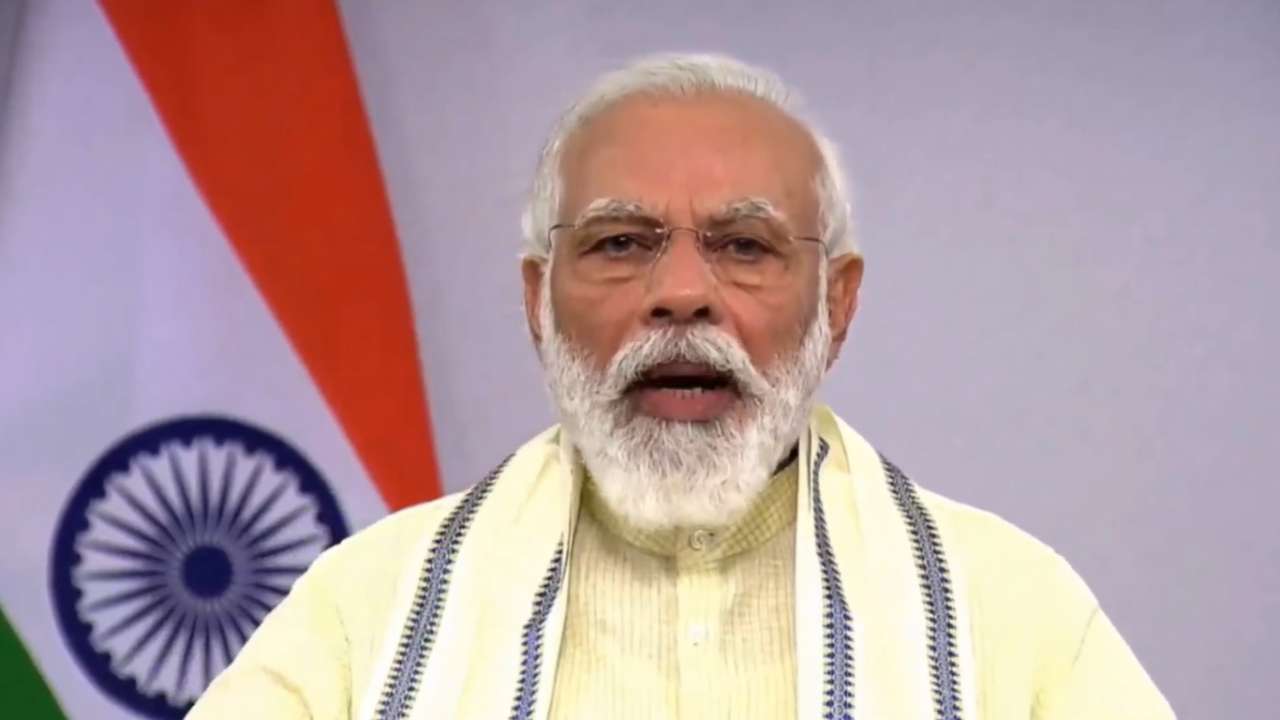

The Proposed tax changes towards PF by the Modi Government a result of Top 20 HNI’s having a staggering Rs. 825 crore in their PF accounts

The Proposed tax changes towards PF by the Modi Government a result of Top 20 HNI’s having a staggering Rs. 825 crore in their PF accounts

The Union Budget had the whole nation biting its nails with anxiety as it waited for what was to come and how it may impact their daily life.

While the budget was greeted with applause by India Inc, the individual tax player was left in a lurch even as the Modi government announced its decision to tax changes for those contributing over 2.5 lakh annually towards provident fund (PF).

Strong criticism on the above-proposed change led to strong criticism from all directions; however, the government has come out with staggering numbers supporting the decision to amend the PF rules.

According to the numbers released by the government, among the HNI’s, one individual has a balance of Rs 103 crore in his PF account and is the highest corpus, followed by another individual who has Rs 86 crore in his PF account. The other top three have 85.6 crores, 72.8 crores, and 47 crores, respectively.

Even as the PF is usually meant for workers, but because of the benefit of high – tax-free returns, it has hugely benefited the HNI’s.

The numbers released state that the 1.2 lakh subscribers, which is less than 0.3% of the 4.5 crore base – were contributing “huge sums.”

If we look at the numbers, the amounts are staggering; the total HNI account holders had an average corpus of nearly Rs. 5.9 crore.

The average earnings of these HNI’s are Rs. 50.3 lakh annually, albeit all tax-free under the present laws.

Of the overall, 4.5 crores who contribute to the Employees Provident Fund out of these High Networth Individuals contribute about Rs. 62,500 crore to the kitty of provident fund.

Hence the proposed change is to curb and directly affect the HNI’s contribution but will not affect an average subscriber of EPF or General PF for government employees.

Will it affect the interest from past contributions?

After the Union Budget announcement about the proposed tax change in PF, many asked and speculated how it would affect interest from past contributions in PF?

According to experts – any interest accruing from April 1, 2020, on past contributions above the threshold of Rs 2.5 lakh annually is also likely to be taxable.

However, it should be noted that in her budget speech, Finance Minister Nirmala Sitharaman had proposed to restrict tax exemption for the interest earned on the EPF contribution to various provident funds to an annual contribution of Rs 2.5 Lakh. The rationale she said was to rationalize tax exemption for income earned by high – income employees.

According to her, “this restriction shall be applicable only for the contribution made on or after April 1”.

However, contributors to the same are hoping that the finance ministry will clarify the above point as there is an element of “retrospective taxation.” They also hope for a clarification of the method of deducting such Tax.

Who will the proposed tax change in PF affect & what about ULIPs?

The proposed amendment is not likely to hit the middle-income group earning an income of up to Rs. 20.83 lakh this is assuming that the contribution to the PF is at 12 percent.

However, those whose income exceeds the above limit may be dragged into the tax net as their contribution would increase more than Rs. 2.5 lakh.

Another Tax-free haven for HNI’s is under the existing rules is the – gains from an insurance policy is Tax-free if the cover is ten times the annual premium.

The budget has also proposed to remove tax exemption to ULIPs with a premium of more than Rs. 2.5 lakh a year.

Such Ulips will now be treated as equity mutual funds, with any gains of more than 1 Lakh to be taken at 10%. However, this will not apply to existing ULIPs but only the new policies bought after the Union Budget was announced.

This is applicable from immediate effect, while earlier, any such changes would come into effect from the next financial year.

This would mean that the window has closed earlier if one looked to take advantage of the same.

It is also important to note that the Rs. 2.5 lakh ceiling is the total premium across all policies held by a policyholder.

What had happened in the past?

The fact is that this is not the first time that the government has proposed to tax PF money. The 2016 budget proposed that the interest accrued on 60% of the EPF be taxed. However, the proposal was rolled back after receiving massive criticism and an enormous outcry against the new proposal.

The reaction of the Insurance Sector

The insurance sector, which until now has been using this benefit to sell ULIPs, will now have a tough time. And understandably, the insurance sector did not take the decision and the proposed change kindly.

But at the same time, the Insurance sector and companies have also been extended and increase in FDI for the insurance sector from the existing 49% to 74%, which is a huge move and a positive one.

However, the change is likely to affect the competitive advantage of ULIPs over other modes of investments, and it would become harder for the insurance companies to sell on this one but highly selling USP.

Hence, while the government is set to tax the HNI’s who have enjoyed the advantage under the previous tax structure, others will be impacted by taking away the benefit of investing in ULIPs’.