Indian markets have perceived a striking contrast to the weakling economy today. They are approaching an all-time high while being surrounded by a volley of bad news. A thundering storm of job losses, unemployment, and unprecedented vaccine vacuum has demolished the positivity enraged by the economic recovery. The demand is eviscerated, and the GDP growth is hinging on yet another staggering low-levels. Moreover, the vaccination strategy adopted by the policymakers hasn’t worked out with barely a tenths of the adult population fully vaccinated. It reflects on the possibility of an inevitable third wave, which could induce lockdowns, restrain employment, accumulate low personal incomes and consumption.

Additionally, other factors would mount up the troublesome times of the Indian economy. The government is extending its borrowing capacity insatiably, throwing bond yields out of the shell. It has reinstated inflation to record highs, inflamed by soaring taxes on fuel, commodities, and food prices. All these factors should be enervating for the Indian stock markets. Yet they are rising clamorously; what could be the reason?

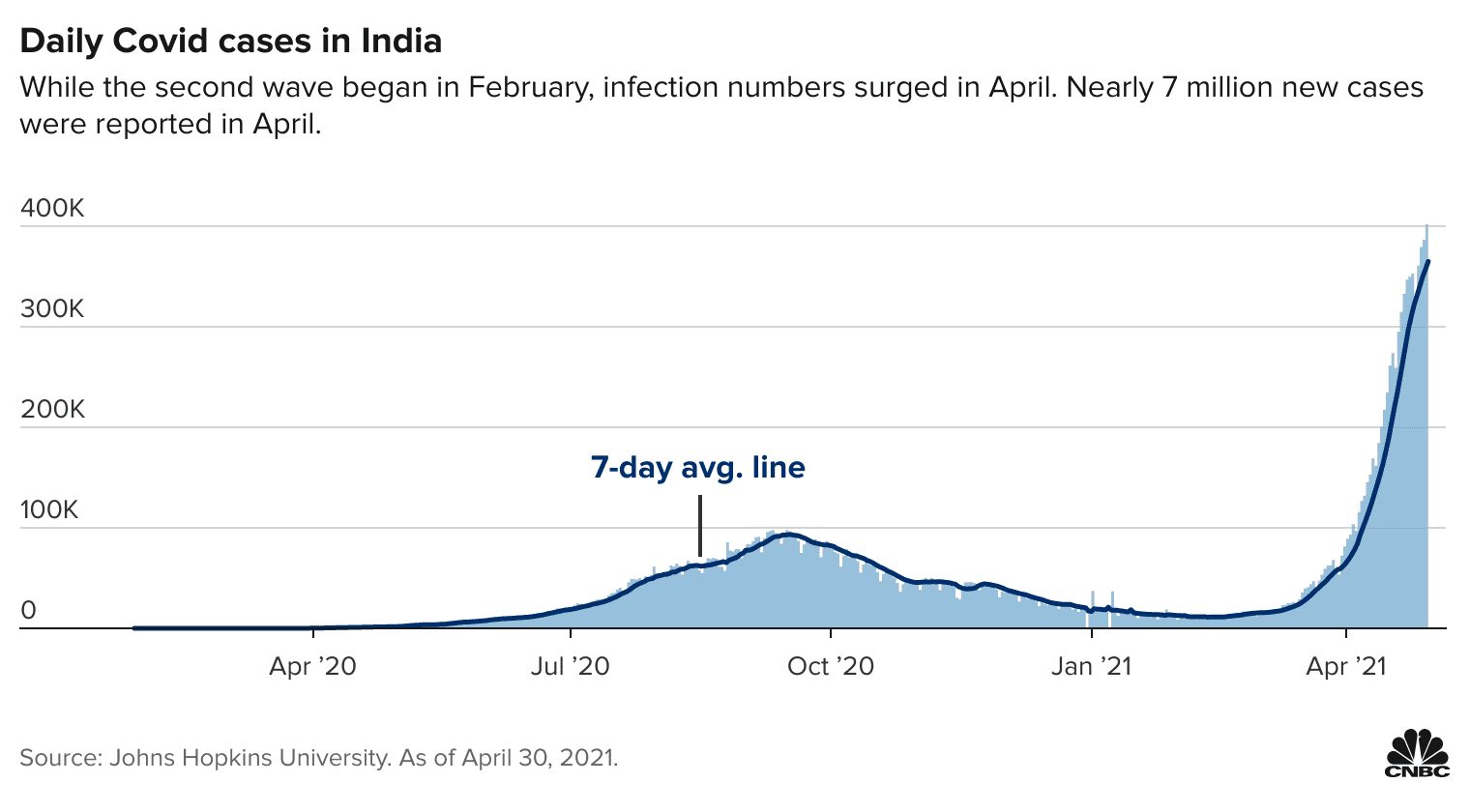

The lack of interoperability between the rallying stocks and the gloomy economic citings is augmented as a heated argument amidst the colossal threat of the Covid-19 pandemic. The appealing upswing in the stock markets has showcased how the people at the zenith of the economic pyramid are making millions, while others are deprived of attaining a substantial living. Last year, the situation was no different, as the Indian markets ballooned to surging heights despite the devastating toll of the pandemic enacting as a roadblock to economic fundamentals.

The economic instability in India didn’t reflect the storyline of the markets. According to reports, when the chips were down and the GDP contracted to its lowest level in April 2020, the markets revolved, heightening the slightest silver lining. The trends worldwide also followed a similar route. In March-June 2020, Americans were highly banished from their jobs, and a striking unemployment scale commenced. The period oversaw around 46 million people being furloughed, and the US GDP tanked to a negative 4.8 per cent, the first time since 2014. The equity markets should have progressed on a similar graph, right? Sadly, it didn’t! The US NASDAQ composite upheaved 40 per cent during March 17-June 18, shocking the world’s economies.

Why haven’t the stock markets envisioned the trends of the economic downturn?

In conscience, it’s astonishing to observe the heightening of stocks over time while the economic downturn has reeled the ordinary folks. The movements penetrating the domestic equity markets haven’t mirrored the economic pathway. As the stock avenues are futuristic, it is challenging to stick to the contentious route of predicting the economic downturn or recovery. What does it mean in simplistic terms? Analysts say that the stock markets frequently dashes when the financial stakes are pushing down and latches upon the grimmest signs of positive recovery. The current synopsis predominantly exemplifies the bullish trends followed in India, the US and Europe.

If you have the analytical knowledge on domestic equities, the vast majority of the population would incessantly know that the companies’ fundings perform ecstatically during March. When the Covid-ravaged lockdowns were rumoured to take place, the Indian markets crashed imminently, reaching 7500 points on March 23. The market experts mentioned no fundamental issues in the current stock listings, and recuperation could eventuate its peak in the later phases. It indicated a pinpointing fact that the stock markets aren’t reactive proactively to immediate news unless it is a flabbergasting event.

Explaining the Affluent Figures of the Indian Markets-

The sky-rocketing surge of the stock markets could pertain to several complexities, but the principal core is unknown. While contemplating the factors, we’ve trotted to the tidal creation of cheap money in the West as the paramount reason for the ballooning. America is leading the charge, and it has engrossed inflated asset prices across the world. The unrelenting foreign exchange reserves in India have buoyed the stock markets, taking the evaluation to a sublime $600 million. However, the rise has represented a catastrophic turn of events for the informal sector and the daily-wage workers.

We can’t fetch far off from India’s accelerated yet violent phenomenon whenever we discuss the economy. The government has integrated some unique strategies over the past five years, which has inflicted harrowing circumstances. In 2016, it began with Demonetization strictly promoted to reduce black money invasion in our corrupt system. Nevertheless, the series of events got exacerbated by the unleash of Goods and Services Tax in 2017, aimed at reforming the tax administration in India. Not only didn’t reform the diverse and regressive system, but it also added to the complexities of businesses. Putting a devastating end to the timeline was the Covid-induced Digital Revolution in 2020, which virtually snatched the interests of MSMEs and the informal workers.

Stock Markets: A Reflection of the Whole Economy, A Misconception!

A misconception swirling the industries is that the stock markets are a roundup of the whole economy. Asking the prominent question- what is the stock market? Isn’t it an accumulation of Big companies? Over the years, economists have reinstated that the whole economic formalization doesn’t reflect the market indices. So, what do they consist of? Ironically, the vivacious inflicted pain on the resistance of other factors is empowered by the rise in the stock markets. The large companies capture the coverage of equities, and the specifics are generally gigantic in size. The revenue growth of approximately 1000 listed companies is generated at the expense of the small players.

Economic correspondents like stagnation and recovery play a vital role in stock markets’ resilience. Its fluctuation in the present circumstances gets heavily interlinked with any optimism from the Covid pandemic. Whether it might resort to vaccine inoculation or declining cases, the indices are constantly triggering to shift to an exceptional growth path.

The Stock Gamers are the Economic Benefitters; While the Unorganized Sector Bears its Repercussions-

The national income’s expansion has been diversely draconic as the significant expansion lies in the hands of large companies. The turn of events was often drastic and alarming for the unorganized sector; however, it didn’t explicitly impact the offshores of the bulls and the gamers. Their comments might tell us that it is different now, but their high profitability in exchange for draining the poor’s resources will never change. Polarization exists in the stock markets, and the analysts compel great exposure in moving their game upward.

The outlook of shareholders and the punters have always centred excessive greed of higher profits. Illiquid shares of unlisted companies spike to striking growth of 20-30 per cent in a month, leaving the economists shocked. In India’s immemorial stock history, 2021 is set to rejuvenate as the highest IPO and fundraising year. Recently, Paytm a loss-financing revolutionary startup plans to scoop up more than $2 million following Zomato’s extravagancy earlier this month. The markets are yet again experiencing a buoyance period, and the greed is evoking better than sanity and judgement. The economy might sink to its endpoint if this turmoil continues longer.

On the other side of the spectrum, the inequalities are restraining their toll on the lower-class community, dealing a tough time with this economic loophole. The poor-inflicted people deprived of jobs, incomes, and food sustainability are growing extremely agitated. The government’s lack of efforts in fulfilling their desired promises has exacerbated their way out of the pandemic. The stock market affluent surge has ultimately confined the colossal manufacturers while afflicted the working population of the society. You might have reckoned it by now- three factors, creation of cheap money, large companies heightened growth, and the excessive greed; contributed to the Indian markets rise amidst the economy crippling at its lowest.