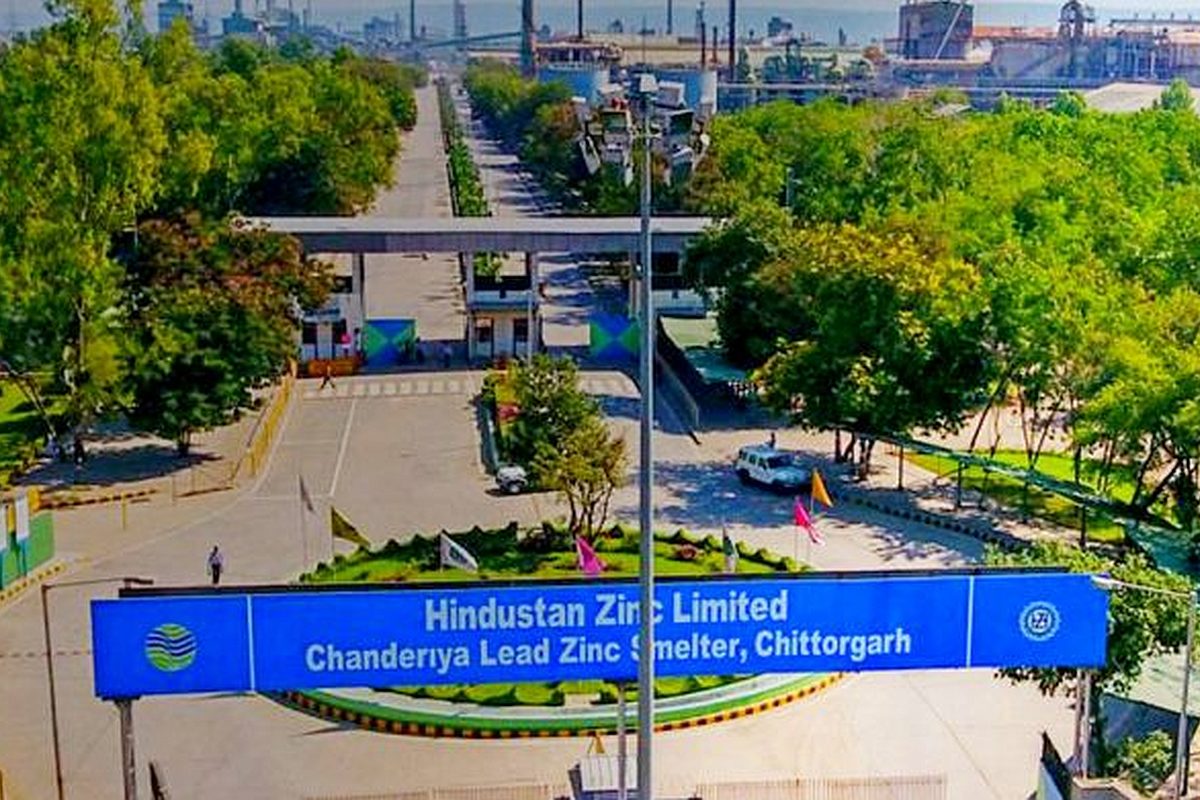

Vedanta’s Chief Asks The Indian Government To Divest The 29 % Stakes In HZL; Says “The Company Will Be Run By The Board And Not The Government”

The Centre has not agreed on the negotiations by the HZL to purchase the international assets of zinc by Vedanta. The latter mentioned in January that they have agreed to the proposed sale of the stakes for the valuation of 2981 million USD.

Anil Agarwal, the chief of Vedanta has asked the government to divest the leftover 29 percent stakes in the Hindustan zinc as the company agreed to sell 100 percent of the stakes 20 years ago. He has stated that the government has to fasten the process and has added that the company would divest the stakes to Vedanta under a particular protocol.

Anil Agarwal has further added that the Indian government could earn a profit of 40,000 to 50,000 crore INR after the negotiations. He has added that the company has to be operated by the board and not the government.

In an interview, he mentioned that the government decided that they would sell 100 percent of the stakes 20 years ago. So, how much will the government make the company suffer? They have to accelerate their decision to divest the 29 percent. The company will be run by the board and not the government.

Agarwal has stated that he wanted to double the size of the agreement with Hindustan Zinc and added that the South African properties will help to increase the profits of Hindustan zinc Limited.

He has further stated that the company has one goal and that is to double the size of Hindustan Zinc. If the government wants to come out, it will be a bold decision for them. They have announced that they want to sell their shares in March, so he is going to look forward to it. He has claimed that if the agreement does not take place, Hindustan Zinc Limited will start to go down. It could earn profits for both companies.

The Centre has not agreed on the negotiations by the HZL to purchase the international assets of zinc by Vedanta. The latter mentioned in January that they have agreed to the proposed sale of the stakes for the valuation of 2981 million USD. The government has opposed the deal stating that it conflicts with the interest of the minority shareholders and corporate governance norms.

Hindustan CEO has addressed the situation. He has mentioned that the Indian government is an integral stakeholder and any decision by the board will require a majority of the minority stakeholders.

Furthermore, there is a time frame of three months to conduct a shareholders’ meeting and ask for approval. The board will come out with alternatives if the deal does not take place.

Meanwhile, recently the parent company Vedanta Resources has stated that they are in the advanced stages to initiate fresh loans of 1 billion USD from a group of banks. The company has even stated that it would meet its maturities for the quarter ending in fiscal 23.

Vedanta’s stakes have performed well recently. Its share prices have increased by 2 percent in the last week. On the other hand, the shares of the company have declined by 21 percent in the last year.

For the past 50 years, Anil Agrawal has worked to establish the mining and metals industries. Additionally, Vedanta, his business, is now listed on the London Stock Exchange. It is also the first Indian business to appear on the reputable list.

Indian Government Opposes Vedanta’s Initiative to sell International Zinc Assets to Hindustan Zinc Limited:

The government’s decision has come off as a setback to the billionaire Anil Agarwal’s mining group. The government has previously refused the proposal of Vedanta group to sell its international zinc business to Hindustan Zinc Ltd for a valuation of 2.98 billion USD. The negotiations were rejected for the concerts involving overvaluation.

In a deal with HZL, the ministry mentioned that the negotiation is a related party transaction and the government would reiterate the dissent.

The ministry has mentioned that it is writing on behalf of the government on the agreement approved by the HZL It has stated the nominee directors have not approved the proposals. It wanted the company to look out for other methods of acquisition.

Recently, the S&P Global ratings have mentioned that the ratings of the Vedanta group may be downgraded if it is unable to acquire 2 billion USD assets or sell international zinc assets.

edited and proofread by nikita sharma