The Indian Economy To Collapse: 3 Major Instances That Proclaim How Modi’s Government Rule Led to it

The GDP has dipped to 7.3% in the financial year 2020-2021 of India.

The growth numbers are negative, which demonstrates how indigent India’s economy is performing. Earlier, the country’s GDP has fallen 5 times before the pandemic situation, but not as low as this. Earlier, the natural calamities, droughts, and floods forced the contraction in the economy, which showed its effect on the growth. India’s GDP is struggling to balance on the right path since PM Modi won the elections.

The previous year, when the unexpected arrival of the COVID-19 pandemic hit the country, the GDP growth of the first quarter was minus 24%.

The downfall in the economy was still justifiable as no one knew that the virus would come one day, taking over all the markets and businesses. But this year, from January to March, all the sales were open, all businesses (except travel and a few others) were working fine like before as the virus wasn’t that effective back then. Even though PM Modi dismantled all the chances of imposing a nationwide lockdown, the economy struggled to grow. What could be the possible reason for it? Definitely the mismanagement in the Modi governance!

The ‘unplanned’ and ‘unprepared’ lockdown also constitutes a massive downfall in the Indian economy. The lockdown was merely announced with a 4-hour notice. All the major businesses and sectors had to forcibly shut down, without planning anything. The lockdown had very little contribution to controlling the COVID-19 virus. India’s COVID-19 cases are still shooting up above 1 lakh, even after several restrictions, and the death numbers are still rising.

Several states are under-reporting the number of fatalities, but that is a different case. The lockdown majorly impacted the migrant workers, who had to immediately leave the cities, travel back to their homes barefoot as they had no income source left. Many lost their lives on their way back home, just to know that Modi would lift the lockdown once again, and the “privileged” ones would be able to travel safely.

As there was no prior discussion between the PM and states regarding the imposition of lockdown, the migrant workers had to arrange their transport by themselves. This caused a huge hole in their pockets as well! The government again failed to identify and acknowledge a major section of our society. All the other nations ensured that the economically weaker section of the society receives universal food and cash transfers, but our PM introduced a fraudulent relief package, out of which no Indian has received a single penny yet!

1. Increasing unemployment rates

India isn’t new to the unemployment issue. A country where an engineering graduate has to do a clerk job isn’t a promising country for its youth. The unemployment rate is the major fundamental factor that justifies Modi’s failed management of the economy. As per the government’s own survey, India’s unemployment rate was about 45 years high in 2017-2018.

This news came after a year of introduction to the demonetization, wherein the Modi government also introduced GST. Since India’s independence, unemployment has not fallen as miserable as it fell in 2019. Total 9 million Indians became unemployed in a single year!

India had an unemployment rate of 2-3% before, but since Modi came into power it routinely fell to 6-7% every year. After the arrival of the pandemic in 2020, the matter got even worse, and the current unemployment rate is down by 8-9%! As the growth prospects are also weak in favor of India, the disastrous unemployment rates add another burden on the shoulders of the country’s overall growth.

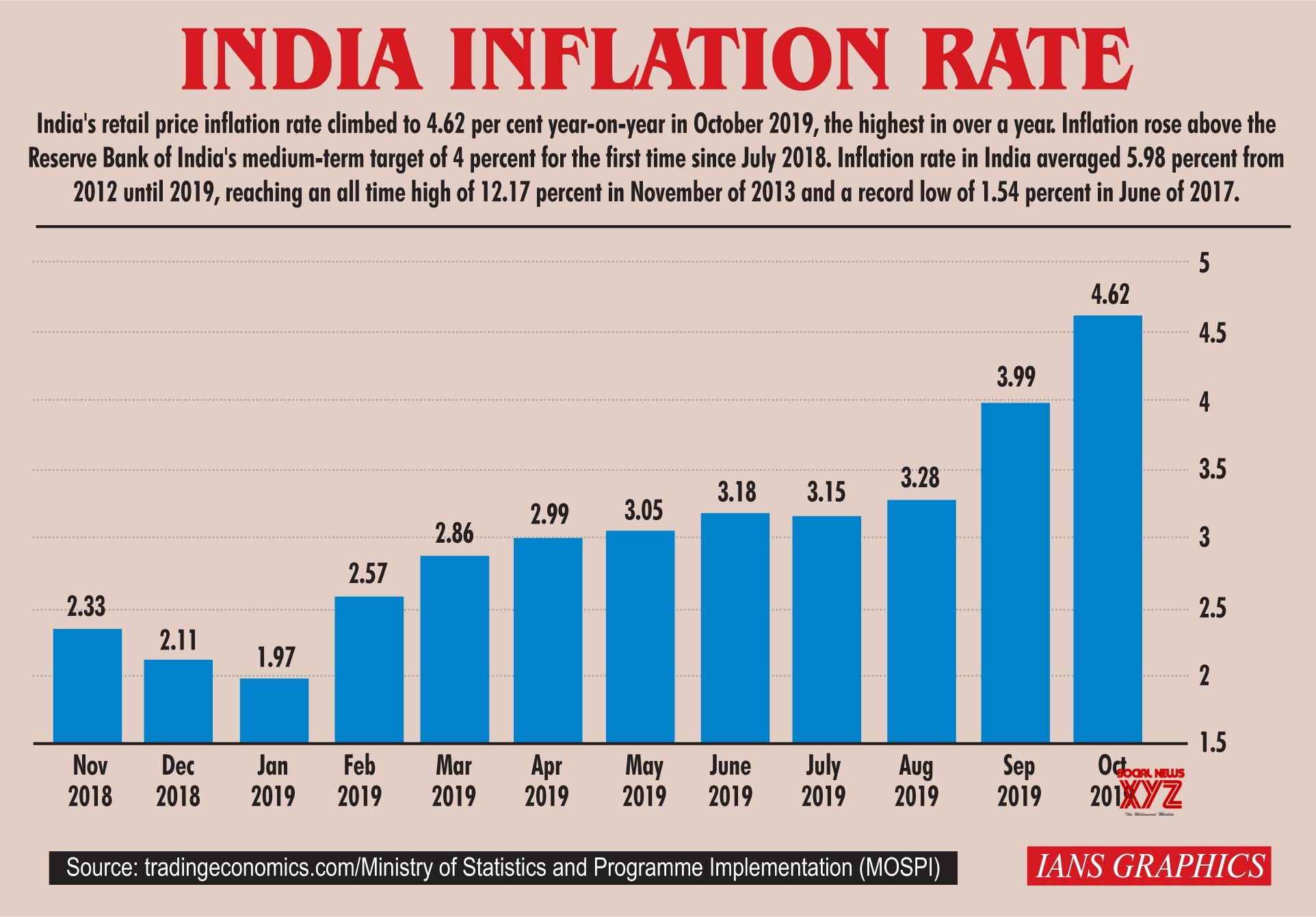

2. Inflation rates

For the first three years, the Modi government benefited the most from the crude oil refineries. After staying close to the $ 110 barrel mark from 2011 to 2014, oil prices plummeted to just $ 85 in 2015 and down (or around) $ 50 in 2017 and 2018. On the one hand, the sudden and sharp decline in oil prices allowed the government to completely control the country’s high commodity prices, while at the same time, it allowed the government to collect more fuel taxes.

Since the last quarter of 2019, India has been experiencing high and sustained inflation. Even the downturn in demand due to Covid’s closure could not quell inflation. India has been one of the few countries – among the developed and developing economies of the market – which has seen inflation continue more or less near the RBI border since 2019.

3. Deciding factor: The fiscal deficit

The health of government finances and its expenditure is measured by fiscal deficit. It also tells us about the amount government borrows from the market to meet its expenditure. If the government borrows excessive amounts, then it affects the nation’s economy severely. There are two disadvantages of excessive borrowing.

- Reduction in funds: If the government borrows imprudent amounts of money from the market, then crowding out of the private sector occurs. Crowding out of the private sector is a phenomenon under which the debts to the government reduce the investible funds available for private businesses. Private businesses are a crucial factor for running out the economy.

- Increase of debts: If there are extra borrowings from the government, then overall debts to be repaid by the government increases. Hence, the government also increase the tax amount to compensate for its loss. Under Modi’s rule, the taxes have been increased in huge folds. The middle class and lower class are suffering the most as they have to pay income tax + additional taxes on individual goods and services they purchase.

In its face, India’s inflation rates were much higher than the norm, but, in fact, even before Covid, it was an open secret that the budget was far above what the government openly acknowledged. In the Union’s budget for the current financial year, the government has acknowledged that it has been reporting a deficit of about 2% of India’s GDP.

The bottom line

The government can save the dipping economy by printing more money, but it involves political risks. If the politicians in power don’t stop printing on time, then it will lead to another crisis. Here is how it will lead to a new crisis: The government would use this newly printed money to build new income sources, and raise the private sector demand of the economy.

As the demand will increase (supply will remain the same as there will be the effect only on the economic aspects), the prices will increase, hence it will lead to inflation. A small increase in inflation is encouraged as it fuels up business activities. But if the government keeps printing money at the same pace, inflation will keep going high, creating a problem for the general public.

Inflation is always revealed with a lag. Generally, the government doesn’t realize that they have over-borrowed and buried in debts. This will lead to high macroeconomic instability as there will high debts and high inflation. Of course, COVID-19 is a tough time is tough to handle economically, and India is struggling to grow at 7%. But we need better policy suggestions to keep the boat of our economy sail on a better path.