Inflation: Is the economy in a recession?

Inflation: Is the economy in a recession?

Inflation: The US economy is not alone if you’re unsure whether a recession is in place.

Despite declining gross domestic product, one of the most important measures of economic output, the country may be entering a recession soon. As for the job market, it is still very strong, which indicates a robust economy.

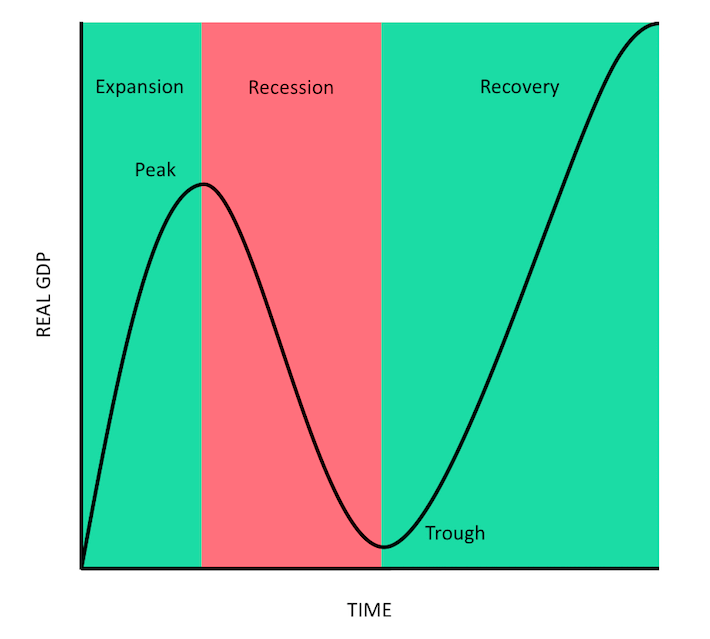

A technical recession is considered to have been a contraction for more than two consecutive quarters. The US economy has been in a recession 10 out of the last 10 times it declined for two consecutive quarters. Seven of the last seven recessions brought about massive job losses, but this isn’t the case this time around.

The United States doesn’t have a steadfast definition of recession. A Business Cycle Dating Committee of eight economists is responsible for determining the official designation. As a nonprofit organization, the National Bureau of Economic Research (NBER) oversees the group. The term “recession” hasn’t been used yet.

Providing wiggle room for interpretation, they write that recessions occur when the economy is affected by an effective decline in economic activity over an extended time.

Inflation & rate hikes

Consumer spending power is being eroded by rising inflation in the United States.

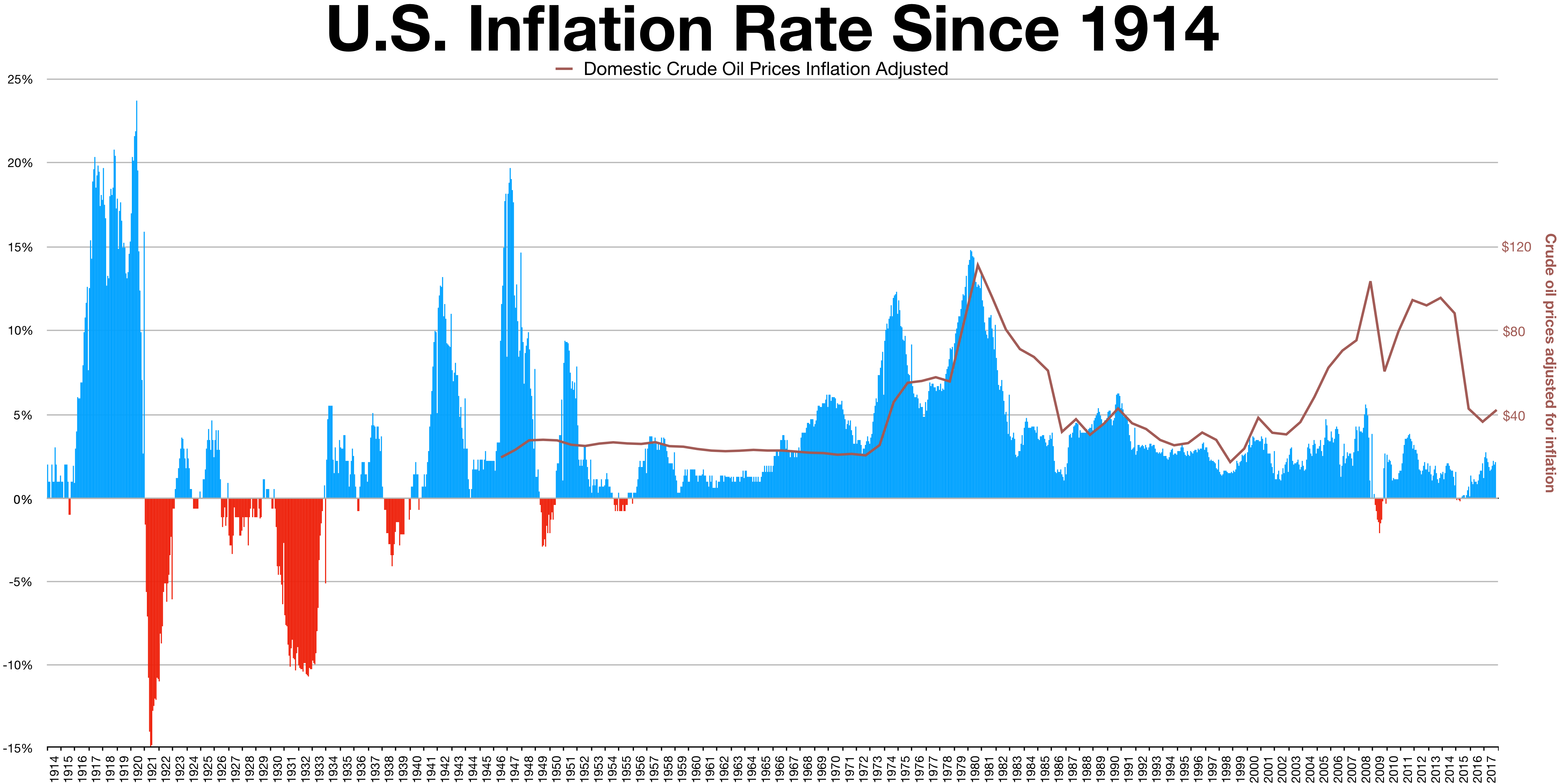

Data from the Bureau of Labor Statistics show US consumer prices surged 9.1% year-over-year in June, reaching their highest level since the pandemic. In the year ending in May, prices increased by 8.6%.

Americans are saving less money than they were a year ago, according to new data from the Bureau of Economic Analysis. As a percentage of disposable personal income, Americans saved just 5.4% in May, down from 12.4% in May 2012.

A series of supersized interest rate hikes have been approved by the Federal Reserve this year to curb white-hot inflation. To keep prices in check, the Fed must walk a narrow line between raising rates and slowing the economy down. There have been 11 times when the Fed raised rates, and only three times have they successfully avoided recessions. During these cycles, inflation was lower than it is now. Market participants and analysts are concerned about a possible recession as a result.

Inventories

In the last quarter, corporations slowed their expansion of inventory, which contributed to the economic contraction we saw. As a result of supply chain issues and anticipated post-Covid consumer demand, businesses stocked up on goods last year, but now they may be overstocked.

The second quarter GDP contracted by 0.9%, but inventories accumulated at a slower pace, cutting output by a whopping 2 percentage points. If companies had not culled their stockpiles, the economy would have grown. A recession could also be signaled by a decline in consumer demand.

Jobs

According to those who believe the United States can avoid a recession, the labor market has remained a source of strength for the economy.

The pandemic had caused the loss of 98% of jobs as of June. There have been 2.2 million job additions since January, nearly the fastest growth on record, while unemployment remains at historic lows.

The number of job openings per job seeker in May was about two, and layoffs were at historically low levels. We’re adding almost 400,000 jobs per month, and paychecks also grew in June. There is nothing normal about that recession.

Yield curve

This curve plots Treasury securities’ returns and has signaled a looming recession throughout most of July, indicating the economy has been suffering.

A yield curve that inverts indicates that investors are less concerned about the long term than they are about the immediate future, which increases interest rates on short-term bonds.

In his Wednesday speech, Fed Chair Jerome Powell claimed that the economy is not in a recession at the moment, yet yield curves suggest otherwise. During the past few weeks, they have entered an “inversion.”

According to research from the Federal Reserve Bank of San Francisco, every recession since 1955 has been preceded by an inversion of the yield curve.

Consumer sentiment & spending

A good sign for the economy is that consumer spending is on the rise. According to Friday’s Commerce Department report, household expenditures increased by 1.1% in June after increasing by 0.3% in May.

Overall, Americans are becoming more pessimistic about the economy, which could explain the growth.

Consumer confidence decreased for the third consecutive month in July, according to the Conference Board Consumer Confidence Index. Just 13% of 3,000 respondents thought there was a greater than 50% chance the US would enter a recession within the next 12 months, compared to 43% in April.

Inflation continues to rise, but wages are not rising as fast

Even though employers continued to raise workers’ wages faster than expected, inflation rose even faster, making it impossible to offset the increases.

As reported by the Bureau of Labor Statistics, the Employment Cost Index showed that salaries and wages for civilian workers increased 5.3% over the past year. Compared to the first quarter, both measures showed faster growth.

Although the quarterly change didn’t exceed the 1.5% increase in the fall of 2021, the 12-month jump was the highest since the spring of 1983.

When inflation is taken into account, the picture is less rosy. Despite rising prices, wages and salaries decreased 3.5% over the past year.

Since the bureau began keeping inflation-adjusted records in 2001, the largest decrease was 3.6% for the year ending in March.

A Harvard University economics professor and former chair of the Obama administration’s Council of Economic Advisers, Jason Furman, said the data show that people are falling behind.

Their wages aren’t slowing, but prices are. That’s why they’re falling behind,” Furman said. We’re worried about the future because of that.”

To fill open positions and retain their staff, employers have had to increase their compensation in the wake of the Covid-19 pandemic. However, these raises don’t keep up with the cost of living.

Further concerns have been raised about inflation’s duration and prevalence.

Among the Federal Reserve’s favorite reports is the Employment Cost Index, which helps it determine how much to raise interest rates based on how inflation is boosting wages. In a bid to curb rising prices, the US central bank raised interest rates for the second time in a row on Wednesday.

As a measure of the labor market’s composition, the index is considered “important” by Fed chair Jerome Powell.

Employers’ labor costs, including wages and salaries, health benefits, and retirement payments, are tracked by the data. Since it keeps the composition of the workforce constant, the index does not suffer from the same distortions as average hourly earnings.

Fry, the chief economist at his eponymous firm, said wage growth won’t abate until the labor market weakens. Despite the second quarter, employers added jobs.

The unemployment rate needs to rise and slack in the economy has to increase, said Fry, who anticipates price growth will slow before pay increases.

Cost of benefits cools

The second quarter saw a moderate increase in employers’ compensation costs of 1.3% before inflation was taken into account. It was still higher than economists expected, compared to 1.4% in the first quarter.

While total compensation costs rose 4.5% for the year ending in March, they rose 5.1% for the year ending in June.

A reduction of 1.2% in benefits costs has been reported for the spring, compared to a rise of 1.8% previously.

In comparison to the March year before, benefits costs increased 4.8% over the past 12 months.

Looking ahead

Federal Reserve rates are most likely to be raised again this year based on the hotter-than-expected wage and inflation data.

Compared to last year, Personal Consumption Expenditures prices rose by 6.8% in June, the Bureau of Economic Analysis reports, which represents the change in prices for goods and services purchased by consumers.

The Fed will not be led to question whether to keep tightening in light of today’s reports, Fry said. We’ll likely see a break in both wages and prices next time, too. I’d lean toward 75 basis points.”

According to the economist, the US economy is not in recession

Despite a slowdown, Moody’s Analytics chief economist Mark Zandi thinks the American economy is not in a recession yet.

According to Zandi, in a phone interview with CNN on Thursday, this is a slowdown, not a recession. There is no doubt about this one. We have created too many jobs.”

Soon, a recession is more likely.

A recession is about 50/50 likely over the next 12 months, Zandi said, adding that the outlook is cloudy. A bit of luck would help avoid recession.

As of Thursday, the economy contracted for the second consecutive quarter, according to GDP data.

It has coincided with a recession every time back-to-back quarters of negative GDP have occurred since 1948. Official recessions are not defined this way, however, by economists at the National Bureau of Economic Research. Jobs, retail sales, and manufacturing are measured in terms of a broad-based decline.

In Zandi’s view, the two-quarters of negative GDP is still a rule of thumb that has worked in the past, invariably since World War II.

It is not true that we are experiencing a recession today since there is no surging unemployment across the economy. It is near historic lows, with an unemployment rate of 3.6%.

According to Zandi, 3 million to 4 million jobs would be lost in a recession in the current economy.

Several months or even years after GDP figures are released, they can be subject to significant revisions.

After revision, either of these quarters could become positive in a few years, Zandi predicted.