Top 10 Best Equity Funds for SIP

Top 10 Equity Funds for SIP

One of the two methods to make investments in mutual funds is an SIP or systematic investment plan. Making a one-time payment is another way to make an investment in mutual funds. Using a systematic investment plan (SIP) to make investments in mutual funds allows you to spread out your Assets and invest a small amount on a monthly basis.

Let’s look at mutual funds first before moving on to SIPs. A mutual fund is created when a pooling firm (fund house or asset management firm) pools money from several retailers and institutional investors with similar investment aims to buy securities. Equity funds, debt funds, and balanced/hybrid funds are the three types of mutual funds depending on their Equity Exposure.

For first-time mutual fund investors, investing in mutual funds through a systematic investment plan (SIP) is suggested since it helps them build a feeling of financial discipline over time. ACCORDING TO YOUR PREFERENCES, your SIP can be done weekly, monthly, or quarterly. Most millennials favor SIPs because they provide them with a lot of freedom. SIPs force you to set away a defined amount on a regular basis, which is important for making investing a habit.

Top 10 Equity Mutual Funds for SIP

Quant Small Cap Fund – Direct Plan-Growth

Quant Small Cap Fund: Direct Plan is an open-ended small-cap equities strategy from Quant Mutual Fund House.

The fund began operations on January 1, 2013.

Quant Mutual Fund’s Quant Small Cap Fund Direct Plan-Growth is an equity Mutual fund strategy. Sanjeev Sharma and Ankit A Pande are the fund managers for this plan, which started on January 1, 2013. It has an AUM of 1,664.22 crores and a current NAV of 144.784 by April 21, 2022, at 12:51 pm.

Quant Small Cap Fund Direct Plan-Growth strategy returned 56.62 percent in the last year, 181.14% in the last three years, and 324.46 percent since its inception. The minimum SIP amount for this program is $1,000.

Small Cap Fund: The fund invests in Indian equities 96.6 percent of the time, with 12.64 percent in large-size stocks, 7.73 percent in mid-cap stocks, and 68.09 percent in small-cap stocks.

Suitable For: Investors looking for large profits over a long period (at least 3-4 years). Simultaneously, these investors should be aware of the chances of big investment losses.

Tax Treatment: Long-term capital gain tax will apply if the property is sold after one year after the acquisition date. If your total long-term capital gain surpasses 1 lakh, the current tax Rate is 10%. Any applicable taxes or surcharges are not included. | Short-term capital gain tax will apply if the property is sold under one year of the acquisition date. The current tax Rate is 15%. The 15% does not include surcharges. Gains from units redeemed after one year of investment are tax-free in a financial year up to Rs. 1 lakh.

Dividend income from this fund will be added to an investor’s income and taxed according to their or her tax slabs for Dividend Distribution Tax.

Furthermore, for dividend income exceeding Rs 5,000 in a financial year, the fund house is obligated to deduct a 10% TDS.

Information about performance quality:

Constantly produced results

Increased rewards for each Extra Unit of risk data

Downside Protection info:

Losses that are well-controlled during market corrections

Returns that are consistent and don’t fluctuate a lot

Investment aim and Benchmark

The fund’s investment aim is to “create capital appreciation through investments in a well-diversified portfolio of small size companies.”

The NIFTY Smallcap 250 Total Return Index is used for a benchmark.

Portfolio Composition & Asset Allocation

The fund’s asset allocation is around 96.63 percent stocks, 0.0 percent bonds, and 3.37 percent Cash and Cash equivalents.

The top 10 Equity Holdings Account for roughly 38.79 percent of Assets, while the top three sectors Account for around 37.76 percent.

The fund invests across market capitalizations, with 12.91 percent in big-cap companies, 29.54 percent in mid-cap, and 56.49 percent in small-cap companies.

Aditya Birla Sun Life Digital India Fund Growth

Aditya Birla Sun Life Digital India Fund is a Birla Sun Life Mutual Fund House open-ended Sectoral-Technology Equity Strategy.

On January 15, 2000, the fund was established.

Aditya Birla Sun Life Digital India Fund Direct-Growth is an Aditya Birla Sun Life Mutual Fund Equity mutual fund program. The fund manager for this program is Kunal Sangoi, and it was started on an Invalid date. It has a market capitalization of INR 3,398.30 crores, and the most recent NAV declared is INR136.920 by 1:04 pm on April 21, 2022.

The return on Aditya Birla Sun Life Digital India Fund Direct-Growth plan has been 30.79 percent in the last year, 145.55 percent in the last three years, and 653.97 percent from its inception. The minimum SIP investment for this plan is INR 100.

Sectoral/thematic: The fund invests 89.65% of its Assets in Indian equities, with 59.13 percent in big caps, 10.59 percent in mid-caps, and 12.54 percent in small caps.

Suitable For: Investors with good knowledge of macro trends who wish to place selected bets for better returns than other Equity funds. At the same time, even when the broader market is performing better,these investors should be ready for moderate to large losses in their investments.

Tax Treatment: Long-term capital gain tax will apply if sold after one year from the acquisition date. If your total long-term capital gain surpasses 1 lakh, the current tax Rate is 10%. Any applicable taxes or surcharges are not included. | Short-term capital gain tax will apply if the property is sold under one year of the acquisition date. The current tax Rate is 15%. The 15% does not include surcharges. Profits of up to Rs. 1 lakh accruing from those units in a financial year are free from taxation for units redeemed after one year of investment.

Dividend income from this fund will be added to an investor’s income and taxed according to their or her tax slabs for Dividend Distribution Tax.

Furthermore, for dividend income exceeding Rs 5,000 in a financial year, the fund house is obligated to deduct a 10% TDS.

Investment objective & Benchmark

The fund’s investing aim is to make money. “With an emphasis on technology and technology-dependent companies, the Fund pursues Capital growth with a second aim of income production. The strategy would use a bottom-up approach to stock selection, with a mix of value and growth investment styles.”

The S&P BSE Teck Total Return Index is used for a benchmark.

Portfolio Composition & Asset Allocation

The fund’s asset allocation is around 94.04 percent stocks, 6.37 percent debts, and -0.42 percent Cash and Cash Equivalents.

The top 10 equity holdings Account for roughly 70.78 percent of the Assets, while the top three sectors Account for around 91.26 percent.

The fund invests in a variety of market capitalizations, with roughly 75.88 percent in big-cap companies, 16.83 percent in mid-size companies, and 7.28 percent in small-cap companies.

Tata Digital India Fund Regular Growth

Tata Digital India Fund – Regular Plan is a Tata Mutual Fund House open-ended sectoral-technology equity Strategy.

On December 28, 2015, the fund was established.

The Scheme’s investment aim is to achieve long-term capital appreciation by investing at least 80% of its net Assets in equity/equity-related instruments of companies in India’s Information Technology (IT) sector, like Software, ITeS, and Hardware.

Indian IT companies are steadily increasing their market share in the USD 900 billion-plus IT services business. In the sourcing area, India has retained its dominance.

Overall, the industry’s revenues in FY’15 (exports + domestic) were roughly USD 146 billion, up around 13% from the last year. The industry’s contribution to India’s GDP is expected to be over 9.5 percent, with a percentage of total services exports of more than 38 percent. Exports were around USD 98 billion, up 12.3%, while domestic IT-Business Process Management (BPM) is increasing faster than exports at USD 48 billion. The industry at present employs more than 3.5 mn people & is India’s largest private-sector employer.

Sectoral/thematic: The fund is invested in Indian equities to the tune of 88.19 percent, with 54.73 percent in big-cap stocks, 16.56 percent in mid-cap stocks, and 15.82 percent in small-cap stocks.

Suitable for: Investors with good knowledge of macro trends who wish to place selected bets for better returns than other Equity funds. At the same time, even when the broader market is performing better, these investors should be ready for moderate to large losses in their investments.

Tax Treatment: Gains are taxed at a Rate of 15% if units are redeemed under one year of acquisition (Short-term Capital Gains Tax – STCG).

Profits from units redeemed after one year of investment are tax-free in that financial year up to Rs. 1 lakh.

Gains of more than Rs. 1 lakh would be subject to a 10% tax Rate (Long-Term Capital Gain Tax – LTCG).

Dividend income from this fund will be added to an investor’s income and taxed according to his or her tax slabs for Dividend Distribution Tax.

Furthermore, for dividend income exceeding Rs 5,000 in a financial year, the fund house is obligated to deduct a 10% TDS.

Investment objective & Benchmark

The fund’s investment aim is to “seek long-term capital appreciation by investing at least 80% of its net Assets in equity/equity-related instruments of companies in India’s Information Technology Sector.”

The NIFTY IT Total Return Index is used for a benchmark.

Portfolio Composition & Asset Allocation

The fund’s asset allocation is around 94.28 percent stocks, 0.0 percent bonds, and 5.74 percent Cash and Cash Equivalents.

The top 10 equity holdings Account for roughly 69.32 percent of Assets, while the top three sectors Account for around 91.05 percent.

The fund invests in a variety of market capitalizations, with roughly 79.8% in big-cap companies, 15.96 percent in mid-cap, and 4.25 percent in small-cap companies.

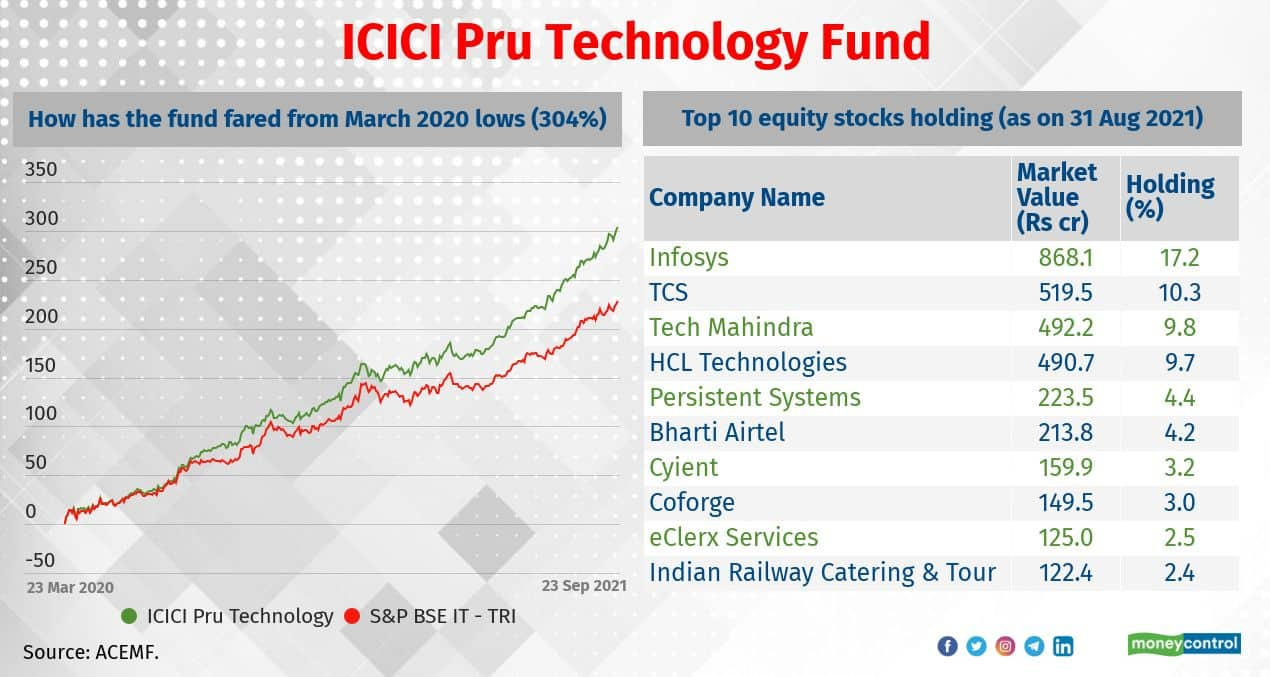

ICICI Prudential Technology Fund – Direct Plan-Growth

ICICI Prudential Technology Direct Plan-Growth is an ICICI Prudential Mutual Fund Equity Mutual fund program. This program was started on January 1, 2013, and it is now handled by Vaibhav Dusad, the fund manager. It has an AUM of INR 8,742.31 crores and a current NAV of 158.020 by 1:27 pm on April 21, 2022.

Since its introduction, the ICICI Prudential Technology Direct Plan-Growth plan has returned 35.78 percent in the last year, 155.65 percent in the last three years, and 711.61 percent since its launch. The minimum SIP investment for this plan is INR 100.

ICICI Prudential Technology Fund – Direct Plan is an ICICI Prudential Mutual Fund House open-ended Sectoral-technology equity Strategy.

The fund began operations on January 1, 2013.

Sectoral/thematic: The fund is invested in Indian equities to the tune of 87.99 percent, with 72.69 percent in big-cap stocks, 6.04 percent in mid-cap stocks, and 6.9 percent in small-cap stocks. Debt makes up 0.11 percent of the fund’s holdings, with 0.11 percent of it in government securities.

Suitable For: Investors with good knowledge of macro trends who wish to place selected bets for better returns than other Equity funds. At the same time, even when the broader market is performing better, these investors should be ready for moderate to large losses in their investments.

Investment aim and Benchmark

The fund’s investment main aim is to “The plan will invest in equity and equity-related securities of technology and technology-dependent enterprises with the main aim of long-term capital appreciation. The plan will invest a major portion of its AUM inequities that are part of the Benchmark Index, but it may invest in other companies that are part of the Information Technology Services Industry.”

The S&P BSE Teck Total Return Index is used for a benchmark.

Portfolio Composition & Asset Allocation

The fund’s asset allocation is around 92.72 percent stocks, 0.11 percent bonds, and 7.17 percent Cash and Cash Equivalents.

The top 10 equity holdings Account for roughly 78.49 percent of Assets, while the top three Sectors Account for around 92.67 percent.

The fund invests in a wide spectrum of market capitalizations, with a target of around 87.79 percent in big-cap companies, 8.07 percent in mid-size companies, and 4.14 percent in small-cap companies.

Implications for Taxation

If units are redeemed under one year of purchase, gains are taxed at a Rate of 15% (Short-term Capital Gains Tax – STCG).

Gains from units redeemed after one year of investment are tax-free in a financial year up to Rs. 1 lakh.

Gains of more than Rs. 1 lakh would be subject to a 10% tax Rate (Long-Term Capital Gain Tax – LTCG).

Dividend income from this fund will be added to an investor’s income and taxed according to his or her tax slabs for Dividend Distribution Tax.

In addition, the fund house must deduct a TDS of 10% on dividend income exceeds of Rs 5,000 in a financial year.

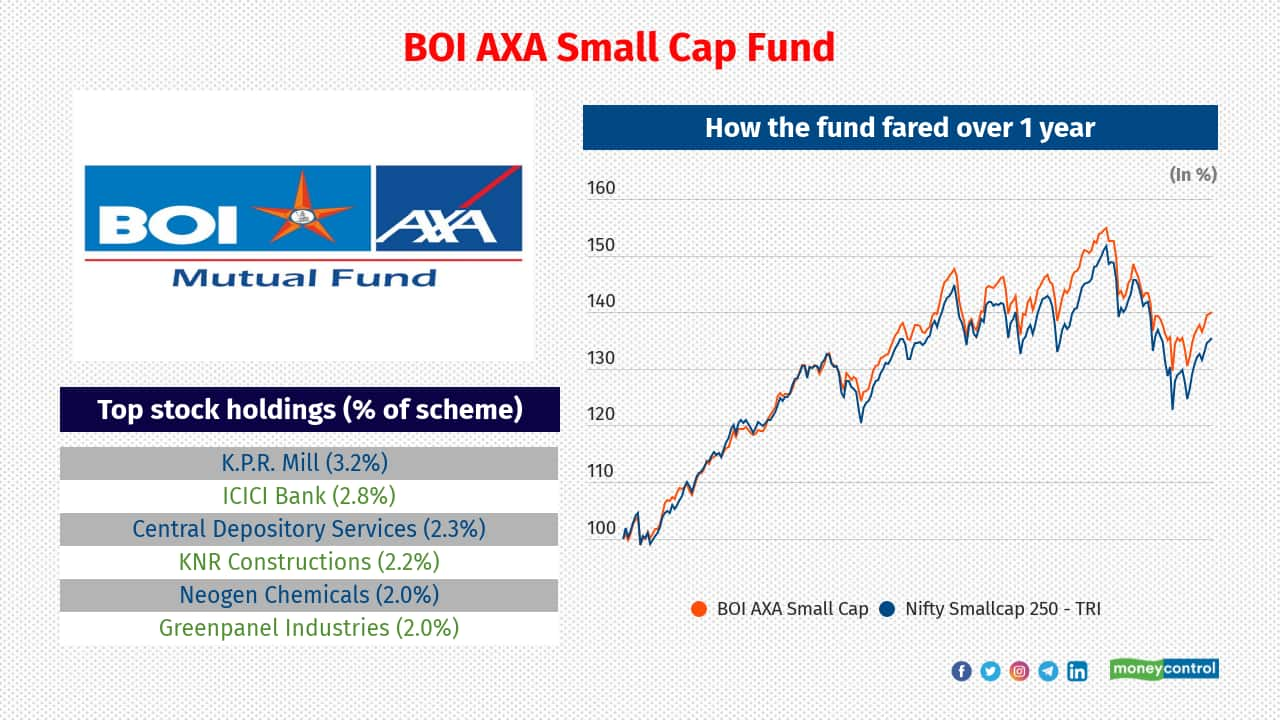

BOI AXA SMALL CAP FUND Direct Plan-Growth

BOI AXA Small Cap Fund Direct-Growth is a BOI AXA Mutual Fund equity Mutual fund program. This Scheme was started on an Invalid date and is now handled by Aakash Manghani, the fund manager. It has a market capitalization of INR 283.50 crores, and the most recent NAV declared is 27.500 by 1:36 pm on April 21, 2022.

BOI AXA Small Cap Fund Direct-Growth plan returned 41.90 percent in the last year, 157.97 percent in the last three years, and 174.73 percent since its inception. The minimum SIP investment for this plan is INR 100.

BOI AXA Small Cap Fund – Direct Plan is a BOI AXA Mutual Fund House Open-ended Small Cap Equity plan.

The fund became live on December 19, 2018.

Small Cap Fund: The fund invests in Indian equities at a Rate of 94.26 percent, with 5.63 percent in big size stocks, 2.84 percent in Mid Cap companies, and 63.48 percent in small cap stocks. The fund contains a 0.05 percent debt investment, with 0.05 percent of it in government securities.

Suitable For: Investors looking for large profits over a long period of time (at least 3-4 years). Simultaneously, these investors should be aware of the chances of major investment losses.

Investment aim and Benchmark

The fund’s investment main aim is to “create long-term capital appreciation by investing largely in equity and equity-related securities of Small-Cap companies.”

The NIFTY Smallcap 250 Total Return Index is used for a benchmark.

Portfolio Composition & Asset Allocation

The fund’s asset allocation is around 94.26 percent stocks, 0.05 percent bonds, and 5.69 percent Cash and Cash Equivalents.

The top 10 equity holdings Account for around 22.03 percent of total Assets, while the top three sectors Account for approximately 35.05 percent.

The fund invests in a variety of market capitalizations, with roughly 7.63 percent in big-cap companies, 54.16 percent in mid-size companies, and 38.21 percent in small-cap companies.

Implications for Taxation

If units are redeemed under one year of purchase, gains are taxed at a Rate of 15% (Short-term Capital Gains Tax – STCG).

Gains from units redeemed after one year of investment are tax-free in a financial year up to Rs. 1 lakh.

Gains of more than Rs. 1 lakh would be subject to a 10% tax Rate (Long-term Capital Gain Tax – LTCG).

Dividend income from this fund will be added to an investor’s income and taxed according to his or her tax slabs for Dividend Distribution Tax.

In addition, the fund house must deduct a TDS of 10% on dividend income in exceeds Rs 5,000 in a financial year.

Quant Infrastructure Fund – Direct Plan-Growth

Quant Infrastructure Fund Direct-Growth (QIF Direct-Growth) is a Quant Mutual Fund equity Mtual fund strategy. The fund manager for this program is Ankit A Pande, and it was started on an Invalid date. It has an AUM of 520.53 crores, and the most recent NAV declared is 23.285 by 1:47 pm on April 21, 2022.

Quant Infrastructure Fund’s Direct-Growth strategy returned 57.00 percent in the last year, 159.18 percent in the last three years, and 341.51 percent since its inception. The minimum SIP amount for this program is INR 1,000.

Quant Infrastructure Fund – Direct Plan is a Quant Mutual Fund House open-ended Sectoral-infrastructure equity Strategy.

The fund began operations on January 1, 2013.

Sectoral/thematic: The fund invests 93.45% of its Assets in Indian equities, with 44.06 percent in big caps, 15.72 percent in mid-caps, and 32.31 percent in small caps.

Suitable For: Investors with good knowledge of macro trends who wish to place selected bets for better returns than other Equity funds. At the same time, even when the broader market is performing better these investors should be ready for moderate to large losses in their investments.

Investment aim and Benchmark

The fund’s investment main aim is to “invest largely in equities and equity-related derivatives of infrastructure businesses.”

The NIFTY Infrastructure Total Return Index is used for a benchmark.

Portfolio Composition & Asset Allocation

The fund’s asset allocation is around 93.44 percent stocks, 0.0 percent loans, and 6.56 percent Cash and Cash Equivalents.

The top 10 equity Holdings Account for roughly 49.34 percent of Assets, while the top three Sectors Account for around 54.59 percent.

The fund invests across market capitalizations, with 58.27 percent in big-cap companies, 26.99 percent in mid-size, and 14.74 percent in small-cap companies.

Implications for Taxation

If units are redeemed under one year of purchase, gains are taxed at a Rate of 15% (Short-term Capital Gains Tax – STCG).

Gains from units redeemed after one year of investment are tax-free in a financial year up to Rs. 1 lakh.

Gains of more than Rs. 1 lakh would be subject to a 10% tax Rate (Long-term Capital Gain Tax – LTCG).

Dividend income from this fund will be added to an investor’s income and taxed according to his or her tax slabs for Dividend Distribution Tax.

In addition, the fund house must deduct a TDS of 10% on dividend income exceeds Rs 5,000 in a financial year.

Quant Infrastructure Fund Growth

Quant Infrastructure Fund is a Quant Mutual Fund House open-ended Sectoral-infrastructure equity plan.

The fund began operations on August 31, 2007.

Sectoral/thematic: The fund invests 93.45% of its Assets in Indian equities, with 44.06 percent in big caps, 15.72 percent in mid-caps, and 32.31 percent in small caps.

The Infrastructure index has outperformed the benchmark index over time. However, there are very few funds in this area, and they have lagged behind the benchmark index.

This group has a higher level of volatility. Investing in these funds will need a thorough understanding of the several investing sectors that these funds specialize in.

In addition, the investor must have the skills, desire, and knowledge to actively watch the possibilities. Investing in diverse funds rather than this category is continuously a better option for investors.

Suitable for: Investors with good knowledge of macro trends who wish to place selected bets for better returns than other Equity funds. At the same time, even when the broader market is performing better, these investors should be ready for moderate to large losses in their investments.

Investment aim and Benchmark

The Scheme’s main investment aim is to achieve capital appreciation while providing long-term growth prospects by investing in a portfolio of Infrastructure-focused companiess. There is no guarantee that the Scheme’s investment aim will be met.

The fund’s investment main aim is to “invest largely in equities and equity-related derivatives of infrastructure businesses.”

The NIFTY Infrastructure Total Return Index is used for a benchmark.

Allocation of Assets and Portfolio Composition

The fund’s asset allocation is around 93.44 percent stocks, 0.0 percent debts, and 6.56 percent Cash and Cash Equivalents.

The top 10 equity Holdings Account for roughly 49.34 percent of total Assets, while the top three sectors Account for around 54.59 percent.

The fund invests across market capitalizations, with roughly 58.27 percent in big-cap companies, 26.99 percent in mid-cap, and 14.74 percent in small-cap companies.

Implications for Taxation

If units are redeemed under one year of purchase, gains are taxed at a Rate of 15% (Short-term Capital Gains Tax – STCG).

Gains from units redeemed after one year of investment are tax-free in a financial year up to Rs. 1 lakh.

Gains of more than Rs. 1 lakh would be subject to a 10% tax Rate (Long-term Capital Gain Tax – LTCG).

Dividend income from this fund will be added to an investor’s income and taxed according to his or her tax slabs for Dividend Distribution Tax.

In addition, the fund house must deduct a TDS of 10% on dividend income over Rs 5,000 in a financial year.

Motilal Oswal NASDAQ 100 ETF

This is a fund that primarily invests in foreign company shares. You can expect profits that outperform inflation and returns from fixed income alternatives if you make the investments for five years or more. Be prepared, though, for fluctuations in the value of your investment in the future.

International stock funds are an excellent place to put a percentage of your money for diversification since they will protect a percentage of your money if the Indian markets experience a major fall. However, make sure you make the investment in a fund with a broad mandate that allows you to make an investment in companies of all sizes, industries, and countries.

You must invest all your capital through a systematic investment plan (SIP) with other equity funds.

Taxability of earnings:

Capital gains

If mutual fund units are sold three years after the acquisition, earnings are taxed at a Rate of 20% after inflation indexation.

If mutual fund units are sold under three years after the acquisition, the whole gain is applied to the investor’s income and taxed at the applicable slab Rate.

Until you keep the units, you won’t have to pay Taxes.

Dividends

Dividends are added to an investor’s income and taxed accordingly. Furthermore, if an investor’s dividend income in a Calendar Year exceeds Rs. 5,000, the fund house deducts a 10% TDS before delivering the payout.

PGIM India Midcap Opportunities Fund Regular Growth

PGIM India Midcap Opportunities Fund – Regular Plan is a PGIM India Mutual Fund House Open-ended Mid Cap Equity Strategy.

On December 2, 2013, the fund was launched.

Mid-cap funds provide long-term performance that outperforms inflation and are appropriate for investment main aims with a time horizon of 10-15 years or longer (minimum of five years).

If you make the investments for seven years or longer, you may expect gains that easily beat inflation and returns from fixed income options.

This is a medium-sized company investment fund. When stock prices fall, such funds tend to decline more than those that make an investment in larger businesses. So, although you probably expect larger long-term returns, you can expect more severe ups and downs along the way.

Mid Cap Fund: The fund invests in Indian companies to 98.67 percent, with 8.88 percent in big size stocks, 44.05 percent in Mid Cap stocks, and 29.52 percent in small cap stocks. The fund contains a 0.2 percent debt investment, with 0.2 percent in government securities.

Suitable For: Investors seeking a strong return on their money over at least 3-4 years. However, these investors should know that their investments may suffer moderate losses.

Investment main aim and Benchmark

The fund’s investment aim is: “The plan attempts to achieve long-term capital appreciation by investing primarily in stock and equity-related securities of Mid-Cap companies.”

The NIFTY Midcap 150 Total Return Index is used for a benchmark.

Portfolio Composition & Asset Allocation

The fund’s asset allocation is 98.67 percent stocks, 1.68 percent debts, and -0.35 percent Cash and Cash Equivalents.

The top ten Equity Holdings Account for roughly 34.16 percent of Assets, while the top three sectors Account for around 38.73 percent.

The fund invests in several market capitalizations, with roughly 11.49 percent in big-cap companies 75.11 percent in mid-cap, and 13.4 percent in small-cap companies.

Implications for Taxation

Gains are taxed at a Rate of 15% if units are redeemed under one year of acquisition (Short-term Capital Gains Tax – STCG).

Gains from units redeemed after one year of investment are tax-free in a financial year up to Rs. 1 lakh.

Gains of more than Rs. 1 lakh would be subject to a 10% tax Rate (Long-term Capital Gain Tax – LTCG).

Dividend income from this fund will be added to an investor’s income and taxed according to his or her tax slabs for Dividend Distribution Tax.

In addition, the fund house must deduct a TDS of 10% on dividend income over Rs 5,000 in a financial year.

Quant Small Cap Fund Growth

“If you make the investment for seven years or longer, you may expect profits that comfortably outperform inflation and fixed-income returns.”

This is a fund that makes investments in small businesses. When stock prices fall, such funds tend to decline more than those that make an investment in larger companies. So, although you probably expect larger long-term returns, you can expect more severe ups and downs along the way.

Quant Small Cap Fund is a Quant Mutual Fund House open-ended Small-Cap Equity Strategy.

On November 24, 1996, the fund was established.

Quant Small Cap Fund-Growth is a Quant Mutual Fund Small Cap mutual fund strategy. This fund has been around for 25 years and six months, established on September 23, 1996. Quant Modest Cap Fund-Growth is a small fund in its category, with Assets under management (AUM) of 1,664 crores by March 31, 2022. The product charges a 2.61% Expense Ratio, more than most other Small Cap funds.

Small Cap Fund: The fund invests in Indian equities 96.6 percent of the time, with 12.64 percent in large-size stocks, 7.73 percent in mid-cap stocks, and 68.09 percent in small-cap stocks.

Suitable For: Investors looking for for large profits over a long period (at least 3-4 years). Simultaneously, these investors should be aware of the chances of more important investment losses.

Investment main aim and Benchmark

The fund’s main aim is to “create capital appreciation through investments in a well-diversified portfolio of small companies.”

The NIFTY Smallcap 250 Total Return Index is used in form of a benchmark.

Allocation of Assets and Portfolio Composition

The fund’s asset allocation is around 96.63 percent stocks, 0.0 percent debts, and 3.37 percent Cash and Cash equivalents.

The top 10 stock holdings Account for around 38.79 percent of Total Assets, while the top three sectors Account for approximately 37.76 percent.

The fund invests across market capitalizations, with roughly 12.91 percent in big-cap companies, 29.54 percent in mid-cap, and 56.49 percent in small-cap companies.

Implications for Taxation

If units are redeemed under one year of purchase, gains are taxed at a Rate of 15% (Short-term Capital Gains Tax – STCG).

Gains from units redeemed after one year of investment are tax-free in a financial year up to Rs. 1 lakh.

Gains of more than Rs. 1 lakh would be subject to a 10% tax Rate (Long-term Capital Gain Tax – LTCG).

Dividend income from this fund will be added to an investor’s income and taxed according to his or her tax slabs for Dividend Distribution Tax.

In addition, on dividend income exceeding Rs 5,000 in a financial year, the fund house must withhold a TDS of 10%.

edited and proofread by nikita sharma