A few years ago, cash was the predominant mode of making purchases in India. Although digital payment options existed, their adoption was restricted to the tech-savvy younger generation. They were considered non-essential and were met with skepticism by a large majority.

The Beginning of Digital Payments

However, the sudden demonetization announced by the Prime Minister of India kick-started India’s tryst with digital payments. Existing private players (already running pre-paid wallet structures) were quick to capitalize on this move.

Cashbacks were deployed every step of the way to ensure maximum market penetration. In fact, a prominent advertisement which most Indians would recall is that of PayTM, a prominent digital payments application, which had a photo of the Indian Prime Minister being used on the front page of most national dailies.

The sudden need for digital payments, as well as a strong advertising campaign, became the two solid supporting pillars of the new Digital India.

Introduction and Growth of UPI

While the wallet infrastructure was gathering steam, Indians were introduced to the concept of the Unified Payments Interface (also known as UPI). UPI enabled the transfer of money directly from their bank accounts to other bank accounts without exchanging sensitive information such as bank account numbers, branch codes, etc.

Much like players in the wallet industry, players offering UPI services also used heavy cashback offers to ensure that the market was penetrated. Players such as Google (whose UPI application was formerly called Tez) started out by giving cashback on a per transaction basis. In some instances, the cashback would be more than the amount of the transaction itself.

The big difference between UPI applications and digital wallets was that UPI directly transferred money from a person’s bank account to another bank account. Whereas wallets required a user to ‘recharge’ their wallet and then transfer the money to the wallet of another user on the same platform.

UPI also eliminated the added step of transferring money from the users’ wallets to bank accounts so the money could be spent at places where a particular wallet was not accepted. Users would also skip paying the minimum fees which they had to pay to transfer funds from their wallets to their bank accounts. Over time these advantages made UPI the most preferred payment method in India, even over the more traditional modes of digital payments such as credit and debit cards.

The Pandemic Impact

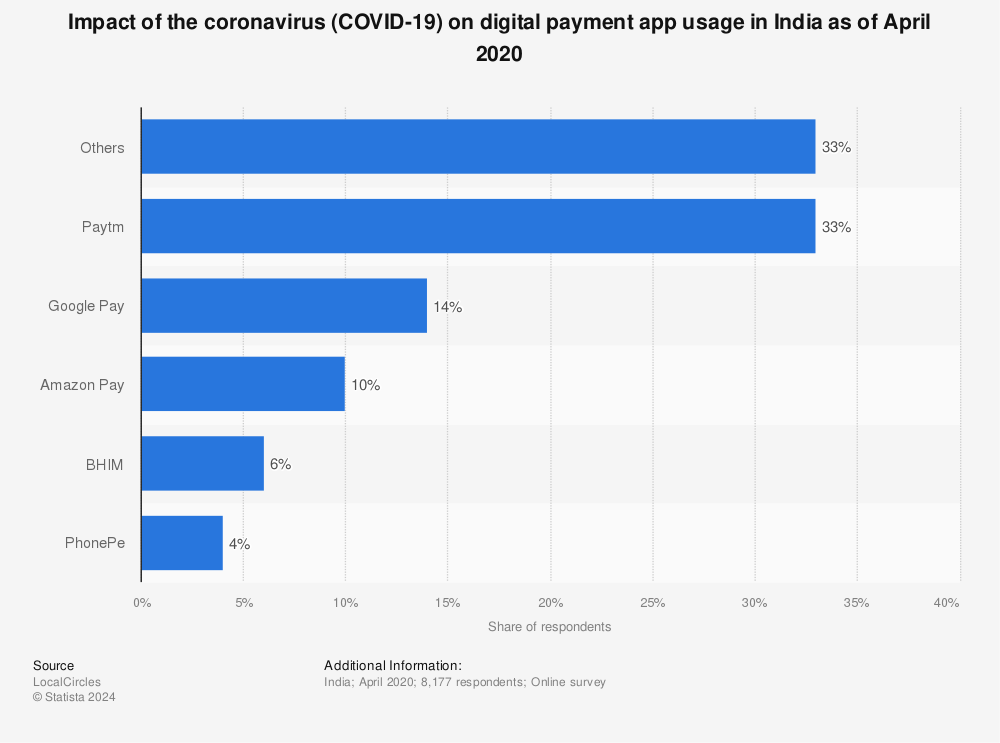

What the demonetization started; the pandemic cemented. Exchanging cash required people to be in close proximity which meant that the COVID-19 virus could easily transmit from one person to the other. Fears loomed over how the transmission could also take place via surfaces including cash. This led to numerous e-commerce companies suspending cash on delivery and allowing users to use the online mode of payment method only.

While such a move gave a big boost to the digital payments industry as a whole, UPI surpassed all other means of digital payments. While UPI took three years to reach a billion transactions in a month, the next billion came in just a year.

One would assume in an economy where cash is inherent and innate, users would look for alternatives wherever cash is acceptable. But this is not what happened. In fact, users embraced the cultural shift. This further boosted the adoption of digital payment methods such as UPI. Numerous industries such as e-learning, online food delivery, online gaming, as well as the use of online lottery websites, etc. also saw a sharp rise in profits despite the pandemic.

Crystal-ball Gazing

Despite UPI’s excellent adoption by the public, it continues to co-dominate the Indian market along with cash. Over time, users are experiencing failing or incomplete UPI transactions, perhaps, due to the mammoth load on the UPI infrastructure.

These problems are aggravated due to the fact that UPI does not have an effective grievance redressal mechanism in place. Only time will tell how the recent notification of the National Payments Corporation of India (also known as NPCI) which requires UPI platforms to limit the number of users on its platform will impact the UPI infrastructure.

Some industry experts have pointed out that UPI has become too big which has resulted in a detriment to competition in the digital payment space. What has been lacking is an equally efficient and effective competitor to UPI. The Reserve Bank of India has proposed to launch a competitor to UPI by the name of ‘New Umbrella Entity’ (also known as NUE). NUEs are envisioned to be non-profit entities run by companies that will set up, manage and operate new payments systems which are expected to compete with NPCI’s UPI.

Taking a cue from the past, it would seem that Indians are in for a déjà vu of another bout of aggressive cashback offers to penetrate the market. But only time will tell whether cashback will be enough of an incentive to make Indians move to another payment ecosystem or will they experience ecosystem fatigue and stay locked in with UPI.