PPF VS NPS Investment: Where Should You Invest To Save For Your Retirement?

Saving for retirement is an extremely critical financial goal. The best way to save for retirement is to make long-term small but regular investments. For this reason, the NPS (National Pension System) and the PPF (Public Provident Fund) are two commonly used products.

Here is a detailed introduction to these products and who should invest in these products while saving for retirement.

Who Should Invest?

NPS: When NPS was first launched in January 2004, it was only open to government employees, and then expanded to all Indian citizens in May 2009.

People can subscribe to NPS in three broader categories.

- One is the statutory contribution of government employees.

- The other is the statutory contribution of company employees.

- The third is open to all citizens on a voluntary basis. NRI can invest in NPS.

PPF: All resident Indians can invest in PPF. NRI is not allowed to invest in PPF.

NPS vs PPF Comparison

|

Eligible Age of Investment

NPS: The minimum investment age is 18 years old, and the maximum age one can join is 65 years old.

PPF: There is no age limit. Even minors can invest in PPF with their guardians.

Nature of Return

PPF: PPF provides you with a fixed interest rate, which changes every quarter and is determined by the committee based on changes in government securities interest rates.

NPS: Investors can choose from investment options, such as government securities, equities, and corporate bonds. Since these are market-related investments, your NPS investment rate of return is not fixed.

Rate of Return

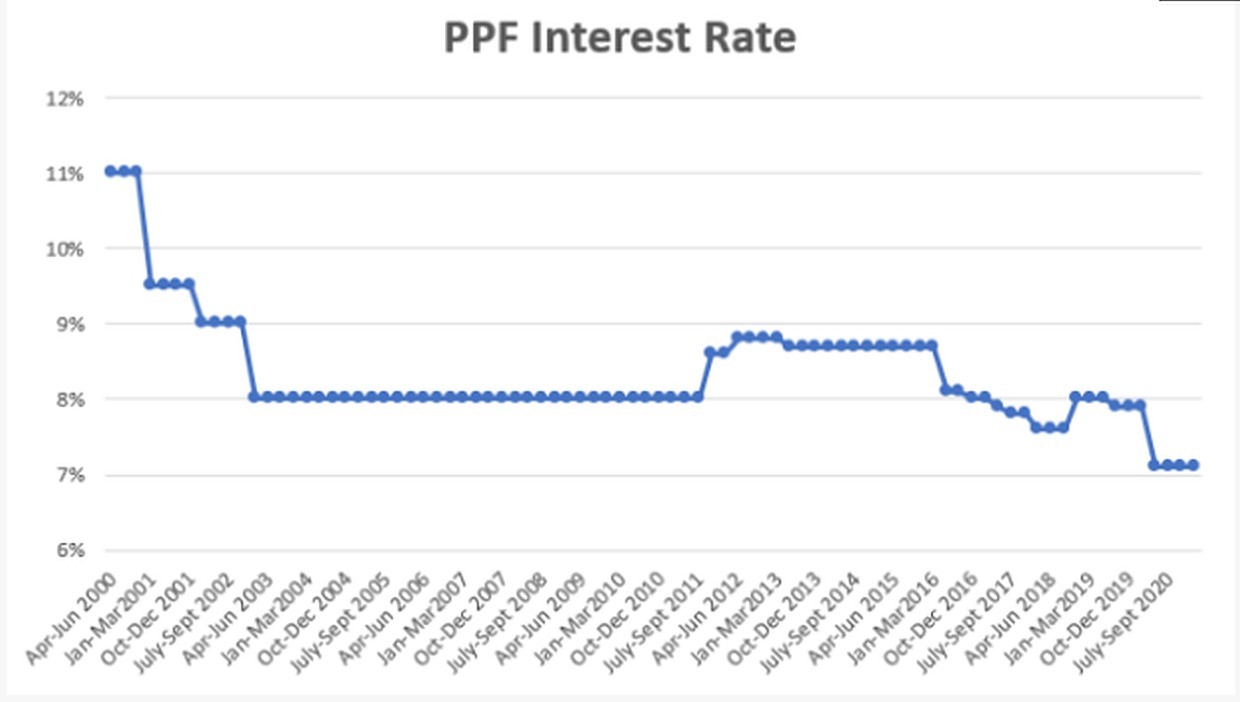

PPF: PPF is recognized as one of the most profitable investment options supported by the government. PPF interest rates change every quarter and are determined by the committee based on changes in government securities interest rates in a particular quarter. For the quarter ending March 31, 2021, the current PPF interest rate is 7.1%.

Historical Interest Rate of PPF

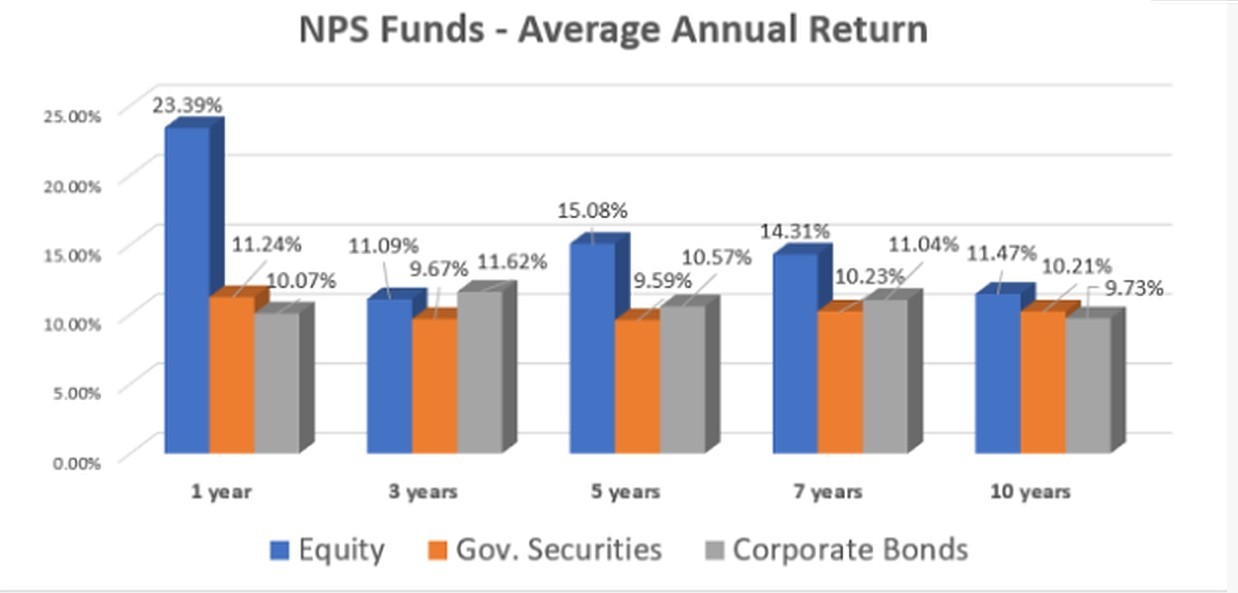

NPS: On the other hand, NPS investors can choose to invest in a combination of corporate bonds, equities, and government securities to get benefits from higher returns. The return is completely market-driven and depends on the performance of your fund manager and the portfolio of assets you choose.

As of February 5, 2021, the average trailing annual returns of all Tier 1 equity funds taken together is 23.39% for 1 year, 15.08% for 5 years, and 11.47% for 10 years.

Similarly, corporate bonds have achieved good returns, with a one-year term of 11.24%, a five-year term of 9.59%, and a 10-year term of 10.21%. For government securities, the average annual rate of return is 10.07% for one year, 10.57% for five years, and 9.73% for ten years.

Returns on NPS Funds

Investment Period

PPF: The maturity period of the PPF account is 15 years. You can extend your PPF investment to 15 years (in 5-year intervals) an unlimited number of times.

NPS: As NPS is a key retirement product, it must be invested until the vesting age is 60 years. You can continue to use your NPS account until you are 70 years old.

Quantum of Regular Investment

PPF: In PPF, you must invest at least 500 rupees, and in any given fiscal year, the maximum investment is 150,000 rupees. Failure to deposit a minimum amount of at least 500 rupees per fiscal year will result in the PPF account being designated as invalid or inactive.

NPS: In NPS, all government employees who joined the state government or the central government services (except the armed forces) on January 1, 2004 or later, will pay 10% of the basic salary plus a dear allowance. This contribution is usually provided by the state government. On the other hand, the central government contributes 14%.

However, in the corporate sector, employees usually pay 10% of the basic salary, and the employer usually provides the corresponding basic salary. When self-employed persons voluntarily contribute to NPS, the amount shall not exceed 20% of their total annual income. There are no restrictions on the time and frequency of investment.

Maturity Payment Period

PPF: In PPF, you will get all the investment and cumulative return after 15 years as a lump sum payment.

NPS: In NPS, when you retire, you must invest at least 40% of your accumulated total assets to purchase an annuity plan that can bring a fixed income. You can extract up to 60% of the corpus at once.

Safety

PPF: PPF investment is supported by the government, so the risk is low.

NPS: NPS is managed by the NPS trust established by PFRDA, the pension fund regulator, which is managed by the government. The funds invested by NPS subscribers are managed by public and private fund management companies appointed by PFRDA.

Although fund management is open to fund managers, they are strictly regulated and regularly monitored by PFRDA. Therefore, when it comes to the security of your investment in NPS, it will have market-driven risks.

Tax Saving

PPF and NPS provide you with tax relief of Rs 150,000 in each fiscal year.

PPF: The PPF return you get is completely tax-free, but in any financial year, your investment cannot exceed Rs 150,000.

NPS: In addition to the 150,000 rupees investment under Section 80CCD1, NPS also provides you with an additional deduction of 50,000 rupees under Section 80CCD (1B). Therefore, if you invest this money in NPS, you can effectively get a deduction of Rs 200,000 per year.

Under NPS, the one-time amount can be up to 60% of the retirement corpus that you get is exempted from tax, but your monthly annuity income is taxable income.

Where to Open an Account?

PPF: PPF accounts can be opened in designated branches of India Post and banks. Many banks also provide online facilities for opening PPF accounts and making investments.

NPS: If you invest in NPS as part of your salary, you can open an account through your employer. If you are unfamiliar with NPS, you can make voluntary investments through a Point of Interest (PoP) or open an NPS account online through eNPS. These PoPs are usually banks, brokerage houses, and other financial intermediaries.

Where Should You Invest?

Both products have their unique advantages and disadvantages, you should research them before investing.

PPF provides you with one of the highest returns in the fixed income category, but as we all know, equities can provide higher returns in the long term.

Looking back at historical returns, we can see that in terms of absolute returns, PPF cannot match the returns (mostly double-digit) delivered by NPS so far.

When it comes to maturity, NPS investment has a big disadvantage, because you can’t get the full amount at once, and you have to buy an annuity with 40% of the equity.

Annuities are known to bring low returns. However, the additional taxes that can be saved by using NPS can make up for the higher effective corpus.

If you invest 10,000 rupees a month for 30 years, assuming an annual rate of return of 8%, you can accumulate 1.41 crore rupees in the PPF, and if calculated at a compound annual growth rate, the investment in NPS can give you a corpus of 2.06 crore rupees if the compounded annual growth rate of your investment remains at 10%. Therefore, if you have a higher tax bracket, NPS will provide you with a way to establish a tax-efficient retirement corpus.

If your retirement goals require higher contributions, you can use PPF for the fixed income portion of your portfolio and NPS for market-linked returns. If your retirement period is less than 15 years, then PPF may not work for you, and you can still apply for NPS.