Government Schemes for Women Entrepreneurs to Help Kickstart their Business in 2020

Government Schemes for Women Entrepreneurs to Help Kickstart their Business in 2020

Its rightly said that woman is the powerhouse of a house, she works relentlessly but in a silent mode. She makes everyone shine on the front foot but at the back foot makes numerous sacrifices. Just like men, women too have dreams to accomplish but the societal norms and lack of confidence on women restrict her to try something new. But, its never too late to start something new or take a new risk. To increase the number of women entrepreneurs in India and to give Indian woman a chance that she desires all their life, the Indian government have come up with these economic schemes so that our girls can shine equally as our boys.

The Need For Women Centric Scheme

This is the most common thought that comes in the mind of more than half of the population. But the need for these empowering schemes has stemmed out from our society itself. The existing patriarchal structure of our society forces the woman to be dependent on the male members of the family. To end this dependence and to make women financially dependent, women entrepreneurial schemes are in place.

This is not an opportunity but an equal right. Government has also initiated various schemes for everyone who wishes to start their enterprise. Low rate interest loans and subsidies on agricultural products have also been rolled out to empower the economy. But women-specific schemes stand like a gateway where women are not only welcomed but are also given business advice to stand and flourish on their feet.

Bharatiya Mahila Bank

Bharatiya Mahila Bank was flagged off by Prime Minister Modi, in 2013 on the birth anniversary of Mrs Indira Gandhi. India’s first women’s bank had the motive of catering the banking needs of women and to boost the economic outlook of women in the Indian economy. Bharatiya Mahila Bank offers low-interest rates especially to low scale entrepreneurs and women entrepreneurs. However, the Bharatiya Mahila Bank was merged with State Bank of India because of lack of capital and increasing disinvestment. Bharatiya Mahila Bank is still functional under the flagship of State Bank India.

- The Bank offers loans of up to 20 crores for manufacturing units.

- The Credit Guarantee Fund Trust for Micro and Small enterprises offer collateral-free loans up to Rs 1 crores.

- A time period of 7 years has been granted for repayment of loans.

- The basic interest rate is 10% upon which 2% additional interest is added making it 12%.

Eligibility: Women above 21 and below 70 are eligible.

Stree Shakti Scheme

The Stree Shakti Shakti Scheme is the scheme of the central government under the flagship of State Bank of India. This scheme is favourable for aspiring women entrepreneurs and those who wish to expand their business. Women entrepreneurs who have a shared capital of 51% as partners, shareholder or directors of a private company are also eligible for availing business plan.

- The rate of interest depends on the current rate of interest at the time of availing a loan.

- This scheme offers a loan of up to Rs. 50 Lakhs

- A mild concession of 0.5% is given if the loan amount exceeds Rs. 2 lakhs.

- The debtor should own 50% of the enterprise, she is availing loan on.

Eligibility: Women who are in retail, manufacturing, services and self-employed occupation are eligible for the loan.

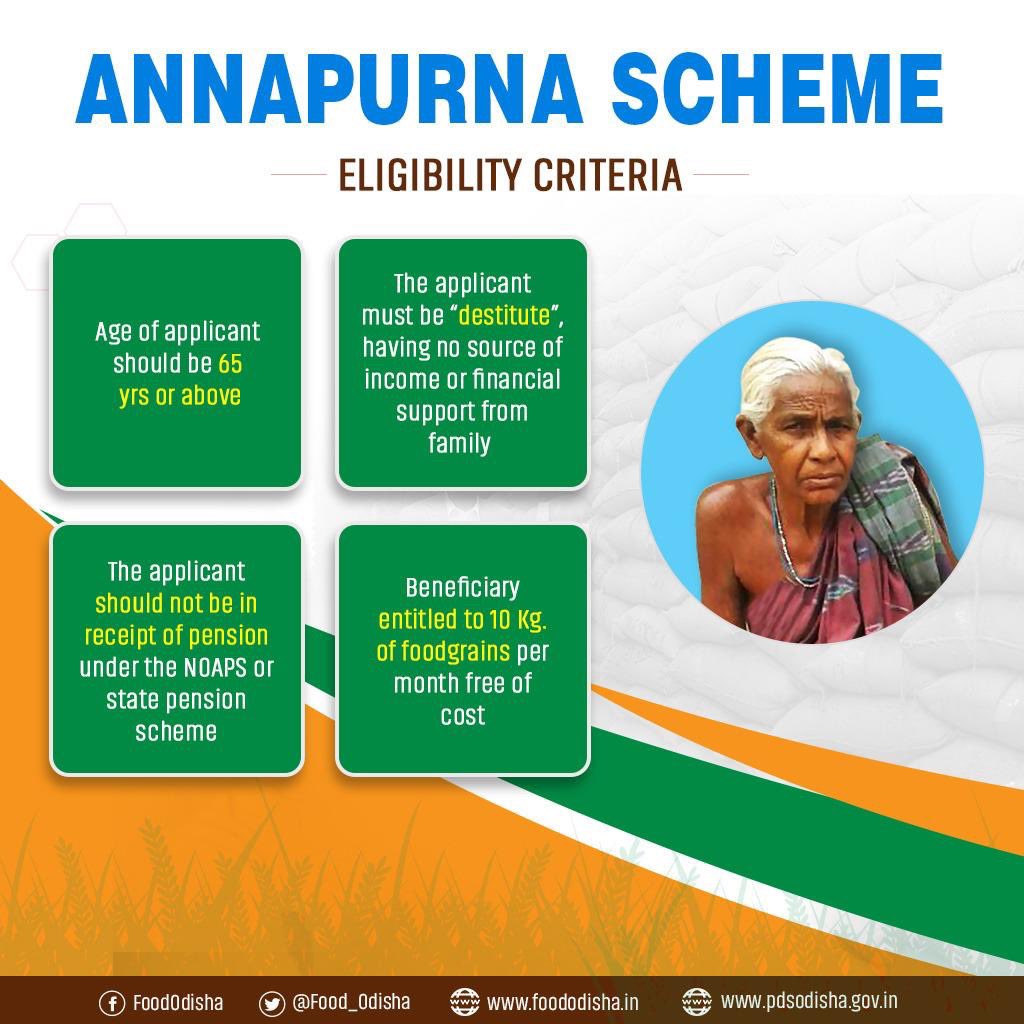

Annapurna Scheme

Annapurna Scheme is one of the schemes that provide loans to women involved in the food sector. Businesses like restaurants, catering and any food-related enterprises owned by women can avail loans through Annapurna Scheme. With the borrowed capital with this scheme, the business owner can utilize it in buying new utensils and kitchen equipment to expand their business.

- This scheme sanctions a loan of up to Rs. 50,000.

- The repayment duration of the loan is 3 years.

- The loan can be repaid Din 36 Installments.

- A guarantor is required with collateral security.

- A grace period of 1 month is given for the repayment of the loan after it is sanctioned to the debtor.

- The interest rate depends on the prevailing market rate.

Eligibility: This scheme can only be availed by the women entrepreneurs who are into catering businesses.

Dena Shakti Scheme

This scheme was also introduced by Central Government under the flagship of Dena Bank. This scheme is for those women entrepreneurs that are involved in manufacturing, retail stores, micro-credit and agricultural businesses.

- The maximum amount of loan levied is Rs. 20 lakhs.

- The loan is sanctioned under the umbrella categories of retail, education and agriculture.

- For Micro-credit the limit of loan is about Rs 50,000.

- A relaxation of 0.25% is given on the prevailing market interest rate

Eligibility: Entrepreneurs who own more than 50% stakes in the organization are eligible for this scheme.Orient Mahila Vikas Yojana

The Orient Mahila Vikas Yojana was initiated by Oriental Bank of India. This scheme offer loan to those women who start a business on their property. - This is a collateral-free loan for small scale industries.

- The loan is offered between a range of Rs 10 to 25 lakhs.

- The duration of loan repayment is 7 years.

- 2% concession is offered on the rate of interest

- If a loan amount of fewer than 10 lakhs is taken, no collateral is needed and in the case of a loan of a higher amount for Small Scale Industry, no collateral is demanded.

Eligibility: A 50% share or more is needed to avail the benefits of this scheme.

Mudra Yojana Scheme for Women

Mudra Yojana helps those entrepreneurs who provide services like a daycare centre, tuition classes, tailoring centres and beauty parlours. This scheme helps the small-scale enterprises and group of women starting their cooperative. The speciality of this loan is that it doesn’t require any support of collateral and has 3 broad categories of procurement.

- Shishu– a loan of Rs 50,000 can be availed by those who are in the initial stage of business.

- Kishor– the well-established business can avail a loan between Rs 50 thousand to Rs 5 lakhs.

- Tarun– Those planning for expansion can avail this loan. This category sanctions a loan of Rs 10 lakhs.

A mudra card is given to the debtor like a credit card and the limit of which is set to 10% less than the granted loan

Eligibility: this loan is eligible for those women who are involved in small scale cooperatives. However, the loan can also be sanctioned to a single woman entrepreneur.

Udyogini Scheme

This scheme functions under the Punjab and Sind Bank and lends to small scale women entrepreneurs who are involved in retail and agricultural businesses. The speciality of this scheme is that it provides loans on flexible and concessional interest rates.

- The loan provided goes up to Rs 1 lakh on the condition that the woman is aged between 18 to 45.

- The family income of the debtor should be less than Rs 45 thousand.

- A special concession of 30% or Rs 10,000 is given to women from SC/ST category, widowed, destitute and women with disability.

- For general category women, a subsidy of 20% loan or Rs 7,500 is granted.

- A guarantor is needed whereas the security of Rs 25,000 has to be deposited

Eligibility: Women Entrepreneurs who own and manage all units of the enterprise, individually or in a group are eligible. Women with a proprietary of 50% are also eligible to apply.

Cent Kalyani Scheme

This scheme is specially formulated for women who work with SMEs and in the agricultural field. The loan can also be credited by women of villages, self-employed and cottage industries. This scheme was initiated by Central Bank of India. It also covers the women involved in the services sector like handloom weaving, food-processing and handicraft.

A maximum loan of Rs. 100 lakhs can be provided.

- No collateral is required.

- Interest rate is subjected to the market.

- There is no processing fee for this loan.

Eligibility: Small scale enterprises and industries which don’t include retail trade, education and training and self-help groups are not eligible for this scheme.

Mahila Udhyam Nidhi Scheme

This scheme works under the flagship of Punjab National Bank. The objective of this scheme is to reduce the gap in equity. The beneficiaries of this scheme are small scale enterprise, rehabilitation of the sick or those who wish to start new projects.

The interest rate depends on the market

- A loan of Rs 10 lakh can be offered

- The repayment duration is 10

- The duration of the moratorium is 5 years.

Eligibility: women who have new or pre-existing MSMEs, small Units and who have over 51% of stakes in their enterprise are eligible.

Apart from these government schemes, some other schemes solely work for women entrepreneurs like ICICI Bank: Empowering women with through economic independence, Ernst and Young Foundation. These organization also work for women and help them set small scale industries or for further expansion.