Two friends change Art and Finance worlds by buying a $70M digital work

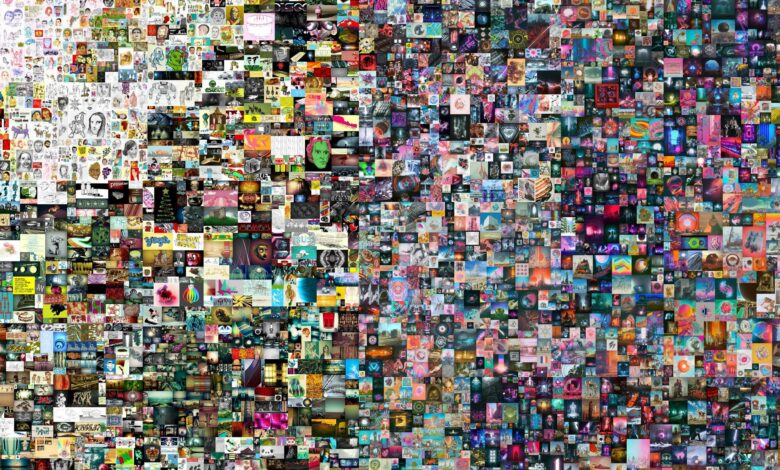

It took Vignesh and Anand Venkateswaran a few minutes to know that they had split up with 69.3 million dollars into a digital artwork housed in a JPEG file and secured their place in the history of art. “We were unsure how we won”, Venkateswarans said, by a collage of 5000 photographs by the artist known as Beeple, explaining the ultimate anxious moments of an online auction. On 11 March at Christie’s London auction Beeple’s work quickly became one of live artists’ most expensive works ever sold, joining David Hockney’s famous pool painting and Jeff Koons’s emblematic stainless steel rabbit paintings.

Venkateswaran said he is still getting to grips with their milestone acquisition with his friend and business partner Sundaresan, both in their 30s. They were both faced with external worries that the deal may have been a compressed plan for inflating the worth of the financial portfolio of the couple. That’s because Venkateswaran and Sundaresan have heavily invested in modern multimedia collectable with unmanageable non-fungible tokens or NFTs. Centred on the crypt-monetary technology called the blockchain, these cryptographic components are an exclusive authenticity certificate that enables backups of digital files quickly to be converted into exclusive collection materials—sometimes worth ten million dollars.

The selling of Beeple’s digital artwork recorded a global dialogue about NFTs and their principles and about whether the digital environment can be sustainably enhanced or not. However, the glaring amount involved attracted international headlines and some concerns that it may have been designed to promote NFTs that could enhance the appeal of the current holdings of the couple.

To convince critics, Venkateswaran said in a call from his home in South India, Christie, a centuries-old Auction House, should be involved. I assume this is the bigger problem here: it will be difficult for people to do so.

That is the case with Beeple itself, who is Mike Winkelmann in real life, a visual artist. “All this NFT thing wasn’t something that I saw coming”, he said, at all. During the auction, the artist in his living room close to the village of Charleston, South Carolina, was surrounded by relatives and vision crew. Another bidder and crypto-monetary contractor, Justin Sun, lost his previously set limit in the final second.

According to NonFungible.com, a website monitoring the business, the NFT market already began with transactions quadrupling to $250 million last year. The Beeple sale turbocharged its growth and helped transform NFTs to a new type of digital asset, mainly from the world of art, music industries, sports, and speculators. The NFTs were mainly used for cryptocurrency nerds.

Not to be overdone, competitor Sotheby’s Auction House schedules his own NFT sales, which will collaborate on sale next month with the pseudonymous digital artist Pak. As he checked waters with an initial decline of his work, Winkelmann started to see visual artists’ NFTs options back in October. People can own and buy my work, and, you know, pay great money, he said this week in an interview.

Once again, at the end of the last year, he hit Sundaresan, who uses the pseudonym Metakovan. The art world for Sundaresan and Venkateswaran was not a regular point of conversation when they first met at The Hindu in Chennai, India, in 2013. Sundaresan was a technology analyst with a ranking of twenty; Venkateswaran was a reporter. Both had humble education. When he learned to code, Sundaresan could not afford a laptop, so he walked around with a hard drive and bought laptops from his colleagues, Venkateswaran said. But by 2020 he had been a wealthy person in several blockchain businesses and acquisitions, now residing in Singapore. They started to investigate NFTs with a new Fund called Metapurse, with the money Sundaresan had saved and the analytical eye of Venkateswaran.

As a nod to his love for the virtual world, called the metaverse, Sundaresan, created the persona Metakovan. In the Tamil language, the title means “King of Meta.” “Twobadour” calls himself Venkateswaran, who lives with his wife and two children in Chennai. The couple unveiled their real identity in a blog post last week and tried to dispel some of the ambiguity about their motivation.

The goal was to demonstrate to Indians and other people of colour that they could be patrons themselves, that crypto was the equal force between Westerners and Rests, and, according to them, the global South was growing.

In December, the pair of Metapurse made their first major investment in Beeple, purchasing twenty of his works for $2.2 million and gifting the artist with two per cent of their new fund of NFT tokens, dubbed B20s. These B20s were designed to take ownership of an art piece accessible to more and more people.

The Everydays: The First Five Thousand Days, a multimedia file combining the works Beeple produced from May 2007 to the start of the current year, was the predecessor for March’s historic selling of Beeple’s Daily. Some are cartoonish while others are grotesque about what had happened in US politics or pop culture. The works accompany the creation of Beeple from an ordinary artist to a renowned personality on the internet with big Instagram following along with digital and multimedia projects by pop stars such as Justin Bieber and Nicki Minaj.

Venkateswaran said that, if you see any image at its face value, they certainly would not all withstand the test of time. Not all five thousand are masterpieces. It’s never been the argument. Not all Beeple does is gold. Gold is not all that Beeple does. At his feet, we don’t adorate. This is all more about the combined story and what he stands for and what he represents.

According to Leila Amineddoleh, New York art lawyer, this sale has shaken the arts and finance worlds but in some ways was very conservative. Many people involved in the art markets think, ‘I own something special; I own it. It’s rare and I own it, look at me.’ She said that’s not so strange. An NFT’s entire value can be said to be based upon its originality. When you buy the commodity, you buy the right to tell “I own the artwork.”

Amineddoleh said the NFTs and other blockchain based cryptocurrency markets and infrastructure also offer open records of art transactions. Yet sales invited further criticism for the detractors from the mostly uncontrolled crypto-monetary environment.

Christie refused to elaborate on the nature of the financial arrangement of the transaction except claiming that the entire sum was charged in cryptocurrencies, known as Ether Define. This was the first time she accepted payments in cryptos.

According to the study co-authored by Friedhelm Victor from the Technical University of Berlin, crypto-currency exchanges can be subject to manipulation. But that normally means buyers and sellers who regularly purchase and sell the same properties build a misleading feeling of increased trading activity.

This kind of back-and-forth trade is also uncommon with NFTs, partly because they usually have higher fees, Victor said. About the Beeple auction, he said, “crazy speculation is not rare. This is a very intelligent approach to pay attention to the whole region.”