India to be the third largest economy by 2030 in the world: Here’s why

India has been predicted to overcome Japan and Germany to become the third-largest economy in the world. The data has been stated by S&P Global and Morgan Stanley.

The predictions have been made by S&P stating that India’s annual nominal gross domestic product growth is likely to average 6.3 percent by the end of 2030.

Morgan and Stanley have proposed that India’s GDP is likely to double more that the current value by the end of 2030.

Morgan Stanley analysts have mentioned that India has all the conditions in place for economic growth because of its offshoring, investments in the manufacturing processes, the energy transition, and the country’s developing digital infrastructure.

These factors will make India the third-largest economy and the stock market by the end of 2030.

India has recorded a 6.3 percent year-on-year growth of 6.3 percent from the July to September quarter compared to the Reuter’s poll has recorded to be 6.2 percent.

On the other hand, India recorded an expansion of 13.5 percent during April and June, which is attributed to the booming domestic demand in the country’s service sector.

According to the data from valid sources, India posted a record 20.1 percent growth in the three months of 2021.

S&P’s projections have emphasized the continuation of India’s trade and financial freedom, reforms made in the labor market as well as investment in India’s infrastructure and capital.

An analyst from Australia and New Zealand Banking Group has mentioned that the scenario is expected from India when it has a lot to catch up on in terms of economic growth and per capita income.

Some of the reforms have already started taking place highlighting the government’s efforts to set aside more capital expenditure in the country.

India to become more oriented as an export-driven hub to boost its economy:

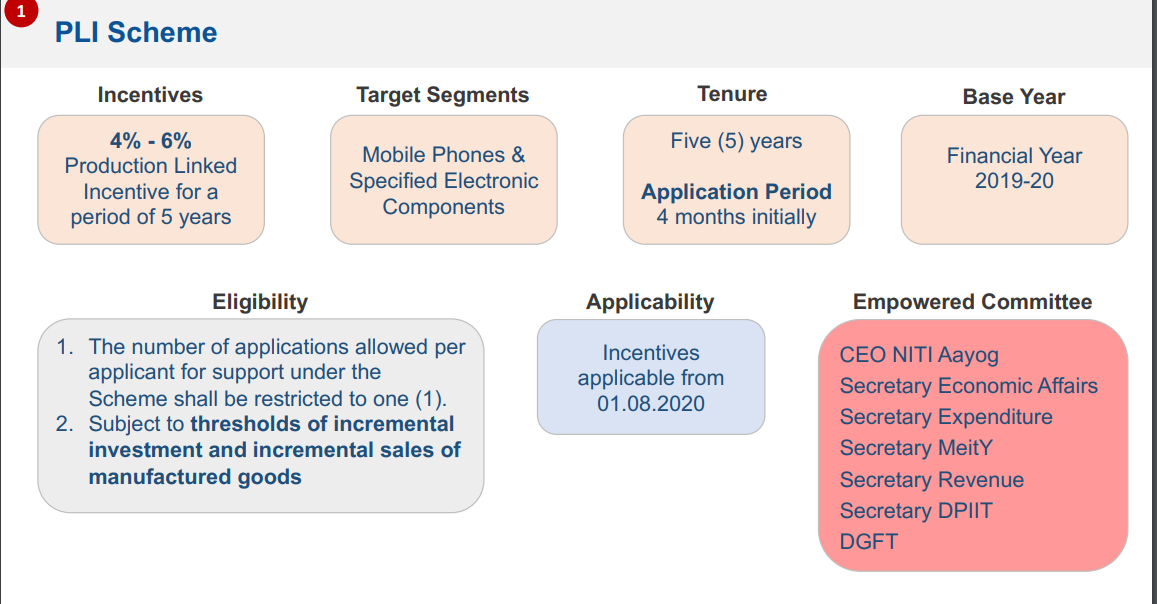

It has been emphasized that the Indian government is trying to become a hub for the foreign powerhouses of investors as well as become a dominant part of the manufacturing sector. India has initiated many Production Linked Incentive Schemes to boost manufacturing and exports.

The Scheme named PLIS introduced in 2020, aims to provide incentives to both domestic and foreign investors in the form of license clearances and tax rebates along with other factors.

The S&P analysts have stated that the PLIS policy was introduced by the Indian government to make India export driven followed by its attempt to be more interlinked in the global supply.

Based on the same perspective, Morgan and Stanley have mentioned that India is likely to increase its GDP from 15.6 percent to 21 percent by the end of 2031, which implies that the manufacturing revenue will increase three times from the present value of 447 billion to 1490 billion USD according to the bank.

Morgan Stanley has stated that multinational companies have become optimistic to invest in India, and the Indian government is emphasizing more to boost the economy by encouraging investments in building infrastructure as well as supplying land for factories.

India has many advantages in this aspect which include low-cost labor, the low cost of manufacturing processes, ready-to-invest, business-friendly policies followed by a young demographic condition in the country.

The attraction options make it suitable for India to be an attractive choice for establishing manufacturing hubs by the end of the decade, boosting the country’s economy.

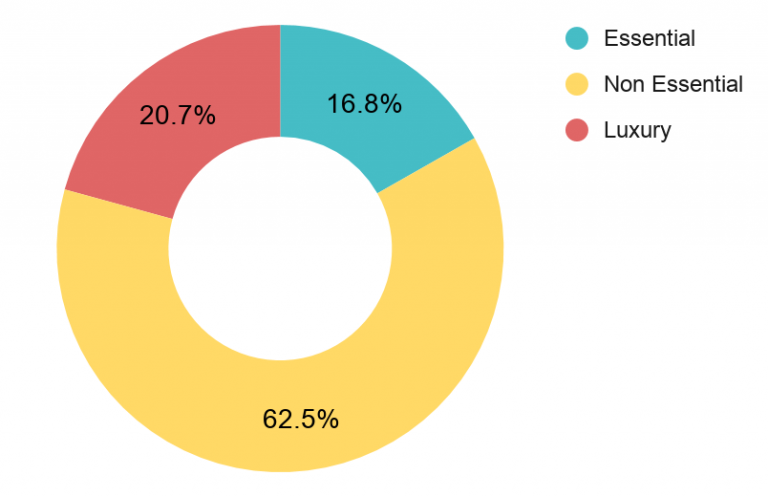

However, there are many risk factors associated with India which can be a hindrance to becoming the third-largest economy in the world since India is highly trade-dependent and exports 20 percent of its output.

Other risk factors may involve the change in political reforms caused by the power given to a weaker government, adverse geopolitical conditions, and lack of skilled labor.

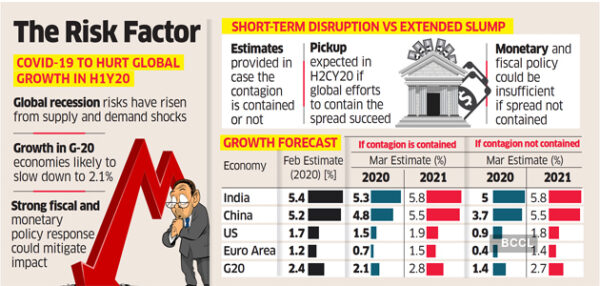

India’s GDP has increased significantly from what it was recorded during the pre-covid times. The forward-looking growth may prove to be weaker than the previous quarters, as stated by the Chief Economist in Nomura.

Based on the rate of growth, real GDP has reached 8 percent above pre-covid times, but the country is likely to be affected by the global recession.

Similarly, all the other sources have stated that more priority should be given to human capital investment to boost human health and investment to minimize the risk factors of India becoming the third dominant economy.

It is especially integral for a post-pandemic economy where greater disruptions have been given to the informal sector due to the inequality in wealth and economic conditions. The covid-19 times saw the downfall of the labor force participation rate, including women.

Edited by Prakriti Arora