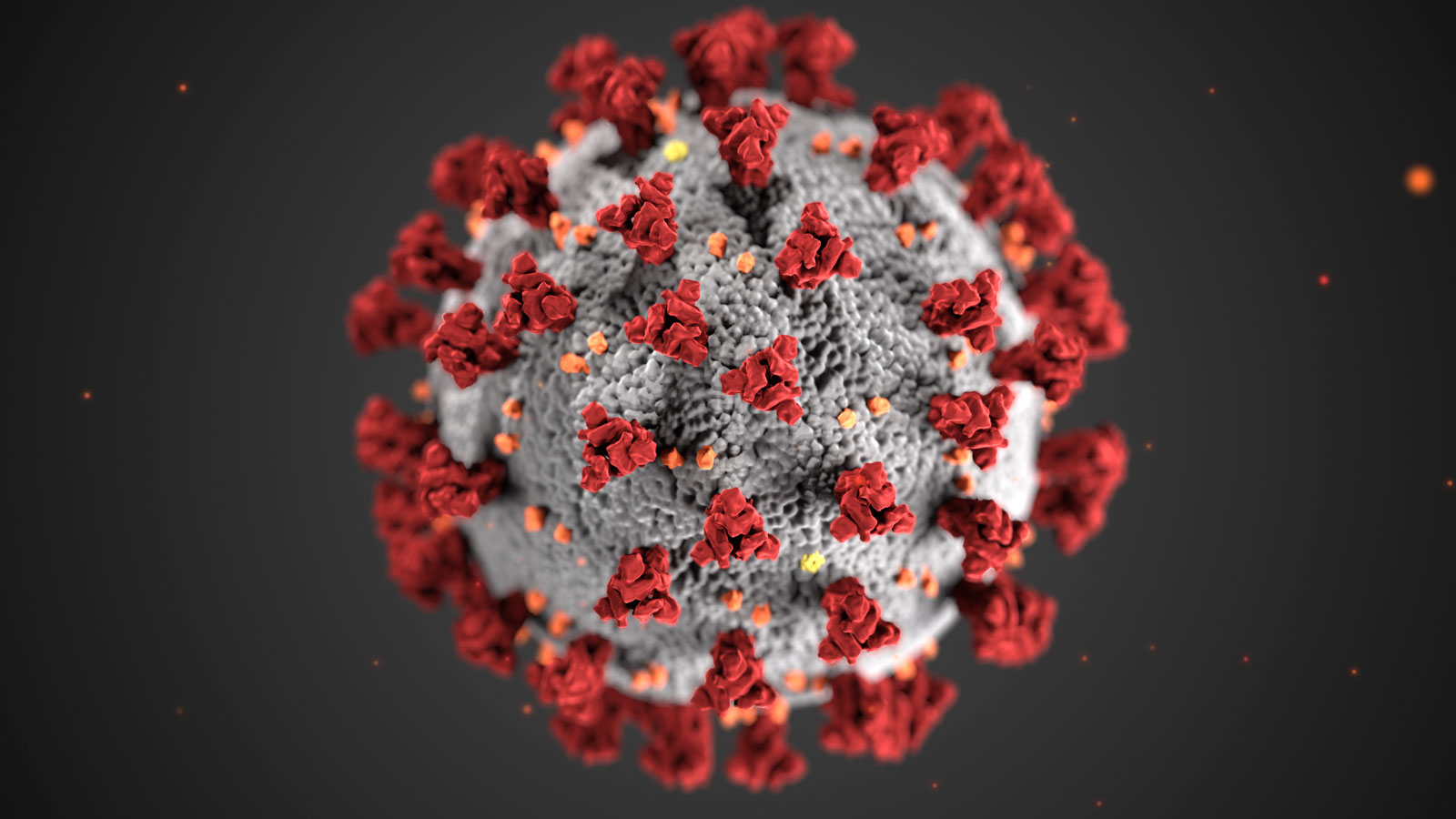

RBI launches inflation expectations survey to gather responses over telephone amid the devastating Covid-19

RBI launches inflation expectations survey; to gather responses over telephone amid a pandemic

The Reserve Bank of India (RBI) has initiated the Inflation Expectations Survey of Households. The responses of the survey will be collected over the telephone due to the COVID-19 pandemic. The Reserve Bank of India has frequently been surveying to extract subjective views of the households on price movement across the nation. The data of the survey will be used as information in making monetary policy.

The government released trimmed retail inflation survey data for April and May due to the pandemic COVID-19. In conducting the July 2020 edition survey on behalf of the RBI was conducted by Hansa Research Group, Mumbai. The interview was conducted over the telephone instead of the regular personal interview mode due to the pandemic COVID-19. According to a release by Hansa Research Group, they will approach the selected households for conducting the inflation expectations of households to provide their response over the telephone.

The Inflation Expectations Survey of Households

The survey aims at obtaining individual evaluations across 18 cities on price movements and Inflation of approximately 6,000 households, based on their consumption. The cities that will be included in the survey are Delhi, Mumbai, Chennai, Kolkata, Jaipur, Lucknow, Ahmedabad, Chandigarh, Bhopal, Bengaluru, Bhubaneswar, Hyderabad, Raipur, Patna, Nagpur, Ranchi, Guwahati, and Thiruvananthapuram.

The survey will focus on exploring qualitative and quantitative responses from households on price changes and Inflation going on across the country. The Reserve Bank of India determined that households’ median inflation expectations have increased in May 2020 as compared to the March 2020 session of the survey.

The three-month median inflation expectations increased by 190 basis points, and one-year ahead expectations faced a spike by 120 basis points over the previous round. More households expect an increase in prevailing prices in the next three years compared to RBI’s last survey.

However, according to the survey, the prices of all products, especially the cost of housing, are expected to increase over a year ahead. There has been a rise in general rates and prices of specific product groups for the past three months and the upcoming one year period.

The RBI is looking forward to conducting the July 2020 session of Consumer Confidence Survey (CCS) to obtain qualitative responses from households regarding their views and opinions on the general economic situation due to the pandemic, employment scenario, Inflation, households’ income, consumption, and expenditure. The survey over the telephone will cover almost 5,400 respondents across 13 cities at a time. Data from both the studies conducted regularly will be used by the RBI while deciding the monetary policy.

Survey of Professional Forecasters in monetary policy

The Reserve Bank of India, moreover, directed the Survey of Professional Forecasters from May 7 to May 28, in which twenty-four specialists participated. As indicated by the survey, Real GDP is going to decline by 1.5 percent in 2020-21; however, expected to return to development territory one year from now, when it planned to develop by 7.2 percent. Real private final consumption expenditure (PFCE) is assumed to fall by 0.5 percent in 2020-21. However, it is also possible to record 6.9 percent development in 2021-22.

Forecasters have assigned the most outstanding probability to positive GDP development lying under 2.0 percent in 2020-21. During 2021-22, the most elevated chance has granted to GDP development lying between 6.0-6.4 percent. Real gross worth added is relied upon to decline by 1.7 percent in 2020-21 however is probably going to record 6.8 percent development in 2021-22, supported by a growth in new and administrations division exercises.

Economic breakdown and Inflation in the country

The COVID-19 lockdown has caused a decline in the economy. All the operations and businesses were closed except for the production of essential goods and services. However, the demand for both primary and non-essential products crashed.

The government of India is failing to control the impact of the pandemic COVID-19 on the Indian economy.

Therefore, imbalance economies always end up in Inflation. Inflation is the only way governments can default on their debts.

The novel virus has increased the prices of groceries and the cost of medical services up to 5.9%. It has increased the cost of health insurance prices up to 19.7%, and hospital costs up to 4.9%.

Post-lockdown situation

In post lockdown, when markets and businesses will resume back, they will start selling their products and services at higher prices to cover the losses they suffered amid lockdown, and this will lead to Inflation in the economy.

We all know how the prices of petrol and diesel are increasing on a daily basis. The government is not controlling the hike in the prices. Not only diesel and petrol we all remember how central and state government increased the costs of beer and alcohol amid lockdown when the liquor shops opened. Also, people are buying willing to pay more for the products. There were long ques outside the liquor shops when it opened it’s shutter. People are also buying petrol and diesel even the price is increasing day by day.

What is Inflation?

A hike in demand for products and services can cause Inflation as consumers are willing to pay more for the product.

Inflation means an increase in the prices of goods and services and a decline in the purchasing value of money. If Inflation happens, it can lead to cost higher rates for necessary items such as food and other products that will ultimately harm society. More the loan is provided by the government to the public, more the probabilities of inflation creation.

Inflation is not accidental. It is policy. Inflation is the only way the government can boost its stimulus package. A stimulus package helps in increasing GDP. GDP is the value of all goods and services produced inside the domestic market of an economy.