Ultratech’s Purchase In India Cements After Adani’s Penna Acquisition: The Race To Capture Southern Cement Throne and Dominate the Indian Cement Industry!

UltraTech Cement Ltd, owned by the Aditya Birla group, has acquired a 23% interest in India Cements Ltd (ICL), sparking rumours of a takeover of the South-based cement company, controlled by N Srinivasan and his family. The move intensifies the struggle to dominate India’s cement industry, which Kumar Mangalam Birla’s firm long dominated before the Adani Group joined the race in 2022 and has since become the country’s second-largest player.

UltraTech authorised “making a financial investment” to take up to 7.06 crores of equity shares of India Cements at a price of up to Rs 267 per share, the Birla group said. This non-controlling financial investment amounts to about 23% of the equity shares capital of ICL. The move by Birlas, the country’s cement king, follows the Adani group’s recent acquisition of Penna Cement and aims to maintain its dominant position in the cement sector.

While the Birla holding falls short of the 26% necessary to make an open bid, Srinivasan-led promoters can face a takeover effort because their share is 28.42 per cent. Although UltraTech said it is purely a non-controlling financial investment, it is behind the screen that the promoters have backed the Birla share acquisition. If the Birlas purchase an additional 3% and make an open bid, the India Cements may face a takeover bid. However, the Birlas have made no hint about this alternative. This wave of purchases by the Birlas and Adani is expected to exacerbate the struggle for market dominance in the cement industry in the coming days.

What fueled this purchase?

While UltraTech claims that the purchase is a ‘non-controlling financial investment,’ the immediate question is why a cement manufacturer would buy a premium share in a competitor without having control or a role in the company’s management. Financial stats lead to conjecture about what could be in store. While Ultratech has an ROE of 12.3%, India Cements is losing money and is expected to lose 2.5% in the current fiscal year.

Why India Cements may have agreed to this sale?

Both the Birla group and Srinivasan of India Cements have been in business for decades and have crossed paths in the past. India Cements was in the first in the sector to pursue aggressive acquisitions in the 90s, when the market was opening up. It made a bid to purchase Raasi Cements Ltd. in the late 90s, which shook the cement sector. The idea was that buying the firm would result in creating a subsidiary that would employ cement and the raw material, limestone.

Srinivasan, at that time, had to fight with Raasi Cements’ supporters on one side and other rivals who wanted to deter the move since it may lead to domination in the South. However, the efforts did not prove as they were planned. Srinivasan’s move turned faulty at a time when SEBI’s takeover code was still in its early stages, and state-run financial institutions led by the Industrial Development Bank of India controlled deals through backdoor management.

India Cements ended up paying more than three times the original price for Raasi Cements after rivals worked with financial institutions in Mumbai to make the purchase unfeasible. Furthermore, while the transaction was underway, Raasi management split off the subsidiary, dealing another blow that regulatory intervention failed to avoid. Consequently, the acquisition that India Cements had hoped would be a bloom turned out to be a burden around its neck. Financially speaking, the company never fully recovered from this blow.

But what was the sweet dish for the Ultratech?

UltraTech, which is almost number one everywhere, is missing two valuable markets: Tamil Nadu and Kerala. So, in discussions, management showed a desire to develop there. The Adani group’s recent acquisition of Penna Cement, which has ambitions for the sector, further fueled this desire to have a stronger foothold in these markets. So, this acquisition can be mutually beneficial since UltraTech can work on the supply to lead market share in the undersupplied AP/Telangana belt, and ICL’s financial performance can recover with the increase in volume.

How strong were the blocks the cement industry made in the last decade, and what are big players doing to build a robust bridge towards the future?

Strong blocks of Acquisitions from the past.

In the commodities sectors, large corporations grow to be seen by pursuing a twin strategy of acquiring peers (inorganic) and organic expansion. Over the past eight years, India’s cement sector has been in the phase of consolidation. It commenced with the acquisition of 21.2 million tonnes (MT) of cement from Jaiprakash Associates by dominant UltraTech in February 2016 for INR 16,600 crore. More acquisitions by The Adani empire followed this. In 2022, Adani Group took over ACC and Ambuja Cements from Holcim. This acquisition was valued at ₹81,400 crore.

Other transactions include UltraTech Cement purchasing cement from Century Textiles and Kesoram Industries and Nirma acquiring Lafarge.

Dalmia Cements acquired cement from Jaiprakash Associates and contributed 20.2 MT, amounting to ₹6,450 crores.

UltraTech Cement, India’s largest cement company, has gained 54MT through acquisitions in the last seven years. The firm tries to add 63MT between FY21 and FY26. Over the last seven to eight years, the Birla Group has gained 54 MT via acquisitions, amounting to more than ₹32,320 crore.

Through purchases, the Adani Group has accumulated 90.9 MT. The total value of these trades was ₹97,245 crore.

Bridging the race to the future.

Since the Adani Group debuted the cement business in 2022 by purchasing Ambuja Cements and ACC, becoming India’s second largest player, the cement sector has been on a roller coaster because Adani and leader Birla seek aggressive consolidation in their pursuit of market dominance.

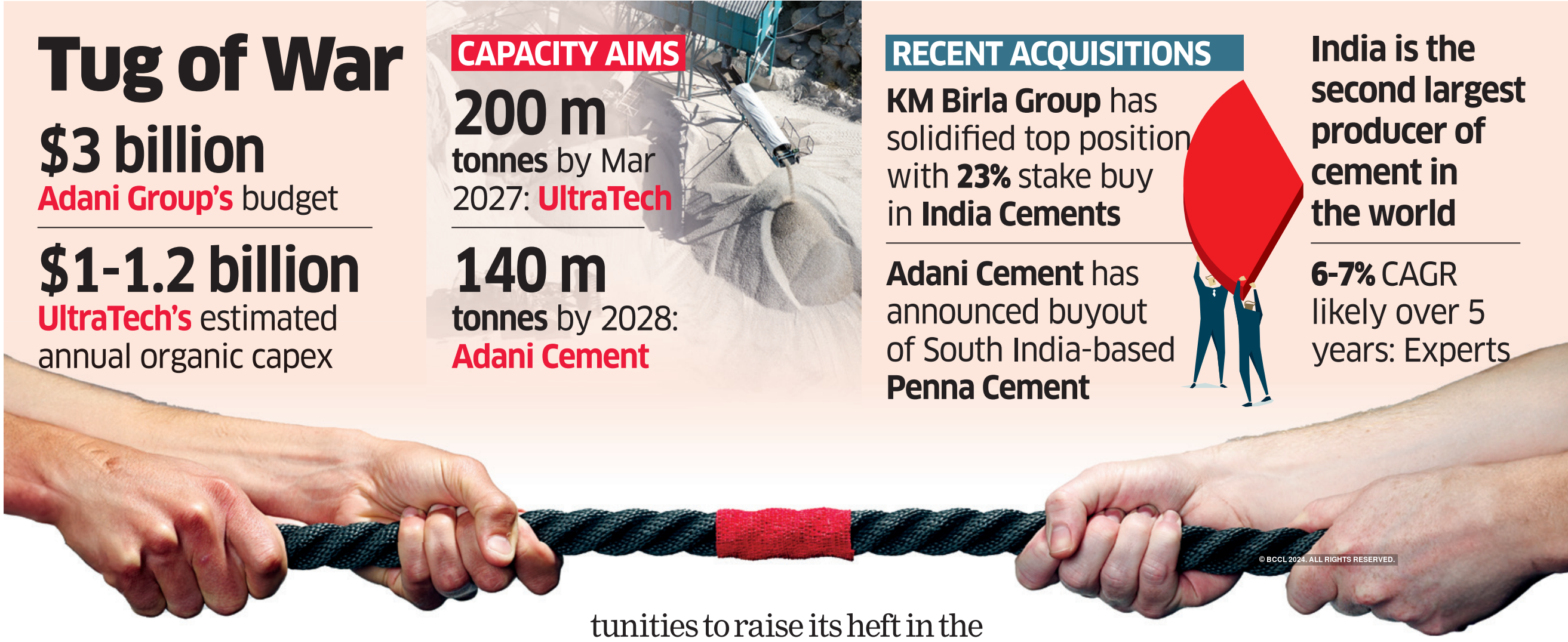

UltraTech displayed its presence earlier in June by launching two greenfield operations in Tamil Nadu and Chhattisgarh, bringing its production capacity (PT) to 150 million tonnes. The country’s top cement manufacturer may generate up to 150% of US cement production while accounting for four-fifths of total European cement production. UltraTech desires to increase its PT to 200 million tonnes, according to chairman Kumar Birla, who announced at the company’s AGM last year that it would infuse Rs 13,000 crore to add 21.9 million tonnes to its existing through a combination of greenfield and brownfield expansion.

UltraTech, the Aditya Birla Group’s main cement firm, has added about 19 million tonnes in the last 12 months and plans to add more than 35 million tonnes to 16 locations. It plans to infuse funds of INR 32,400 crore in capital expenditure over three years. “With a combination of integrated cement plants, grinding units, and bulk terminals ranging over 59 sites in India, and 307 ready mix concrete facilities, UltraTech’s size and capacity is unsurpassed,” said Kumar Mangalam Birla, chairman of the Aditya Birla Group.

UltraTech bought Kesoram Industries last year, and the conclusion of this transaction is expected to increase the capacity to 198.2 million tonnes. It has announced the acquisition of India Cements’ grinding mill in Parli, Maharashtra. UltraTech’s quarterly profit increased 35% to Rs 2,259 crore, owing to decreased costs of inputs and higher volume growth. Revenue increased 9% to Rs 20,419 crore in Q4 FY24.

On the other hand, Adani’s cement investment is based on India’s rapid infrastructure construction, which requires a large amount of cement. India has been creating roads, highways, bridges, and airports. The country is the world’s second-largest cement production behind China. However, its per capita consumption is only 250 kilogrammes, compared to China’s 1,600 kilogrammes. This is what drew Adani Group Chairman Gautam Adani to the cement business in 2022.

According to sources, the Adani Group has kept a $ 3 billion war chest for purchases. According to reports, Adani is looking into myriad cement entities for purchase, including Gujarat-based Saurashtra Cement, Jaiprakash Associates’ cement division, and ABG Shipyard-owned Vadraj Cement. Adani already has Sanghi and Penna in the bag. It is aggressively pursuing an inorganic plan to shoot up capacity and become the leading cement king in the next three to four years, surpassing Aditya Birla Group’s UltraTech.

Adani has a lot going for itself. The organisation has specific enablers for development, and it already owns some land, with others in the purchase process. Adani Cements stated that it had a total reserve of 8,000 million metric tonnes of limestone, a crucial raw material for the cement industry, “in possession at nil to nominal premium.” Furthermore, it meets 40% of Fly Ash criteria under the long-term agreement, which will rise to more than 50% by 2028. Ambuja has better corporate risk management, and 65 % of the total cement cost is synergistic with the group’s other businesses. Furthermore, Ambuja continues to be debt-free.

Why do the big players take the acquisition route and not manufacture from scratch?

Decades ago, when a big player wanted to debut in an industry, they planned to set up the factory from scratch. However, the scenario is a bit different now. Whether it is the edtech industry, where Byju became the market leader or the cement industry, every biggie is looking for acquisition rather than starting from scratch. So, what was the catalyst of this acquiring behaviour?

Given its pros, the inorganic road to expansion has become prominent. A cement factory with 1 MT costs around ₹800 crore in capital investment. Furthermore, there are issues with land acquisition and locating the proper location with easy access to limestone sources. Given these prospects, large corporations find it easier to move on with acquisitions.

The conclusion is still folded.

A Crisil Market Intelligence and Analytics analysis estimates that India’s overall PT is around 595 million tonnes. Adani’s Ambuja, through its subsidiaries ACC Ltd, now has the ability to produce 77.4 million tonnes of cement per year from 18 integrated cement production facilities and 18 cement grinding units across the country. Experts predict that consolidation will continue in the business, with more inorganic than organic expansion.

Rate of consolidation has increased dramatically in the recent 2-3 quarters, which emerges to be due to a combination of causes. One is market share, the second is regional diversification, and the third is reserve captivity, or the type of limestone reserves that companies possess,” said Sehul Bhatt, director of research at CRISIL Market Intelligence and Analytics.

“The robust underlying demand, meanwhile, has persisted, ensuring that the utilisation for the industry will stay high.” India is the world’s second-biggest cement manufacturer. With most of the industries that drive demand projected to continue increasing, experts predict that the sector will grow at 6-7% over the next five years. According to ICRA, the top five companies in the country would control more than half of the market, with a 55% share by March 2025.

Adani Group, a biggie in India’s infrastructure and materials sectors with a strong presence in airports, ports, mining, energy, and real estate, is now vying for the top spot in the cement industry. However, the market leader Ultratech Cement’s parent company, Aditya Birla Group, is quickly adding to their portfolio, resulting in widening the already present difference with Adani, which has around half of Ultratech’s.

What the India Cements promoter group, which owns a 28% share in the company, plans to do is a crucial monitorable. There are rumours that the following generation is not interested in taking over the company. Adani and JSW, the industrial giants, are interested in increasing their cement PT. Could they go after Srinivasan for his share and start a fight, or does he approve of UltraTech’s acquisition?