Effect of Ukraine-Russia on the global market

Effect of Ukraine-Russia on the global market

The invasion of Ukraine happened on February 24, 2022. A dramatic escalation of the Russo-Ukrainian War in 2014. Since World War II, it is the greatest military strike in Europe.

Map view of Russia-Ukraine war

Russia annexed Crimea after the February 2014 Ukrainian Revolution of Dignity, and Russian-backed separatists captured a chunk of south-east Ukraine, beginning the Donbas conflict. In 2021, Russia began a significant military buildup near its border with Ukraine, igniting a global crisis.

During this time, Russian President Vladimir Putin stoked nationalistic feelings among Russians, Ukraine’s validity as a sovereign state was called into doubt, and NATO was accused of being a security threat to Russia, prompting a request that Ukraine be barred from joining the alliance. Putin also stated Ukraine was committing genocide against its Russian-speaking population, which was incorrect. The US and others accused Russia of plotting an attack or invasion of Ukraine, which Russian officials flatly denied on February 20 and 23, 2022.

Russia’s military operations in Ukraine on global markets have been massive. Commodity prices have risen, bond yields have climbed, and equities markets have fallen sharply.

Fears of transportation and disruptions in supplies caused prices to rise for a variety of commodities. Oil and gas, as well as agricultural commodities and metals, are the region’s main exports.

According to various news reports, the long-running dispute could harm industries that rely on the supply of raw materials, particularly industrial commodities, as Russia bears the brunt of Western sanctions, which include the exclusion of several Russian banks from the SWIFT interbank payment system.

Furthermore, the consequences are endangering the global economy, causing financial markets to tremble, and making life more dangerous for everyone. Economic forecasters are beginning to take into account the consequences of the Ukraine conflict in their models. It appears that it is not in Europe’s best interests.

What’s at stake: Much of the world is expected to witness slower growth and more significant inflation than had been predicted only a few weeks ago. I am assuming that some of the most terrible consequences of further conflict escalation don’t occur.

The big picture: Soaring energy costs are the most straightforward way for the conflict to wreak havoc on the global economy. Inflation will be fueled by increased costs for other commodities, disrupting supply chains.

- These predictions were made last week, just before a massive jump in oil futures overnight Sunday into Monday, only adding to the tensions.

- Furthermore, financial conditions have tightened due to geopolitical risk, limiting investment, though the effect has been minor thus far.

According to the numbers: According to JPMorgan economists, the global economy would grow 0.8 percentage points slower in 2022 than it did in February.

- They only cut their U.S. growth forecast by 0.1 percentage points but slashed their eurozone growth forecast by 2.1.

- The JPMorgan team expected the crisis to have a more significant impact on inflation in the United States, raising its fourth-quarter prediction for the Consumer Price Index by a whole percentage point.

Economists at Goldman Sachs estimate that the current rise in oil prices will subtract 0.2 percentage points from U.S. growth in 2022, with the increase in agricultural commodity prices deducting another 0.1 percentage point. If prices continue to rise, this will become even worse.

The bottom fact is that the situation is unpredictable, and any further escalation would increase the economic danger. However, Ukraine appears to be a significant barrier for the global economy in 2022.

See also: China sees a new surge in cases despite” zero tolerance.”

No war pleads the public during the Russian-Ukraine war.

Here’s how the escalating Putin war on Ukraine can affect the world economy:

Energy:

Many European countries rely substantially on Russian energy, particularly gas, transported through numerous vital pipelines. Even if the situation is resolved, the heavy economic penalties imposed on Russia may make it difficult for these countries to buy gas.

Meanwhile, oil prices soared on Wednesday as supply interruptions grew due to Russian financial penalties, and traders hurried to find alternative crude sources in a market that was already tight.

A hypothetical Russian invasion of Ukraine would have ramifications for wheat and oil prices, regional sovereign dollar bonds, safe-haven assets, and stock markets, among other demands.

Transport:

The conflict will likely exacerbate the situation with global transportation already severely hampered following the pandemic. Ocean shipping and rail freight are two vehicles likely to be affected. While rail only transports a small percentage of total freight between Asia and Europe, it has been critical during recent transportation bottlenecks and steadily increases. Russia’s sanctions are expected to impact countries like Lithuania’s rail traffic significantly.

Supply Chain:

Companies are trying to obtain enough raw materials and components to fulfil growing client demand due to the world’s unexpectedly rapid rebound from the pandemic slump. Shortages, transportation delays, and increased pricing have resulted from overburdened factories, ports, and freight yards. Industries in Russia and Ukraine may be disrupted, delaying restoration to normalcy.

Edible Oil:

Ukraine is known for exporting roughly half of the world’s sunflower oil. If harvesting and processing are hampered, or exports are halted in a war-torn Ukraine, importers may struggle to replace supplies.

With significant supply interruptions looming in India, firms are left with few options to contemplate raising prices of daily-consumed edible oils within weeks. According to India’s main edible oil producers, imports cover more than 70% of the country’s crude edible oil needs. The sunflower oil content is even higher.

Food supplies:

Ukraine and Russia account for 30% of global wheat exports, 19% of corn exports, and 80% of sunflower oil exports, all of which are utilized in food processing. As per the Associated Press, much of the Russian and Ukrainian windfall goes to poor, insecure countries like Yemen and Libya

The threat to eastern Ukraine’s farms, as well as a halt to exports through Black Sea ports, could limit food supplies at a time when prices are at their highest since 2011, and several countries are experiencing food shortages.

Increase in Price:

The battle in Ukraine comes at a challenging time for the Federal Reserve and other central banks. The recent spike caught them off a surprise in inflation, primarily due to the economy’s unexpectedly strong recovery.

Consumer prices in the United States grew by 7.5 per cent over the previous year, the most significant increase since 1982. In Europe, numbers released Wednesday show that inflation in the 19 nations that use the euro currency increased to a record 5.8% last month compared to a year ago.

Automobile Industry:

The automobile sector is expected to be severely impacted by the war. Rising oil prices, a continued lack of transistors and circuits, and other rare earth metal shortages will almost certainly compound the industry’s problems. Aside from that, Ukraine is home to a slew of enterprises that produce automobile parts for automakers.

According to The Wall Street Journal, Leoni AG, which supplies European automakers with wire systems built in Ukraine, has closed two plants. As a result, Volkswagen AG had to complete one of its German plants.

“Ukraine is not crucial to our supply chain,” a Volkswagen spokesman told the publication, “but suddenly we learned that when this part goes missing, it is.”

Even before Putin’s troops invaded Ukraine, the global economy was already suffering from many problems, including rising inflation, clogged supply chains, and falling stock prices. The Ukraine situation has amplified each threat while also complicating possible remedies.

See also: Ukraine says evacuations stall amid Russian shelling.

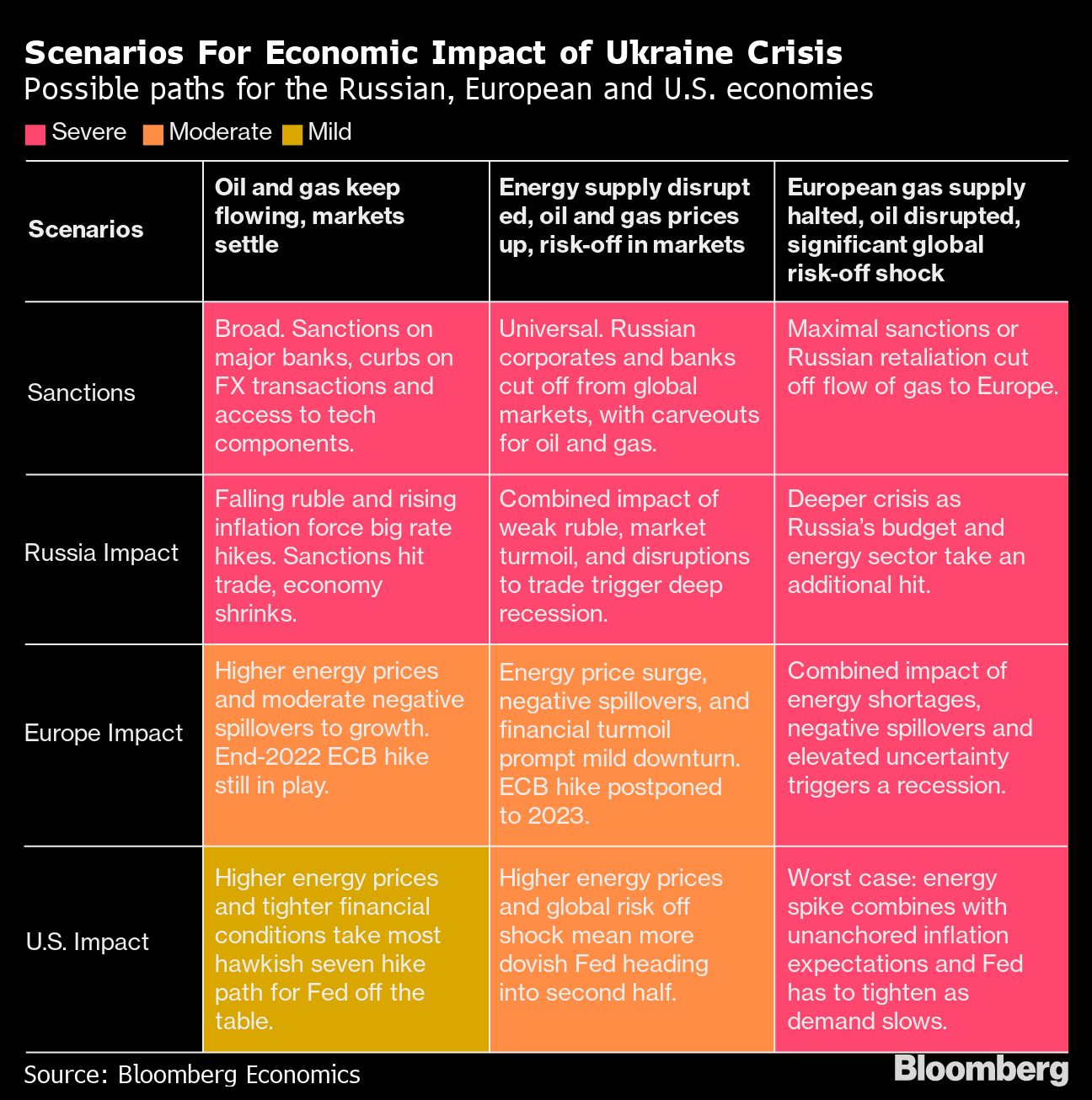

Scenarios For Economic Impact of Ukraine Crisis

Possible economic routes for Russia, Europe, and the United States

Source: Bloomberg Economics

Here are a few parts that could feel an escalation of tensions throughout global markets:

SAFEHOUSES

Following a significant risk occurrence, investors often return to bonds, considered the safest investments. This time even if a Russian invasion of Ukraine risks further fanning oil prices and consequently inflation.

With inflation at multi-decade highs and the threat of interest rate hikes, bond markets have had a nervous start to the year, with U.S. 10-year rates still hovering around For the first time since 2019.

On the other hand, a full-fledged conflict between Russia and Ukraine may help.

The euro/Swiss franc exchange rate is the most prominent measure of geopolitical risk in the eurozone on the F.X. markets. In late January, the Swiss franc reached its highest level since May 2015.

Gold is at 13-month highs, making it a haven in times of war or economic hardship.

WHEAT AND GRAINS

Any impediment in grain transit out of the Black Sea region is predicted to have a significant impact on price and fuel food inflation at a time when food affordability is an important issue worldwide as a result of the COVID-19 pandemic’s economic impact.

The four leading exporters, Ukraine, Russia, Kazakhstan, and Romania, carry grain from Black Sea ports that may be affected by military action or sanctions.

According to forecasts from the International Grains Council, Ukraine is predicted to be the world’s third-largest exporter of corn and fourth-largest exporter of wheat in the 2021/22 season. Russia is the world’s largest grain exporter.

GAS AND OIL FROM NATURAL RESOURCES

Energy markets are prone to be impacted if tensions escalate into a confrontation. Around 35% of Europe’s natural gas comes from Russia, primarily through pipelines that travel through Belarus and Poland to Germany and Nord Stream 1, which runs straight to Germany and others through Ukraine.

When lockdowns curtailed demand in 2020, gas shipments from Russia to Europe dropped, and they did not fully recover last year when consumption rose, helping to drive prices to new highs.

Germany has proposed that Russia’s new Nord Stream 2 gas pipeline be blocked as a blockade of possible sanctions if Russia invades Ukraine. The channel is expected to improve gas shipments to Europe, emphasizing its reliance on Moscow for energy.

Analysts expect that sanctions will be imposed that natural gas exports from Russia to Western Europe will be cut through a lot of stuff both Ukraine and Belarus, with gas prices potentially returning to Q4 levels.

Restrictions or Interruptions have an impact as well on oil markets. Oil from Ukraine is shipped to Slovakia, Hungary, and the Czech Republic. Ukraine is a transit country for Russian crude oil, according to S&P Global Platts. In 2021, exports to the bloc totaled 11.9 million metric tones, down from 12.3 million in 2020.

According to JPMorgan, the tensions could lead to a “substantial increase” in oil prices, with a rise to $150 a barrel lowering global GDP growth to 0.9% annualized in the first half of the year and more than doubling inflation 7.2 per cent.

EXPOSURE OF THE COMPANY

A Russian invasion could have had an impact on publicly traded western firms; however, a surge in oil prices might partially compensate for the income or profit losses experienced by energy companies.

B.P. holds 19.75 percent of Rosneft and has multiple joint ventures with Russia’s largest oil producer, which accounts for a third of the company’s output.

CURRENCIES AND REGIONAL DOLLAR BONDS

Russian and Ukrainian resources will focus on any given market repercussions of military action.

Investors have reduced exposure to both countries’ dollar bonds in recent months as heightened tensions between Washington and its allies and Moscow have risen.

However, due to sanctions and geopolitical tensions, Russia’s overall capital market position has decreased in recent years, reducing the threat of contagion through such channels.

On the other side, the Ukrainian and Russian currencies have suffered. The hryvnia has had the worst year of any planned events market currency thus far, and the rouble was nearing the end fifth.

According to Chris Turner, global head of ING, the Ukraine-Russia crisis offers serious worries for foreign currency markets.

Bank for International Settlements suspends Bank of Russia.

The Bank for International Settlements, widely considered to be the central bank of central banks, suspended the Bank of Russia on Thursday, furthering Moscow’s financial isolation over the conflict in Ukraine.

The multinational financial institution responsible for links central banks, based in Switzerland, said it imposed international sanctions on Russia’s central bank. The Bank of Russia has adopted unprecedented steps to support the faltering economy and ruble, including capital controls.

Last week, the central bank made an attempt, but failed to staunch the ruble’s bleeding by more than doubling. Its main policy rate has been raised to 20%.

The Russian currency has lost around 40% of its value since the start of the year 2022. In another warning of impending trouble, the bank has given instructions to the lenders not to release financial statements for February.

In their first high-level negotiations since Moscow’s incursion two weeks ago, Russia and Ukraine failed to reach an agreement Thursday, despite international condemnation of a blast at a children’s hospital that killed three people, including a small girl, according to Kyiv.

The BIS was founded in Basel in 1930 and is owned by 63 central banks representing countries that provide for about 95% of global GDP (GDP).

Central bankers meet at the BIS to discuss significant budgetary policy concerns.