The appealing saga involving Tata Sons Ltd finally resolves in the Supreme Court. Price quotation of an asset becomes valuable if it sells at the said price. After a protracted uncertainty on one of the ugliest boardroom battles in recent history, the Supreme Court finally put the curtains down on the ongoing Tata-Mistry Case. Recently, The Supreme Court set aside a tribunal’s order in 2019 reinstating Cyrus Mistry as the executive chairman.

Tata Sons Ltd has been the most prominent force in the share markets stocking, worth over $100 billion. Cyrus Mistry believed to be someone who burnt his house on fire by disregarding the Board of Directors of Tata Sons Ltd. The Supreme Court bench, including the judges AS Bopanna and V Ramasubramaniam, asserted that Cyrus Mistry could not accuse Ratan Tata of being a shadow director after making him Tata Sons Ltd. successor. Considerably, it turned out to be the wrong decision of a lifetime for Ratan Tata.

The court has turned the decision in favor of the Tatas, setting aside the National Company Law Appellate Tribunal’s order which reinstated Cyrus Mistry as the chairperson. The Tribunal held the appointment of his successor N Chandrasekaran as illegal. In the long-standing battle, it has upended both the parties before furnishing the final closure.

The Supreme Court’s actions got delayed due to the lack of shreds of evidence to rule out the case in anyone’s favor. The ruling has unfastened the lingering uncertainty, which has constantly haunted one of India’s colossal business groups over the last few years.

HOW DID THE BOARDROOM BATTLE BEGIN?

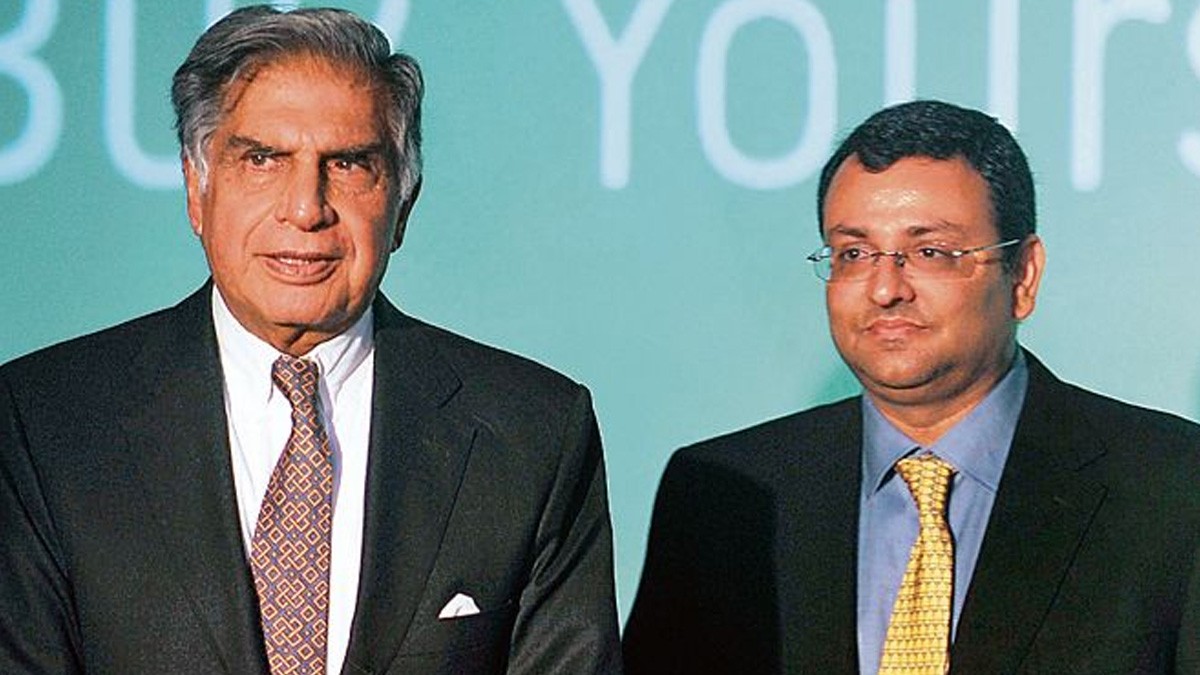

In December 2012, Cyrus Mistry, one of the most influential entrepreneurs at that time, got appointed as the executive chairman of Tata Sons Ltd. Over his regime, the $100 billion salt-to-software Tata Group mounted flabbergasting figures initially. As the years passed, issues over integrity and validation of the company’s efforts towards growth started concerning the shareholders; hence, Tata Sons Ltd encountered hefty losses. In October 2016, the extensively admired Tata Group got engulfed in many controversies.

At that moment, Cyrus Mistry got withdrawn from the chairman’s post by the majority of the board of directors. Later in February 2017, the woes worsened for Cyrus Mistry when he was removed from Tata Sons’ board by the shareholders in an EGM meeting. Mistery got infuriated and challenged this ouster at the Mumbai Bench of the National Company Law Tribunal. He alleged Tata Sons by claiming oppression and mismanagement within the company’s internal boardroom.

The challenge got rescinded by the NCLT by claiming the allegations as baseless. The judgment by the NCLT paved the way for many controversies among the Tata Group. While on one side of the spectrum, some board of directors felt that Cyrus Mistry got involuntarily withdrawn. The others observed that the company’s integrity declined harmlessly during his regime. The company, in consultation, tried to revolutionize the company’s thought process towards growth.

But the constant allegations on the integrity disrupted the company’s statutory authority in the global markets. Ratan Tata said that the false narratives hamper the progression of the company’s vision in the longer term. “It is not an issue of winning or losing. After relentless attacks on my integrity and the ethical conduct of the group, the judgment upholding Tata Sons is the validation of the values and ethics that have always been the guiding principles of the group. It reinforces the fairness and justice displayed by our judiciary,” Ratan Tata posted.

HOW DID TATA SONS LTD GROWTH HAMPER DURING THE BOARDROOM BATTLE

Tata Group is a privately-owned conglomerate of nearly 100 companies encompassing several primary business sectors. The emergence of the Tata Group has got recognized, and it has been the growth prospect for many sectors. In 2007, the company perceived a breakthrough when it completed the mammoth corporate takeover by an Indian company. The troublesome moments began when the company got involved in controversies late in 2016.

Tata Sons Ltd’s integrity got validated, and the shareholders started losing confidence in the company. It becomes one of the low moments in the company’s colossal business establishment since 1868. Tata Consultancy Services bore the brunt of the uncertainty over the outcome of the conflict between the Tata Group and its sizeable minority shareholder Shapoorji Pallonji Group. A section of the market got inflamed towards selling the company’s shares that the Tata Group might sell a portion of their stake in the Tata Consultancy Services. It hindered the company’s share prices immensely, which give its competitors a golden chance to surpass in the Indian markets.

WHAT WERE THE DIRECTIVES OF THE PREVIOUS ORDER BY THE NCLAT?

The National Company Law Appellate Tribunal in 2019 reinstated Cyrus Mistry as chairman of the Tata Group. The move contradicted the previous order’s directives and proved costly for the company and its shareholders. Mistry, while appealing to the NCLAT, claimed his removal to be a sign of double-minded politics. After assessing all the facts and figures of the case, the NCLAT ordered the removal illegal. Therefore, the shareholders felt subdued to his reinstatement in the framework.

It hurt the people’s sentiments associated with the colossal group and lost their interest in the company matters imminently. However, the company share prices didn’t hinder much because of the vast coverage it already has. Cyrus Mistry was one of the prolific entities and his resurgence as the CEO had some positive responses too. The shareholders believed that his appointment could help the stocks build up by the scruff of the neck. But only a small segment believed that, while the other side thought that his reintegration is hurting the integrity and showing that the company is not competent enough to handle the termination of prolific CEOs.

Why Mistry’s Oppression Case Failed In The Supreme Court

The Supreme Court has assertively dismissed every charge of oppression and mismanagement made by entities owned by Cyrus Mistry against Tata Sons Ltd. Moreover, the Supreme Court has managed to dismiss proceedings saying that there wasn’t a case to move ahead. Mistry got ordered with several charges to show oppression against the colossal running enterprise. The three particular charges that he had to comply with were:

Removal of Cyrus Mistry as executive chairman and director – Affirmative voting rights to Tata Trusts’ nominee director on Tata Sons – Corporate governance and other articles including Article 75. The condemnation proved to be costly for the Shapoorji Pallonji Group which is owned by Cyrus Mistry. Along with that, the shareholders thanked the former CEO for his services but also expressed their disappointment in a public statement earlier in March.

“Though the complainant companies padded up their actual grievance with various historical facts to make a deceptive appearance, the causa Proxima for the complaint was the removal of CPM (Cyrus Pallonji Mistry) from the office of executive chairman.” The Supreme Court said in a statement. Furthermore, it stated that the removal of a chairman or even a director from the company is not the required groundwork to determine oppression or prejudicial behavior. The staggering aspect is that Mistry kept on reverberating on the fact that Tata Sons Pvt. Ltd. has mishandled its integrity and recognition.

Cyrus Mistry’s Dismissal, what could it Mean for Tata’s conglomerate?

On Mistry’s Dismissal as executive chairman of Tata Sons, the apex court noted that it is a well-settled position that crucial failed business decisions or the removal of a person from directorship could not be claimed as acts oppressive to the minority shareholders. The court also asserted that it was nowhere an illegal proposition and it getting debarred as a legal case subsequently. Under Section 241, 242 of company law, a tribunal cannot question whether the removal was correct/ valid.

But a certain norm of the law suggests that the court has to see whether such removal would tantamount to the oppression of the minority shareholders. Cyrus Mistry’s removal was subject to the understanding that he was regularly posing problems in key financial decisions. The indecisiveness to take proper measures might have cost him the job. He was a trustworthy acquaintance of Ratan Tata, and there is a feeling among the board of directors that Mistry framed his downfall.

Although, the company oversaw heightening rewards during his tenure but was too staggered to let go of his viciousness in dealing with the corporate dealings. The company could look forward to new achievements and new heights and should know that the validation of the company is much higher than any shareholder.

” …the fact that the removal of CPM was only from the executive chairmanship and not the directorship of the company as on the date of filing of the petition and the fact that in law, even the removal from directorship can never be held to be oppressive or prejudicial conduct, was sufficient to throw the petition under section 241 out, especially since NCLAT chose not to interfere with the findings of fact on certain business decisions.” The Supreme Court claimed that it does not like to interfere on confidential company matters.

How did Article 75 and Affirmative Rights turn in favor of Tata Sons Pvt Ltd?

Article 121 of Tata Sons’ Articles of Association grants affirmative voting rights to the nominee directors of the Tata Trusts in certain matters. It further grants them the authorization rights of consulting it with the boardroom and it thus limits the appointment of directors beyond the Trusts. Referring to the clause, the supreme court pointed out that such rights are a global norm and at the moment they only confer limited rights to the nominee directors.

If we observe the trends of the previous shareholding, Tata Trusts with 66% could have packed the board, but it didn’t as it wanted to keep the chairman’s integrity confined within the company. Article 75 allows Tata Sons to resolve by special resolution the transfer of any shareholder’s shares. Mistry termed the norm as coercive. But it wasn’t to be, and he was just trying to buy the shareholders with his directives. The Supreme Court viewed Article 75 as an exit clause.

The Supreme further stated that a chairman or a shareholder who willingly subscribed to the Articles of Association, cannot later turn on the norms and challenge these articles. It is against the integral judicial laws of the company. If Article 75 got invoked, it would tantamount to requesting the court to rewrite a contract to which he became authenticated with eyes wide open.

Shifting Arguments did not do the world of good for the Former Chairman; Cyrus Mistry

Not only is SP Group strapped for cash, but it also has little wiggle room: It can only sell its stake back to Tata or an entity approved by it. Contrarily, Cyrus Mistry enacted rigorously and said that it was an act of oppression being imposed. It felt that the company should not have been stubborn in dealing with the situation. Alongside, the top court termed the demand for some rights as “quite funny.”

The Supreme Court detailed the shifting arguments of the Mistry Group through the five-year litigation on seeking crucial reliefs. The plea for reinstatement of Mistry was later amended to seek proportionate representation on the board purview. It seemed like that the group wanted to reinstigate some more stakes in the company. Previously, the Group wanted to sell the shares. It indeed sought the same affirmative rights for his SP group. It wasn’t validated by the apex court and the company was written out for any rights and grants.