India’s 6 crore MSMEs need immediate reliefs on loans, simple compliance to revive

India’s 6 crore MSMEs need immediate reliefs on loans, simple compliance to revive

Approx six crore MSMEs need an example of prompt reliefs extending from transient liquidity to basic understanding for India’s economy to come out more grounded, said a team framed by Global Alliance for Mass Entrepreneurship.

One-third of these micro small and medium enterprises could see destruction if they do not have access to loans from government and industry bodies said by the task force. K P Krishnan is the chairperson of the task force, a former secretary at the Ministry of Skill Development and Entrepreneurship. Ravi Venkatesan is the co-chairman and founder of Global Alliance for Mass Entrepreneurship (GAME) also he is a former chairman of Microsoft India and Bank of Baroda.

Global Alliance for Mass Entrepreneurship reports on MSMEs:

As per proposals distributed by GAME, the MSME segment contributes almost 25% of the administrations in the economy and 33% of the assembling yield, should be conveyed well about the plans and the partners should command 30% of the stimulus package to be discharged to endeavors falling into the MSME sector and loosen up standards with the goal that borrowers can reimburse credits in a progressively broadened period and permit exclusion from bank ensures.

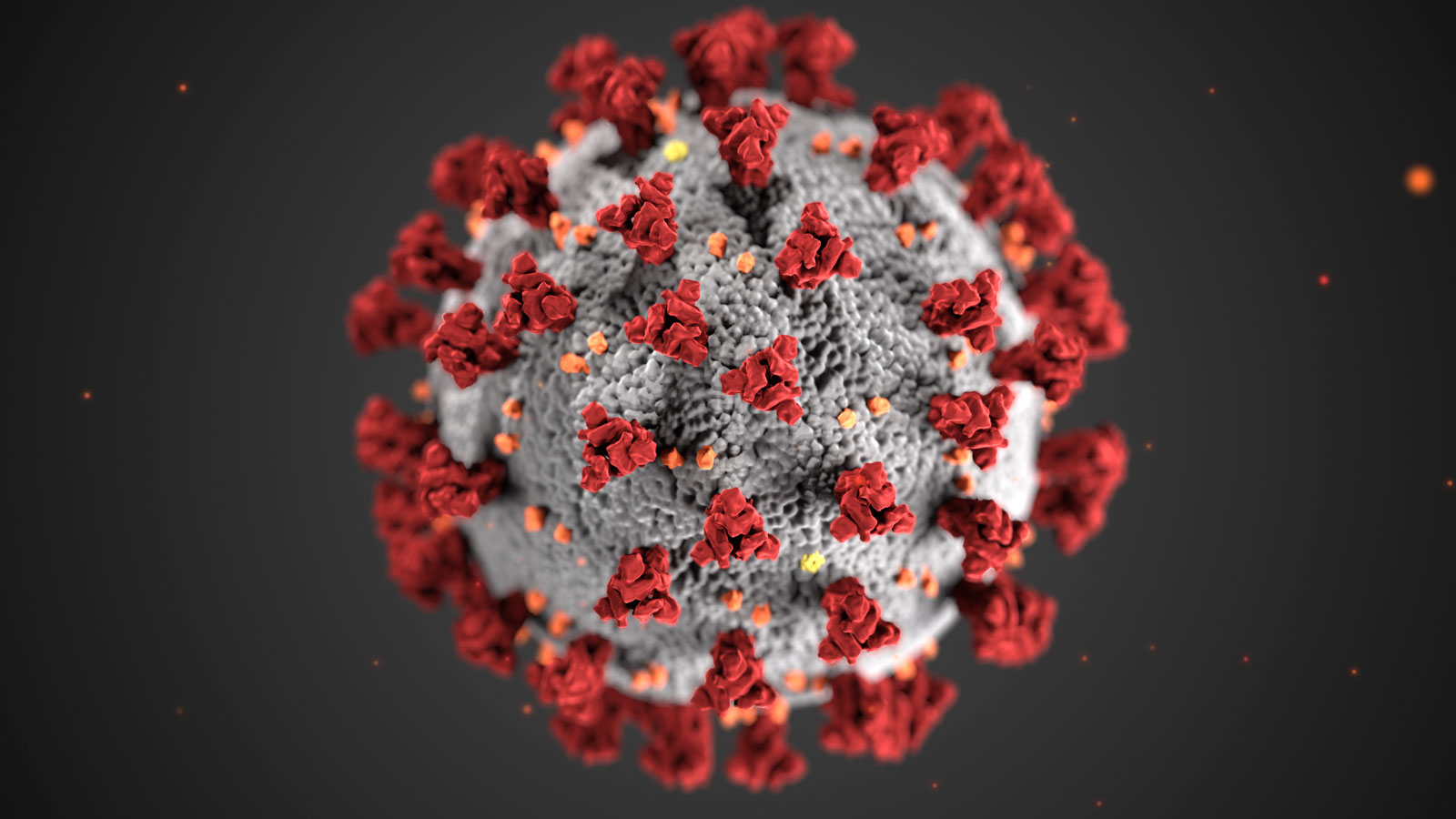

Global Alliance for Mass Entrepreneurship said these businesses were battling even before the pandemic Covid-19 and would require budgetary and consistence related changes by the government to hold over the continuous emergency brought about by the pandemic COVID-19 and the declining economy.

“An enormous number of MSMEs in India are still battling in adjusting to the improvements brought about by demonetization, GST, and fall in the economy when Covid-19 attacked the nation. Certainly, even pre-COVID, the area was cost uncompetitive. Numerous little firms are lastingly stuck in an endless low efficiency and productivity, and staying hindered,” GAME, the union for MSMEs, said in its suggestions.

“Momentary relief from debts and growth in medium-term liquidity can aid the digitization of recognition. It can set up a usage body with dynamic state standards. The three significant advances we have suggested separated from different measures for the MSMEs sectors to restore,” Venkatesan uncovered.

Krishnan said these MSME sectors need better communication on the financial stimulus package and better distribution of the dedicated funds.

The partnership emphasized that the simplicity of working together through untwisted consistency is necessary to restore and sustain these organizations. “Regardless of the reality the nation has gained great ground in the simplicity of working together as indicated by the world bank positioning, the consistency trouble is extreme,” said Venkatesan.

Among different proposals, the team has suggested that there be 1 lakh crore worth of new advances to the first run through MSME borrowers. “This can combine Rs 1 crore loans with the government’s extended credit limit,” said GAME.

Nitin Gadkari’s statement on MSMEs

“The financial fight caused in the nation needs a more extended period to recuperate, and we should take a snappy long haul and momentary choice to battle against it. We are available to have some realistic proposals. We assume the liability of execution,” said Nitin Gadkari, the Union Minister of MSMEs, including that the MSME sector plays an essential role in supporting the economy and creating employment opportunities.

The financing plan will help the MSME part includes a sub-obligation office to the advertisers of those operational MSMEs that are non-performing resources (NPAs). It is additionally called the ‘Bothered Assets Fund – Sub-ordinate Debt for MSMEs.’

As indicated by the plan, the assurance spread worth Rs 20,000 crore will be given to the advertisers who can take the banks’ obligation to put resources into their MSME units as value-added.

It was being felt that the most significant test for focused on MSMEs was in getting capital either as obligation or value. Along these lines, as a substantial aspect of the Atmanirbhar Bharat bundle, on May 13, 2020, Finance Minister Nirmala Sitharaman had reported this plan of sub-ordinate obligation to the advertisers of operational yet focused on MSMEs.

After finishing the fundamental conventions, remembering endorsement of the Cabinet Committee for Economic Affairs and counsel with the account service, SIDBI, and the Reserve Bank of India (RBI), Gadkari officially propelled the plan in Nagpur.

A portion of the execution plans proposed for this committed loan corpus incorporates controlling the fund by SIDBI, an advancement money related foundation, observing a necessary and rule-based case process, giving loans at lower interest charges, and other things.