The Shocking Decline of Ola Electric Shares: Can the Company Survive the Turmoil?

Ola Electric, once seen as a promising entrant in India’s electric vehicle (EV) market, has recently experienced a sharp decline in its share price. The stock has fallen by more than 28% since its peak following the company’s August listing. This decline was partly triggered by the end of the lock-in period for anchor investors, leading to a surge in sell-offs. However, the drop in stock value isn’t just a result of this investor activity; it is also rooted in broader concerns about the Indian EV market and Ola Electric’s business model.

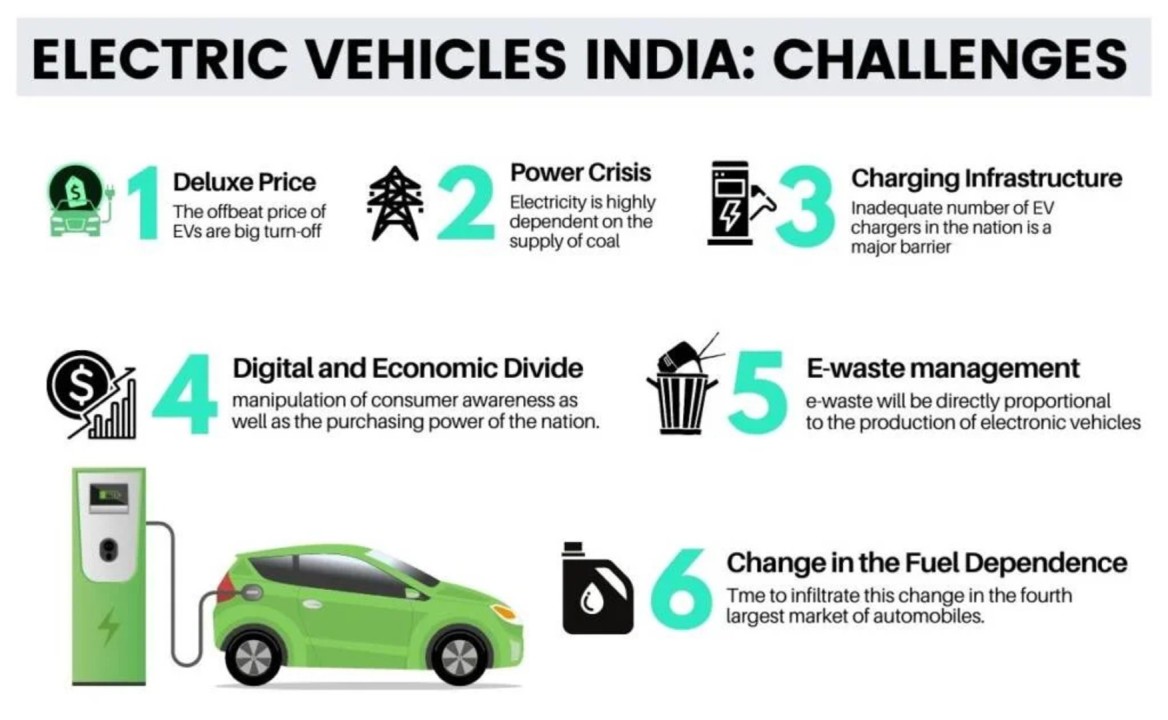

The Challenges of India’s EV Market

The Indian EV market, although growing, is still in its nascent stage. Ambit Capital has pointed out that Ola Electric’s market share, which stood at 35% in FY24, is projected to decline to 27.5% by FY29 and further to 25% by FY31. This anticipated decline is primarily due to the expected entry of major automotive players like Honda and Suzuki into the electric two-wheeler (e-2W) market by the end of FY25. Their entry is expected to intensify competition, putting pressure on Ola Electric’s ability to maintain its dominance

However, there are deeper issues rooted in the Indian context that exacerbate the challenges faced by electric vehicle manufacturers. Even today, more than 80% of rural India lacks consistent access to electricity. In many parts of the country, especially in remote areas, people still face power cuts lasting 15-18 hours a day. This scarcity of reliable electricity not only affects daily life but also raises serious questions about the feasibility of adopting electric vehicles in such regions. If basic agricultural activities are disrupted due to insufficient power supply, expecting a seamless transition to EVs that rely on regular charging becomes unrealistic.

Practical Challenges in EV Adoption

Electric vehicles, including those manufactured by Ola Electric, require substantial charging time. On average, it takes about 4-5 hours to fully charge an electric car. For long-distance travelers, this poses a significant inconvenience. For example, consider someone driving from Delhi to Dehradun—a journey that typically takes 4-5 hours. With an electric vehicle, this travel time could potentially double, considering the need for charging stops. In such scenarios, the practicality of using electric vehicles diminishes, especially in a country where long road journeys are common and the infrastructure for quick charging is not yet widespread.

Moreover, electric vehicles are often criticized for their relatively lower power output compared to traditional petrol or diesel cars. Many Indian consumers prefer vehicles with high power and torque, especially in regions with rugged terrains. The current generation of electric vehicles, despite advancements, may not fully meet these expectations, further limiting their appeal to the average Indian consumer.

Cost and Safety Concerns

The initial cost of electric vehicles remains high, largely due to the expensive battery, which accounts for almost 80% of the vehicle’s total cost. Additionally, these batteries typically need to be replaced every 4-5 years, adding to the long-term cost of ownership. Despite government efforts to promote EVs through subsidies, many of these incentives have been reduced recently, impacting both manufacturers and buyers. The reduction in subsidies increases the cost burden on consumers, making electric vehicles a less attractive option for price-sensitive markets like India.

Safety concerns also loom large over the EV industry. Electric vehicles, including those from Ola Electric, have been reported to catch fire or face short-circuit issues. Over the past five years, there have been numerous incidents where electric vehicles, particularly electric scooters, have caught fire. Ola Electric has been frequently cited in these reports, raising serious concerns about the quality and safety standards of its products.

Notable Safety Incidents Involving Ola Electric

- Ola S1 Pro Electric Scooter Fire Incident in Raipur, Chhattisgarh: An Ola electric scooter caught fire while being charged overnight, resulting in the destruction of a two-story building and injuries to the occupants.

- Showroom Fire in Karnataka: A dissatisfied customer set an Ola electric scooter showroom on fire following a dispute over his faulty vehicle.

- Fire Incident in Thiruvananthapuram, Kerala: An Ola electric scooter worth ₹149,000 reportedly caught fire, causing public outrage and safety concerns.

- Adarsha Nagar Incident: A brand-new Ola S1 Pro Gen2 electric scooter caught fire, leaving two people hospitalized in Nelamangala, Karnataka.

- Jabalpur Highway Fire: An Ola electric scooter burst into flames on a highway, sparking renewed concerns about the safety of electric vehicles.

These incidents have not only resulted in property damage and injuries but have also severely impacted public trust in Ola Electric. The company has had to recall 1,441 e-scooters in response to these repeated fire incidents, further denting its reputation. Despite these efforts, the damage to the brand’s image seems significant, as customer frustration continues to be visible, with instances of public protests and showroom attacks reported in the media.

Leadership and Strategic Focus

Another factor that may be contributing to Ola Electric‘s current predicament is the strategic approach of its founder, Bhavish Aggarwal. While Aggarwal is recognized for his ambitious vision, his focus has often been criticized as scattered. Ola Electric is not his first venture; he also founded Ola Cabs in 2010. Despite operating for nearly 14 years, Ola Cabs is yet to turn a profit, raising questions about the long-term sustainability and focus of his ventures.

Aggarwal has been known to venture into new projects frequently, sometimes driven by a sense of competition or even retaliation against major companies. This approach, while potentially innovative, might have led to a lack of focus on improving existing systems and addressing critical issues within Ola Electric. Instead of concentrating on perfecting the current offerings, the company has been seen launching new projects. This strategy might be diverting attention and resources away from solving the pressing problems that could make the existing products more reliable and customer-friendly.

Financial Performance and Market Outlook

Ola Electric’s financial performance has also played a role in the stock’s decline. The company reported a consolidated net loss of ₹347 crore for the quarter ending June 30, 2024, marking a nearly 30% increase in losses compared to the same period in the previous year. While revenue from operations increased by 32.3% to ₹1,644 crore, the expanding losses have raised alarms among investors. The company’s high capital expenditure to maintain its competitive edge and market share, coupled with the reduced government subsidies, has contributed to these financial strains

While analysts acknowledge that Ola Electric has a unique position in the Indian market by manufacturing key components like motors, battery management systems (BMS), and lithium-ion cells in-house, they also point out that maintaining this competitive edge will require significant capital investment. The company’s ability to become EBITDA positive is anticipated only by FY27, with tight margins expected to persist. As production-linked incentives phase out, this financial pressure is likely to increase.

Conclusion

The decline in Ola Electric‘s share price is a multifaceted issue, reflecting both the broader challenges of the Indian EV market and specific concerns related to the company’s business model, leadership, and product safety. India’s EV market is still in its infancy, struggling with infrastructure challenges like inconsistent electricity supply, long charging times, and high costs. Safety incidents and leadership strategies have further complicated Ola Electric’s position, leading to a loss of public trust and investor confidence. As competition intensifies with the entry of established automotive players, Ola Electric faces the critical task of not only retaining its market share but also addressing the pressing issues that threaten its long-term sustainability.

For Ola Electric to navigate through these challenges, it will need to focus on improving product safety, addressing customer concerns, and building a more resilient business model. Whether it can achieve these objectives in the face of stiff competition and infrastructural challenges will determine its future in India’s evolving EV landscape.