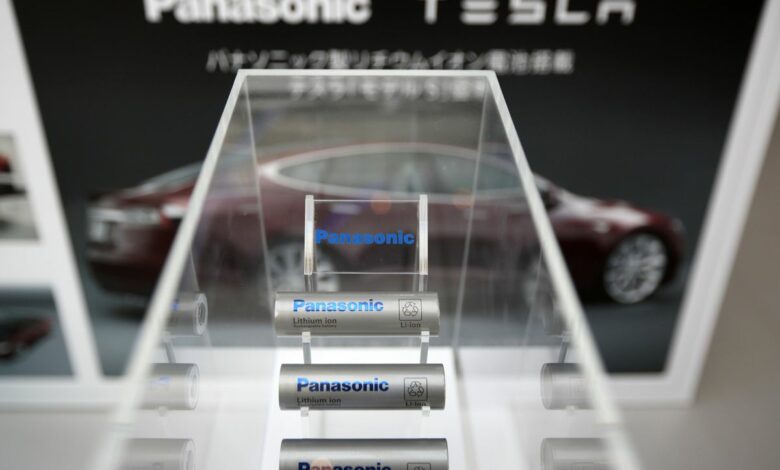

How Panasonic and Tesla’s ‘beer can battery” make electric vehicles cheaper?

Panasonic Corporation believes that nearly a hundred years of experience in the manufacturing of automotive batteries has prepared it for the production of the next-generation hard-to-produce battery, currently championed by Tesla Incorporation.

Elon Musk, Tesla’s CEO, first presented the 4680 battery as the massive breakthrough in-cell technology during Tesla’s Battery Day in September that will enable his company to manufacture $25,000 Electric Vehicles, roughly a third lower than Tesla’s most basic model- Model 3. While Tesla is planning to produce the cells on-site, it has requested Panasonic, the oldest battery supplier, to start production.

The catch: the thicker and bigger 4680 cells are still relatively unproven, named for their measuring 46 m diameter and 80 mm height. Industry analysts also doubt whether it is possible to produce a great number of batteries that are similar to a small version of the aluminium cans used for sodas and beer.

There are major technical challenges that have been overcome, and those in the industry have tried to address these problems for years, said Wood Mackenzie’s transport and mobility analyst Ram Chandrasekaran. These battery cells will be breakthroughs if attainable. However, the jury always decides if they are deliverable.

Panasonic claims that it will look best to sell these challenging new cells. The Japanese electronics manufacturer is currently working on setting up a manufacturing sample line for tests. To manufacture these large cells, you need one or two complete levels of skills or security problems, Yasuaki Takamoto, the EV battery manager of Panasonic, said during an interview. The time-tested security monitoring systems of the group give us an upper hand here, he added.

The great advantage of the new 4680 cells is the fact that the cells Panasonic supplies to Tesla are more than five times the size of the smaller cells which range from 1865 and 2170 cells. The standard 4000 to 8000 cells contained in an EV today can therefore be reduced to around 500, which means fewer parts as binding pieces are used to string cells together. New cell shapes like the 4680 are the secret to producing more inexpensive EV models which can expand significantly, said Akira Nagasaki, head of Takamoto’s technical strategy group.

However, the greater capacity also makes cells harder to produce. They are vulnerable to overheating because the heat from their core is difficult to spread. It’s even more vulnerable to particulate pollution, which is a common cause of EV battery fires that happens when tiny metal parts are found in the middle of a cell, which, according to Takamoto, causes shortcuts.

He said that as compared to other heavyweights for EV batteries, Panasonic is slow in manufacturing, instead of taking advantage of the safety advantage of its batteries and accelerating manufacturing to a level that enables it to keep safety standards, said Takamoto. He said Panasonic’s expertise in manufacturing 2.5 billion cells a year without significant safety problems gives it a benefit in the production of 4680 cells.

Tesla and Panasonic are pushing the next-generation battery so that almost all car manufacturers ensure their key product supply. Batteries are key to the differentiation of models of car manufacturers when the whole market moves towards EVs, said Chandrasekaran, Wood Mackenzie. This period is very crucial, he said. In the fear of future deficit, car manufacturers such as Volkswagen AG need more batteries and also drive them to produce themselves. Chandrasekaran said that this has led to significant friction between OEMs and their suppliers, as battery manufacturers hesitate only to invest in new capacity based on lively future sales projections. In the production of the 4680 cells, this challenge is evident. Musk, who has given Tesla a highly aggressive target of producing 20 million EVs per year by 2030, expects to integrate the cells and will also be talking to other battery manufacturers other than Panasonic. Panasonic, in particular, claims that it is going to want to supply batteries to electricity manufacturers rather than Tesla.

The next-generation technology also highlights the opportunity for shared advantage if car manufacturers and battery providers will today create special technologies, which would enable them to manage the surge of increasing electric vehicle purchases in the future together. Musk recognized the difficulty of mass production of 4680 cells at a November European battery meeting. The battery Tesla produced in the “bench-top stage,” and soon wanted it to be “the pilot plant,” but it’s much harder to increase the manufacturing process than to prove anything on a laboratory bench, said Musk. Since 2010 Panasonic has been doing the mass production of lithium-ion batteries for vehicles, although the first public offering was just launched by the largest purchaser of batteries.

For Panasonic, Tesla’s 4680 battery is a possible source of expansion, as it seeks to reduce its dependence on its one core business in consumer electronics. Taking into account the number of EVs Musk needs to see the roads and also demand from other car manufacturers, Takamoto said that if Panasonic were to continue making 4,680 cells.