We’ve walked on this path before and we’ve seen this destruction before as well. We may be standing on the same path yet again and the question is hanging right on our heads, which we may have been avoiding for quite some time now. Did you guess what we are referring to?

The asset-price bubble burst.

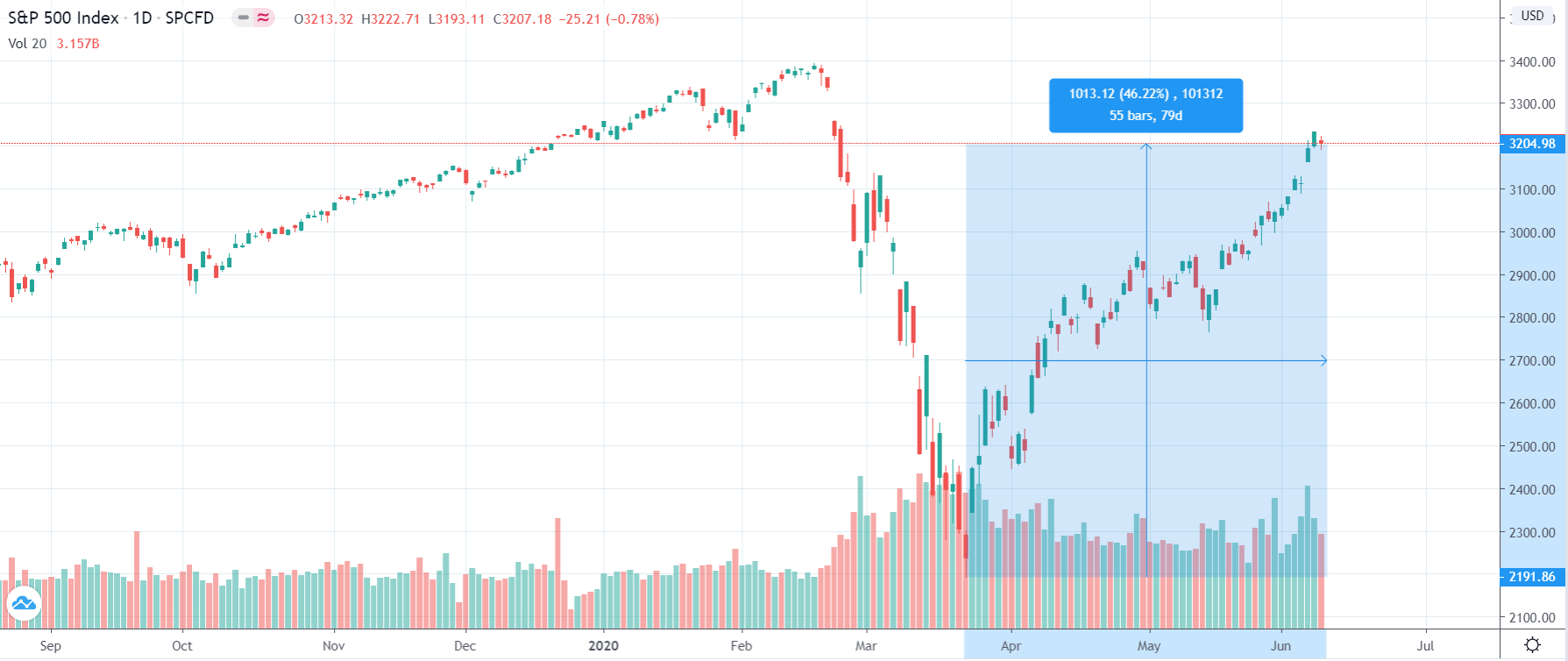

The stock markets are booming at a time when the economy is finding it hard to even crawl back up, economists are confused about the estimations of the future and asset prices are soaring high. Are we looking at an asset-price bubble likely to burst in the time to come and shatter the already tampered economy?

How likely is this destruction and when are we expecting it? We have a lot of questions roaming our heads already because it’s going to be a tough phenomenon to deal with. The economy has witnessed a primary shift in fundamentals and is in a very vulnerable position at the moment. Flashbacks from earlier bubble bursts are too hard for us to incorporate at this state.

Before we move ahead, let’s take a moment to understand the reason behind this difference between the response of stock markets and the economy, especially in India’s context. While it’s no secret that there is this underlying difference between the stock market and economic behaviour due to how people who see these assets as commodities behave in the market, the major driving force for the higher distinction this time around is the gigantic increase in income inequality that the pandemic has ultimately resulted in.

Before we move ahead, let’s take a moment to understand the reason behind this difference between the response of stock markets and the economy, especially in India’s context. While it’s no secret that there is this underlying difference between the stock market and economic behaviour due to how people who see these assets as commodities behave in the market, the major driving force for the higher distinction this time around is the gigantic increase in income inequality that the pandemic has ultimately resulted in.

This means that the road to economic recovery and stability both go through the path of an equitable allocation, at least more equitable than the one we have right here. Let’s keep this a topic of discussion for another day.

For now, let’s analyze how likely it is that the asset-price bubble would burst. As mentioned, economists are a little conflicted in their approach to this question so we may not have a direct answer to it. But we can, till then, analyze these approaches to different outcomes and see which one makes more sense to us.

What factors are contributing to the likelihood of an asset-price bubble burst?

On one side of the panel consists of those who place the bubble burst as a highly likely possibility. The primary reason cited for this possibility range from the heavy boom seen in the bitcoin sect of the crypto-currency market that has seen an increase of about 1.2 percentage points, a rather significant amount. The high volatility in the market is one reason prompting economists to think a bubble is approaching.

Along with that, another sector prone to bursting has been named as the boom seen in the special purpose acquisition companies. It refers to companies that have no capital operations and their entire existence is based on strictly raising initial public offering for another firm. As the description suggests, the unwarranted boom in this industry is a tricky sign for the economy and that is why economists and experts see a bubble bursting likelihood in there. To affirm our proposition is a better way, allow me to take you back to the South Sea bubble, a financial collapse that became the byname for financial scandal.

Joining this list is the worries of the real estate sector, with inflationary valve further strengthening. With unchanged repo rates by the reserve bank, home loans can be availed for as low as 6.65 per cent annual interest, meaning that housing affordability has improved. However, with lower discretionary consumption and lower-income prospects, the bubble for this housing availability is getting more prominent. It is thus has been presented as a growing concern by a number of economists, and history flashbacks of similar incidents are exactly what we do not need right now.

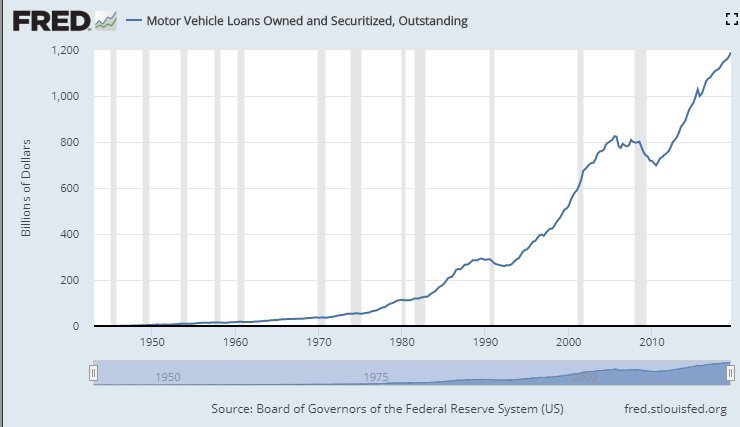

A recent report published by the banks showed how the non-banking financial institution branch of the HDFC bank saw a two-times increase in the number of bad loans made over a period of three months, and this is specifically alarming. Especially because the emergency provisions for stabilization aren’t yet taken back, which, once done, would see a further addition in the non-performing assets and bad loans, furthering the threat of this bubble burst.

Therefore, the prominent concern that has made its surface is the growing dependence of countries on poorly managed non-bank financial intermediaries, which has led to instances of liquidity and leverage mismatches.

What factors are contributing to the unlikelihood of the asset-price bubble burst?

On the other side of the panel, however, are the economists who are not so worried about the asset-price bubble bursting because they think the phenomenon is unlikely at the point. Their core argument is based on the fact that the fundamentals have changed for all equity, bonds and real estate markets, and that none of them is greatly exceeding these fundamentals. To put it in simple words, even though these assets are expensive historically, they are in accordance with the fundamentals of the current economy.

As for the lower interest rates prevailing in the economy, these economists have termed a number of factors like weak productivity growth and excess cash valuations responsible. While these have caused portfolio reallocations, it is assumed by this side of the panel that any meaningful tightening of monetary policy is a little unlikely, which, ultimately, would’ve been the factor causing the asset-price bubble to burst.

Conclusion-

/hand-holding-needle-about-to-pop-bubble-with-dollar-sign-184064999-5b1bfab5a5de4c688286dc56ac584bf2.jpg)

So, if you think about it objectively, both the sides are playing on endogenous and where the wind would blow is still a deterring factor. However, one thing we can say with certainty at the moment is that we can neither be too sceptical nor too eased about the probability of the bubble bursting. It is because inflation does not seem to be as transitory as it was once claimed by the monetary institutions and this could eventually lead to policy tightening.

So government pressure or economic stability, it is still to be seen where the Central banks turn their face. However, even if the asset-price bubble bursts, this is not too heavily driven by debt so, we cannot, with a guarantee, claim that the macroeconomic impact would be as severe as historical instances tell us. So, at this point, it is all messy and contingent, but it is never too early to be cautious, right?

Edited by Tanish Sachdev