Kotak Bank fake Twitter account exposed: Is Indian Banking System this Vulnerable to Online Frauds even in 2023?

Kotak Bank's Experience with Online Fraud: Don't Get Trapped in the Twitterverse.

Kotak Bank fake Twitter account exposed: Is Indian Banking System this Vulnerable to Online Frauds even in 2023?

Twitter fake account of Kotak Mahindra Bank leading many to the bait of Online frauds.

It all started back in the 90s when the Indian Banking Sector started climbing steps to get Online. The aim was to provide convenience to its customers and be readily available on online platforms.

During this process, the Indian banking channel faced numerous obstacles, especially those concerned with cybersecurity and online fraud.

By creating awareness and building strong cybersecurity control, banks have done outstanding work under the supervision of the Reserve Bank of India (RBI).

But it seems like Kotak Mahindra Bank is lacking way behind and still not in the race anywhere yet. Such a thing is a real threat to the Indian Economy. As cases of online fraud are on the rise, hackers have incredible ways to fool people around.

How, in such a situation and with so many ways to deal with it, Kotak Mahindra is being so careless?

Do they have infrastructure issues, or are they just avoiding the need of the era concerning their customer’s security?

Well, let’s dive more into the story of Kotak Bank.

Kotak Bank Scam on Twitter!

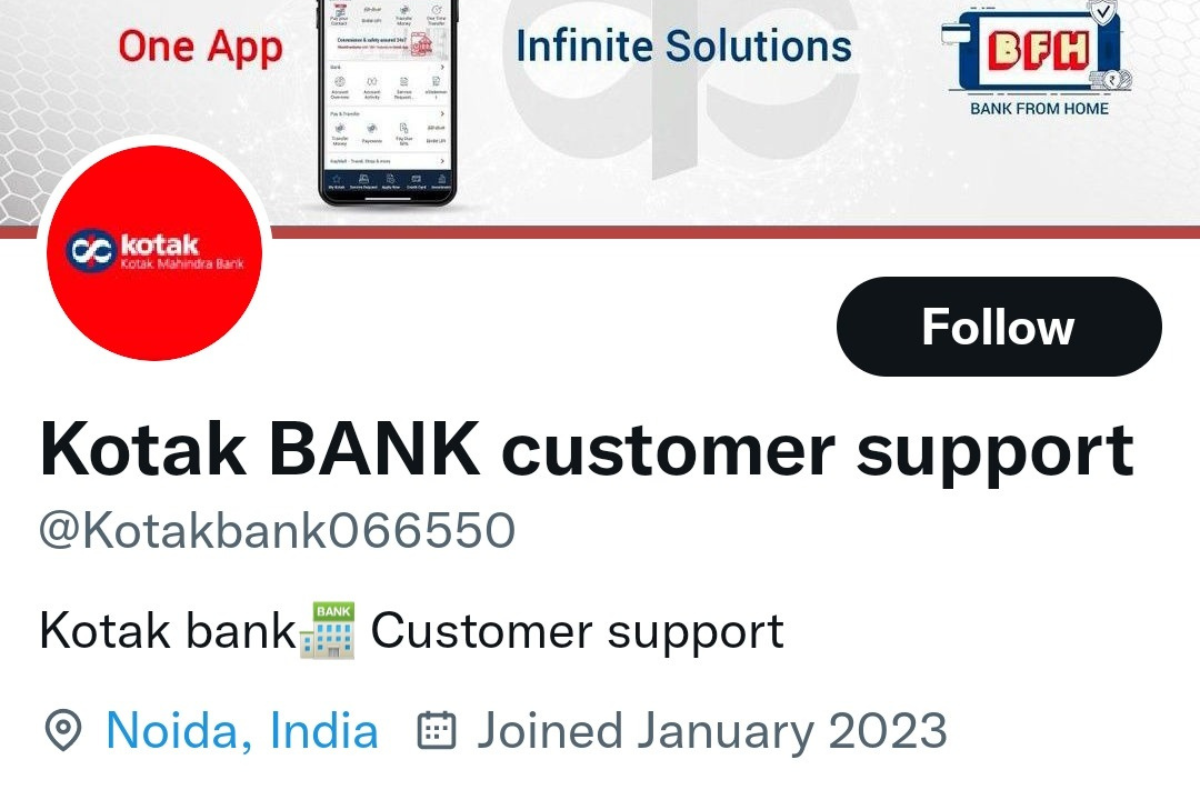

The case includes a fake Twitter handle with the name “Kotak BANK customer support” and id “@Kotakbank066550“, is replying to tweets tagging Kotak Bank.

The person behind this acts as a customer support service agency of Kotak Bank and asks for details a Bank should never ask such as OTP, passwords, PIN or anything else they can extract from you.

Feel like that web series, “Jamtara: Sabka Number Ayega”?

Yes, it is.

And the worst is they are replicating the account as it is, and the Bank has not done anything proactively on the same subject.

Wondering why?

Likewise, maybe they are not yet aware of it. But, then it shows how vulnerable this Bank is that any handle on social networking sites can exploit their customers without them having any idea.

Or are they just lazy enough to take action against it?

Kotak Bank, the vulnerabilities it is showing to the country’s economy and the related adverse effects.

Background of Kotak Mahindra Bank.

It was founded in 1985 by Uday Kotak as just a bill discounting firm. Over the years, it has grown into a full-fledged bank with all financial services under one roof.

Today, it is recognized as a leading private-sector Bank in India.

In 2003, it received a banking licence from the Reserve Bank of India. Its most prominent services are banking and financial products and services to individuals, corporates, and SMEs.

It includes many other services like savings accounts, current accounts, fixed deposits, personal loans, home loans, car loans, credit cards, mutual funds, insurance, and more.

Even after its strong digital presence and offering various online and mobile banking services, there is quite a loophole in cybersecurity by Kotak.

As of 2021, Kotak Mahindra Bank has a network of over 1,600 branches and 2,500 ATMs across 700+ cities and towns in India.

The bank had a market capitalization of over USD 50 billion and is one of the largest banks in India in terms of assets.

Vulnerabilities of Kotak Bank during past years.

During past years, this Bank has been into numerous controversies. They are as follows –

1. In 2010, Insider trading case, the Securities and Exchange Board of India (SEBI) imposed a penalty of Rs. 1.5 crore on Kotak Mahindra Bank for alleged insider trading by some of its employees. The bank had denied any wrongdoing and had challenged the SEBI order in court.

2. In 2016, Alleged fraud by a Senior executive, a senior executive, Ankit Agarwal of Kotak Mahindra Bank was arrested by the Mumbai police for allegedly syphoning off Rs. 2.9 crore from the bank’s accounts. The bank had said that it had detected the fraud and had taken appropriate action.

3. In 2018, Kotak was in three controversies –

(A) Violation of RBI shareholding norms, where the Reserve Bank of India (RBI) had asked the bank’s founder, Uday Kotak, to reduce his stake in the bank from 30% to 20% by December 2018. However, Kotak failed to meet the deadline and was subsequently fined Rs 50 crores by the RBI.

(B) KYC non-compliance, the RBI had imposed a penalty of Rs. 5 crore on Kotak Mahindra Bank for non-compliance with KYC (Know Your Customer) norms. The bank said that it had taken corrective measures to address the issue.

(C) ATM skimming, several customers of Kotak Mahindra Bank reported unauthorised withdrawals from their accounts through ATM skimming. The bank had identified a few ATMs that were compromised ATMs and had taken measures to secure them.

4. In 2019, Mobile banking fraud, a customer of Kotak Mahindra Bank reported a mobile banking fraud where an unknown person had accessed their account and transferred Rs. 1 lakh to another account. The bank had refunded the amount to the customer and had advised them to be cautious while sharing their login credentials.

5. In 2020 –

(A) Alleged money laundering, Kotak Mahindra Bank was accused of money laundering by a whistleblower who had written to the Prime Minister’s Office (PMO) and other regulatory bodies. The bank had denied the allegations and had said that it was fully cooperating with the authorities.

(B) Fake loan offers, Kotak Mahindra Bank has warned its customers about fake loan offers being made in the bank’s name through social media and other channels. The bank advised customers to only apply for loans through the official channels and to be cautious while sharing their personal information.

(6) ln 2021, Malware attack, Kotak Mahindra Bank had detected a malware attack on some of its systems, which had led to unauthorised access to some customer data. The bank had assured customers that no financial loss occurred and taken measures to prevent any further attacks.

Effects it can have on Country’s Economy.

The banking channel is the most critical sector of any economy. Likewise, in India, it is the backbone of the economy, but banks like Kotak Mahindra, can put the economy under real threat.

Some of the significant adverse effects on the Country’s economy are –

1. Loss of Funds: Bank fraud leads to the loss of funds from financial institutions, which can impact their financial stability and ultimately lead to a decline in the country’s economic growth.

2. Reduced trust in financial institutions: Bank fraud erodes the confidence of the public in financial institutions, which can have a ripple effect on the economy. This can lead to a decrease in deposits and investments, slowing down economic growth.

3. Increase in non-performing assets (NPA): Bank frauds result in an increase in non-performing assets (NPAs), which are loans that have become defaulted or are expected to default. This increases the burden on the financial institutions and reduces their ability to lend further, which can hamper economic growth.

4. Decreased foreign investments: Bank fraud can lead to decreased foreign investments, as foreign investors may view it as a sign of an unstable economic environment. This can harm the overall economical growth of the country.

5. Increase in interest rates: Bank frauds can lead to an increase in interest rates as financial institutions try to cover their losses. This can have an adverse effect on the economy as higher interest rates can slow down borrowing and investment.

Conclusion

Kotak Mahindra Bank is impersonated, and there is no action taken on the same. Even if the bank is aware of such a situation or not, that isn’t clear yet.

Well, they must have received complaints from the users.

But why, after the banking sector is the most critical part of the economy, isn’t it concerned about its customers’ security or maybe they are just taking it lightly?