India GDP Q1 Data: Demand from private businesses and individual citizens fell in Q1, an increase in government’s demand made up for just 6% of this decline.

Complete analysis:

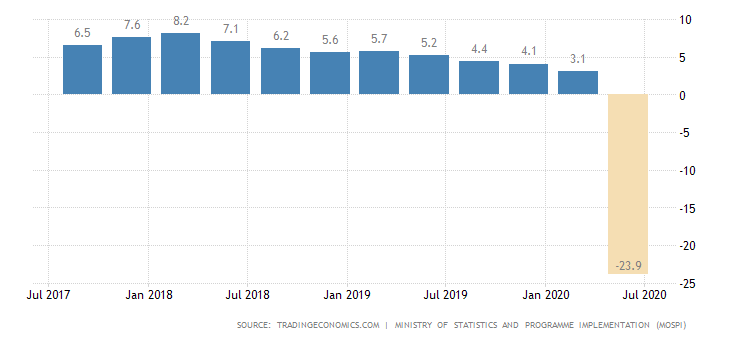

Although most utmost people presumed India’s GDP to record a strong reduction when the Ministry of Statistics and Programme Implementation (MoSPI) issued the details for the first quarter (April, May, June) of the present fiscal year on Monday, the apparent agreement was that the drop would not surpass 20%. As it turns out, the GDP declined by 24% per cent in Q1.

In other words, the absolute value of goods and services produced in India in April, May, and June in 2020 is 24% less than the entire cost of goods and services produced in India in the same three months in 2019.

Almost all the significant pointers of extension in the economy, whether it be the production of cement or consumption of steel witnessed deep contraction. Even complete telephone subscribers witnessed a recession in this quarter.

What is more critical is that, because of the nationwide lockdowns, the data quality is sub-optimal, and most observers assume this estimate to get worse when it is reviewed in a scheduled course.

What is the most significant implication?

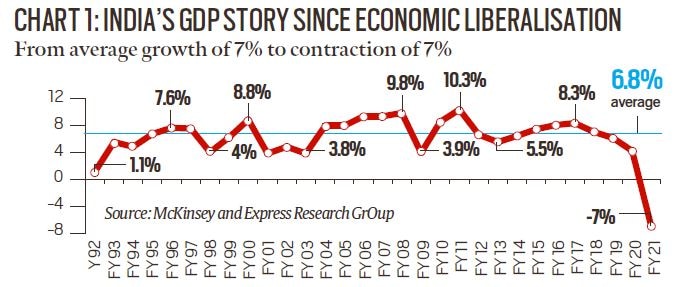

With GDP declining by more than what most observers assumed, it is now guessed that the full-year GDP could also get more worst. A reasonably conservative approximation would be a decrease of 7% for the full fiscal year.

Chart 1 puts this in viewpoint. After economic liberalization in the early 1990s, the Indian economy has measured an average of 7% GDP increase each year. This year, it is possible to turn turtle and fall by 7 percent.

In terms of the gross value added (a substitute for production and incomes) by various sectors of the economy, data determine that excluding agriculture, where GVA increased by 3.4%, all other sectors of the economy observed their incomes to be dropped.

The most damaged were manufacturing (–39%), construction (–50%), hotels, and other services (–47%), trade, and mining (–23%). It is necessary to remark that these are the sectors that produce the maximum new employment opportunities in the country. In a scenario where each of these sectors is declining so clearly, that is, their production and revenues are decreasing it would drive to more and more people either losing jobs (drop in employment) or missing to get one (surge in unemployment).

What causes GDP contraction? Why hasn’t the government been able to cope up it?

In every economy, the total demand for goods and services, that is the GDP, is created from one of the four generators of growth.

The biggest generator is consumption demand from private individuals like the ordinary citizen of the country. It is denominated as C, and in the economy of India, this value for 56.4% of total GDP before this quarter.

The second-largest generator is the demand produced by private sector businesses. It is denominated as I, and this value for 32% of total GDP in India.

The third generator is the demand for goods and services produced by the government. It is denominated as G and is valued for 11% of the total GDP of India.

The last generator is the net demand for GDP after we deduct imports from India’s exports. It is denominated as NX. In India’s case, it is the smallest generator and, after India typically imports more than it exports, its impact is negative on the Gross Domestic Product (GDP).

Hence, total GDP = C + I + G + NX

Private consumption — the most significant generator driving the Indian economy — has declined by 27%. In money terms, the decline was of Rs 5,31,803 crore over the same quarter in 2019.

The second most influential generator is investments by businesses that have dropped even harder, and it is half of what it was in 2019 in the same quarter. In money terms, the recession is Rs 5,33,003 crore.

So the two most prominent generators, that valued over 88% of Indian total GDP, Q1 observed a massive recession.

The NX or the net export demand has become positive in this Q1 because India’s imports have dropped more than its exports. While on paper, this gives a lift to overall GDP, it also leads to an economy where economic activity has fallen.

That guides us to the last generator of growth, that is the government. As the data reveals, the government’s expenditure moved up by 16%, but this was nowhere near adequate to compensation for the lack of demand (power) in other sectors (generators) of the economy.

Viewing at the absolute numbers provides a more precise picture. When the demand from C and I declined by Rs 10,64,803 crore, the government’s spending rose by just Rs 68,387 crore. In other words, the government’s spending grew, but it was so little that it could meet just 6% of the total drop in demand being endured by people and businesses.

The net result is that while, on paper, government expenditure’s part in the GDP has moved up from 11% to 18% still the reality is that the overall GDP has decreased by 24%. It is the lower level of absolute GDP that is causing the government to seem like a larger generator of growth than what it is.

What is the solution to this?

When incomes drop distinctly, private individuals limit their consumption. When private consumption drops distinctly, businesses stop investing. After both of these are voluntary choices, there is no way to pressurize people to spend more and/or force businesses to invest more in the present situation.

The likewise logic continues for imports and exports as well.

Under the conditions, there is only one generator that can raise GDP, and that is the government (G). Only when the government contributes more — either by constructing roads and bridges and paying salaries or by directly giving out money then only it is possible got the revival of the economy in the short to medium term. If the government does not spend appropriately enough, then the economy will need a long time to revive.

What is pressing back the government from investing more?

Even before the crisis caused by then pandemic COVID-19, government investments were overextended. In other words, it was not only borrowing but borrowing more than what it should have, and as a result, today, it doesn’t hold as enough money.

It will have to consider some innovative solutions to generate resources. Chart 4 presents approaches in which an extra 3.5 percent of the GDP can be boosted by the government of India.

Now let’s get to know the possible reasons behind the decline of the GDP.

The possible reasons behind the decline of GDP:-

1. Sharp decline in overall demand:

Demand is the actual accelerator of the economy. If demand rises then the producer has to boost the production, that can not be developed without hiring the more labour force.

Increase in employment opportunities begins to promote demand for other products in the economy. After the last few months, the Indian economy is suffering the difficulty of lower demand, that ultimately caught the whole economy.

2. sharp fall in consumption

Consumption has estimated for 55-58% of GDP. Remember, consumption is at the essence of domestic demand in India. Indian economy underwent a sharp decline in private final consumption expenditure from 7.2% in the March quarter to 3.1% in June in last year.

3. Wrong procedure in the GST implementation

Goods and Services Tax (GST) is a significantly increasing step (the government is receiving approximately Rs. 1 lac crore per month as tax collection ) for the Indian economy but its implementation is not much stable. The traders are facing difficulties in making the GST returns, and their colossal money is trapped in the hands of the government, that is influencing their business due to the limited availability of sources.

4. Decline in investment

There is a 79.5% reduction in the value of new projects declared during April to June 2019. This is the biggest decline since September 2004. The number of reported investments in the same quarter is Rs 71,337 crore, that is also the lowest after September 2004. This is a notable sign that industries are not yet sure in India’s economic future.

5. Poor condition of the banking sector

We all know that the Indian banking sector is moving within a very rough time for a long time. Total NPA of the Indian banks is approximately Rs 7.9 lac crore, that is blocking the way of the new loan to the other borrowers. The new announcement of the alliances of the banks may further generate an atmosphere of chaos in the mind of the investors and depositors.

6. Agricultural crisis

Indian agriculture has been a significant contributor to India’s growth story and remains to be one of the biggest employers. It contributes approximately 15% in the Indian GDP and employs around 55% population of the nation. But this sector is also moving through a very rough time. Farmers are not receiving a fair price for their crops; that is why farmers are committing suicide everywhere in the country.

About 12,000 farmers committed suicide in Maharashtra in the past three years. Now the farmer’s suicide rate is about 12.9 suicides per 100,000 in India.

So these six significant causes are behind the drop in the GDP of Indian Economy. I believe that the central government is trying hard to bring out the economy from this trap. Newly announced bailout package to the banking sector, stimulus package, cut in GST rate for the automobile sector, cut in corporate tax and other proposals will provide the favourable outcomes for the Indian economy.