While GST is a fairly recent phenomenon in India, only being introduced in the year of 2017, the concept of GST was incepted back in 2000, when a committee was set up by the then Prime Minister to design a GST model for the country. A 2003 task force on fiscal responsibility and budget management set up by the Central Government suggested that GST replace existing state and central Value-Added Taxes, making it a comprehensive tax on all goods and services.

The movement towards the Goods and Services Tax was then articulated by the then Union Finance Minister in his budget speech during the years of 2006-2007. The very first date announced to introduce GST to the nation was April 1, 2010. The Empowered Committee of State Finance Ministers, that had planned the design of State VAT, was requested to come up with a road-map and structure for GST.

Various aspects of the GST were examined by a wide variety of representatives from Join Working Groups of state officials and those of the Centre. Reports specifically targeting exemptions and thresholds, taxation of services, and taxation of inter-State supplies were drawn up and published on the same. Based on these discussions, the Empowered Committee released its First Discussion Paper on the GST in November 2009.

Introducing GST:

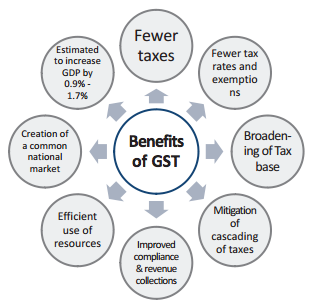

Introducing the Goods and Services Tax is a significant step in indirect tax reforms in India; by amalgamating many centrals and State taxes into a single tax, GST is an attempt to mitigate the ill effects that accompany cascading and/or double taxation in a major way. Such a path leads to a common national market.

The biggest advantage, for the consumer, would be an overall reduction in tax burden on goods, which is currently estimated to be ~25% to 30%. GST is also a step in the right direction for transparency of indirect tax burden to the consumer. Studies have shown that this will have a boosting impact on economic growth. This tax is also of a self-policing character, which means it is easier to administer. And since the GST was put in place from July 1, 2017.

GST and the common man:

No matter the merits or demerits of an umbrella tax, GST has completed the mission it was designed to achieve—easing the tax burden on the consumer. Under the one Nation, One Tax regime, widespread makeover was observed in the country’s business landscape and the lives of common people in tandem. The government has since termed GST a significant change for the Indian economy, thanks to its abolishment of various indirect taxes and bringing them to a single window.

One of the more important achievements of GST is the elimination of the increasing burden of cascading taxes. With various taxes being added on to every single transaction, the percentage of money involved in the transaction being owed to the government gets larger. GST is a onetime tax payment on any transaction—whenever you perform a transaction, you pay a fixed percentage of the price to both the State and Central governments.

Under a singular roof, everything is cheaper—this applies to the Goods and Services Tax scheme. GST is one of the crucial factors that helped in the reduction of prices of various commodities that were heavily double taxed before it was put in place. This helped uplift the poor and middle-class by providing them more access to such products, with numerous of them being classified as daily use.

Almost all daily utilities are exempt from the tax, with a minority share of them under the 5% GST slab. Most of the items in the market fall on or below the 18% level, the government reported. Anxieties have now transformed into relief at various levels of the nation, with the government extending full support to ensure that the transition stays less painful that it should. Reduction in prices on account of anti-profiteering rules benefit the end users, and relaxation of compliance’s during the transition phase has kept business transactions sane. “The people of India have accepted GST on a positive note”, said Sanjay Agarwal, Partner, TASS Advisors.

Introducing GST has also led to the digitization of the India economy.

Most markets present in India followed the conventional cash-on-paper method to conduct most transactions—this limited the layman’s ability to conduct pan-geographic purchases and transactions and laid a burden on them. As of 2020, a major portion of all Indian markets have moved onto digitized transactions – these are much more secure, and does not limit a person’s ability to conduct transactions depending on their territory. While it brings up the problem of Internet accessibility, that is a problem for an atypical day.

Digitized transactions are also more transparent, and with decentralized systems and blockchain technology on the rise, the adoption of such infrastructure is becoming a necessity fast. From returns to refunds, to any sort of transactions, everything takes place online.

As per government reports, GST has helped significantly for curbing corruption practices. Irrespective of whether the organization is an SME, MSME, or large enterprise, the prescribed tax regime is uniform across the market, making it very easy to conduct business. For this consolidation, there is almost zero scope for evasion or legal wrangling, routing out corruption and eliminating various middlemen—it is an anti-profiteering move that is beneficial to the economy.

And finally, GST is a move that can help increase productivity of all institutions. With every back-end process becoming automated and electronic, the ensuring of effortless movement of money across the nation helps increase productivity. A simplified, single tax regime in line with the tax framework applies across the globe, not just India. As every year passes us by, it is only more obvious that the pains of the transition have passed, and the gains are now showing up in the records.

A common man’s view:

After an initial bumpy ride, the Goods and Services Tax has undergone a large scale of changes, and any final verdict on its success would be a judgement made too early.

Consumers play a major vital role in all economies, hence a common man’s view of such an economic game changer is a standpoint that should be considered mandatory, including a primary focus on pricing of various consumer products. GST rates were fixed based on the principle of equivalence—the prices of many products have either stayed stable, or gone down steeply.

In the initial phases of the transition, prices of products and services hiked up by a large margin as expected—as the market stabilized, prices have either gone to or decreased from pre-GST prices. While the industry was very apprehensive about implementing the tax, the transition was handled as smooth as it could have been. As one of the biggest tax reforms in the nation’s history, it has widely affected both businesses and the common man’s budgets, mostly in a positive manner.

Various industries have been impacted in differing manners, with the common observation being that higher-tier services and products get more expensive, while lower-tier services and products are cheaper than before. As the tax reaches a steady state, the consumers of the nation are the winners in this situation. GST, apart from bringing about greater transparency, is also expected to improve compliance levels and create a common playing field for businesses by amalgamating a host of taxes under a single umbrella—one nation, one tax.