Ola, Swiggy, And Most Avocado Startups May Never Turn Profitable As Very Few Indians Can Actually Afford These

How can these startups ever make money if only a small percentage of the population can actually afford their services? We break down the story in this article.

Before understanding the concept of avocado startups, let’s first understand a little about avocados first. Avocado is a fruit of the rich. It grows on trees and there is a huge supply-demand mismatch, due to which the prices rise and only the wealthiest can afford it.

The fruit looks big, but it is mostly seed inside, with very little pulp to eat.

Avocado Startups

Avocado startups are those whose customers lie in the upper-middle to upper-class income bracket, with access to the latest technology and resources.

In India, most startups that emerge on an everyday basis are avocado startups, as their market is only generally limited to the people with high disposable incomes who can afford to spend on products not falling in the basket of necessities.

Dividing India Into Different Tiers

If we collect 100 Indians, their income distribution will be as follows:

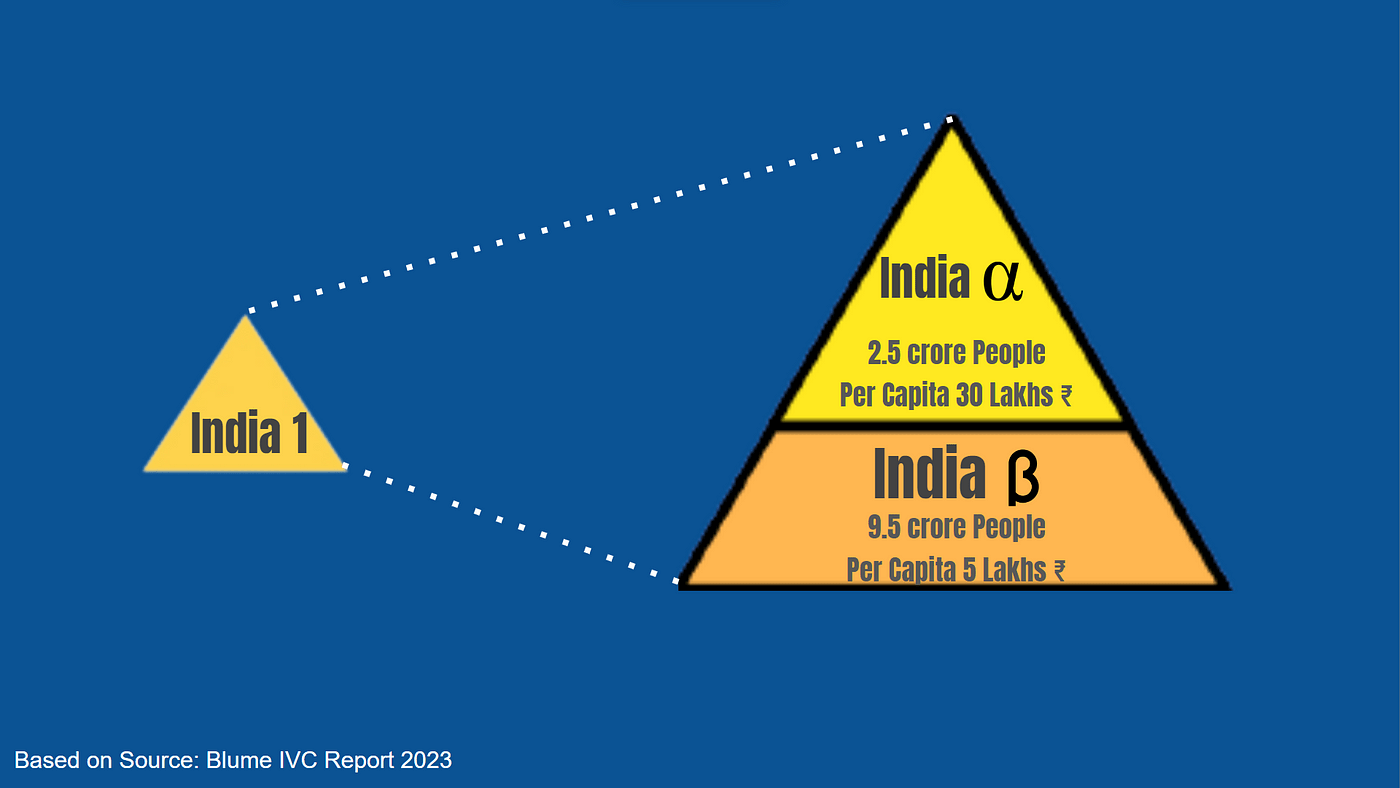

Three Indians make up 30% of the total wealth, making more than Rs 25 lakh annually.

Subsequent 30 Indians make 30% of the total, with each earning around Rs 5-25 lacs per annum.

Then, 52 Indians will receive 30% of the total, earning Rs 1.25 – 5 lacs per annum.

The bottom of the pyramid has 15 Indians, each earning 10% of the total income at less than Rs 1.25 lacs rupees per annum.

In other words, we reside in three countries:

India One

By combining the top two categories, it is evident that the top 15% of Indians (150-180 million people) earn an average of Rs 50,000 per month, which leaves them with disposable income after purchasing essentials. Over half of the economy’s spending power and nearly all of its discretionary expenditure are under the control of these 15% of Indians.

They use the most recent, flashy applications without concern for the amount of internet data being consumed on their overpriced and oversized smartphones. They have internet access 24 hours a day, Wi-Fi, and power generators in their home and office.

They can be considered the same as a developed nation (having a population equal to Canada’s) and maintain the lifestyle of people in a developed European country (if assessed on a purchasing power parity, or PPP) basis—and with an even more luxurious lifestyle.

They employ drivers, housekeepers, cooks, and peons to manage the burdensome tasks. They prefer to stay in their air-conditioned rooms and avoid going into our city’s filthy streets and traffic—everything must be served immediately at home.

India Two

This category encompasses the middle-of-the-pyramid 30% of the Indian population, which is approximately 400 million people. Their average monthly income is Rs 7,000 – 15,000 per month. If compared to a nation, it would be almost three times the size of Bangladesh, with the same level of purchasing power.

The $1 trillion market India One represents is “serviced” by them.

Over the past two decades, they have worked hard and improved their fate. They have emerged from destitution (a state of extreme poverty) by moving out of their diminutive plots of unproductive land to the bustling cities of India.

They have subsequently found employment to meet the demands of these markets. They operate small enterprises, work two shifts as cab drivers, or work as cooks in fast-growing food chains. Additionally, they send money back to their families in the villages.

Fortunately for us, they continue to respect education, family values, and hard labor as a means to a more promising future. Most individuals allocate their entire income to their children’s education.

Every day, they surmount the basic life obstacles. Most of their income is allocated to rent and sustenance, with the remaining funds carefully used to download movies or songs on SD cards from the local store in order to escape the monotony of life.

In order to maintain communication, they use second-hand or cheap smartphones and diminutive data bundles priced at less than Rs 100 per month. Certainly, we identify them as internet consumers in our sophisticated presentations on Startup India.

India Three

These are the 650 million people who are often overlooked and are unable to purchase two square meals. Their incomes are comparable to those of sub-Saharan Africa.

Instead of abandoning their villages, which were devoid of roads, schools, toilets, and electricity, they opted to send a family member to work in the larger cities. They subsist on the generosity of our monsoons and the small income they receive from the government’s poverty alleviation schemes.

They reside on the outskirts of our economy and, in all likelihood, do not engage in it. Nevertheless, they are the ones who establish our vote banks and have the power to change the political landscape of India.

And no, these three Indias are not geographically divided. In a city like Mumbai, the gradual urbanization of India resulted in the intermixing of all three in our metropolises, from Dharavi to Dadar to Malabar Hill. We share the same GSM spectrum, air pollution, and roads with our favorite mobile operator. The cellphone and the perpetual anxiety surrounding its battery life are an integral part of our existence.

We comprise three big nations. One with the size and prosperity of a developed country, one with 400 million people, similar to a developing nation, and a third with 650 million people, whose lives are comparable to those of a poor nation. The Pew research illustrates an even more dismal scenario: According to global standards, 80% of our population is classified as low-income.

Every estimation of the market has been compromised by the inability to differentiate between “internet users” and “internet consumers.”

The Smartphone Proxy’s Failure

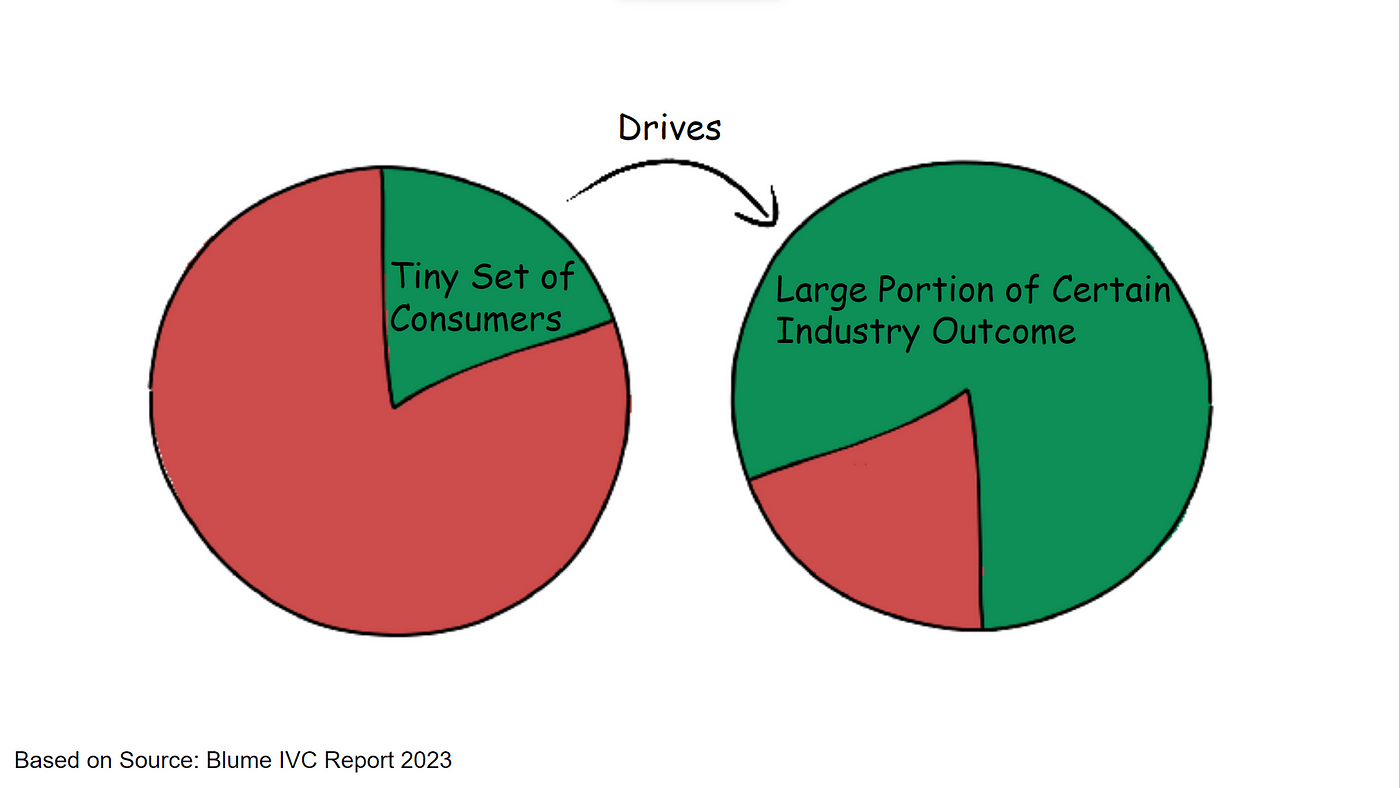

Every market estimate has been inaccurate due to the failure to differentiate between “internet users” (India Two) and “internet consumers” (India One). This resulted in the destruction of the Total Addressable Market (TAM) calculations, which have been the primary factor in the determination of VC funding and valuations.

In reality, the total amount of money (TAM) that individuals can afford to spend on the current offerings of our internet titans is approximately 150 million rather than one billion. Sixty percent of the total!

TAM is approximately 150 million people, not one billion as previously believed.

The low penetration levels of e-commerce firms are discussed, as well as the significant potential they possess. However, our online shopping penetration abruptly rivals the best markets in the world when the TAM was redefined, i.e., assuming it is not 250 million households but rather 40-50 million with discretionary income.

Most households that could afford to establish an online purchasing habit have done so due to the mass media coverage and mind-boggling discounts. The market has reached saturation, and subsequently, growth will decrease.

So, how should one evaluate the market today? Investors and founders who interpreted the rapid expansion of mobile phones and smartphones as a representation of the potential of the consumer internet market are now experiencing the consequences.

The bubbles are not just because of their hyped valuations but also because of the business models that presumed a much larger addressable market than exists.

The smartphone cannot judge one’s spending capacity; rather, it is a tool for survival for have- not Indians who are willing to compromise on other luxuries (such as branded clothes and a restaurant meal) to use the internet.

In India, nearly 60% of internet consumers do not access the internet more than one time a day. These individuals are not Internet consumers; rather, they are Internet customers who use it as a utility with an emphasis on data consumption.

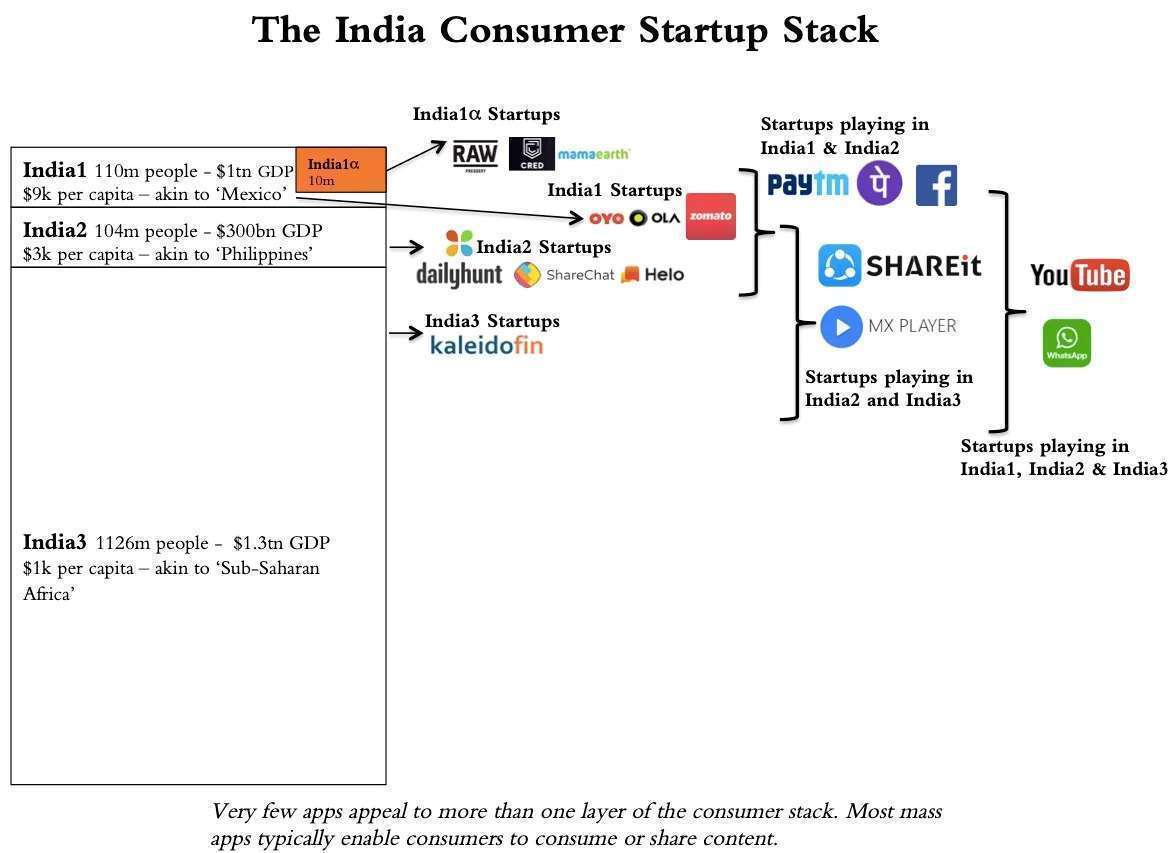

How Most Startups Today Cater To India 1

India 2 and India 3 can only use those tech startup platforms that do not have a paid service model. These include YouTube, WhatsApp, other messenger platforms, and Instagram.

The avocado startups that we see emerging, such as Cred, Uber, Ola, Nykaa, Myntra, Zomato, Swiggy, Oyo, etc., are all for India 1 consumers primarily.

Let’s understand this with the help of an example – Zomato. It is a food delivery service startup through which people can order food from their favorite restaurants from the convenience of their homes and offices. Even though, Zomato provides discount coupons, it is still largely servicing India 1.

The cost of a meal for two people is a minimum of Rs 300 from any restaurant listed on Zomato. On a good day, if you manage to get a big discount coupon, you may get something for Rs 200. Even by scraping the barrel, Rs 1500 is the monthly expenditure on Zomato if someone orders even just five times a month for two people.

While this can be done easily by India 1 consumers, can a person earning Rs 15,000 a month afford to use Zomato often?

The same concept applies to the rest of the startups.

This shows that the money that these startups are burning to acquire users is not even their true long-term users. These are the people who might get attracted to the platform once through lucrative discounts but would never use the platform again (except on a few occasions).

Hence, burning investors’ money for user acquisition is a flawed strategy, as many of these startup founders are now realizing.

Indian consumers are very price-sensitive. Food inflation can burn holes in their pockets, causing them to adjust their monthly budgets and make expenditure cuts. In such a case, only a few people can actually afford the services of these avocado startups.