The Reserve Bank of India(RBI) on Monday issued a statement that banks and other regulated entities can not cite its April 2018 order on virtual currencies to deter the customers from dealing in cryptocurrencies. The 2018 order has been declared null and void by the Supreme Court’s judgement of March 4th 2020.

The RBI in a notification to banks and other regulated entity said, “in view of the order of the Supreme Court the circular is no longer valid from the date of judgement, and therefore cannot be cited or quoted from“.

What happened to issue such a circular?

The statement comes after the State Bank of India and HDFC bank dissuaded their customers from dealing in virtual currencies like bitcoin stating the April 2018 order by RBI. The banks went as far as threatening the customers that failing to comply with the 2018 circular will result in the cancellation of credit cards and accounts. The RBI intervened and said that since the Supreme Court has quashed the 2018 order, the banks have no choice but to allow their customers to deal in cryptocurrency if they want to. RBI also advised the banks to stop being nosy, questioned the motive behind such unprofessional conduct of business.

The banks now can carry out their due diligence process which is adhered to with following regulations like the know your customer KYC, anti-money laundering AML, combating of financing of terrorism CFT, prevention of money laundering act 2002 PMLA in addition to foreign exchange management act FEMA for overseas remittances.

RBI hinted at India’s virtual currency

The RBI has mentioned that it is thinking about developing its virtual currency. This news will provide breathing ground to some customers who have invested their money in currencies like bitcoin, ethereum etc. An estimated amount of 10,000 crore rupees is invested in cryptocurrency by Indians. When RBI says that it is developing a virtual currency of its own it implies that these 10,000 crore rupees won’t be wedged in regulations anymore. Blockchain Experts have said that this is only temporary relief as they believe that the government may one day ban cryptocurrencies permanently.

Let’s take a look at what exactly is cryptocurrency

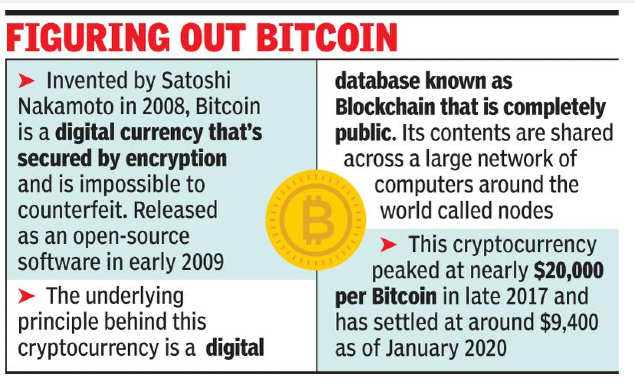

The most popular and oldest cryptocurrency is Bitcoin which was created in 2009 by Satoshi Nakamoto. It is still unknown who is this “Satoshi Nakamoto”, is believed to be either a person or a group of persons. Bitcoin was created as a reward for digital mining. Digital mining is good bookkeeping in the form of Blockchain.

Most of the cryptocurrencies are not legally backed by governments. But the scenario is changing now as many governments are accepting payments in cryptocurrencies and rolling out virtual currencies of their own. For instance, Venezuela proposed accepting payment in virtual currencies for oil trade from India, even put forward a deal of 30% discount if the payment was made in virtual currency.

There are different types of cryptocurrencies serving different goals, but mostly they are used instead of cash for some private transactions. There is no physical coin or note for Cryptocurrency and it’s solely digital. It is stored in online wallets from where a person can buy or sell. Decentralisation is the key to cryptocurrency. All the transactions of cryptocurrency are recorded on a decentralised ledger for bookkeeping, which is available publicly to crypto users. This decentralised ledger is called Blockchain.

Blockchain is a method of storing information in such a way that after the information is recorded, it is impossible to change, misuse or hack that information on the system. So every time a person deals in cryptocurrency, the transaction’s details are added to the Blockchain or the digital decentralised ledger. This transaction is available to other crypto holders with some rules. To prevent fraud in cryptocurrency transactions, a digital validation process is followed. The information of transactions in cryptocurrency is secured using cryptography to avoid misuse. Cryptography is the art of encoding and decoding.

Let’s delve deeper into types of cryptocurrencies

There are two types of cryptocurrency

- Coins or altcoins

- Tokens

Altcoins or alternative coins are usually those coins that are other than bitcoins. Bitcoin was basically made as a reward for digital mining. This digital mining was done by finding computational answers to complicated digital mathematical problems. Namecoin was the first alternative coin that came into use in 2011. Most cryptocurrencies that deal via alternative coin have a limited supply of coins available.

Like bitcoins are only 21 million in number as decided by the creators. This number was fixed so that value of bitcoin does not fall to the principle of excess supply. This limited number keeps on emphasising the value of bitcoin. Not every alternative coin works by the process of mining, different altcoins have different protocols.

Dodgecoin is an altcoin that was recently in news because of a sudden decrease in the value of dodgecoin.

Tokens are cryptocurrencies that are distributed just like shares. There is initial coin offerings or ICO. The ‘shares’ of tokens are represented as value tokens, security tokens, utility tokens.

Even though the value tokens represent utility, but they in themselves do not have any value, just like an Indian rupee note. Security tokens are bought to protect one’s account and utility tokens are designed for specific uses. All tokens are encrypted using cryptography with long lines of letters and numbers.

Sneak peak at real-life crypto millionaires

Erik Fineman invested in bitcoins when it was worth $12 and by the time he turned 18, he was one of the most successful Crypto millionaires.

Peter Saddington bought his first bitcoin in 2011 for three dollars per coin and he sold his bitcoins at a profit of 250,000%.

Winklevoss brothers are one of the earliest bitcoin investors who made millions by selling their bitcoins.

Jared Kenna bought his bitcoins at $0.2 each and sold them for a handsome profit.

Charlie Shrem bought his first bitcoin when is it was for three to four dollars each. Later on, after successful earnings via bitcoin, he opened Bitinstant – a physical platform where people could buy and store their coins.

So what about the future of virtual currencies in India

The future of cryptocurrencies in India in in a fog. The RBI has many times in past advised or cautioned people against the use of cryptocurrencies. The RBI in the recent notification informed that they are working on all the aspects to soon launch virtual currency. The government is also giving mixed signals regarding cryptocurrencies.

Given the coronavirus pandemic which is completely engrossing all the time of government, RBI will have to wait for the dust to settle before any clear directive is rolled out. The central government will be soon rolling the regulation of digital currency Bill 2021, which will give absolute power to the central government to ban any virtual currency in India.

Experts of virtual currencies have many times pointed out that no government is going to give power to a decentralised authority in terms of money. Things like money, resources, energy are important areas whereby exerting control government establishes, reinforces its authority.

The Central government may cite reasons like no legal backing, high volatility, no control over virtual currencies, high inflation rate due to limited supply (Bitcoin are only 21 million in total) as a reason to ban them. The centre should also take into account all those who have invested in cryptocurrency before banning it. The sum of 10,000 crore rupees invested in cryptocurrencies should be reimbursed to avoid losses.

There have been incidents in past where the rich got richer and the poor got poorer while dealing in cryptocurrencies.