Do you wonder which 2 confidential bank details are strongly needed to receive money?

What bank details are needed to receive money?

If you are approved for loans in the UK, then chances are that the lender is going to need your bank details. After all, they need to know where to send the cash that they are lending you. Thankfully, loans in the UK, including loans for bad credit don’t require all that much in the way of special information. In fact, you will likely have this information to hand anyway.

There are just two pieces of information that you need. These pieces of information are 100% unique to you.

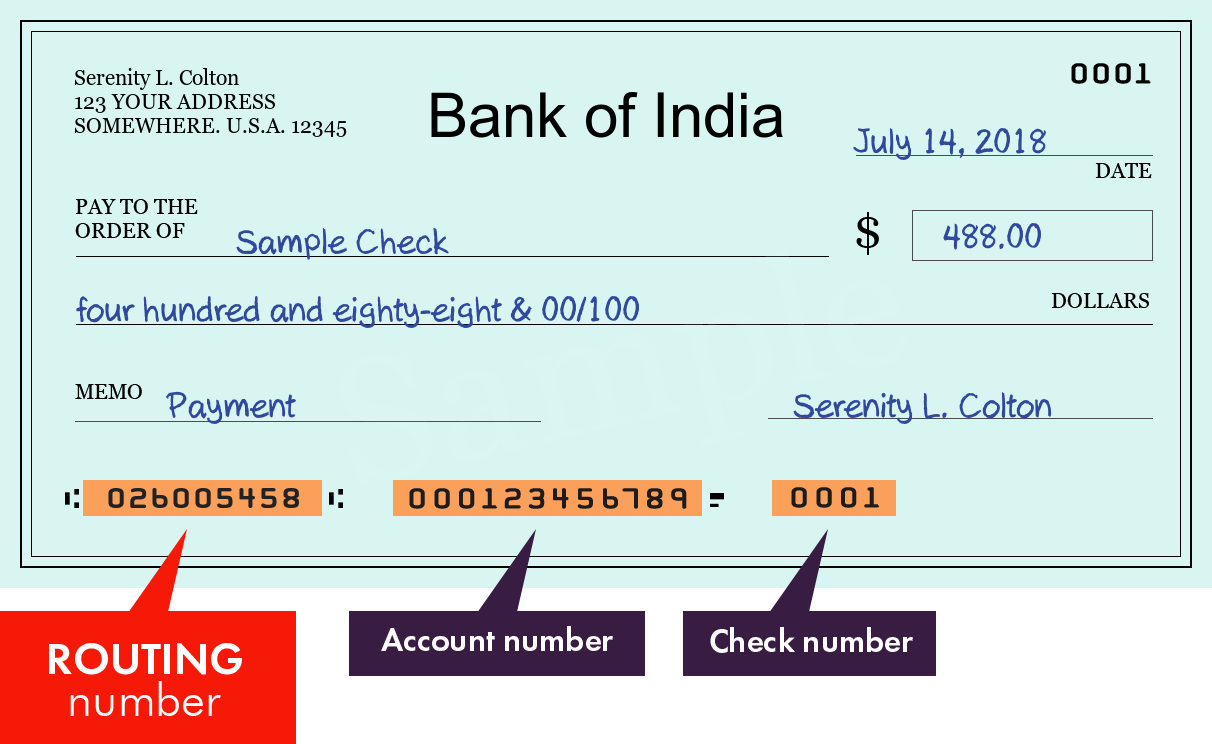

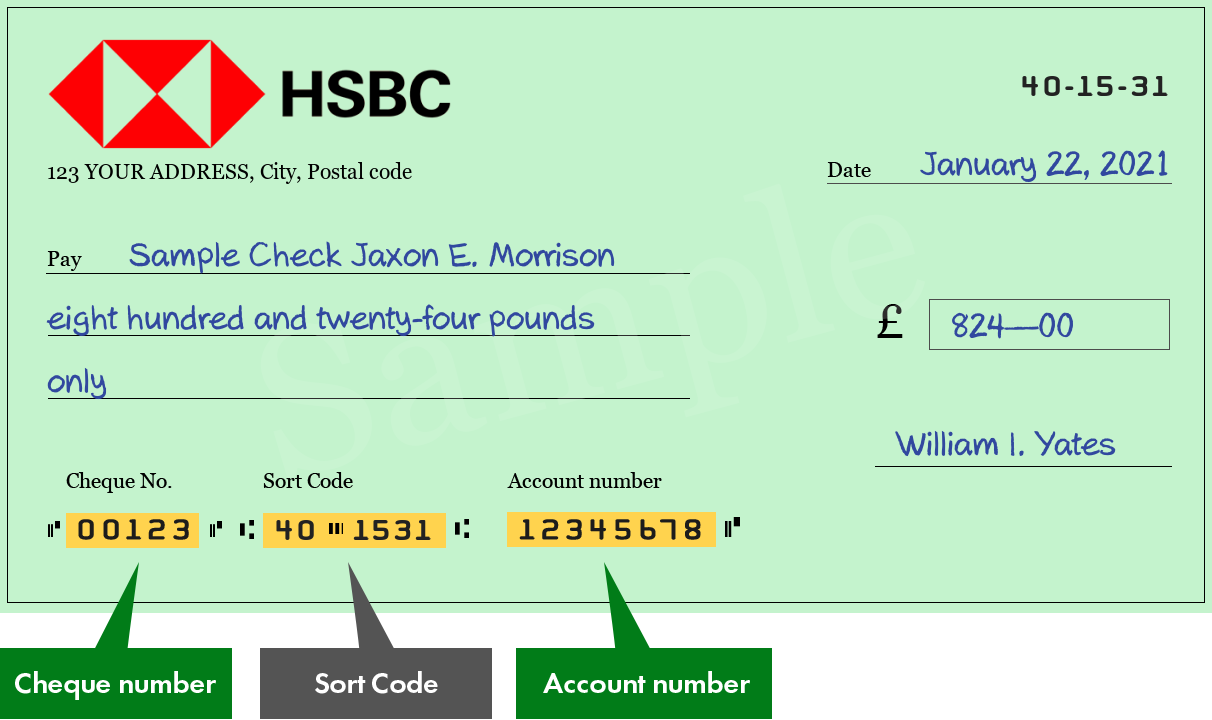

YOUR BANK ACCOUNT NUMBER

Your account number is an 8-digit number. This number is unique to you. The number tells your bank exactly which account to place the money into.

Some accounts may have a 7-digit account number. If this is the case for you, then you need to add 0 to the start of your account number when you are telling the loan provider where to send your cash.

Finding your bank account number shouldn’t be too difficult. If you have a debit card, then it should be listed on there somewhere. However, make sure that you are actually looking at the account number. This is _not _the same as your debit card number (that would be 16-numbers long!)

If you don’t have a debit card or it isn’t listed there, then you can grab your statement or look at your online banking. This will also tell you your bank account number.

YOUR SORT CODE

Your bank account number is pretty useless on its own. This means that you will need to grab a second piece of information for receiving cash from loans. This is your sort code.

The sort code is always 6 numbers long. It will be listed in this format 12-34-56. So, you will see a dash in between each pair of numbers.

The sort code is vital because this will tell the lender two important pieces of information:

* The bank that holds your bank account.

* The branch that holds your account

Your sort code will _not _be unique to you. Only your account number will. This means potentially thousands of people will have the same sort code. This is why it is so important that you get the account number right. You don’t want the money heading to the wrong account, do you?

It is important to note that the branch that holds your account may not necessarily be the closest branch to you, particularly if you opened your bank account online. So you shouldn’t use one of those online services that tell you what your sort code is unless you are 100% sure where your holding branch is located.

Again, finding your sort code should be dead simple. It will also be listed on your debit card. If you can’t find it there then check your bank statement.

CONCLUSION

In order to receive money from lenders in the UK, all you need is the bank account number and the sort code. As long as the lender is based in the UK, then they will be able to send you money. These are the same details that you will need to hand over to the lender if you want to make repayments via direct debit.