The soaring petrol prices and its tax tale

Petrol prices and why they are so high

As I sit to write this piece on petrol prices, all I can think of how Indian parents have been reacting to it all this while. With every one rupee hike that appears in the news, their concerns go up a notch, with every conversation unintentionally ending at how petrol prices have been increasing. As you read this, the petrol prices have reached a golden three digit price number at Re 100 per liter, fueling the inflation prospects of the country.

Petrol prices have always been a matter of concern for the economy since it affects the situation at both the micro and macro level.

Heavy petrol prices disrupt individual budgets, further restraining the constraints of households at a time when income and consumption prospects are at an all-time low. At the macro level, a hike in petrol prices indicates a higher cost of production and eventually, its transfer to consumers in the form of high commodity prices, driving up inflation of the country. The heavy retail and wholesale inflation being witnessed in the country somewhat have a causal relationship with the case mentioned. Another factor contributing to this hike in prices is the pent up global demand, but we’ve had a long discussion on that.

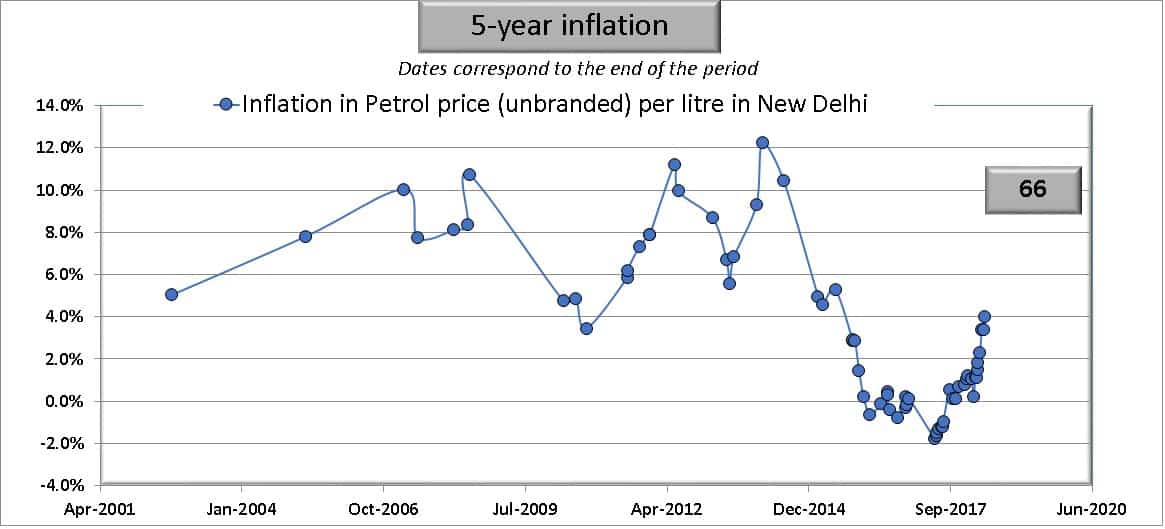

Let’s talk about the cause of these high inflation prices from the root, to understand the direction we’re headed in. A part of this rise in prices in fuel comes from the risen global fuel costs since India primarily depends on the import of these oil commodities. The petrol price hike, even in the past, however, has been a result of global prices and we definitely remember the 2009 and 2013 historic global petrol price hikes, no?

Still, nonetheless, the prices hadn’t touched the three digit number, and the Consumer Price Index, which is a measure of the price of a common basket of goods, didn’t get that far.

11 percent fuel inflation witnessed in the month of May, as opposed to 4 percent in March is, in fact, indicative of the above mentioned statement, driving up prices in the entire economy as well.

What this discussion is trying to imply is the fact that even though the hike in global prices results in a hike in domestic prices of fuels, a cut in global prices or their normalcy to the original one isn’t necessarily driven down to the public. This was seen as the BJP government, after taking the reigns from the UPA rule, imposed higher taxes on petrol prices such that the levels remained high. This brings us to our next conversation- taxes on fuels.

Of the 100 rupees that you pay per liter of petrol, more than 50 go in the pockets of the government, both central and the state. Union government levies taxes on fuels in the form of excise taxes, which currently stand at about 32-33 percent. The state further collects an additional about 20 percent value added tax, bringing a total to the amount that you’re paying.

Both the state and the central governments have been fairly reluctant to cut these taxes, despite the numbers reaching historic highs. Even the monetary body headed by the Reserve Bank urging the government to do so in an attempt to mitigate the inflationary pressure. And well, the reason for it is pretty obvious. Despite the movement restrictions in 2020, the excise tax revenues for the government increased by a surprising 62 percent year on year, most of it coming from the heavy taxes imposed on petrol prices.

To give a little context, in normal situations when mobility is at its normal pace, a one rupee hike in the prices of petrol in terms of taxes brings about rupees 13,000-14,000 crore in the government’s revenue box, a significant revenue creation source for the government. Therefore, at a time when the corporate tax revenues have been on a decline, the government has been corroborating its spending via the revenue generation from taxes on fuels.

As for the state government as well, the revenue generation from value added tax on fuel prices plays a significant role in filling the government’s exchequer, especially at a time when the fiscal federalism chain has been broken and the goods and service tax revenues for the states are still in union’s pending list.

However, one rather quirky thing to note here is that global fuel prices have been rising for quite some time now. Why then the domestic prices decline in the month of March and April, and were so consistently spiking in the month of May? Well, some politics washed its dirty hands behind the scenes. It is because as the country was battling the deadly second wave in March, we remember our supreme leader and union government being busy in winning state elections, and what better way to win people’s support than luring them in with some fuel price cuts and promises?

While it may not have worked for the government to win the elections, it still cost the country a great deal, for the sudden price hike, that too this disapprovingly frequent, was very harsh on the people’s budget and the economy. To statistically provide evidence to support the statement, note that petrol prices hiked 16 times in the month of May, to eventually get aligned to the global crude prices, which have been increasing for a few months now.

This fact makes it readily clear as to how the price hike was an attempt to make up for the push break imposed in the election months of March and April. Well well, Indian politics is just as disappointing as it can get. So, while the petroleum minister blames it all on the international prices, the citizens know more than what they choose to show us.

As for now, the government has been explicitly vocal about how this revenue generation would aid the government to ease its burden owing to the large fiscal demand that had been created during the pandemic. The currently running vaccination drive has also put fiscal pressure on the center and the state, and as mentioned, the government would have a hard time letting go of this source of revenue. In the light of the upcoming third wave, economists are suggesting a fiscal stimulus, which would even further drain down the fiscal balance of the government.

But if the situation remains, and inflation continues to grow at the rate it is at right now, the central bank would have to undertake policy actions to curb inflation, which would, in turn, be negatively impactful on the growth prospects of the recovering economy. If the central bank leaves the situation as it is and the government doesn’t cut taxes either, inflation would negatively impact consumption, which is already in a slump right now, and the economic recovery would be hindered.

Edited by Aishwarya Ingle