional documents in response to the dropped allegations.

Zomato’s stock drops 5% intraday after CCI demands a probe into meal delivery aggregators.

On Tuesday, investors were wary of Zomato shares after the Competition Commission of India (CCI) ordered a probe against the food delivery platform and its competitor Swiggy for alleged unfair business practices.

In early trading, Zomato stock fell 4.6 per cent due to yesterday’s news. At 9:40 a.m., the shares traded 2.7 per cent lower on the Bombay Stock Exchange (BSE) at Rs 83.80 and 2.6 per cent lower on the National Stock Exchange (NSE) at Rs 83.95.

Even though Zomato shares have rebounded more than 5% in the last five days, the firm has lost more than 40% of investors’ wealth in 2022 (year-to-date), compared to the benchmark Sensex, which has gained roughly 2%. This comes as investors continue to be wary of new age stocks. On July 23, 2021, the meal delivery service made its Dalal Street premiere.

CCI has ordered a full inquiry into food delivery services Zomato, and Swiggy for alleged unfair business practices in their dealings with restaurant partners, prompting Tuesday’s drop. The order came after the National Restaurant Association of India filed a complaint (NRAI).

The case will be investigated by the watchdog’s probe arm, the Director-General (DG). “Prima facie, there exists a conflict of interest issue, necessitating a careful examination of its impact on overall competition between the RPs and the private brands/entities that the platforms may be incentivised to favour,” the regulator said. The DG has been given 60 days to submit the investigative report by the CCI.

In a statement, Zomato stated that it would cooperate with CCI in its inquiry. It went on to say, “All of our practices are compliant with competition laws.”

Karan Taurani has raised concerns regarding the meal delivery app’s growth rate, Senior Vice President and Research Analyst at Elara Securities, as the eateries with whom it is affiliated struggle with order numbers.

“Before the pandemic, the aggregator platforms offered discounts, which the restaurants shared and the aggregators in terms of losses.” The total loss has been passed on to the restaurant partner since the outbreak began. Suppose you look at some smaller cloud kitchen operators and freestanding restaurants. In that case, they’re suffering, and all of their order numbers were spurred by discounts because once you have value, customers are more inclined to eat cuisine from these types of restaurants,” he explained.

However, since the discounts have decreased, eateries are now experiencing volume issues, which has a significant impact, according to Taurani.

“We believe there was a very low possibility of taking rates increasing higher from hereon at the time of the IPO last year when the company was listed because global take rates are in the region of 5-15 per cent, whereas the take rate for something like Zomato is now at 17-18 percent.” It can even reach 27-28 per cent for new operators, independent eateries, or cloud operators. “There are significant signals in terms of concerns about Zomato’s growth rate.”

Meanwhile, cautious investors should avoid owning or investing in such “unfair business practices,” according to Prashanth Tape, Vice President (Research), Mehta Equities Ltd. He went on to say that current new-age company valuations are still much below his firm’s estimates. According to him, Zomato or Swiggy would have to adapt their strategy to keep up with market trends and develop faster. Given the fierce competition, they are likely to engage in unethical business practices and get into difficulty.

“Given these risk concerns, I’d be more inclined to investigate Zomato if it’s accessible for Rs 45-50/- and then take a prudent risk.” “At this point, accumulating losses are a problem, and the only way to keep the firm operating is to get financing.”

About CCI

Through competition, the most effective approach to ensuring that the ‘Common Man,’ or ‘Aam Aadmi,’ has access to the most extensive range of goods and services at the most affordable prices. Due to more incredible rivalry, producers will be more compelled to innovate and specialise. Lower costs and more options would benefit consumers. A level playing field in the marketplace is essential to achieve this goal. Our goal is to develop and maintain fair competition in the economy, which will give producers a “level playing field” and make markets work for the benefit of consumers.

The Competition Act

The 2002 Competition Act, as amended by the Competition (Amendment) Act of 2007, is based on current competition law thought. Anti-competitive agreements, enterprise abuse of a dominant position, and mergers and acquisitions (acquisition, control, and M&A) that have or are likely to have a significant adverse effect on competition in India are all prohibited under the Act.

India’s Competition Commission

The Competition Commission of India, constituted by the Central Government with effect from October 14, 2003, is tasked with carrying out the Act’s objectives. The Central Government appoints a Chairperson and six members to the CCI. The Commission’s responsibility is to eradicate anti-competitive activities, promote and sustain competition, safeguard consumers’ interests, and ensure free trade in India’s marketplaces. The Commission is also mandated to provide an opinion on competition concerns in response to a referral from a statutory entity formed under any law and engage in competition advocacy, raise public awareness, and provide competition training.

edited and proofread by nikita sharma