March 24th, 2020: A Half Decade After, Life Had Come A Full Circle!

India at March 24,2025: A half decade and life had come a full circle!

Do you recall March 24th, 2020; that fateful spring evening when 1.38 billion Indians collectively held their breath as PM Narendra Modi declared a lockdown across the country? “Jaan hai toh jahaan hai,” he declared, and our unruly country came to a standstill. Fast-forward to March 24, 2025, and here we are, purportedly pandemic-free and yet more restricted than ever!

It is 5 years since COVID changed our lives. The virus may have become lighter now, but its effects still hang in our economy, society, and our psyche. On this significant date, we should sit back and question ourselves: Have we learned anything at all? Or are we simply doing things differently?

The Imposed Lockdown; A Journey From An External Force to Self Choice!

When COVID-19 came, it kept us all inside. Overnight, our homes were everything; they were our offices, schools, gyms, and movie theaters all at once. We didn’t have a choice; we needed to stay safe. The streets were empty, stores ran out of products, and we needed to adapt to it without the luxuries we had before the pandemic. Do you remember whipping up dalgona coffee and banana bread? When “Work From Home” was a new novelty shift instead of a normal way of life?

But once the pandemic ended, something peculiar happened. Freed from our forced confinement, we opted to remain indoors, this time for yet another reason: the tempting idea of instant gratification. The irony is clear to see—we complained loudly about being locked indoors in lockdown, yet we opted to lock ourselves in afterwards.

Rather than walking out to malls, gyms, or restaurants, we have everything brought to us now. The grocery comes to our doorsteps in 10 minutes or so.

- Hungry for dinner? Swiggy and Zomato come to the rescue.

- Want to watch a movie? Netflix, Prime, and Hotstar bring the movie to you.

- Even talking to friends has gone online, with rapid texts, tweets, and Instagram reels replacing the slow, deep face-to-face conversations we once had.

It is like what great thinker Acharya Chanakya would say if he were alive today: “A man who cannot control his desires becomes a slave to them.” Our desires have merely changed—from actual experience in the world to the immediate pleasure of instant gratification.

See how the terrain has changed: Blinkit and Zepto bring groceries in under 10 minutes. Dunzo will bring you anything your heart craves. Tinder and Bumble reduced love to a swipe. Food ordering platforms have proliferated, with even the chai-wala in your own locality on some app or the other. We’ve substituted the tactile joy of wandering through books at Crossword with the clinical ease of Kindle downloads.

It’s not convenience; there’s a rush to having what we want, when we want it, with minimal effort. But with this desire for speed and instant gratification, we’ve isolated ourselves!

By opting to have it now instead of earning it, we’ve isolated ourselves.

We’re not locked down due to a virus, but a lifestyle that has us indoors, staring at screens, waiting for our next fix, and become the couch potato!

As the world continues to move, we remain indoors trading community and connection for the fleeting rush of a notification or a delivery. The lockdown we were forced to endure taught us how to survive; the lockdown we opted for is teaching us how quickly we can get into the habit of convenience that distracts from the richness of real-life experiences. Do you remember when we used to actually speak to our neighbors? When we’d bump into friends at the market? When we’d discover new restaurants by exploring within our neighborhoods?

As the old proverb goes, “Convenience is the enemy of resilience.” We’ve become so accustomed to the convenience of our virtual lives that the prospect of venturing into the real world—with all its unpredictability and rough edges—appears increasingly daunting. It seems the pandemic imposed lockdown forced us to create self imposed lockdown giving birth to the situation where “Life has come a full circle”!

The Wealth Divide: We Laughed at Their Mismatched Dances, and They Laughed at Our Bank Accounts!

Since 2020, inequality has increased. The richest 1% of the world now take an even greater share of national incomes than they did before the pandemic. The pandemic, far from being the “great equalizer” that some had hoped it would be, has made the rich richer and put the vulnerable in a place of greater poverty.

The Ambanis had hosted a grand wedding of Anant Ambani at a mind-boggling expense of INR 5000 crore, complete with Rihanna performing at the wedding and Rolls Royces made to order. Barely a week after the splurge, Reliance was retrenching employees for “restructuring.” Similar was corporate India: the unacademy Founder made layoffs announcements while sporting a T-shirt worth INR 33,000, and Byju’s experienced a steep rise and fall resulting in thousands of layoffs, while its founder lived a lifestyle that would make even the Maharajas envious.

Do you remember PhonePe moving to India from Singapore, supposedly for patriotic reasons? But they let go of more than 700 employees within months. And then there’s Paytm, where the employees’ shares lost almost all their value while its founder kept living a lavish lifestyle. Even well-established companies were not safe—Wipro and Infosys also laid off workers while their leaders received record paychecks.

These paradoxes remind one of Marie Antoinette’s infamous phrase, “let them eat cake.” It’s as if today’s wealthy businesspeople are crying, “Let them watch our Instagram Stories” while taking away their livelihoods.

The problem is not just with big companies in India. Politicians reside in big, spacious houses while they make promises of low-cost housing schemes that never materialize. Movie stars speak of doing good to society from their very costly vehicles. Cricket players sign contracts worth more than all women’s leagues make in a year.

As the Hindi proverb states, “If a person has no one, they have God”—but now it is more accurate to say, “If a person has no one, they have LinkedIn,” for unemployed laborers try to network with others in hopes to find work again.

Following COVID, it appears that companies here are embracing conspicuous consumption like never before! Same firms that proudly displayed black boxes for #BlackLivesMatter and rainbow logos for Pride Month readily downsized when profit declined. The same startups with their “family culture” to boast of in hiring practices sent workers packing during hard times, as if they were expendables. Life, as it appears, has come full circle!

From Fun to Financial Loss: We Have Redefined the Definition of Fantasy (League)!

The last half-decade has changed everything regarding the way money systems are dealt with by individuals, businesses, and whole economies. We’ve witnessed a huge increase in online interaction, and this has changed the way in which financial influence is built and wielded.

This rapid expansion, primarily driven by the surge in apps, has opened new opportunities but also introduced large risks, a lot of which have become extremely obvious in the long run. The app economy—the vast universe of mobile apps that facilitate things like rapid stock trades and immediate loans—rapidly made it simple for individuals to tap into financial markets.

- Do you remember when investing required you to visit a broker personally or phoning them up?

- When borrowing a loan involved filling out a lot of forms and waiting for weeks for it to be approved?

Those were the dark ages, like dial-up internet, it appears. Now, apps like Groww, Zerodha, and Angel One make trading in stocks as simple as ordering food. Apps like Cred, LazyPay, and KreditBee offer loans quicker than you can cook Maggi noodles.

This new exposure created a tremendous amount of activity that was outside the boundaries of the previous trading floors, where millions of people were able to engage in financial speculation with their cell phones. While this revolution was hailed as a victory of technology over the limitations of the past in finance, it also created habits that most now think are unsustainable.

The simplicity of access attracted new speculators, often with only a phone and a fear of missing out (FOMO). This contributed to more volatility in the markets and an increase in risky short-term trading. From the GameStop phenomenon through to the instability of cryptocurrency, we’ve seen how group activity on the net can make and lose money instantly.

India also experienced these trends. Do you recall when everyone was a crypto expert? When your uncle was discussing blockchain at your family functions? When students were skipping classes to view “technical analysis” videos on YouTube? When your barber, Uber driver, and everyone in between was spewing investment tips?

Madhabi Puri Buch, the first female chairperson of SEBI, and the then SEBI chief had done many things to manage the situation. She and her team did a lot to keep a close eye on the market. They issued rules on “Finfluencers” and limited F&O Trading to help new investors. However, we do not know how many IPOs were floated during her time and how that helped, or damaged the common investors!

If we consider the case of Zomato, Paytm, and Nykaa—businesses which entered the market with great hype but subsequently watched their shares decline—an issue is raised. Were regular investors simply made the “bakra” (scapegoat) in a complex game by venture capitalists seeking an exit?

These issues were exacerbated by platforms that blurred investing and gambling. Commission-free trading apps, for example, made stock market trading a game, with individuals trading constantly without understanding the risks. The colorful graphics, cheerful notifications, and easy charts made large money decisions look like Candy Crush.

Meanwhile, fantasy sports platforms such as Dream11 and MPL turned every cricket match into an opportunity to bet. What was initially a source of entertainment turned into a serious addiction for most, resulting in huge money issues. There are countless stories of individuals losing all their savings on these platforms, yet they continue to perform well, even sponsoring the sports they are betting on.

The result of this financial turmoil was a great deal of borrowing and purchases that could not be sustained, usually financed by high-interest loans extended through these apps. The “Buy Now, Pay Later” phenomenon, spearheaded by players such as LazyPay, Simpl, and Amazon Pay Later, made it appear cheaper, getting individuals to purchase goods they could not otherwise afford.

This cycle of easy loans and wild investing made people feel financially strong, but it also put many users at risk of big losses. This new financial strength was not always a means of accumulating wealth; for many, it was a trap that resulted in too much debt and financial anxiety. The increase in credit card debt and many individuals in this predicament is evidence of this.

As they say, “There is risk in the market,” maybe we should add, “You have an addiction.”

In retrospect, the past five years have seen the double-edged consequences of digital financial inclusion. The app economy and emerging trends such as Buy Now, Pay Later provided individuals with new access and opportunity, but at the same time they introduced risk and detrimental behavior.

This era of swift digital participation showed us that we need a considered and well-educated strategy for handling financial innovation. We must balance making it easy to use with being responsible, and creating opportunity with proper regulation. As markets change in this digital age, the lessons of the last five years should serve to remind us that while financial power is more readily available, it must be exercised carefully and with an awareness of long-term implications.

The shifts in consumer consumption instigated by this generation and propelled by inflation are what we are having a hard time coping with—and most likely will keep having a hard time coping with, for decades to come. Gandhiji would most probably say today, if he were with us, “There is enough in the world for everyone’s need, but not for everyone’s greed—especially greed based on algorithmic recommendations and single-click purchasing.” From “Learning How To Use Financial Tools” to “Falling Prey To Financial Tools”, Life, as it seems, has come full circle!

From Interest Rates to Intensified Distress: We Learned to Manage Stress!

In the meantime, following heavy borrowing by governments to protect jobs and welfare of people, government debt across the world increased 12% from 2020, with bigger rises in emerging markets. Central banks have been reacting by raising interest rates to fight back. While the US and Europe started reducing rates last year, India only started reducing them last month.

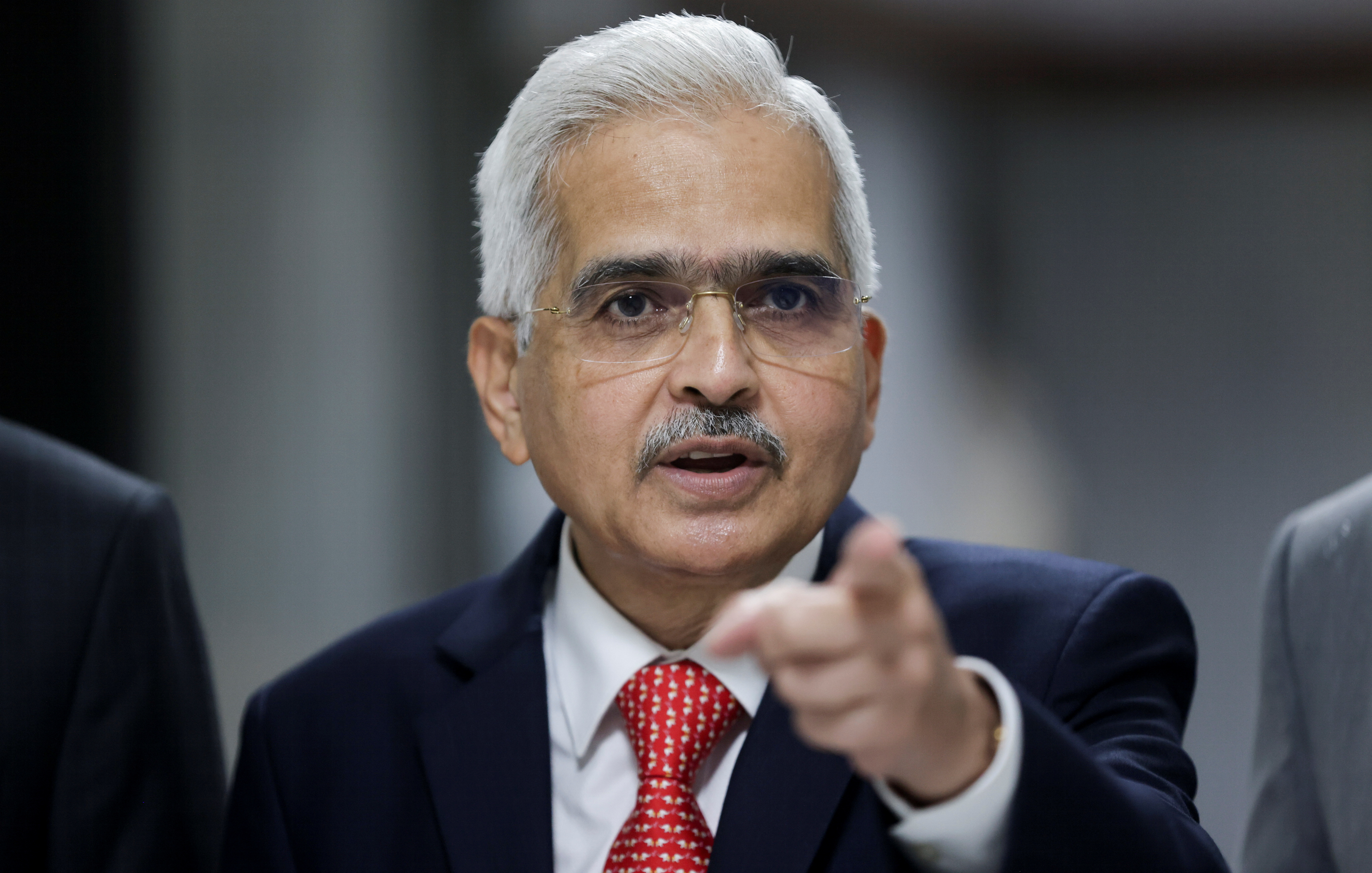

The RBI Governor at that time, Shaktikanta Das, was careful in handling this situation. He managed interest rates, helped the economy, and taught banks about bad banking practices. He deserves praise for guiding banking into a new age.

- Do you remember how he stood firm against Kotak Mahindra Bank’s ongoing technology problems?

- Or how he questioned HDFC Bank’s loan processing methods? When he told public sector banks to stop depending on government help and improve their practices?

Das behaved like the strict teacher we all had at school. He made us do our homework and also stood up for us when the situation demanded. In leadership, the RBI was in a precarious balance. It prevented economic meltdown and inflation at a very challenging period in recent financial history.

Intriguingly, India faces the unique challenge of reducing interest rates without precipitating another bout of debt and borrowing. It’s a bit like offering liquor at a party where half the guests are recovering alcoholics—you want them to enjoy themselves, but you don’t want to trigger a relapse.

We are still being propelled by the strong market years of the last couple of years, specifically the buying mania after COVID, which started to ease last year. However, the majority think that spending fueled by loans and financial market appreciation will continue—especially younger workers who entered the workforce in the last five or six years.

Talking about the new folks, the Gen Z, that entered the workforce in the last handful of years, people have a plethora of mixed emotions about the courtesy and laziness of these young fellas. From drawing boundaries between personal and professional domains to diluting the areas of professional courtesy, these young folks emerged as a dicey form of human beings.

On one side, you have 60-year-old corporate leaders griping that “these kids don’t want to work hard,” and on the other, you have 25-year-olds firing back that working 14-hour days for pennies isn’t exactly a square deal. The generational war has been a daily soap opera unfolding across LinkedIn posts and Twitter threads.

Do you recall when Infosys founder Narayana Murthy suggested that Indian youth need to work 70 hours a week? A huge number of people took to action and responded adversely to the suggestion. Gen Z contended that billionaires who had earned their wealth by working for long hours may not be the best people to advise on work-life balance.

When L&T Chairperson Mr. Subramanium spoke highly of long working hours, young workers rolled their eyes in response because they care more about mental well-being and quality of life than working hard for the company. On the contrary, individuals such as Swiggy CEO Rohit Kapoor and Namita Thapar, Executive Director of Emcure Pharmaceuticals, spoke freely about the need for a healthy work-life balance and working late hours for the job.

It is like watching two films running parallel—the older generation views sacrifice and commitment, and the younger generation views exploitation and poor work culture. Somebody needs to remind these corporate warhorses that “Log kya kahenge?” does not work in a generation raised on social media, where public perception changes every fifteen minutes. From blaming Gen Z for their behaviors to embracing their work boundaries, life, it would appear, had come full circle!

From Tax Relief to Hidden Problems: The Myth of Financial Freedom

Adjusting to the pre-COVID economy might not be what everyone wants. I mean, who wouldn’t want to exist in a world where we can simply just spend openly on stocks and pizzas with easy-to-use apps to spend and consume more than we can or ought?

An ascending stock market gives us the illusion that our wealth is increasing, even though incomes have not increased much in the last few years. But tax exemption on annual income of up to INR 12 lakh was good news. The middle class was thrilled, WhatsApp groups were filled with congratulatory messages, and memes took over social media celebrating this surprise benefit.

But while income taxes have been lowered, it still appears that the man on the street is still paying other types of taxes, such as GST and toll taxes. The sleight of hand was perfect—what we saved in income tax, we paid in consumption taxes. Your 18% GST on medical insurance, 5-18% on restaurant bills, and those ubiquitous toll booths growing like mushrooms after the rains have more than made up for any income tax savings.

Do you recall when GST was introduced as “One Nation, One Tax” to simplify things? Now we have several levels of taxation, frequent rate changes, and a complex scenario that might even confuse Einstein. Samosas are taxed differently if they are frozen or freshly prepared. Cinema tickets are taxed at varying GST rates based on their cost. Even puffed rice (murmuri) is taxed differently based on its brand!

The problem became worse when we needed to pay toll for the bad roads. It is like we are being asked to pay for burnt pizza! We are saving on taxes but paying for vadas and popcorn. It looks like money and taxes have come full circle!

As the old Hindi proverb says, “What appears to be is not so, and what is so is not apparent”—what appears is not so, and what is so appears not to be. The government provides but also withdraws, keeping the middle class perpetually stressed but occasionally appeased with little gestures of generosity.

Road Safety and Healthcare: Where Life Is a Gamble

When we talk about roads, we must talk about road safety. On the one hand, we want to make safer vehicles for the driver, but we go ahead and kill two-wheelers and pedestrians. It seems accidents are part of our daily routine, and we have moved from the Pune Porsche accident in 2024 to the Vadodara accident in 2025.

Do you remember when a 17-year-old son of a Pune property developer crashed his Porsche into a bike and killed two people? The outrage raged for a week, then faded, and before you knew it, it was announced that the guy in question was out on bail. And then there was the Vadodara case, when another well-heeled youth from a costly vehicle took more innocent lives. This cycle repeats ad nauseum—anger first, then hashtags, candlelight marches, and then silence until the next.

Our roads have become battlegrounds where might equals right. SUVs bully sedans, sedans intimidate motorcycles, motorcycles terrorize scooters, and everyone bullies pedestrians. It’s social Darwinism with horsepower, playing out daily on our pothole-riddled roads.

The government don’t care about our lives. They are not repairing the potholes, addressing the illegal basements, or penalizing the reckless drivers. The message is clear: you are on your own as far as your safety is concerned, and justice is reserved for the privileged.

From Food lover to food reader: How health perspective changed?

Perhaps we, Indians, have decided to take care of our health by shifting the perception about healthcare. While on one hand, individuals have become food-aware and label-aware, thanks to individuals like Revant Himatsingka (aka Food Pharmer). While on the other hand, the awareness has taken a toll on companies which indulged in false advertisements, not only for food but for cosmetics and Ayurveda as well.

Do you remember when Revant criticized Bournvita for having too much sugar and the company altered its product? Or when he exposed that “sugar-free” foods contained artificial sweeteners that were worse than sugar? His campaign against big food companies earned him a number of followers and some legal threats, but it certainly made people more aware.

The increase in skincare awareness has led consumers to be more cautious when it comes to cosmetic labeling. Businesses that were once able to make such claims as “natural,” “chemical-free,” and “ayurvedic” now have to deal with consumer distrust and regulation. The days of placing a tulsi leaf on a label and calling it “ancient wisdom” are over.

Simultaneously, the health care market is increasingly ruled by the latest advancements in treatments for weight loss, such as Ozempic, and naturally, the companies benefiting from them. The irony is not misplaced—the same players that have marketed us junk and processed foods for decades now will reap the profits from the cure for the very conditions they produced. It seems that if companies cannot sell products by labeling them wrongly, then they will sell something by “products that claim to cut the fat”. So, life seems to have come full circle!

International Relations: When the Criticism Is One-Way

The US, now under the Trump administration, has announced that it is withdrawing from the World Health Organization. It believes the organization did not expect or manage the pandemic. Complying with the friendship of ‘Howdy Modi’, India also appears to be following the same trend of criticism of international organizations in this case.

Our Prime Minister Narendra Modi recently said in a podcast that the UN and international organizations seem irrelevant with the increasing global conflicts. This is the perception of most nations—international organizations are helpful when they are aligned with national interests and troublesome when not.

May be, if the same formula is applied, then should we also denounce Indian rule as they could not manage Manipur, and left it ablaze for more than a year; or condemn them for Nuh and Nagpur violences! For the government, what they utter, if applied to them, looks like their lies’s life has come full circle!

Hypocrisy is transnational. Do you recall Western countries condemning India’s COVID response, only to have their own plans fails months later? Or when world observers were condemning India’s democratic processes while their own nations were grappling with populism, extreme ccommunalism, and political extremism?

As the adage goes, “Those who live in glass houses shouldn’t throw stones,” but the world political arena seems set on building ever taller glass houses and piling ever more massive stones to hurl.

Conclusion: Five Years Later, What Do We Know?

We are half-way through the new decade with a couple of years having passed since COVID, and life seems to have come full circle!

Five years on from that fateful night in March when our lives were forever altered, what have we actually learned? Have we grown stronger, wiser and more compassionate? Or have we merely adapted our same old ways to new circumstances and discovered new means of perpetuating the same disparities and injustice?

The pandemic was supposed to unite us all, a moment when everybody was equally vulnerable that cut across borders, social classes, and castes. It instead exposed our social cleavages further—magnifying existing inequalities as well as generating new ones.

We made healthcare workers heroes but promptly forgot to enhance their working conditions. We understood that delivery workers, sanitation workers, and farmers are crucial but did not really increase their pay or dignity. We saw how vulnerable global supply chains are but did not really change the way we consume.

As we mark this sorrowful 5-year anniversary, the most honest conclusion may be that we have not learned as much as we ought. Our memories are short, our attention is even shorter, and our willingness to embrace big changes is the shortest of all.

But there are silver linings. The pandemic accelerated beneficial developments that would otherwise have taken an extremely long time to occur—like home working, greater use of technology by older people, a greater valuation of public space, and a larger interest in local communities and self-reliance.

As we make our way through this post-pandemic period, the question isn’t if life has returned to the way it began—it has in so many ways—but if we’re trapped running in circles over and over again, or if we can finally break the pattern and discover something new.

Now that we’re shopping for groceries, checking our portfolios, and driving potholes while checking social media, we need to recall an old proverb: “History doesn’t repeat itself, but it often rhymes.” It’s been half a decade since the life in India can be analysed after COVID-19 pandemic, and the trend is beginning to emerge.

Life is back to square one! But perhaps the real test of our wisdom and strength is in our ability to create a new circle.