It is neither a secret nor an exaggeration to say Mukesh Ambani owned Reliance Industries Limited acts as the cornerstone of the Indian economy, with the company being the largest by market capitalisation in the country. Not only that, with its powerful roots and diversified dominance across sectors, it also holds in its hands great power to influence decisions and pathways for a large proportion of Indi’s corporate sector. Therefore, a discussion on the firm’s activities that can have a ripple effect on the entire economy becomes a rather urgent one, since it concerns not only the present but the future of the economy.

Reliance Industries Limited’s path to deleveraging-

If you’re confused about what we are referring to, let me throw some light to bring you up to speed. For that, let us trace the path of how the conglomerate’s investment trend has looked like. Singlehandedly changing the dimension of telecom and internet in the country, Reliance Industries played the biggest gamble of the decade.

Well, looks like it rolled in their favour. An investment fuelled take on some of the existing key players of the market and completely eroding their bases, Reliance Industries has made an undeniable mark in all the industries it has set foot in. However, the impact of this has not been limited to their huge business conglomerates, but the Indian economy and its corporate drive as well.

The seven yearlong investment spree that Reliance Industries went onto opened doors for the acceleration of private investment in the Indian economy. Back by the end of 2016, Reliance by itself contributed 15 per cent of the USD 117 billion investment in the country, a cumulative of 1,250 top listed companies of the Indian market. This outlier has continued to make its mark in accelerating the investment prospects of the economy and has witnessed Reliance make its dominating mark on the economy.

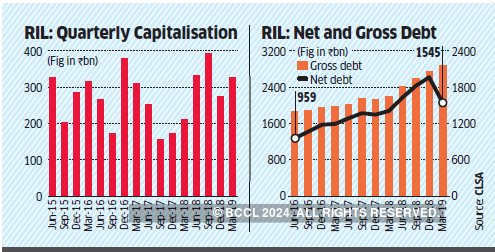

This is exactly why any particular move by the conglomerate has a large impact on the economy too. While we talked about the giant’s journey from one angle, let me draw the same journey but from a different lens. By 2012, Reliance Industries Limited has declared itself to be completely debt-free on a net basis. Since then, the gross debt amount has increased by 438 percentage points, to INR 2.87 lakh crore.

This comes as a result of Reliances’ leveraging over the years and has been taken in a healthy spirit until some time ago. Back in FY19, the net debt amount of INR 154478 crore emerged as a concerning number to the investors. This made Ambani take the leap of declaration and announced a zero net-debt Reliance Industries Limited in 18 months, with promises of big dividends and bonuses.

Unsurprisingly, the announcement came at the back of a planned and sorted deleveraging plan, ranging from asset sale plans to credit deceleration. This debt-diet plan aimed to achieve the ambitious targets set by the richest man in the country, and well, it looks like other top firms of the country and some prominent industries are following closely behind. Reliance Industries Limited has, however, been driving the number’s list. The company made a debt cut of INR 85,000 crore in fiscal 2021. Opting for lower-cost loans, aggressive asset sales and avoiding new projects were methods Corporate India had adopted to check debt.

What does this mean for other sectors of the economy?

Before we go into details of this, note the fact that while a number of listed firms of the country showed profits in their balance sheet in the pandemic year, it came at a pile of loss in revenue. This means that most of the income generation was from deleveraging and that is not a very healthy prospect for the country. A recent report released by the State Bank of India revealed how the credit growth in the corporate sector has plunged, despite numerable attempts by the banks and the central bank to accelerate credit demand.

India’s steel industry is also closely in the loop, with constant global prices and increasing global demand. The companies have, as estimated by experts, started accelerating their speed of deleveraging. Large Steel companies like Tata Steel, Steel Authority of India and Jindal Steel and Power are some of those big names that have embarked on their debt reducing journeys in the recent times. As mentioned, the pace has only been estimated to go even higher from the point onwards.

It has been estimated that the Steel Authority of India has reduced its debt amount by 30.5 per cent, followed closely by the Jindal Steel and Power, with a deleveraging of about 29.7 per cent.

What impact does this have on the longer term prospects of the country?

So, let’s talk about the bigger picture here. We have seen how India Inc. has embarked on its deleveraging journey, with some top names in the country leading the process. This would not have been as big of a problem if it were not for a collective deleveraging pattern. It is because what it has done now is to slump credit growth of the economy, and has brought a question mark on the future prospects of the country.

There are two essential reasons that can be used to explain this collective deleveraging process. The primary of those is the grim expectations of the uncertain future since the economy currently is in a very tough situation. This means that even though the old costly debt is being paid off by the firms, fresh borrowings are a farfetched sight. The COVID-19 pandemic heightened these concerns since it made it even harder to sustain businesses, and lowered the growth and investment will of the firms.

The other reason is that a number of large firms in Reliance are still undergoing the insolvency process, back from 2019, and the country’s slow resolution process has a significant role to play. Even though mechanisms have been put in place for various parts of the processes, there is a significant lag between delivery time and optimality. The country’s four balance sheet problems play in the mind during the time.

Nonetheless, low credit growth is not helping the already slow economy, because it makes future prospects of the country grimmer. Credit growth in the corporate sector in the current period shows the prospective investment projects for the longer term, the ultimate resource a country’s long term growth backs on. What we are looking at right now is a slowdown in both. And what can be estimated from the current numbers and firms’ actions, is that deleveraging is still a long way from being over, which means the slowdown would sustain for a considerably long time if actions aren’t taken at urgent.

Edited by Aishwarya Ingle