What is a mutual fund?

Mutual funds is an investment collected by the investor for the purpose to invest in securities like shares, bonds, money market instruments, etc. These funds are allocated by professional money managers and they attempt to make maximum profit out of the capital gains of the investor’s fund.

In India, more than 63 mutual funds are operating. These are the popular mutual fund investment

- Kotak mutual fund

- Tata mutual fund

- HDFC mutual fund

- Birla Sun Life mutual fund

- Alliance capital mutual fund

- Pioneer ITI mutual fund

- Canbank mutual fund

- Standard Chartered mutual fund

- Templeton in India income fund

- Sundaram mutual fund

What are the types of Mutual Funds Scheme?

Mutual funds have laid down various investing schemes to attract investors. Mutual Funds are broadly classified into 2 categories that are open-ended scheme and close-ended scheme.

(a) Open-ended scheme:- Under this scheme one cast invest or redeem, enter or exit any time in the market. There is no fixed maturity date under this scheme.

(b) Closed-ended scheme:- Under this scheme funds are redeemed only after the fixed maturity date. In a closed-ended scheme, investors can only enter or invest at an initial period known as the New fund offer (NFO) period.

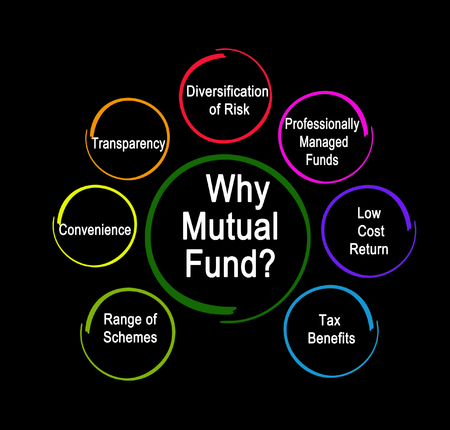

What are the benefits of investing in a mutual fund?

- Professional management:- Mutual funds are managed by professionals in the field of finance, business, and management. The frame systematic investment policy for a mutual fund. They take care that the investments are safe and profit-generating.

- Tax benefits:- Tax benefits are provided by the government to the Mutual Fund investors under section 80L of income tax. There is an additional benefit of tax relief for mutual fund investors this tax benefit relates to the income they earn through such investment.

- Benefits of profitable investment:- An investment in mutual funds is also known as reasonable and a profitable investments. The basic work of a mutual fund is to collect a small amount from investors and pool those funds into profitable investments.

- Liquidity to the investment:- Mutual fund provides an open-ended scheme to the investor. Under this scheme, the investor can sell the unit of shares in the market to recover his investment. Both purchase and sell facility is provided in the mutual fund.

- Assured allotment:- All applications made to the purchase of mutual funds are usually allotted to all the investors. This idea reduces the burden on the part of investors. On the loss of interest, application money is also provided.

- Effective Regulations:- Mutual fund operates under the guidelines of SEBI and also under the Government of India. It has to report is all the actions to RBI from time to time. There is supervision and control over the functions of mutual funds this makes this investment safe and secure

- Diversified portfolio:- Since the funds are invested in various companies it makes the portfolio diversified and profitable. If one investment occurs losses then it could be compensated through the profit-making companies.

What is the limitation of investment in mutual funds?

- Since the investment policies are framed by the trustees of mutual funds investors have no direct access to their investments

- Mutual fund investors are likely to face difficulties if their funds are not managed appropriately. And investment in mutual funds becomes risky if the rate of return goes down.

- The profit of mutual funds depends upon the profit-generating skills of the mutual fund manager.

- There has been a vast difference in the expectations and the actual returns on investments of mutual funds. Since there is a rise in mutual fund return expectations it has been difficult for the managers to meet the expectations of the market.

- An investor is likely to face loss if there is a mismanagement of mutual funds because the future profit of the investor depends upon the future of the mutual fund.