NMDC Steel: A Narrative Of People, Politics And Privatization!

The government owns 60.79 per cent of NMDC Steel Ltd (NSL), formed after NMDC, India's largest iron ore producer, was demerged.

According to sources, the government would likely accept financial bids for privatising NMDC Steel only once the blast furnace at the company’s steel factory in Chhattisgarh is commissioned. Officials anticipate the company’s worth will increase once the steel plant’s blast furnace is operational. The approval to the demerger of the Nagarnar steel manufacturing unit from NMDC and strategic disinvestment of the resulting entity by selling the entire stake of the central government will not only unlock wealth for NMDC shareholders. However, it will also greatly enhance NMDC’s return profile now that the big-ticket item has been removed from its balance sheet.

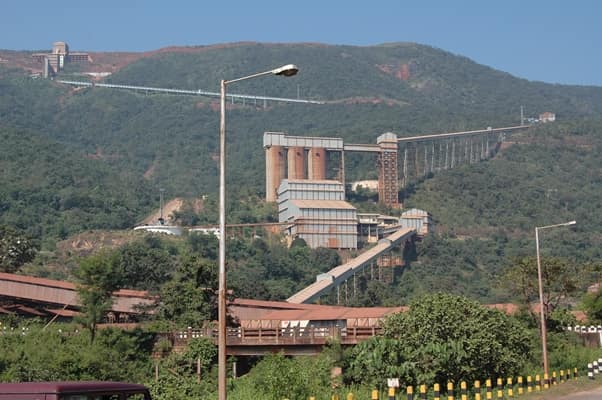

NSL’s annual output capacity is projected to be 3 million tonnes. The government owns 60.79 per cent of NMDC Steel Ltd (NSL), formed after NMDC, India’s largest iron ore producer, was demerged. Nagarnar, Chhattisgarh, is the site of the facility. The public owns the remaining 39.21% interest.

The government aims to sell 50.79% of its investment in NSL and managerial control. The government has received many preliminary offers or indications of interest for the corporation. According to officials, the government will learn the fair worth of NSL after the blast furnace, the core of a steel factory is commissioned and production begins. Financial bids would be solicited once investors had trust in the company’s true potential.

NMDC Steel, which debuted on the markets in February of this year for Rs 30.25 per share, is trading at roughly Rs 42 per share. The government would get around Rs 6,500 crore based on current market prices to sell a 50.79 per cent share.

The CCEA approved ‘in-principle’ permission in October 2020 to demerger the Nagarnar steel production unit from NMDC and strategic disinvestment of the emerging firm by selling the Government of India’s whole interest. Following that, on December 1, 2022, the government requested bids for a 50.79 per cent interest in NSL. After the strategic buyer for 50.79 per cent of the share is chosen, the government will offer the remaining 10% stake to NMDC.

NSL’s privatisation is planned to be completed during the current fiscal year. The current fiscal year’s budgeted disinvestment aim is Rs 51,000 crore, of which the government has already earned Rs 4,235 crore from minority share sales in PSUs.

The bidders’ qualification.

Only potential bidders who meet the eligibility conditions will be allowed to move to the next transaction stage, which includes thorough due diligence and financial offer submission. Nonetheless, the strategic sale is expected to fetch significantly more than the market share price in the competitive bidding process, including some of the largest local and worldwide steel makers.

The health of NMDC.

NMDC has invested over Rs 22,000 crore in the new facility’s development. Excavation, concreting, structural construction, and equipment supply have advanced significantly. There may be some negatives, such as disruption due to unrest in the Chhattisgarh region and regulatory uncertainty due to increased royalty demand from state governments.

The iron-ore business remains enticing because NMDC’s mines provide high-grade, low-impurity iron-ore, which, when paired with favourable geological conditions, makes them among the lowest cash-cost mines in the world. At the current production rate, NMDC’s reserves can last 40 years, while new drilling might provide more enormous reserves. Furthermore, NMDC’s large foray into the pellet market would act as a natural hedge against fluctuations in its iron-ore sales volume caused by industry cyclicality. The oligopolistic structure would also benefit NMDC, given that most of the world’s high-grade seaborne iron ore is supplied by a few businesses, mainly from Australia and Brazil.

The concept of privatisation.

NMDC Steel’s stock price has risen since the demerger of its steel segment, and it is expected that the company will be able to cut its capital intensity and boost its dividend payout ratio.

India without politics is impossible; the same goes for NMDC- Introducing the NMDC region’s politics.

In 2000, NMDC envisioned a steel factory capable of producing 3 million tonnes of steel per year in the newly formed state of Chhattisgarh. Despite strong tribal resistance, the government persuaded them to support the project by promising employment and a super speciality hospital, sports complex and schools. Tribals contributed around 1,996 acres for the steel factory, another 21.68 acres for the super specialised hospital, and 50 acres for the sports facility. Individuals whose land was taken over for the steel mill were promised work at the plant, which is set to open soon.

Promises that were broken.

On the other side, the tribals are outraged since the promises of the hospital and sports facilities remain primarily on paper, some 20 years after the project was initiated. Mahender John, a tribal member whose property was seized and now works at the facility, alleges the government deceived the tribes. They seized land from tribals while placing the PSU (NMDC) front and Centre. Tribals are anxious about how they will maintain their jobs now that the government is privatising this. The property was purchased from tribals in two stages: 996 acres from 303 farmers in 2001 and about 1,000 acres from 1,154 farmers in 2010.

While tribals report that compensation in the first phase was pitiful, at around ‘19,000 per acre (with just one farmer receiving ‘1 lakh per acre), the second phase saw “acceptable” remuneration ranging from ‘9.5 lacks to ‘13.5 lacks per acre. “The land was purchased in both stages,” says one of the tribals, adding that this property was seized from tribals with unrealistic promises of government jobs, a super speciality hospital, a school, and a sports stadium.

Politics on a tribal scale.

The emotionally fraught topic has now acquired political dimensions. The BJP and the Congress have both shown an interest in selling the government’s 50.79% stake in the ‘20,000 crore facility. Seeing that the Centre’s decision may backfire on the state BJP, former Legislator Santosh Bafna has made the construction of a super speciality hospital the main issue, organising a rally from the proposed hospital site in Kopaguda to the steel factory on December 26.

The tribals, a reliable Congress voting bank, had remained mute because the state government promised to acquire the plant if the Centre sold it. The matter sparked tribal uproar in the House even before he assumed office in 2018.

In 2016, the party organised a 20-kilometre padayatra from Nagarnar to Jagdalpur to show support for tribals and to oppose the decision to disinvest. However, the state government is not authorised by the DIPAM disinvestment process. However, Lakheshwar Baghel, a Bastar Legislator for the Congress, has set a January 26, 2023, deadline for the Centre to complete its commitment to a hospital and schools, or it would stop transporting iron ore from Bastar to the rest of the country.

Disclosure.

Let’s see where the story of the NMDC steel factory, which focuses on privatisation and politics, goes.