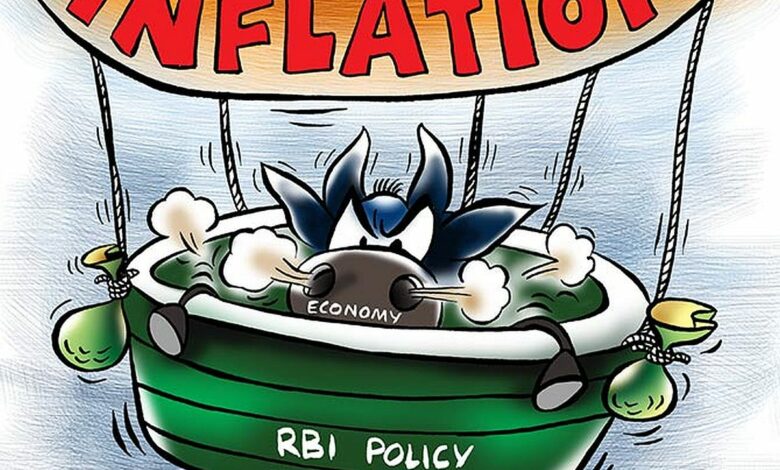

The Reserve Bank of India’s spree to prioritize growth over inflation- what it means for the country post covid-19?

The Reserve Bank of India has been the topic of conversation a lot of times lately since the country is stuck at a crossroad of trade-offs. The Reserve Bank recently released its monetary policy review which aims at evaluating the economic growth and inflation condition of the country, and if you’ve been paying even the slightest bit of attention, we are performing badly at both. Even though we discussed in detail what the monetary policy review included and what it gave out, it’s imperative that we understand what it means for the future of the country.

To understand where we are headed, allow me to paint you a picture of the position we are currently standing at. The economic growth of the country has been anaemic despite the Central Bank’s accommodative stance. Inflation, on the other hand, has broken the Reserve Bank’s affirmation of being transitory, with the price levels going beyond the target brackets by huge margins for a considerably long time now. If this continues, inflation will become a rather persistent phenomenon since it would come at the back of people altering their expectations and asking for higher wages, in turn increasing the overall price level.

However, the Central Bank must choose its priority between the two because both of them require completely opposite policy responses to tackle them. The Reserve Bank of India is required by law to keep the inflation levels of the country in check at 4 per cent, with a 2-percentage point margin below and above.

Economic growth, on the other hand, has no such limit but the bank holds on its shoulders the responsibility of ensuring consistent economic growth. For a long time now, the Central Bank has been prioritizing economic growth over inflation control. The difference this time, however, is from the fact that the Monetary Policy review committee did not have unanimity in their declared position of maintaining the accommodative stance.

This is unlike the usual cases where the Central Bank has maintained a united front. It is because the repercussions of the Reserve Bank of India continuing its stance to prioritize economic growth over inflation have started to be felt. Let’s understand what and why of these pitfalls that we could see going forward.

According to the Reserve Bank of India how does the “state of the economy” look like?

The “State of the Economy” report released by the Reserve Bank of India analyzed the situation of inflation in the country. According to the report, the Consumer Price Index inflation rate has stayed somewhat over 6 per cent over the past, with the retail inflation in food and beverages largely carrying the trail. This high inflation growth has been increasing over time, which means that the overall price hike has been much higher than what the percentages clearly give away.

This is seen in terms of the returns earned by the savings, called the real interest rate, which is just the difference between the nominal interest rate and the inflation rate. Over the past, it has been assessed that the real interest rates have been negative, implying that long term investments have been fetching negative returns for the people.

Not only that, but the impact is also largely felt by the section that doesn’t save or invest either- the poor. It is because a higher inflation rate robs them of their real income or purchasing power, further worsened due to the pandemic.

Most essential goods like vegetables, pulses and oils have also seen steady growth in the past, even though the retail inflation of food and beverages have decelerated a bit. This comes in effect from the high inflation rate observed in the past. The high price levels of this time, however, are being carried by the devastatingly high fuel prices and uneven supply to meet the stimulus-led global demand.

And this high inflation is not something that we contracted post the entry of the virus in the country, since India has already been dealing with high inflation since 2019. This term is relative with respect to comparable emerging markets and advanced economies, amongst whom India’s inflation stood out.

What is the Reserve Bank of India’s stance on this, then?

This is representative of the fact that the Reserve Bank of India has been consistently making a judgement call to prioritize economic growth over inflation, no matter what the surveys or analyses dictate. This trade-off between the inflation rate and economic growth is referred to as the sacrifice ratio.

The ratio measures the loss in output per each 1 per cent change in inflation, with regards to the direct relationship between the two. The latest estimates for the sacrifice ratio for the Indian economy represent that for every 1 per cent fall in the inflation rate, the economic growth of 1.5-2 percentage would have to be let go. This number is considerably large given the contraction the country suffered in the last fiscal year as well as the consistent cuts in the predictions of output growth for this year.

Reserve Bank of India has revealed that if the committee decides to attack the supply-shock induced inflation, as explained earlier, it will take away the chance from the already weak economy to stand back on its feet. Again, the Central Bank has made it effectively clear that the country’s economy cannot afford that. The Reserve Bank explains this approach of theirs as a “glide path of graduation that spreads the inherent output losses over a period.”

What does this stance mean for different market players?

Well, this policy action of the Reserve Bank placing inflation over growth has clear winners and losers.

Let us first talk about the losers.

As explained above, the investors and savers that have been trying to fill up their exhausted savings are fetching in negative real interest rates, meaning that they are ultimately losing money in the longer run.

This is a disincentive to save, which may be a good sign for the economy in the short run since the funds would be directed towards consumption, but over the long run, this would bring in economic trouble. Another loser is the ones with a higher marginal propensity to consume, specifically the poor since their real income i.e. purchasing power goes further down.

The winners are relatively fewer aka the borrowers, who are able to fetch funds at negative real interest rates at the moment. These loans are being made more for the purpose of paying off past debt, than for investment given the deleveraging spree currently being observed in the country. The fundamentals at the moment are not too healthy, no matter what some distorted indicators represent singularly.

What do dissenters suggest? What should have been the RBI’s move?

As pointed out before, unlike previous instances, the Reserve Bank’s accommodative stance was not unanimous. It is because some committee members felt like the position of the monetary policy should be changed from accommodative to neutral. It is because of the following reasons, as mentioned by Professor Jayanath R. Varma-

The duration of the pandemic has been estimated to last much longer than previously anticipated, which means that the support of monetary policy cannot be extended over such a wide origin. As a result, the bank would need to alter its stance and make room for neutrality towards economic growth in the coming period.

“Monetary policy has very broad effects on the entire economy, and this was appropriate in the early phase of the pandemic which caused generalized economic distress. More recently, however, the ill effects of the pandemic have been concentrated in narrow pockets of the economy. At the industry level, contact intensive services have suffered heavily, while many other industries are now operating above pre-Covid levels.

At the firm level, MSMEs have suffered severely, while large businesses have prospered. At the household level, the pandemic has been devastating for weaker sections of society, while the affluent have weathered it reasonably well. Geographically also, the pandemic has done its worst damage in around 100-200 districts spread across a relatively small number of states,” stated the monetary policy review committee member. This is in reference to the need for specific fiscal policy action to aid the worse impacted regions, while the economy as a whole continues to fare through the impact of the pandemic.

Lastly, the Reserve Bank has predicted the inflation to grow at about 5 per cent even in the first quarter of 2022-23, which means that the price hike is here for a longer-term. Alterations in people’s expectations of inflation could further aggravate this estimation, which means that it is almost imperative on the bank’s part to make right on its obligation to keep inflation in the designated bracket.

Edited by Sanjana Simlai.